South Carolina Tax Lien Withdrawal Letter

Description

Form popularity

FAQ

In South Carolina, judgments typically remain enforceable for ten years, but they can be renewed if necessary. This duration means that creditors can pursue collection efforts within this time frame. If you have settled a judgment, obtaining a South Carolina tax lien withdrawal letter is crucial for clearing your record. Knowing about judgments and their expiration helps you better manage your financial health.

In South Carolina, a tax lien typically remains on your property for ten years unless resolved earlier. However, if you address the tax obligations, you can obtain a South Carolina tax lien withdrawal letter, which signals the termination of the lien. This timeframe can be extended if the tax debt is not addressed. For property owners, knowing how long a lien lasts can greatly impact financial planning.

In South Carolina, lien laws protect creditors by allowing them to secure interests in a debtor's property for unpaid debts. A tax lien can arise from unpaid property taxes and remains until the debt is settled. If you receive a South Carolina tax lien withdrawal letter, it may indicate that the outstanding tax obligation has been rectified. Understanding these laws is vital for property owners who want to protect their rights.

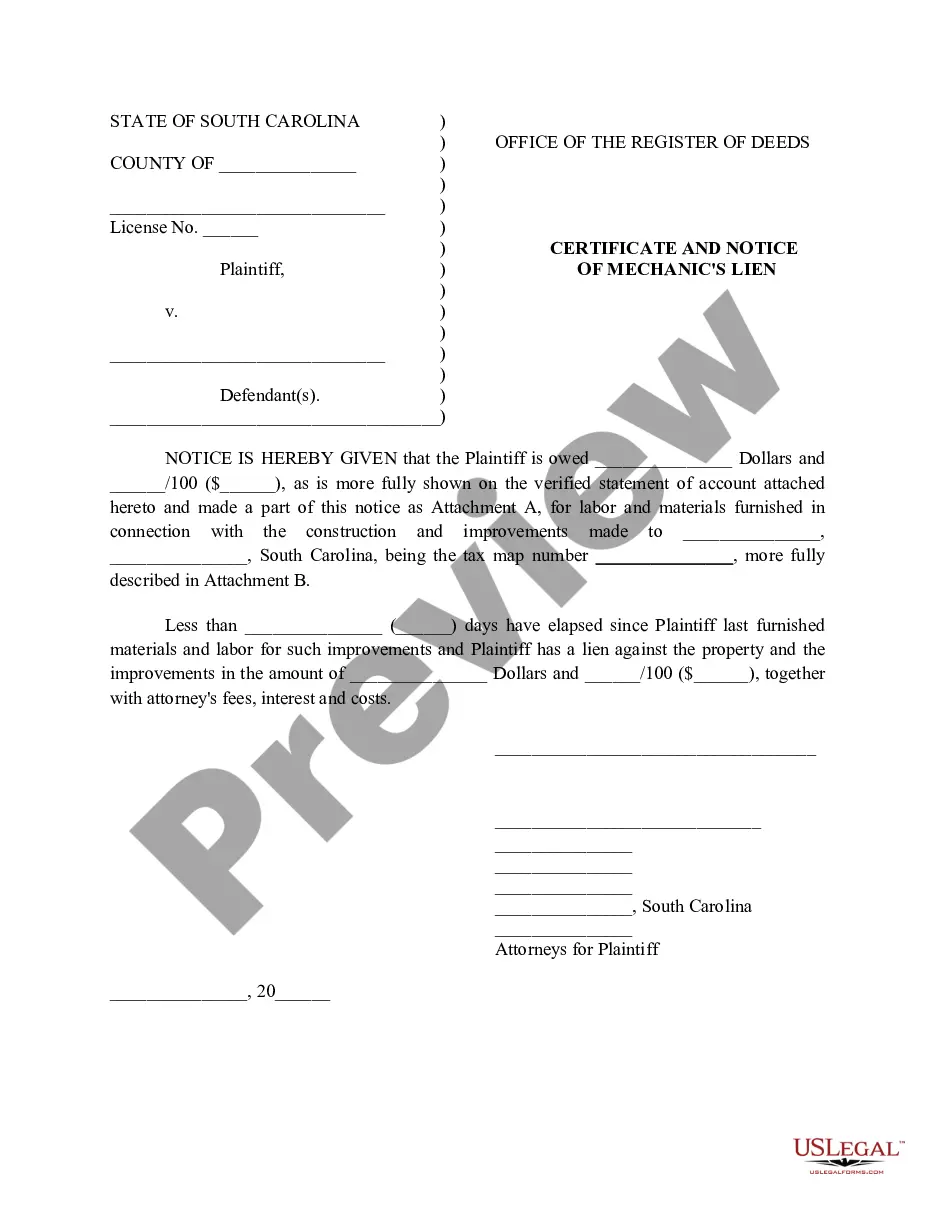

