Affidavit Of Consideration South Carolina For Buyer

Description

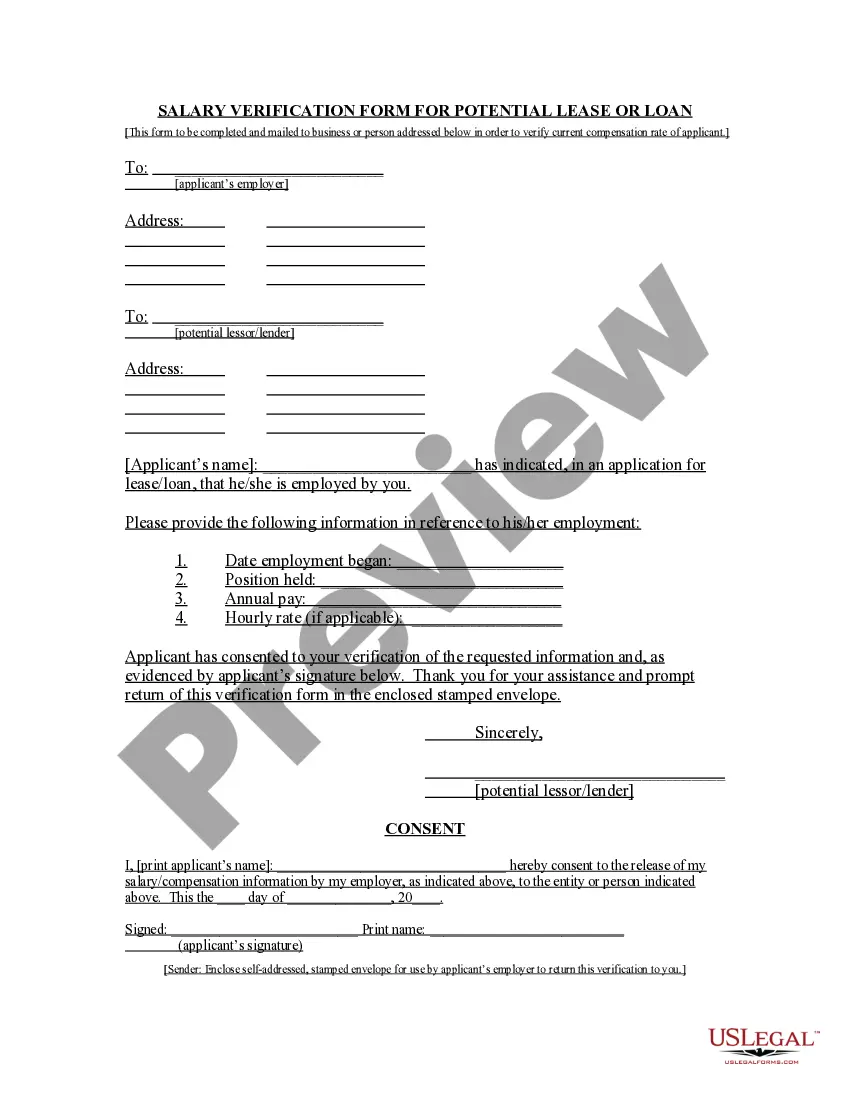

How to fill out South Carolina Affidavit Of Consideration?

It’s obvious that you can’t become a law expert overnight, nor can you learn how to quickly draft Affidavit Of Consideration South Carolina For Buyer without the need of a specialized set of skills. Putting together legal forms is a time-consuming process requiring a certain education and skills. So why not leave the creation of the Affidavit Of Consideration South Carolina For Buyer to the specialists?

With US Legal Forms, one of the most extensive legal document libraries, you can find anything from court papers to templates for in-office communication. We understand how important compliance and adherence to federal and state laws and regulations are. That’s why, on our website, all forms are location specific and up to date.

Here’s start off with our platform and get the form you need in mere minutes:

- Discover the form you need by using the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to determine whether Affidavit Of Consideration South Carolina For Buyer is what you’re looking for.

- Start your search again if you need a different template.

- Register for a free account and select a subscription plan to purchase the form.

- Choose Buy now. As soon as the payment is through, you can download the Affidavit Of Consideration South Carolina For Buyer, fill it out, print it, and send or mail it to the necessary individuals or entities.

