Electrical Construction Company South Dakota Withholding

Description

How to fill out South Dakota Electrical Contract For Contractor?

Individuals typically link legal documentation with something complex that only an expert can manage.

In some respect, this is accurate, as formulating Electrical Construction Company South Dakota Withholding requires significant comprehension of subject matter criteria, including state and county laws.

However, with US Legal Forms, everything has become more straightforward: ready-made legal templates for any personal and business circumstance tailored to state regulations are assembled in a single online directory and are now accessible to everyone.

All templates in our catalog are reusable: once obtained, they remain saved in your profile. You can access them at any time via the My documents tab. Discover all the benefits of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85k current forms organized by state and area of use, making it easy to search for Electrical Construction Company South Dakota Withholding or any other specific template in just minutes.

- Returning users with an active subscription must Log In to their account and click Download to receive the form.

- New users on the platform will need to establish an account and subscribe first before downloading any files.

- Here’s a step-by-step guide on how to acquire the Electrical Construction Company South Dakota Withholding.

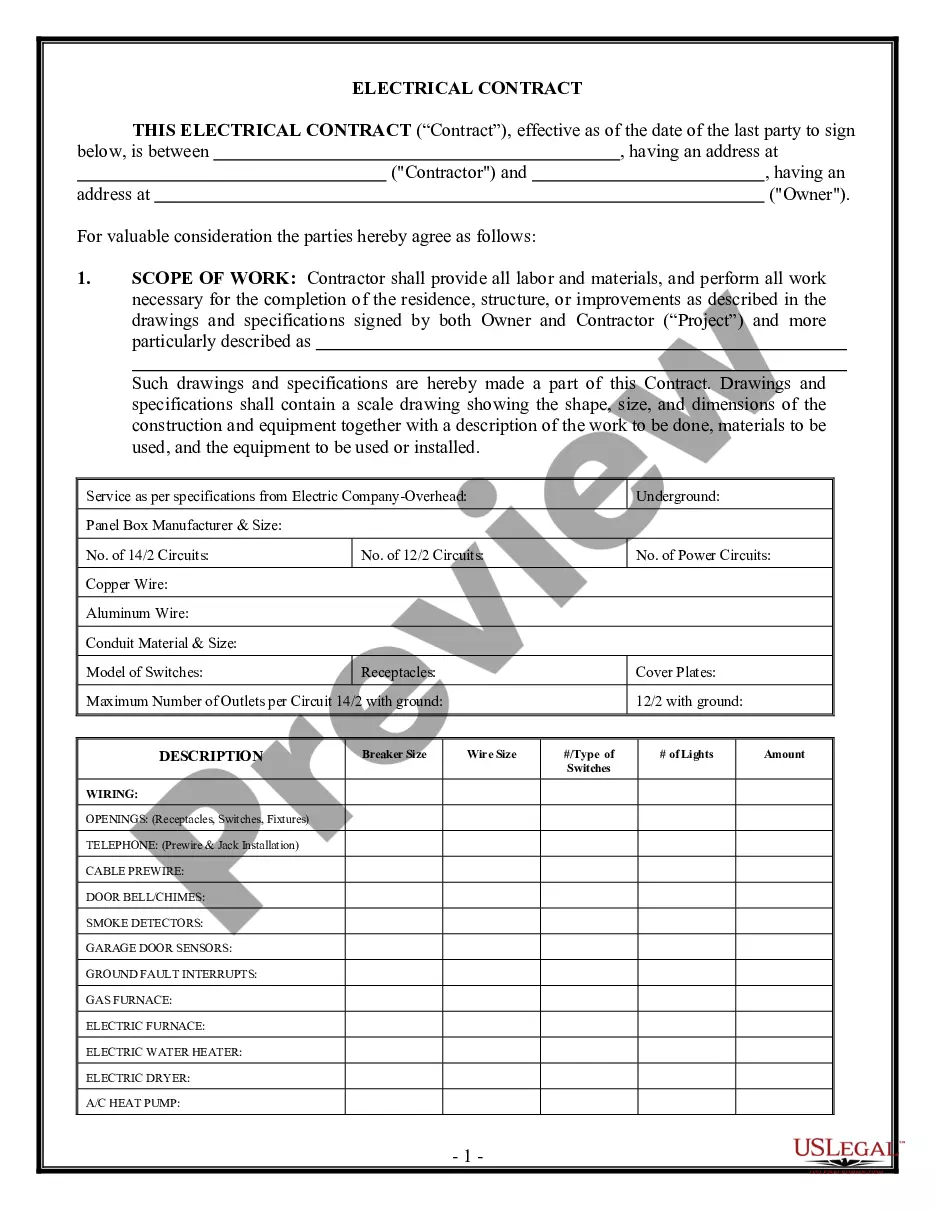

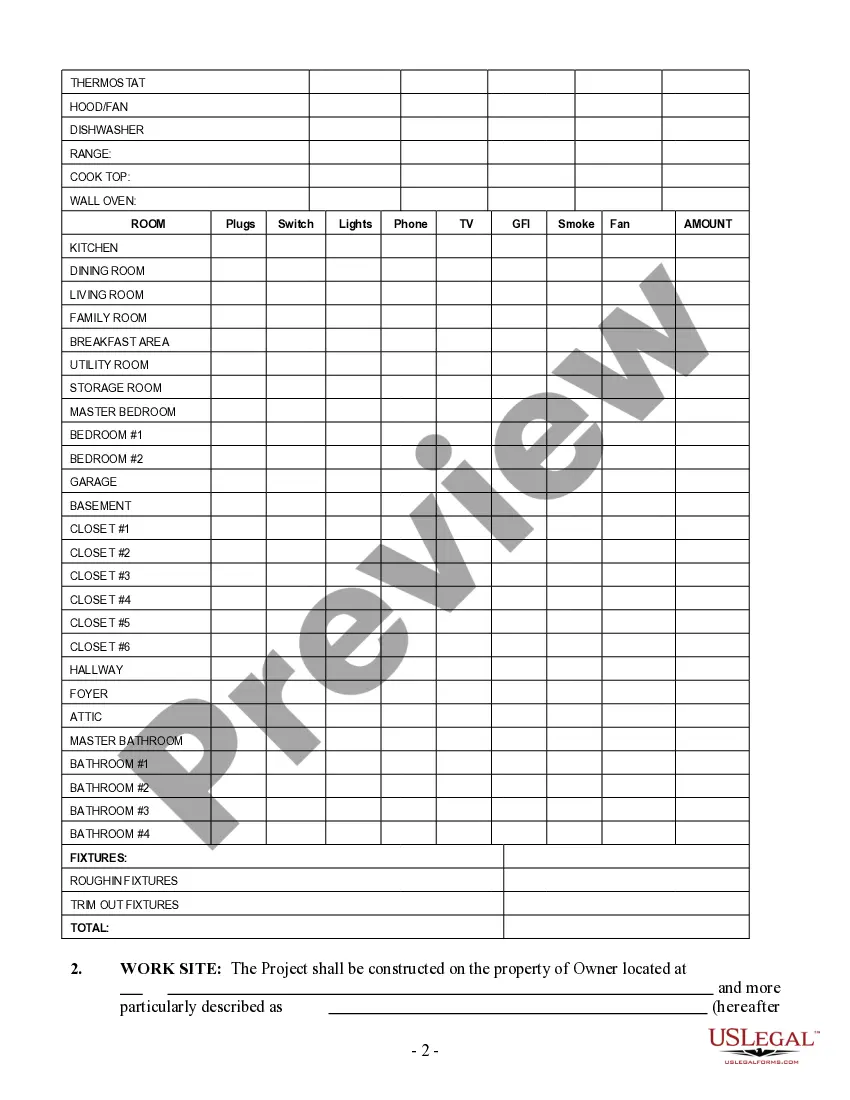