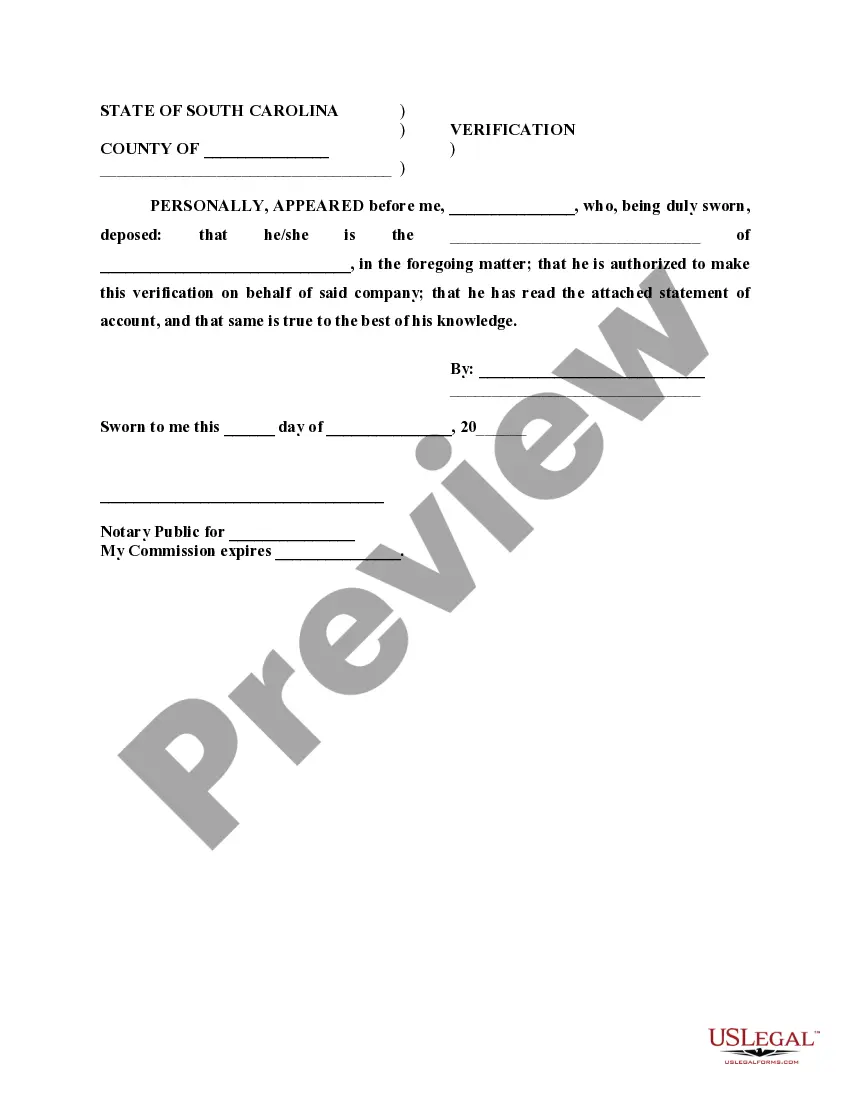

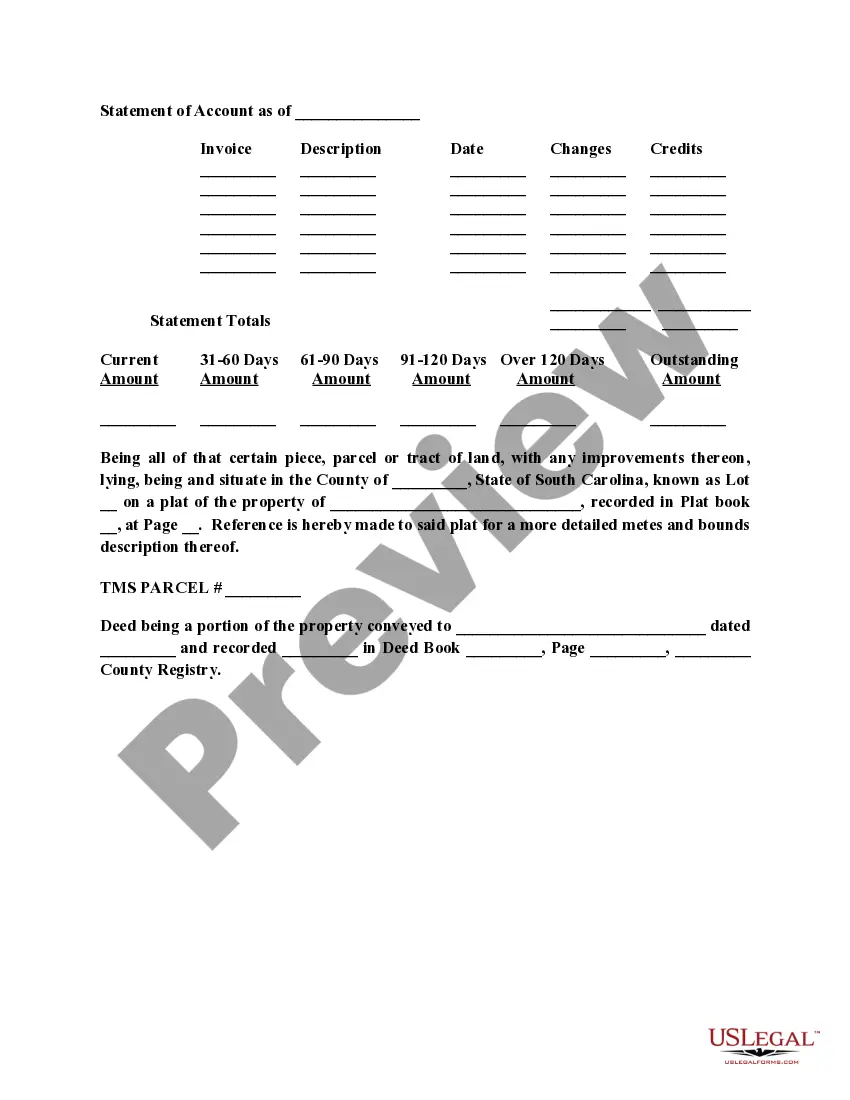

To file a lien on property in South Carolina, you must prepare the lien statement and submit it to the local county clerk's office. Ensure all information is accurate and includes the debtor’s name and the amount owed. Utilizing platforms like USLegalForms can help simplify this filing process, ensuring that you comply with all necessary legal requirements effectively.

A lien withdrawal is a process that formally removes a lien from a property title. Various circumstances can warrant a withdrawal, such as when a debt is settled or through negotiated agreements. To process a lien withdrawal in South Carolina, a South Carolina tax lien withdrawal letter must often be submitted, providing notice of the removal to relevant parties.

A notice of intent to file a lien is a formal document that informs a debtor of an impending lien against their property. This notice serves as a warning, allowing the debtor an opportunity to address the obligation before the lien is recorded. If you receive such a notice, consider responding promptly to avoid complications, including the potential need for a South Carolina tax lien withdrawal letter.

Yes, South Carolina is considered a lien state, meaning that property liens can be placed on property for unpaid debts. The law allows creditors to file liens to secure their interests. If you face difficulties with lien withdrawal, a South Carolina tax lien withdrawal letter can be a vital tool to reclaim your property rights.

Filing a lien in South Carolina involves preparing the lien documents and submitting them to the county clerk where the property is located. You must ensure that all relevant information is included, such as the debtor's details and the amount due. Utilizing a service like USLegalForms can streamline this process and guide you to ensure compliance with state regulations.

In South Carolina, a property lien typically lasts for a period of 10 years. However, it is subject to renewal, which can extend its duration, provided that proper procedures are followed. Once the lien reaches its expiration, property owners may need to consider a South Carolina tax lien withdrawal letter to formally clear the title.

The lien law in South Carolina outlines the rights of the government to place a lien on a property when taxes remain unpaid. Liens serve as a claim against the property until the associated debts are settled. Familiarizing yourself with these laws can help you navigate tax issues more effectively and may lead you to consider drafting a South Carolina tax lien withdrawal letter after resolving an issue. Always consult legal resources, like UsLegalForms, for detailed guidance.