South Carolina Trust Form With 2 Points

Description

How to fill out South Carolina Living Trust For Husband And Wife With One Child?

Finding a go-to place to access the most recent and appropriate legal samples is half the struggle of handling bureaucracy. Discovering the right legal documents demands precision and attention to detail, which is the reason it is vital to take samples of South Carolina Trust Form With 2 Points only from trustworthy sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to be concerned about. You can access and see all the information regarding the document’s use and relevance for your situation and in your state or county.

Consider the following steps to complete your South Carolina Trust Form With 2 Points:

- Make use of the library navigation or search field to find your template.

- Open the form’s information to see if it fits the requirements of your state and area.

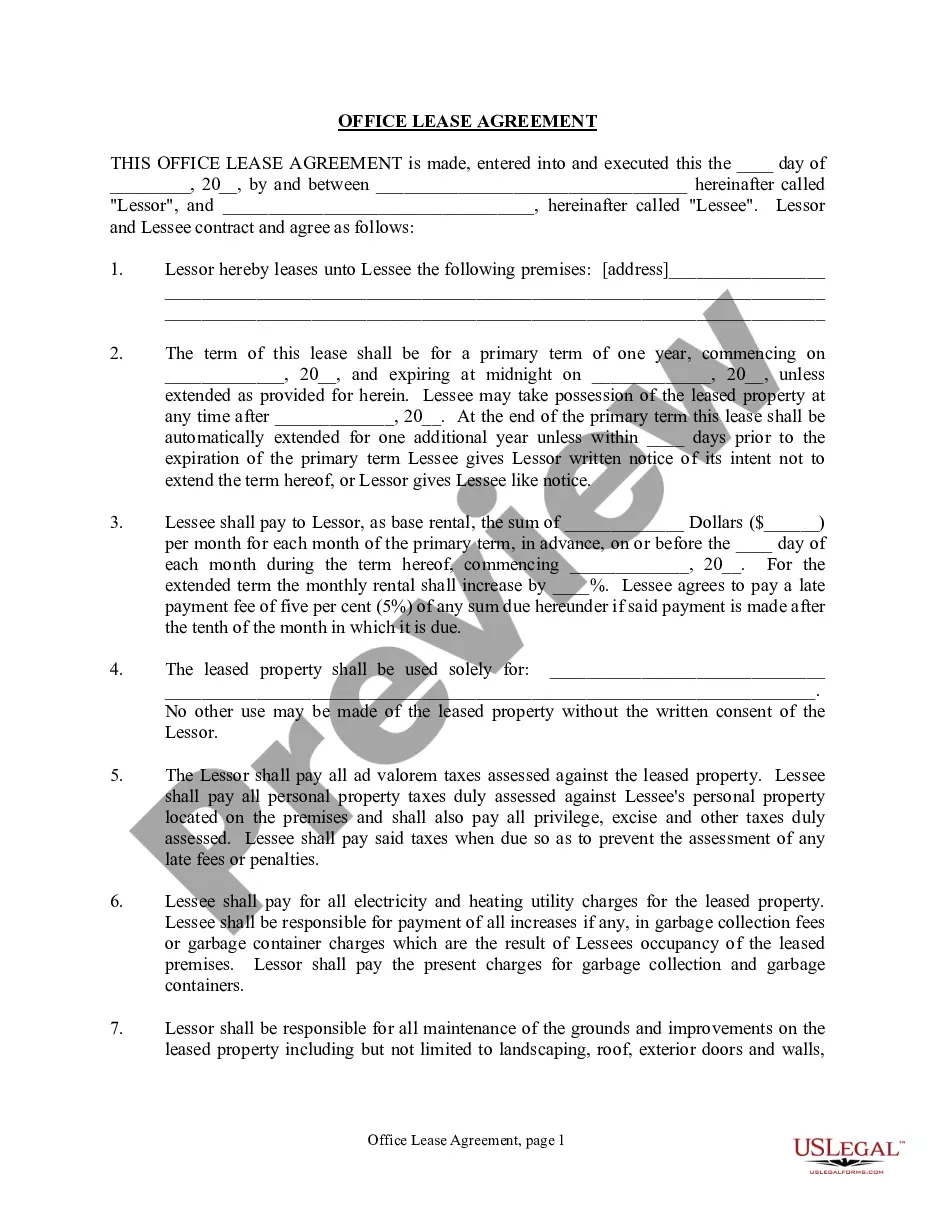

- Open the form preview, if there is one, to ensure the template is definitely the one you are looking for.

- Go back to the search and find the proper template if the South Carolina Trust Form With 2 Points does not match your needs.

- If you are positive regarding the form’s relevance, download it.

- If you are a registered user, click Log in to authenticate and gain access to your selected forms in My Forms.

- If you do not have an account yet, click Buy now to obtain the template.

- Select the pricing plan that fits your preferences.

- Go on to the registration to finalize your purchase.

- Complete your purchase by picking a payment method (bank card or PayPal).

- Select the document format for downloading South Carolina Trust Form With 2 Points.

- When you have the form on your device, you may change it using the editor or print it and complete it manually.

Eliminate the inconvenience that comes with your legal documentation. Explore the comprehensive US Legal Forms library where you can find legal samples, examine their relevance to your situation, and download them immediately.

Form popularity

FAQ

An electing small business trust is taxed at the highest rate as provided in SC Code Section 12-6-510?. Any other estate or trust pays the same rate that applies to individuals. An estate or trust may be eligible for the reduced Income Tax rate of 3% on active trade or business income from a pass through business.

Creating a living trust in South Carolina involves creating a written trust document and signing it in front of a notary. The trust is not final until you transfer assets into it. A living trust might offer benefits that are valuable for you. Compare it with other estate planning options before deciding.

To make a living trust in South Carolina, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

A simple example would be the situation in which one member of a family advances money to another and asks the second member to hold the money or to invest it for him. A more complicated example of an implied trust would be the situation in which one party provides money to another for the purchase of property.

Creating a living trust in South Carolina involves creating a written trust document and signing it in front of a notary. The trust is not final until you transfer assets into it. A living trust might offer benefits that are valuable for you. Compare it with other estate planning options before deciding.