You can re-gain access to your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your documents-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

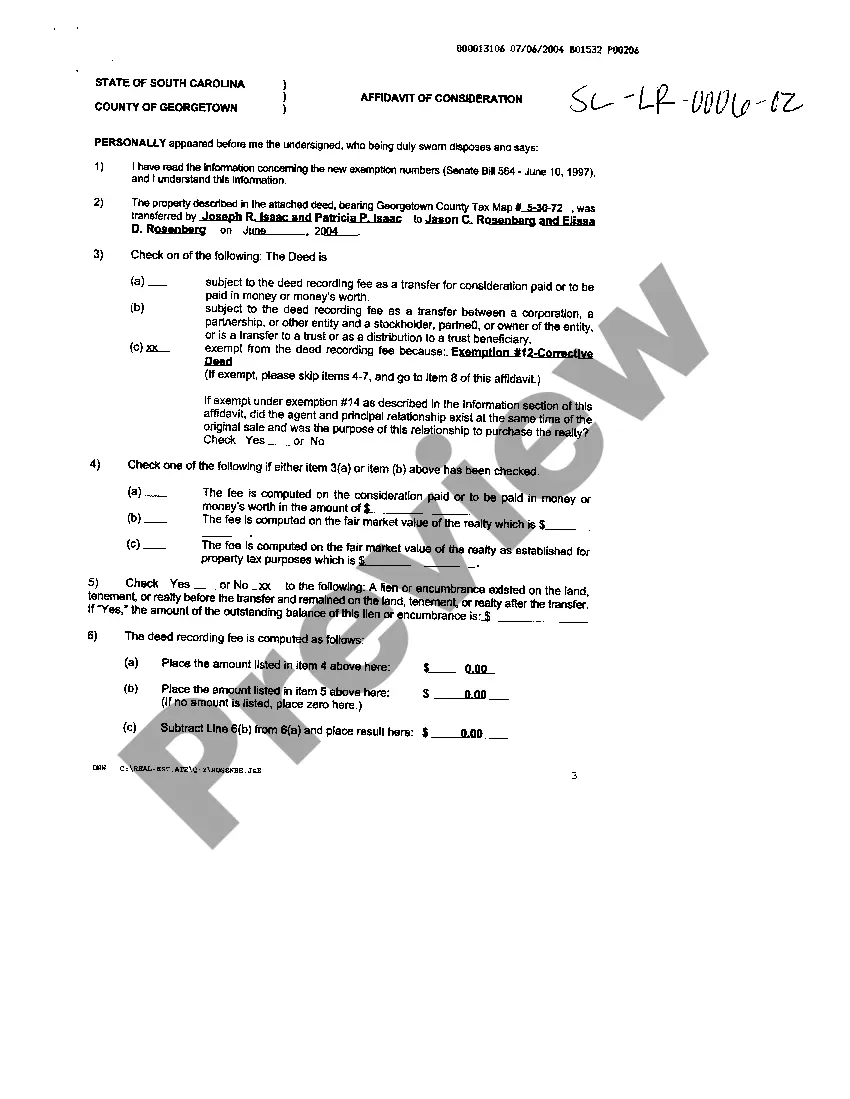

Code Section 12-24-30, in subsection (A), states that the fair market value of the realty may be used "in determining fair market value of the consideration under the provisions of this section." The only mention to fair market value in subsection (A) concerns when the consideration is in money's worth, or when the ...

Transfer Tax/Deed Stamps (Seller) South Carolina has a real estate transfer tax of $1.85 per $500 of the sales price. The seller typically pays this fee when transferring the property from the seller's name to the buyer.

After the process server serves the papers, he or she must prepare an affidavit that they completed service of process. This affidavit must be notarized. File the affidavit with the Clerk of Court's office where the case is filed.

SECTION 12-24-70. Affidavits. (A)(1) The clerk of court or register of deeds shall require an affidavit showing the value of the realty to be filed with a deed. The affidavit required by this section must be signed by a responsible person connected with the transaction, and the affidavit must state that connection.

The prior owner conveying the property is primarily responsible for payment, and the new owner is secondarily responsible. The deed-recording fee rate is $1.85 for each $500.00 of the real estate's value.