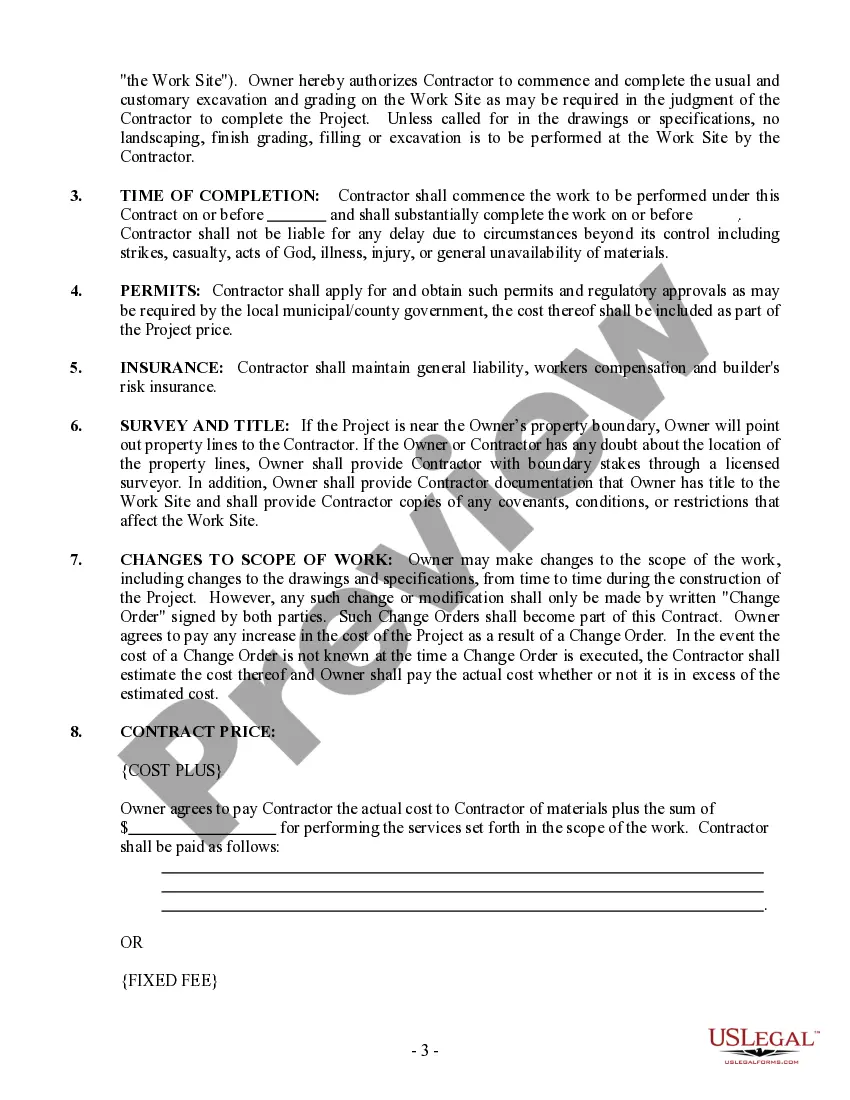

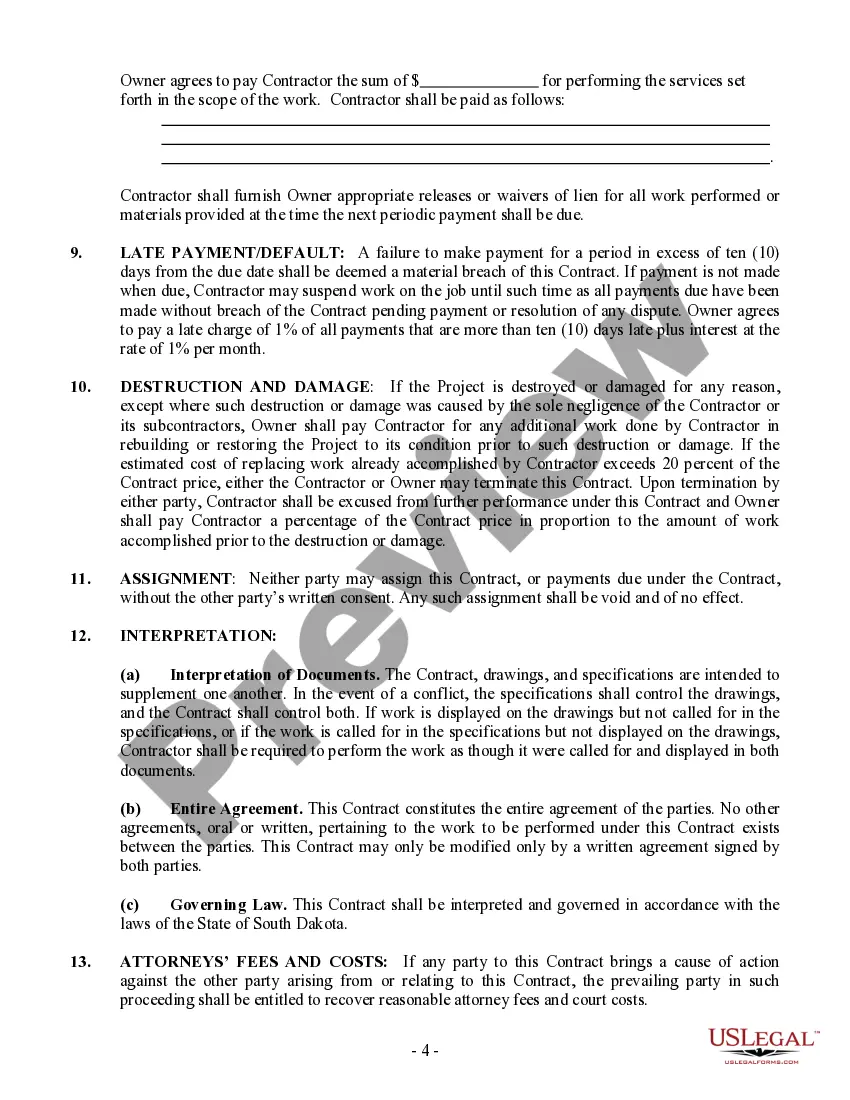

- Examine the page content carefully to ensure it meets your requirements.

- Review the form description or view it through the Preview option.

- If the previous one doesn't match your needs, find another example using the Search bar in the header.

- Once you find the appropriate Electrical Construction Company South Dakota Withholding, click Buy Now.

- Choose a subscription plan that fits your needs and budget.

- Create an account or Log In to continue to the payment page.

- Complete your subscription payment via PayPal or with your credit card.

- Select the format for your document and click Download.

Form popularity

FAQ

In South Dakota, the taxation of services varies, with many services being exempt from sales tax. For instance, if you run an electrical construction company, it’s vital to know which aspects of your work are taxable. Keeping yourself informed about local tax legislation will help you remain compliant and avoid penalties. US Legal Forms provides valuable information to help you understand these tax regulations better.

Engineering services in South Dakota often do not incur sales tax; however, this can depend on the nature of the service provided. As an electrical construction company in South Dakota, understanding how specific services relate to taxation is crucial. Always check for updates to tax laws, as they can change. For expert assistance in navigating these regulations, US Legal Forms can offer essential resources.

