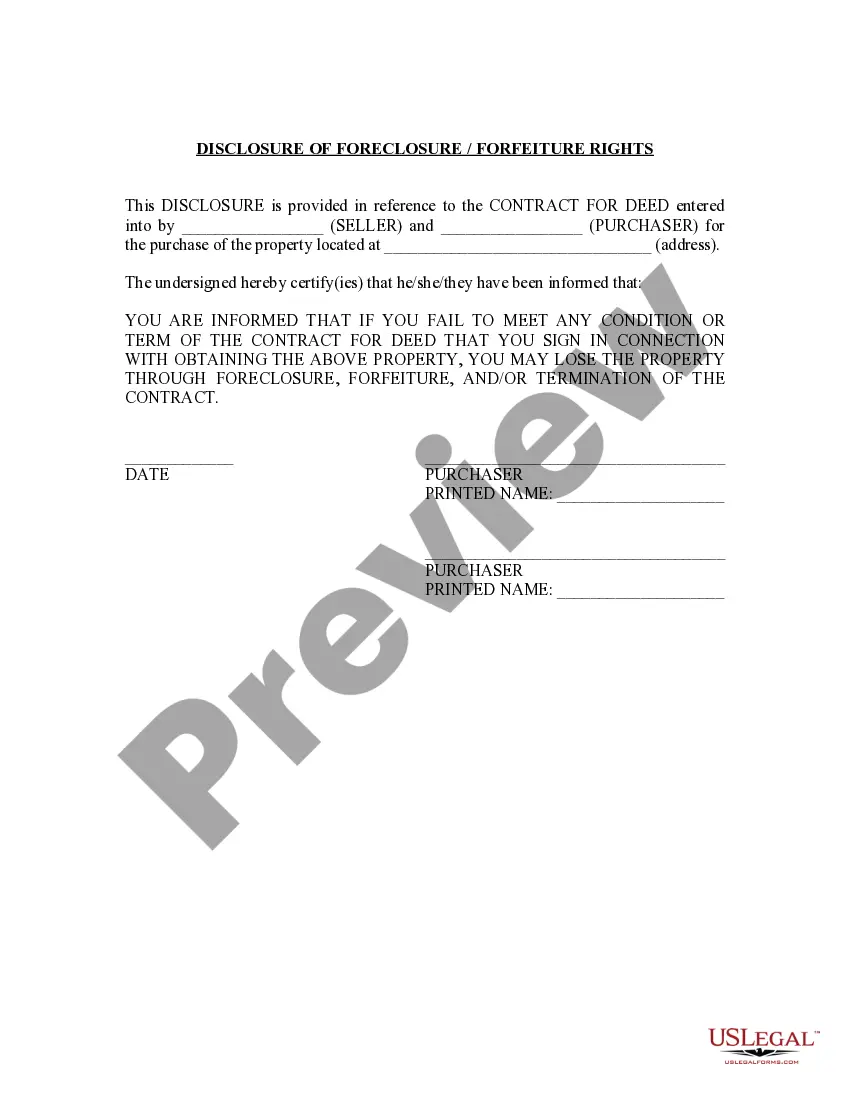

This Disclosure Notice of Forfeiture Rights form is provided by the Seller to the Purchaser at the time of the contract signing. Mandatory use of this form is rarely required; however, this form provides the Purchaser with a good understanding of forfeiture and how he or she can be affected by it in the event of a default. Should the courts become involved, the use of this form will help the Seller show that the Purchaser understood his side of the bargain and may help the Purchaser pursue the remedy of forfeiture if challenged by the Purchaser.

South Dakota Disclosure For Retirement

Description

Form popularity

FAQ

A disclosure about your retirement plan provides essential details regarding your benefits, options, and potential penalties. This document helps you make informed decisions for your financial future. By reviewing your South Dakota disclosure for retirement, you can understand what to expect upon retirement and how to plan effectively.

The Rule of 85 allows you to retire when your combined age and years of service total 85. This incentive supports work-life balance and acknowledges long-term commitment. Review your South Dakota disclosure for retirement to identify if this rule applies to you and explore your retirement options with confidence.

The Rule of 85 refers to a plan where employees can retire when their age plus years of service reaches 85. This rule allows for earlier retirement options, depending on your personal situation. It's important to consult your South Dakota disclosure for retirement to see how the Rule of 85 applies to your benefits.

To calculate the 85 factor for retirement in South Dakota, add your age to your years of service. If this sum equals 85 or more, you can retire without penalties. Understanding this factor is essential when reviewing your South Dakota disclosure for retirement, as it impacts your financial planning and eligibility.

South Dakota does not tax pensions or Social Security benefits. This tax-friendly environment can enhance your overall financial situation during retirement. Understanding these tax advantages is essential for effective retirement planning. For insights on South Dakota disclosure for retirement, utilize tools like US Legal Forms that can guide you through the specifics.

Several states do not tax retirement income, including South Dakota. This unique feature makes South Dakota an attractive option for retirees looking to preserve their income. By residing in South Dakota, you can potentially keep more of your retirement funds. For a comprehensive understanding of state-specific rules, refer to resources that clarify South Dakota disclosure for retirement.

Withdrawing from the South Dakota retirement system involves a few steps. First, you need to complete the necessary forms, which you can find on the official South Dakota retirement system website. After submitting your application, it will take some time for processing, and you might receive a disclosure detailing the implications of your withdrawal. For more assistance, consider using US Legal Forms to simplify the process and ensure you meet all requirements related to South Dakota disclosure for retirement.

The South Dakota retirement system primarily operates under the SDRS, which combines employee contributions with employer matching to fund retirement benefits. Members earn a vested interest in their benefits after a certain period of service, enabling them to secure financial security in retirement. The system's structure helps participants plan effectively for their future by offering various investment options and benefits. Understanding the nuances can greatly aid your South Dakota disclosure for retirement.

Absolutely, South Dakota is considered a retiree-friendly state due to its low taxes, affordable housing, and access to outdoor activities. Many retirees appreciate the peaceful environment and welcoming communities that South Dakota offers. The state provides various recreational opportunities that cater to diverse interests, making it easy for retirees to stay active and engaged. Evaluating these factors is critical when looking into South Dakota disclosure for retirement.

The Rule of 85 in South Dakota allows eligible employees to retire when their combined age and years of service total 85. This provision provides a more straightforward pathway to retirement for long-term employees compared to traditional methods. By meeting this requirement, employees can retire with peace of mind, knowing they have fulfilled their service commitments. Be informed about this rule when reviewing South Dakota disclosure for retirement.