South Carolina Trust Form For Estate

Description

How to fill out South Carolina Living Trust For Husband And Wife With One Child?

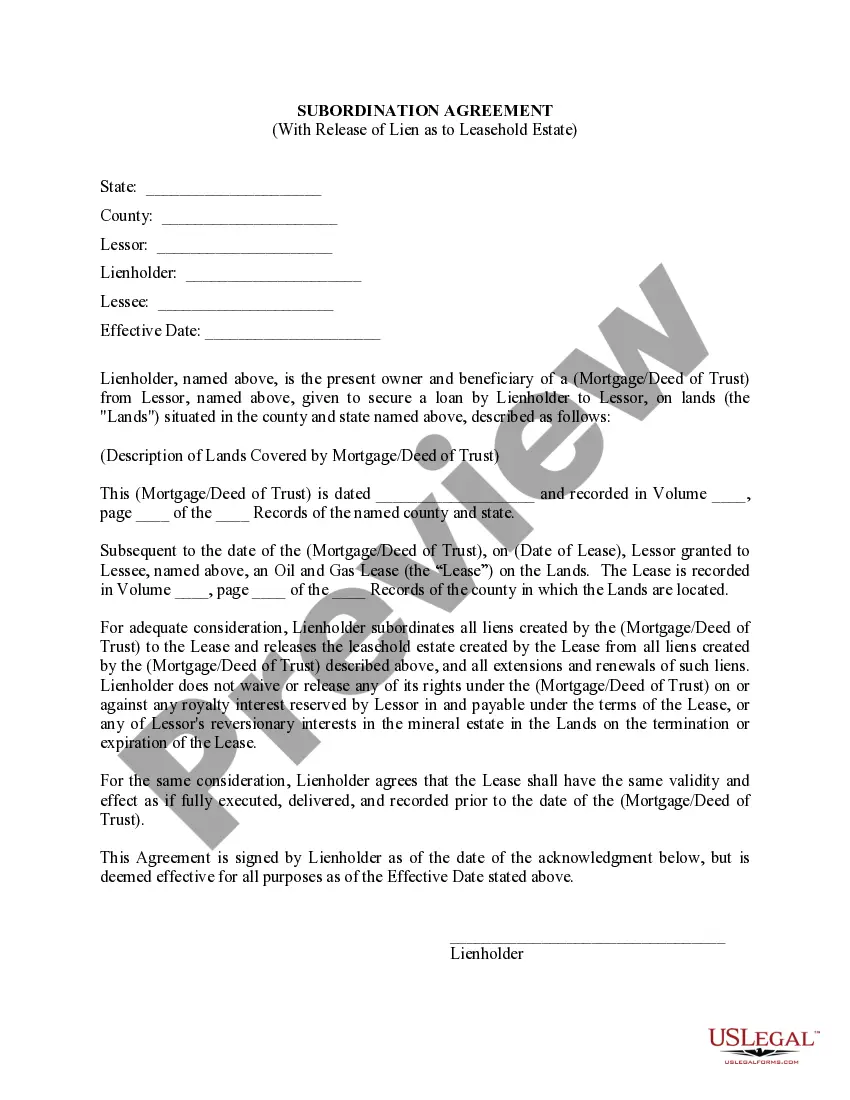

Getting a go-to place to take the most current and relevant legal samples is half the struggle of working with bureaucracy. Discovering the right legal documents requirements accuracy and attention to detail, which is why it is crucial to take samples of South Carolina Trust Form For Estate only from trustworthy sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to be concerned about. You may access and check all the information about the document’s use and relevance for your circumstances and in your state or region.

Take the following steps to complete your South Carolina Trust Form For Estate:

- Utilize the library navigation or search field to locate your template.

- Open the form’s information to see if it suits the requirements of your state and region.

- Open the form preview, if there is one, to make sure the template is definitely the one you are interested in.

- Get back to the search and locate the correct template if the South Carolina Trust Form For Estate does not fit your needs.

- If you are positive regarding the form’s relevance, download it.

- When you are an authorized user, click Log in to authenticate and access your picked forms in My Forms.

- If you do not have a profile yet, click Buy now to obtain the template.

- Choose the pricing plan that suits your requirements.

- Go on to the registration to complete your purchase.

- Complete your purchase by choosing a transaction method (credit card or PayPal).

- Choose the document format for downloading South Carolina Trust Form For Estate.

- Once you have the form on your gadget, you may change it with the editor or print it and complete it manually.

Remove the headache that accompanies your legal documentation. Discover the extensive US Legal Forms catalog where you can find legal samples, examine their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

South Carolina also does not impose an Estate Tax, which is a tax taken from the deceased's estate soon after the loved one has passed.

One of the benefits of a living trust South Carolina is that it keeps the assets in the trust out of probate. Probate is a court proceeding used to verify and carry out a will. Probate can take months and involves costs: an attorney, executor, and court fees.

South Carolina does not levy an estate or inheritance tax. Large estates may be subject to the federal estate tax, and you may need to pay inheritance if you inherit property from someone who lived in another state. You should also keep in mind that some of your property won't technically be a part of your estate.

An electing small business trust is taxed at the highest rate as provided in SC Code Section 12-6-510?. Any other estate or trust pays the same rate that applies to individuals. An estate or trust may be eligible for the reduced Income Tax rate of 3% on active trade or business income from a pass through business.

If filing by paper, mail balance due returns to SCDOR, TAXABLE FIDUCIARY, PO BOX 125, COLUMBIA, SC 29214-0038. Mail refunds or zero tax returns to SCDOR, NONTAXABLE FIDUCIARY, PO BOX 125, COLUMBIA, SC 29214-0039.