Limited Liability Company For Dummies

Description

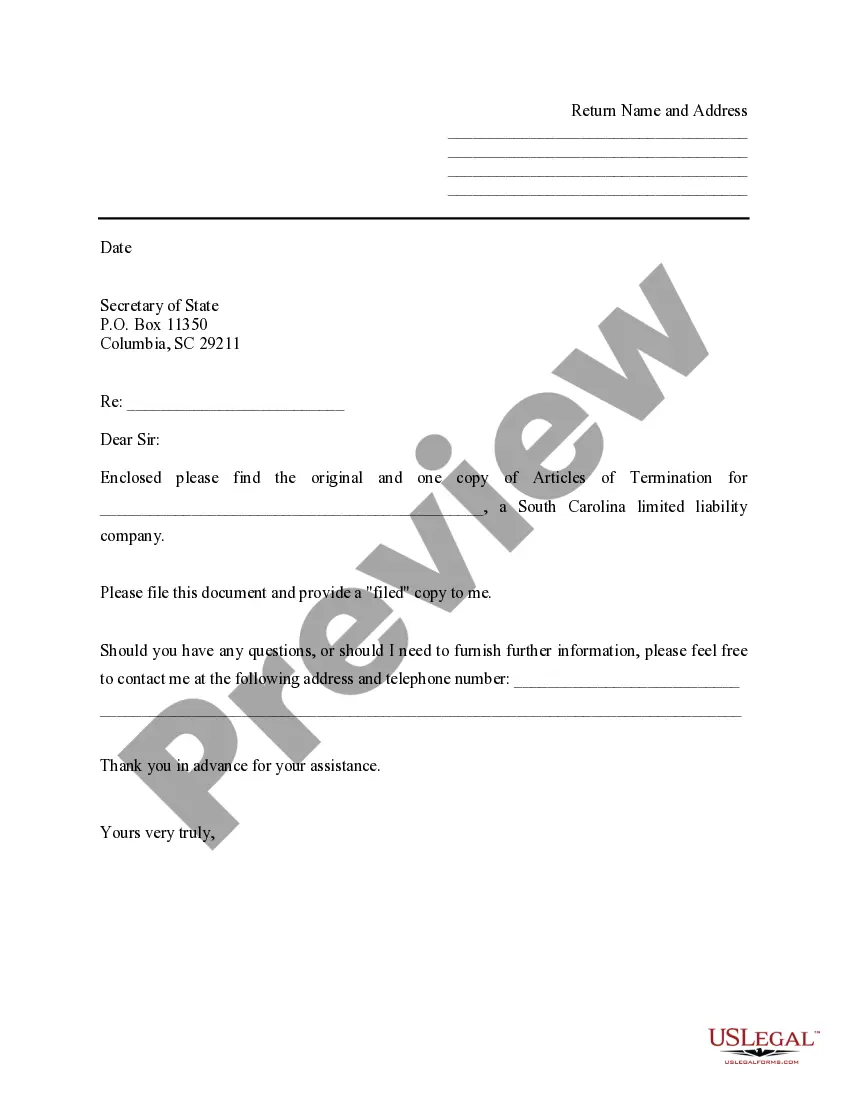

How to fill out South Carolina Dissolution Package To Dissolve Limited Liability Company LLC?

- Log in to your US Legal Forms account if you are a returning user, ensuring your subscription is active. If necessary, renew it according to your chosen plan.

- For new users, start by reviewing the Preview mode and accompanying description of the LLC form. Confirm that it aligns with your specific needs and local regulations.

- If the form does not meet your requirements, utilize the Search feature to explore alternative templates and find the appropriate one.

- Once you identify the correct document, click the Buy Now button. Select your preferred subscription plan and create an account to access the full library of resources.

- Complete your purchase by entering your payment details via credit card or PayPal.

- After your transaction, download the form to your device. You can also find it later in the My Forms section of your profile for easy access.

US Legal Forms stands out with its robust collection, offering more forms than competitors at comparable prices. With over 85,000 editable templates, users can easily find the exact legal documents needed.

Additionally, premium experts are available to assist you in completing your forms accurately, ensuring your legal documents are precise and compliant. Start your LLC today with ease!

Form popularity

FAQ

Writing an LLC example involves presenting a typical business name structure and its components. For example, you could write 'Cozy Books Publishing LLC,' indicating that it is a Limited Liability Company. Include information such as the registered agent and the state of formation. If you need a comprehensive guide, US Legal Forms can provide templates and examples tailored for those learning about Limited Liability Company for dummies.

To write an LLC example, start by using a fictional business name followed by the designation 'LLC'. For instance, 'Green Thumb Gardening LLC' shows that this business is a Limited Liability Company. The example should also illustrate the basic information needed for the formation, such as the business address and the names of its members. US Legal Forms can provide real-world examples to help you grasp this concept as a Limited Liability Company for dummies.

In layman terms, an LLC is a type of business structure that combines the benefits of a corporation and a partnership. It protects your personal assets while allowing flexibility in management and taxation. This means your liability is limited to what you invest in the business, making it a secure way to operate. Understanding an LLC as a Limited Liability Company for dummies can help clarify this essential concept.

