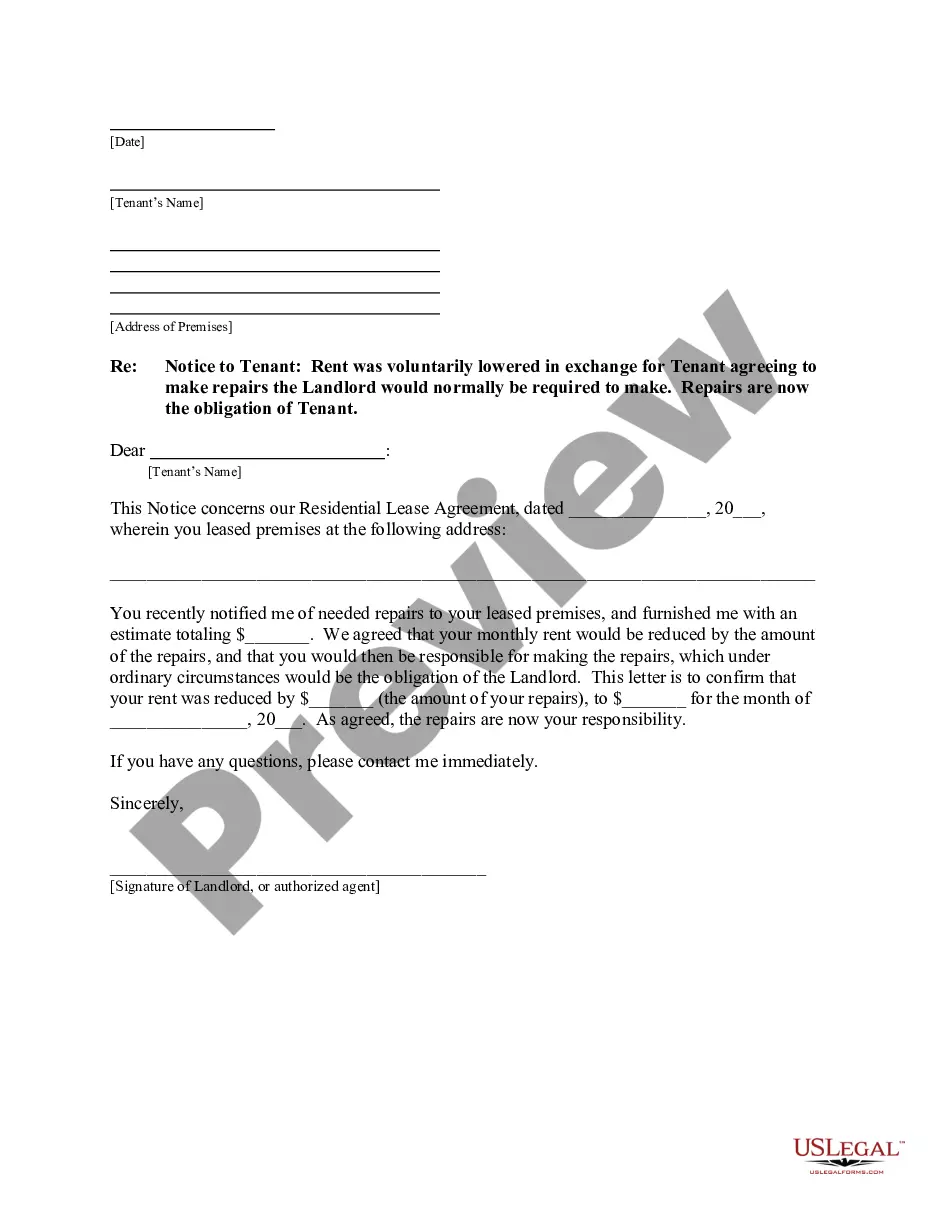

This form covers the subject matter described in the form's title for your State. This is a letter written from a Landlord to Tenant serving as notice that in exchange for Tenant making repairs or performing certain duties, Landlord will be voluntarily lowering the rent. Repairs are now the obligation of the Tenant.

South Dakota Exchange Foreclosures And Tax Lien Sales

Description

Form popularity

FAQ

Filing a lien in South Dakota involves submitting a formal written document to the local county register of deeds. This process requires specific information about the debtor and the nature of the lien. For those interested in South Dakota exchange foreclosures and tax lien sales, utilizing platforms like uslegalforms can provide clear guidance and resources to ensure proper filing procedures are followed.

In South Dakota, there is no mandatory age at which individuals stop paying property taxes. However, seniors may qualify for property tax reduction programs or exemptions that can lessen their financial burden. Understanding these programs can prove helpful for those considering South Dakota exchange foreclosures and tax lien sales, allowing for better financial planning.

The foreclosure process in South Dakota typically takes several months, but timelines can vary depending on specific circumstances. After a homeowner misses payments, banks or lenders can initiate foreclosure, which usually involves court proceedings. For those exploring South Dakota exchange foreclosures and tax lien sales, being informed about timelines can help in making quicker decisions.

Yes, South Dakota offers various property tax exemptions for qualifying homeowners, including exemptions for veterans, elderly citizens, and disabled individuals. These exemptions can significantly reduce your property tax burden. Understanding these options is crucial when navigating South Dakota exchange foreclosures and tax lien sales to maximize your savings.

Property taxes in South Dakota are calculated based on the assessed value of the property. Each county appraises property values, and tax rates are applied to these assessed values to determine how much you owe. For those interested in South Dakota exchange foreclosures and tax lien sales, being aware of valuation assessments is essential to avoid potential payment surprises.

South Dakota has a unique tax structure that benefits property owners. The state does not impose a corporate income tax or a personal income tax, which can enhance financial stability for residents. Property taxes primarily fund local services, such as schools and public safety, making understanding them essential for those involved in South Dakota exchange foreclosures and tax lien sales.

In South Dakota, the redemption period for foreclosure typically spans 90 days after a property is sold at auction. During this time, the homeowner can reclaim their property by paying the owed amount plus applicable costs. Understanding this timeline is vital for participants in South Dakota exchange foreclosures and tax lien sales, as it affects investment strategies.

Ted Thomas is a well-known figure in the field of tax lien investments, with decades of experience under his belt. Many investors trust his insights and resources for understanding South Dakota exchange foreclosures and tax lien sales. However, as with any investment advice, it's wise to conduct your research and consider multiple perspectives.

To place a lien on a house in South Dakota, you first need to acquire the appropriate legal documentation, such as a judgment or mortgage. Next, file the lien with the Register of Deeds in the county where the property is located. This process is crucial for securing your investment in South Dakota exchange foreclosures and tax lien sales, as it legally establishes your claim to the property.

To obtain a sales tax license in South Dakota, you must complete the application available on the state's Department of Revenue website. Ensure you gather all necessary documents, including your business registration and identification. Once submitted, your application will be reviewed, and you will receive your license, allowing you to engage in South Dakota exchange foreclosures and tax lien sales legally.