In South Dakota, professional services do not generally fall under taxable categories. However, if you operate as an electrical construction company in South Dakota, withholding regulations may apply for specific services. It's essential to stay informed about state tax laws to ensure compliance. For more clarity, consider utilizing resources like US Legal Forms to manage your tax obligations effectively.

The taxation of professional services varies significantly across the United States. Some states impose sales tax on specific professional services while others do not, impacting electrical construction company South Dakota withholding. Understanding the exact regulations in your state is crucial for compliance, and platforms like USLegalForms can provide guidance on the issues related to tax obligations for your electrical services.

South Dakota does impose sales tax on certain services, but not all services fall under this rule. For electrical services provided by an electrical construction company in South Dakota, the tax situation can vary based on specific circumstances. To ensure compliance and clear understanding of taxation, consulting resources like USLegalForms can help you navigate the nuances of electrical construction company South Dakota withholding.

In South Dakota, most construction services are indeed taxable, including both labor and materials. Contractors must ensure they correctly collect and remit sales tax for these services. An electrical construction company in South Dakota can help navigate local tax laws to ensure compliance and accurate withholding practices.

Yes, in Arizona, construction labor is generally subject to sales tax. This includes the labor associated with the installation of personal property. Electrical construction companies in South Dakota should be mindful of tax directives to avoid unexpected tax liabilities, particularly when dealing with contracts across state lines.

In South Dakota, an LLC is typically taxed as a pass-through entity, meaning profits are taxed on the members' personal tax returns rather than at the corporate level. This can offer flexibility for managing income effectively. For electrical construction companies in South Dakota, understanding withholding related to LLC income can streamline their financial processes.

The excise tax rate for contractors in South Dakota can depend on the type of services provided. Currently, it stands at 4% for construction services, which includes labor and materials in various projects. Electrical construction companies in South Dakota must ensure they comply with these tax regulations and manage any withholding accurately.

Sales tax on labor varies by state, with some states imposing tax on specific services while others do not. States such as New York and New Jersey have sales tax on certain labor services. Understanding these intricacies is crucial for businesses, including electrical construction companies in South Dakota, to manage their withholding correctly.