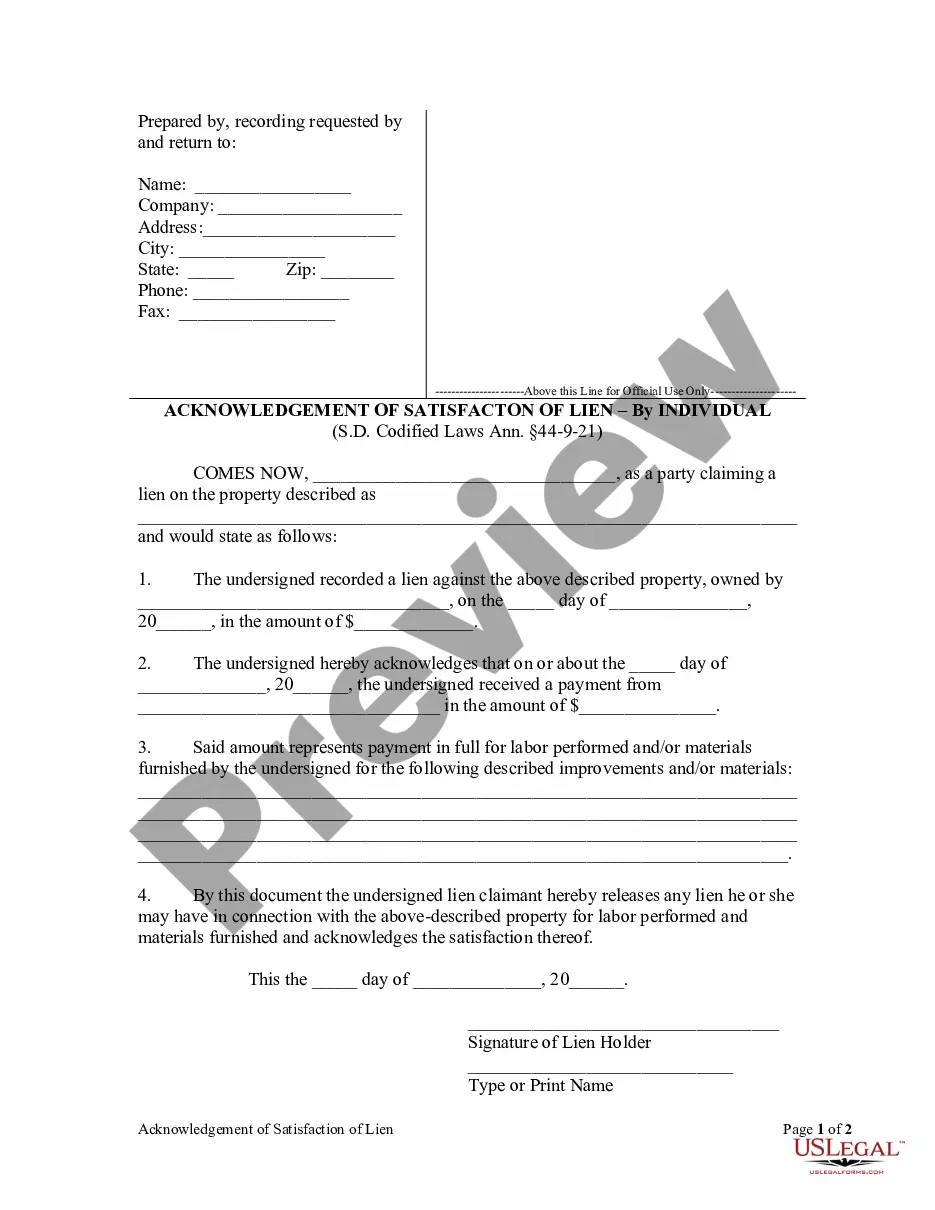

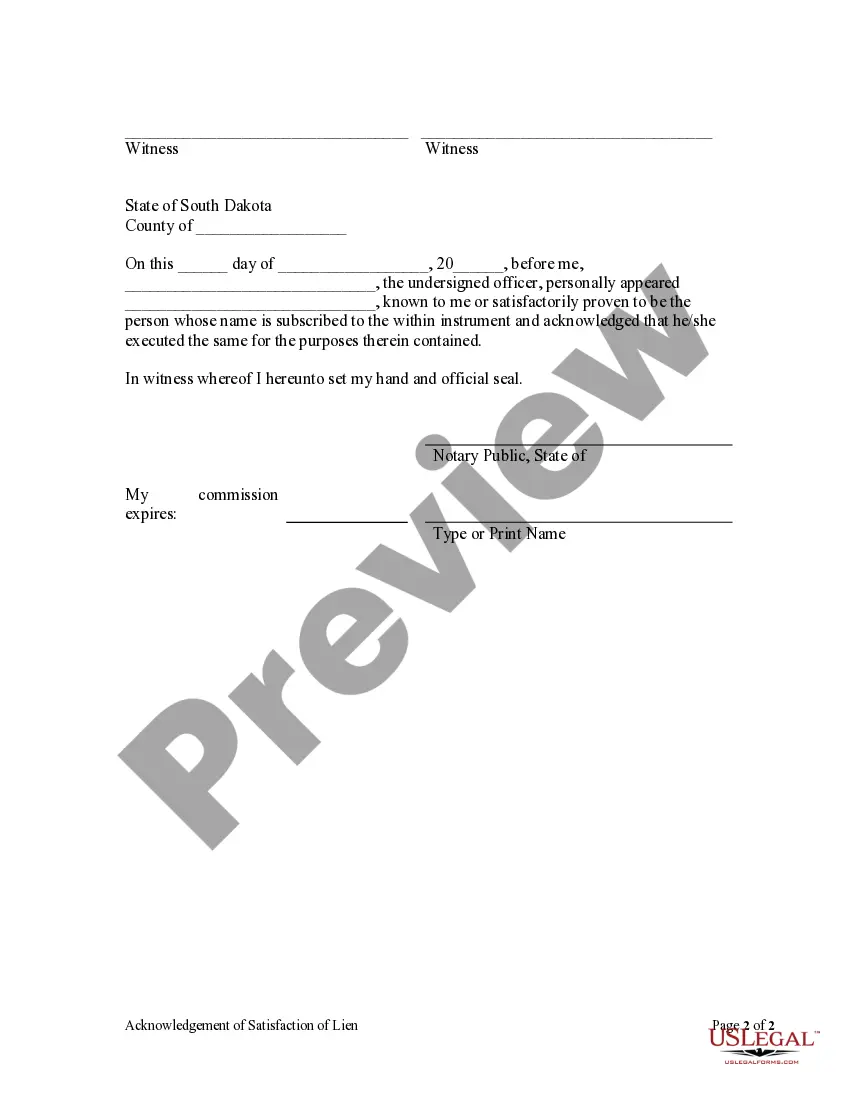

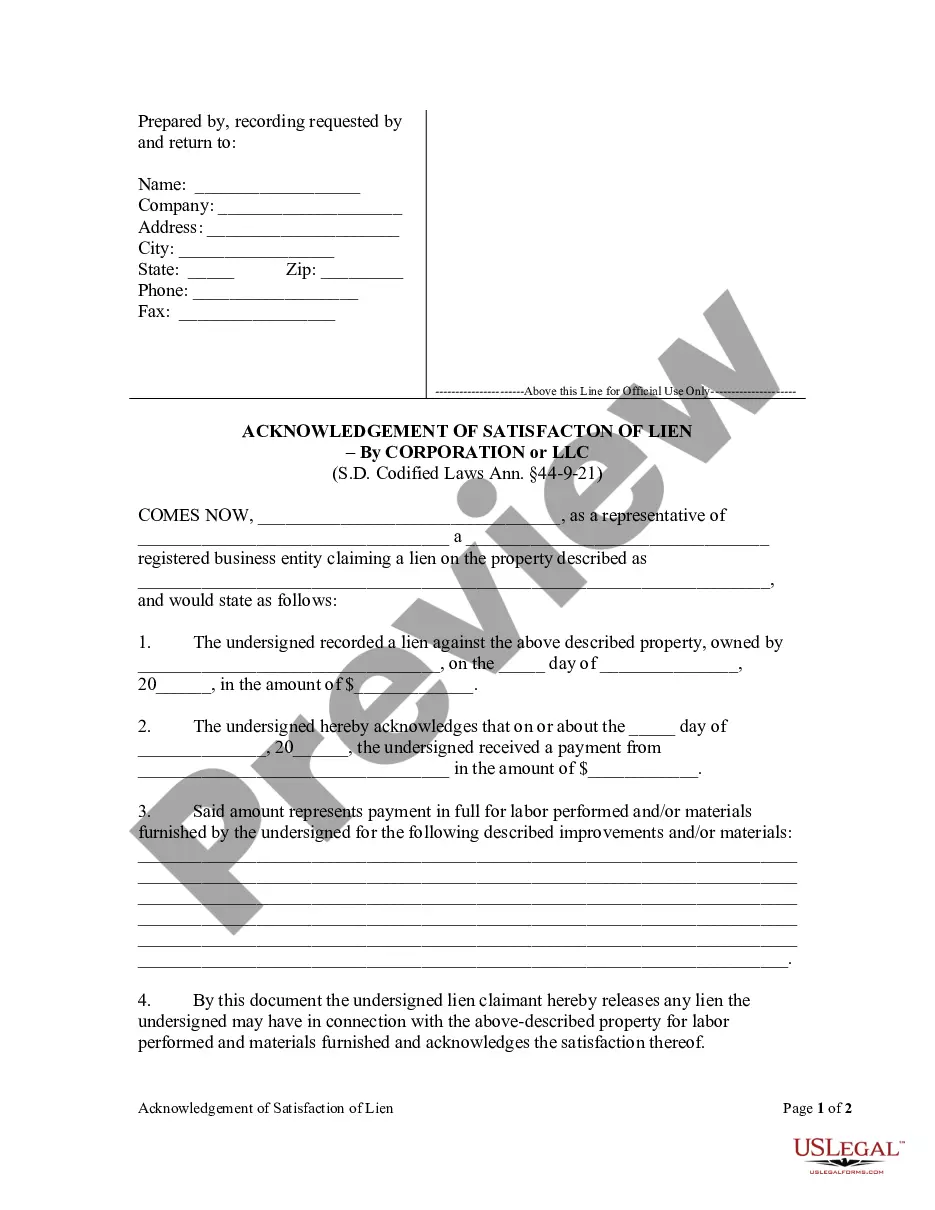

Whenever a lien has been claimed by filing the same in the office of the register of deeds and it is afterward satisfied by payment, foreclosure, compromise, or other method, the creditor shall execute and deliver to the owner of the property a satisfaction describing the lien by its date, date of filing, amount claimed, description of the property, and the names of the lien claimants and owner of the property. Such satisfaction shall be executed before two witnesses or acknowledged before a notary public, and upon presentation to the register of deeds, he shall file the same and cancel the said lien of record.

South Dakota Acknowledgment Foreclosures And Tax Lien Sales

Description

Form popularity

FAQ

Yes, South Dakota imposes a capital gains tax on real estate, which is generally applied to profit from the sale of real estate. However, you might qualify for certain exemptions depending on your situation. Having a clear understanding of South Dakota acknowledgment foreclosures and tax lien sales can help you navigate potential tax implications effectively.

Property tax rates in South Dakota can range significantly based on locality and property type. On average, homeowners can expect rates to be around 1.3% of the property’s assessed value. It's important to understand how South Dakota acknowledgment foreclosures and tax lien sales can impact property values, as this knowledge can be beneficial for tax assessments.

