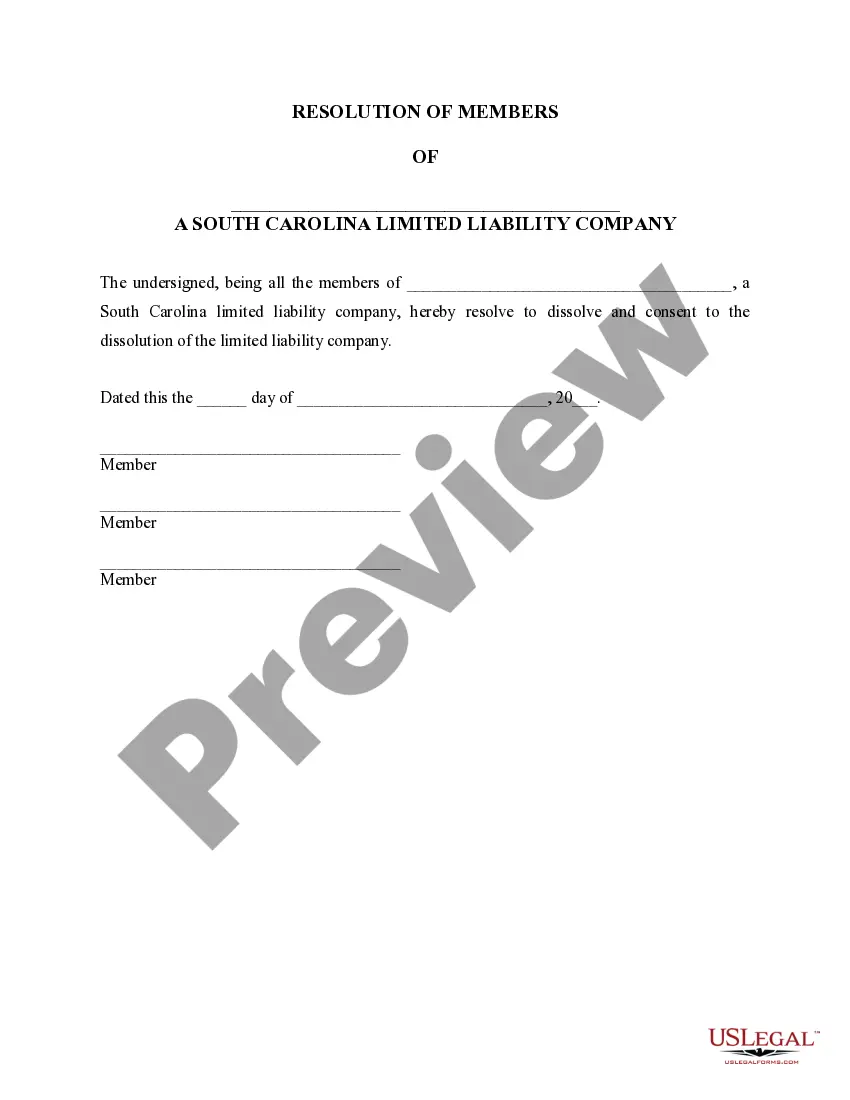

Limited Liability Company With Example

Description

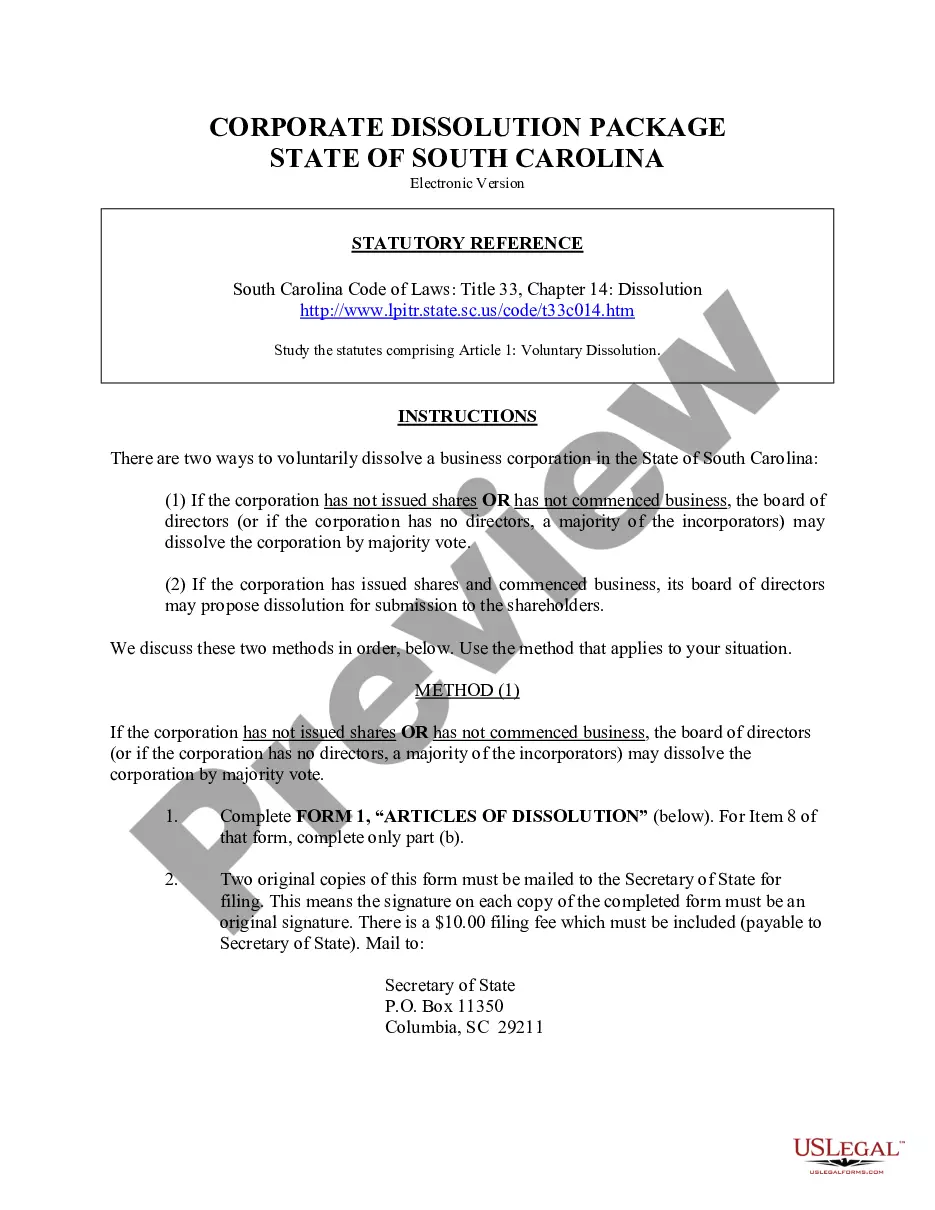

How to fill out South Carolina Dissolution Package To Dissolve Limited Liability Company LLC?

- Log in to your US Legal Forms account. If you're a new user, you will need to create an account first.

- Explore the vast library of legal forms in the Preview mode. Make sure to select the right LLC form that meets your business needs and complies with local laws.

- If necessary, use the Search feature to find any additional templates that may suit your requirements better.

- Purchase the selected document by clicking the Buy Now button and choose a suitable subscription plan.

- Complete your transaction by entering your payment information via credit card or PayPal.

- Download the finalized form to your device and access it anytime via the My Forms section in your account.

By following these steps, you'll have everything you need to establish your LLC swiftly and securely. US Legal Forms not only provides a robust collection of forms but also expert assistance, making the process seamless and efficient.

Don't hesitate—start your LLC creation journey today with US Legal Forms and empower your business with legal protection!

Form popularity

FAQ

To formally write your Limited Liability Company, include the phrase 'Limited Liability Company' or the abbreviation 'LLC' in your business name. For example, if you choose a unique name, you might write 'Spark Innovations LLC.' It is essential to follow your state’s specific guidelines for naming your LLC, ensuring it clearly communicates its structure to any interested parties.

When writing Limited Liability Company in documents, use LLC as the abbreviation after the full term has been stated. For instance, you might say, 'I am forming a Limited Liability Company, or LLC, to protect my personal assets.' This clear distinction helps avoid confusion and ensures your audience understands that the LLC offers liability protection.

One common example of an LLC is a local bakery that operates under that structure. The owners benefit from limited liability, which means that if the bakery faces financial issues, their personal assets like homes or savings are typically safe from creditors. This example illustrates how an LLC can provide protection and peace of mind while running a business.

