Limited Companies

Description

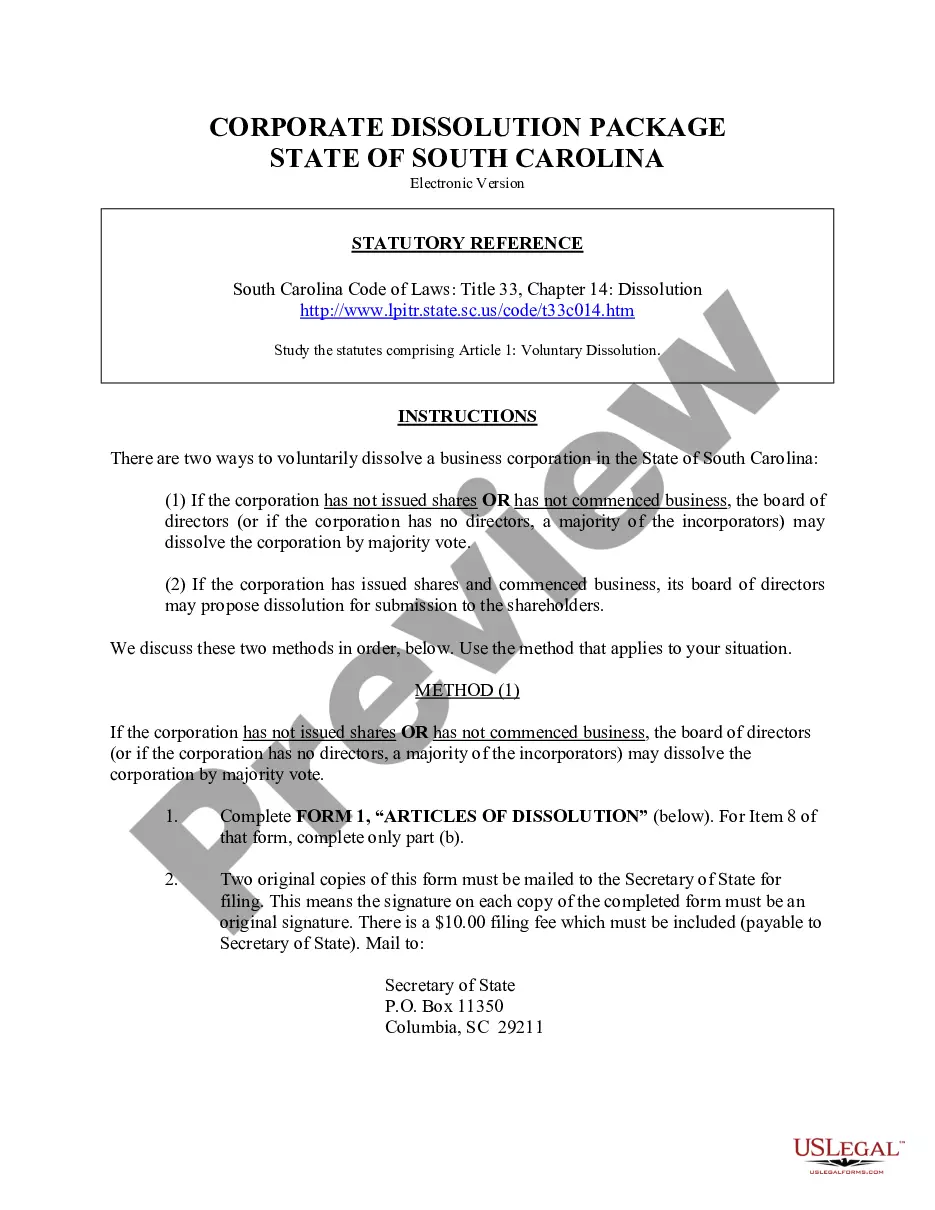

How to fill out South Carolina Dissolution Package To Dissolve Limited Liability Company LLC?

- Access your US Legal Forms account. If you've used the service before, simply log in to download your required form template.

- Ensure your subscription is active. If it has lapsed, renew it as per your payment plan.

- If you're a first-time user, browse the available forms. Check the Preview mode and ensure the form aligns with your needs and jurisdiction.

- Use the search feature if necessary. If any discrepancies arise, look for another template that suits your needs.

- Purchase the document. Click on the Buy Now button and select a subscription plan, creating an account if required.

- Complete your payment. Enter your credit card information or utilize PayPal for the subscription.

- Download your selected form. Save it to your device and access it at any time in the My Forms section.

By choosing US Legal Forms, you gain access to legal expertise and a robust collection of forms, more extensive than competitors'. This not only simplifies the process but ensures accuracy in your documentation.

Start leveraging the benefits of US Legal Forms today and make your legal documentation process smoother. Visit US Legal Forms now and discover the right forms for your limited company needs!

Form popularity

FAQ

A limited company is a type of business structure that separates personal assets from business liabilities. This means that the owners, or shareholders, are not personally responsible for business debts beyond their investment in the company. Limited companies can be found in various industries, offering advantages such as easier capital raising and a structured way to manage growth. If you need guidance on establishing limited companies, US Legal Forms provides essential tools to navigate the process.

known example of a limited liability company is Amazon, LLC. This type of company structure allows its owners to limit their personal liability for business debts and obligations. Limited companies like Amazon benefit from flexibility in management and tax treatment, making them appealing to entrepreneurs and startups. To explore how to form your own limited company, check out what US Legal Forms has to offer.

Apple Inc., commonly known as Apple, is indeed a limited company. It operates as a publicly traded corporation, which means shareholders have limited liability regarding company debts. This structure protects individual investors, making it an attractive option for many businesses. If you're considering forming limited companies, the US Legal Forms platform can provide valuable resources.

Your LLC can be classified as an S Corp, C Corp, or partnership based on your election with the IRS. By default, a single-member LLC is treated as a disregarded entity, while multiple-member LLCs are treated as partnerships. To elect S Corp status, you must file IRS Form 2553. Knowing your business structure ensures you can make informed decisions regarding taxes and liability.

A limited company typically needs to file specific documents like an annual return, financial statements, and tax returns. The exact requirements may vary based on state regulations or the type of business structure. Timely submission of these documents helps avoid penalties and keeps your limited company compliant. Using US Legal Forms can help ensure you meet all deadlines correctly.

Determining whether your LLC is classified as an S or C Corporation depends on your tax election. Generally, an LLC is not automatically categorized as a corporation unless you elect to be taxed that way. You can choose to file IRS Form 2553 to opt for S Corp status, or let your LLC default to C Corp. Understanding these classifications can benefit your tax strategy significantly.

Limited companies must file several essential documents to maintain compliance. Common filings include an annual report, financial statements, and articles of incorporation. These submissions ensure that the company remains in good standing with state regulations. By utilizing platforms like US Legal Forms, you can simplify the filing process and stay organized.

Limited companies can encompass a wide range of businesses, including startups, family-owned ventures, and corporations. These businesses typically enjoy the limited liability protection that helps mitigate financial risk for their owners. Popular forms of limited companies include LLCs and limited partnerships, both designed to serve different business needs.

The terms LLC and limited both refer to business structures that restrict owner liability but in different contexts. An LLC, or limited liability company, is a specific type of limited company recognized in the U.S., while the term 'limited' often refers to various forms of businesses, including LTDs in the UK. Understanding these distinctions is essential when forming a business.

Being a limited company means that the business has a separate legal identity from its owners. This structure helps protect personal assets, as only the company's assets are at risk if the business faces financial issues. Limited companies are favored for their potential tax advantages and ability to attract investors.