To fill out a South Dakota title transfer, gather the necessary documents, including the current title and identification. Complete the title transfer form, ensuring all information is accurate, particularly details about the buyer and seller. Understanding South Dakota acknowledgment foreclosures and tax lien sales can help you identify potential issues affecting the title, so stay informed throughout the process.

The habitual offender law in South Dakota addresses individuals with multiple felony convictions, resulting in stricter penalties for repeat offenders. This law plays a crucial role in legal proceedings, including those involving South Dakota acknowledgment foreclosures and tax lien sales. Understanding this law can help you navigate potential legal situations involving property and criminal behavior.

To file a lien in South Dakota, you must prepare a lien statement that includes specific information about the debt and the property. You then must file this statement with the appropriate county register of deeds. This process is vital for protecting your financial interests in matters related to South Dakota acknowledgment foreclosures and tax lien sales.

In South Dakota, a property is considered abandoned if it has been unoccupied for a continuous period, generally six months or more. Understanding this timeframe is crucial, especially for investors interested in South Dakota acknowledgment foreclosures and tax lien sales. Once a property is designated as abandoned, it may open up opportunities for acquisition through legal procedures.

To cite South Dakota codified law, you must reference the specific title and section number. This ensures clarity in legal documents and communications, especially related to South Dakota acknowledgment foreclosures and tax lien sales. An accurate citation might look like this: 'SDCL 10-23-1,' where 'SDCL' stands for South Dakota Codified Laws, followed by the title and section.

The religious exemption law in South Dakota allows certain properties owned by religious organizations to be exempt from property taxes. This can impact South Dakota acknowledgment foreclosures and tax lien sales, as properties under this exemption may not be subject to tax liens or foreclosure processes. It is important for religious organizations to understand the specific criteria required for this exemption to ensure compliance.

To find out who owns property in South Dakota, you can search public property records available through the county register of deeds. Many counties offer online databases that allow you to look up property ownership using the address or parcel number. This search is particularly useful when considering South Dakota acknowledgment foreclosures and tax lien sales, helping you stay informed.

To file a lien on a property in South Dakota, you need to complete a lien form that specifies the debt details and the property involved. This form must then be filed with the appropriate county office and may require additional documentation. Knowing how to accurately file a lien is essential, especially in situations related to South Dakota acknowledgment foreclosures and tax lien sales.