A limited liability company (LLC) is a specific type of business entity that combines the flexibility of a partnership with the liability protection of a corporation. Entities classified as LLCs have limited personal liability, allowing owners to protect their assets from business liabilities. This structure is ideal for many small business owners who seek to safeguard their personal finances.

An example of a limited company is a small consulting firm that operates as an LLC. This firm provides consulting services while enjoying the benefits of limited liability protection. This structure allows the owners to separate their personal assets from the company's debts and liabilities, fostering financial security.

You can indeed create a limited liability company even if you don’t have an active business yet. Many people form an LLC in advance, which allows them to secure their business name and limit their personal liability from the start. It’s a proactive approach that also sets the stage for future business activities.

Limited liability means that the personal assets of the owners are protected from business debts and legal claims. An example of this is if your LLC faces a lawsuit, the court can only go after the business's assets, not your personal property. This protection is one of the key reasons many entrepreneurs choose to form a limited liability company.

To establish a limited liability company (LLC), you need to file the appropriate paperwork with your state's business division. This process usually involves choosing a unique name for your LLC, designating a registered agent, and submitting the Articles of Organization. With the help of a platform like US Legal Forms, you can complete these steps efficiently, ensuring your LLC is set up correctly.

Apple operates as a corporation, known as Apple Inc., and not as a limited liability company. Incorporating enables Apple to raise significant capital, expand its reach globally, and trade its stocks publicly. In contrast, many small businesses favor the LLC structure for its liability protection and simpler governance.

No, Amazon is not an LLC company; it is structured as Amazon, Inc., a corporation. This structure allows it to attract investors, raise funds through stock sales, and manage its vast operations efficiently. While many small businesses benefit from an LLC, Amazon’s scale and needs fit better with a corporate framework.