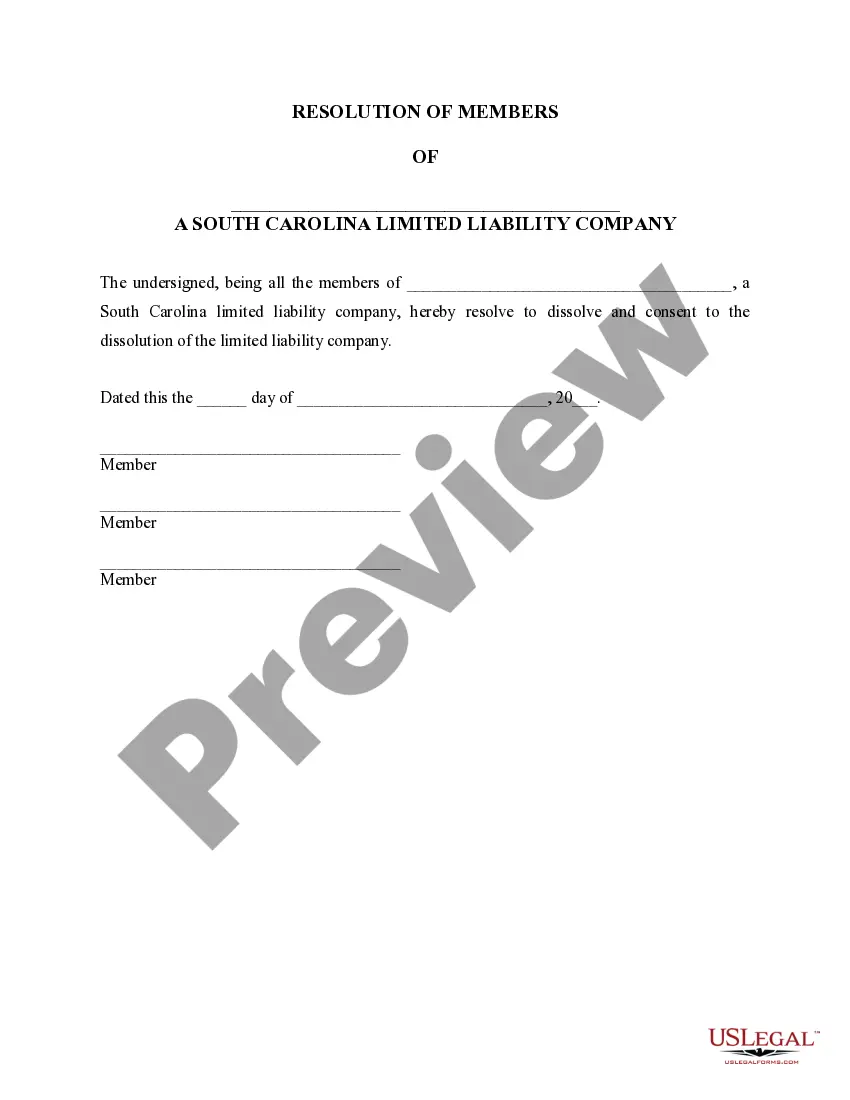

Filling out an LLC usually involves completing a form called the Articles of Organization. You will provide essential details like your business name, address, and the names of members. It’s crucial to check the specific requirements for your state, as they may vary. US Legal Forms offers step-by-step instructions and templates to simplify the process of forming your Limited Liability Company for dummies.

To write LLC correctly, you must include 'Limited Liability Company' or the abbreviation 'LLC' in your business name. This designation protects your personal assets from business debts. Ensure your name is unique and adheres to state rules. For further assistance, consider using US Legal Forms, where you can find templates and guidance on naming your Limited Liability Company for dummies.

Filing taxes for a limited liability company can be simplified. Generally, an LLC files taxes based on its chosen status such as sole proprietorship or partnership. To navigate this process with ease, consider consulting resources from US Legal Forms, ensuring you understand your obligations and make the correct filings without confusion.

The best filing status for a limited liability company often depends on your individual business needs. LLCs can choose to be taxed as sole proprietorships, corporations, or partnerships, offering flexibility in how income and taxes are managed. It's wise to consult with a tax professional or use platforms like US Legal Forms to determine which status aligns best with your financial goals.

Filing for a limited liability company in the most efficient manner involves using an intuitive online service. By choosing US Legal Forms, you gain access to comprehensive resources that help you fill out the necessary forms correctly. This approach minimizes mistakes and maximizes your chances of a smooth filing experience.

The best way to file for a limited liability company for dummies is by using a reliable online service. With the right platform, such as US Legal Forms, you can ensure that all your paperwork is completed accurately and submitted on time. Their templates and guidance make the filing process straightforward and less daunting for new business owners.

One significant disadvantage of a limited liability company for dummies is the potential for self-employment taxes. LLC owners may be responsible for paying both income tax and self-employment tax on their profits. It's essential to understand these financial implications, as they may affect your overall profit and tax situation in the long run.