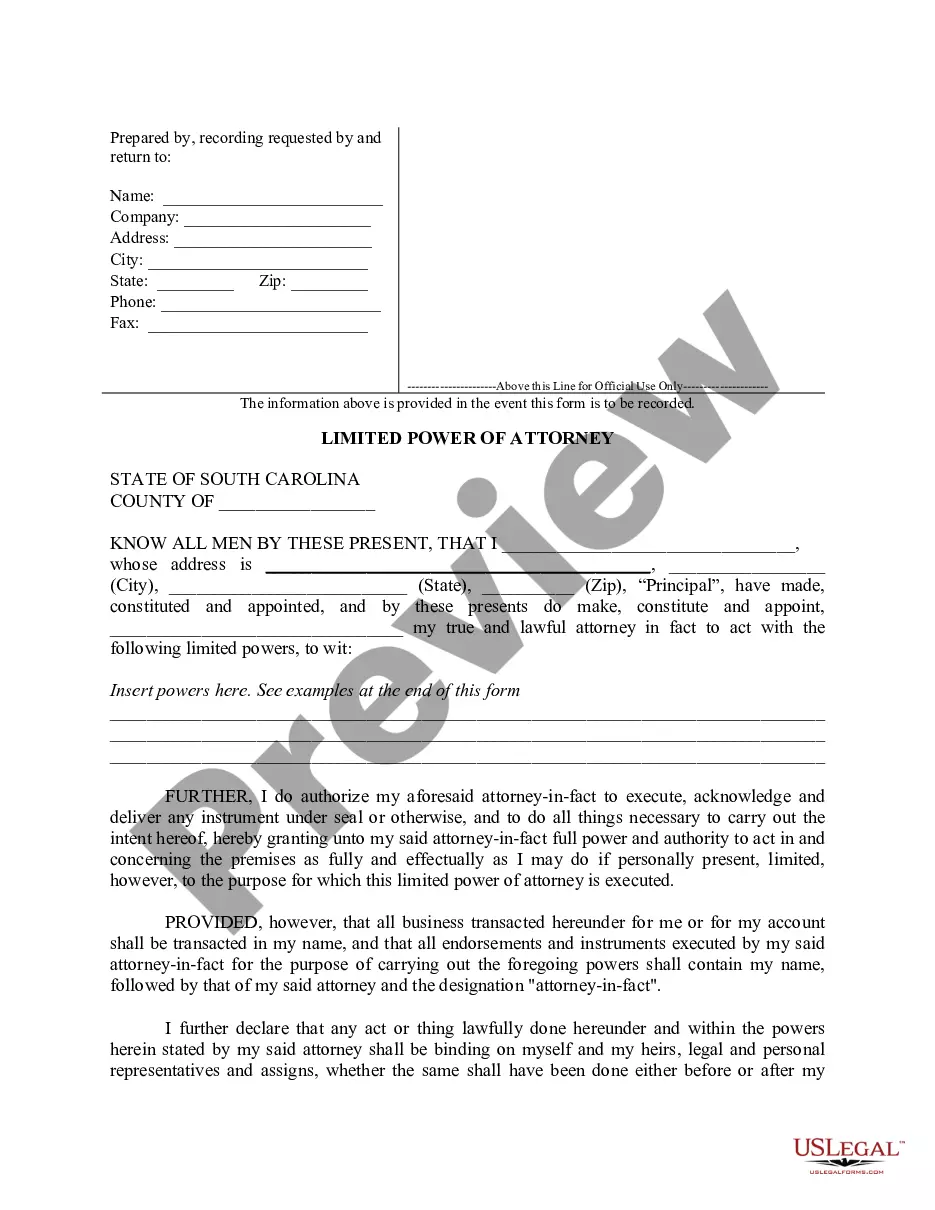

Power Attorney

Description

How to fill out South Carolina Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

- Log in to your US Legal Forms account if you're a returning user. Ensure your subscription is active; renew as needed to maintain access.

- For first-time users, start by previewing the available forms to find the specific power attorney template that meets your local jurisdiction's requirements.

- If you require a different template, utilize the Search feature to locate the appropriate one. Once identified, proceed to the next step.

- Select your desired document by clicking the 'Buy Now' button. Choose a subscription plan that meets your legal needs, and register to gain access to the full library.

- Complete your purchase by entering your payment details via credit card or PayPal.

- Finally, download your power attorney form to your device. You can access it anytime through the 'My Forms' section of your profile.

US Legal Forms makes the process of obtaining legal documents straightforward and efficient. With over 85,000 templates and expert assistance available, you can ensure your power attorney is precisely tailored to your needs.

Start your journey towards stress-free legal document preparation today! Explore US Legal Forms now.

Form popularity

FAQ

Yes, you can obtain a power of attorney without a lawyer in Florida. There are online platforms, like US Legal Forms, that provide templates and guidance for creating a valid document. However, it’s crucial to ensure that all legal requirements are met to avoid complications in the future.

A power of attorney grants your agent authority to make decisions on your behalf, which can include managing your financial matters, making legal decisions, or handling your healthcare. The level of authority depends on how the document is drafted. This flexibility allows you to tailor the powers based on your unique needs.

In Florida, a health care power of attorney does not necessarily need to be notarized. However, it must be signed in the presence of two witnesses who are not related to the principal or entitled to any part of the principal's estate. This setup ensures clarity and reduces potential disputes over the document's validity.

Florida has specific rules governing power of attorney. These rules require that the document clearly states the powers being granted and must be executed properly to be effective. It's also important for the agent to act in the best interest of the principal to comply with legal obligations.

In Florida, the requirements for a power of attorney include the principal being at least 18 years old and mentally competent. The document must be signed by the principal in the presence of two witnesses and a notary public. It's essential to ensure your power attorney specifically outlines the powers you wish to grant to your agent.

To file a power of attorney with the IRS, you need to complete Form 2848 and provide the necessary details, including the taxpayer's information and the specific powers you are requesting. Once completed, submit the form to the appropriate IRS office based on the taxpayer's location. Make sure to keep a copy for your records and confirm receipt with the IRS. Platforms like US Legal Forms can provide you with the templates and instructions you need for a smooth filing experience.

Yes, the IRS does recognize power of attorney documents. To establish your authority to act on behalf of someone else for tax-related issues, you need to submit Form 2848 along with your power of attorney. This ensures that the IRS acknowledges your role as the representative for the taxpayer. To help you navigate this process, US Legal Forms provides helpful resources and templates.

Filing taxes as a power of attorney involves completing the taxpayer's return using the appropriate forms while indicating your status as their representative. It's crucial to attach your signed power of attorney document, usually Form 2848, to certify your authority. Ensure you have all necessary documents, including income statements and deductions, in order to file accurately. With US Legal Forms, you can find resources to assist you in this process.

The processing time for a power of attorney with the IRS typically varies, but it can take several weeks to a few months depending on the complexity and the volume of requests. Once the IRS has processed your Form 2848, they will inform you of any updates or issues. To facilitate quicker processing, ensure that your documentation is complete and accurate. Utilizing US Legal Forms can help streamline your application, reducing potential errors.

Yes, you can upload a power of attorney (POA) document to the IRS if you are acting on behalf of someone else regarding tax matters. The IRS requires Form 2848 to be completed along with the POA to specify the authority granted. This procedure ensures that the IRS recognizes your authority to act on behalf of the taxpayer. US Legal Forms can offer guidance and templates to help you through this process.