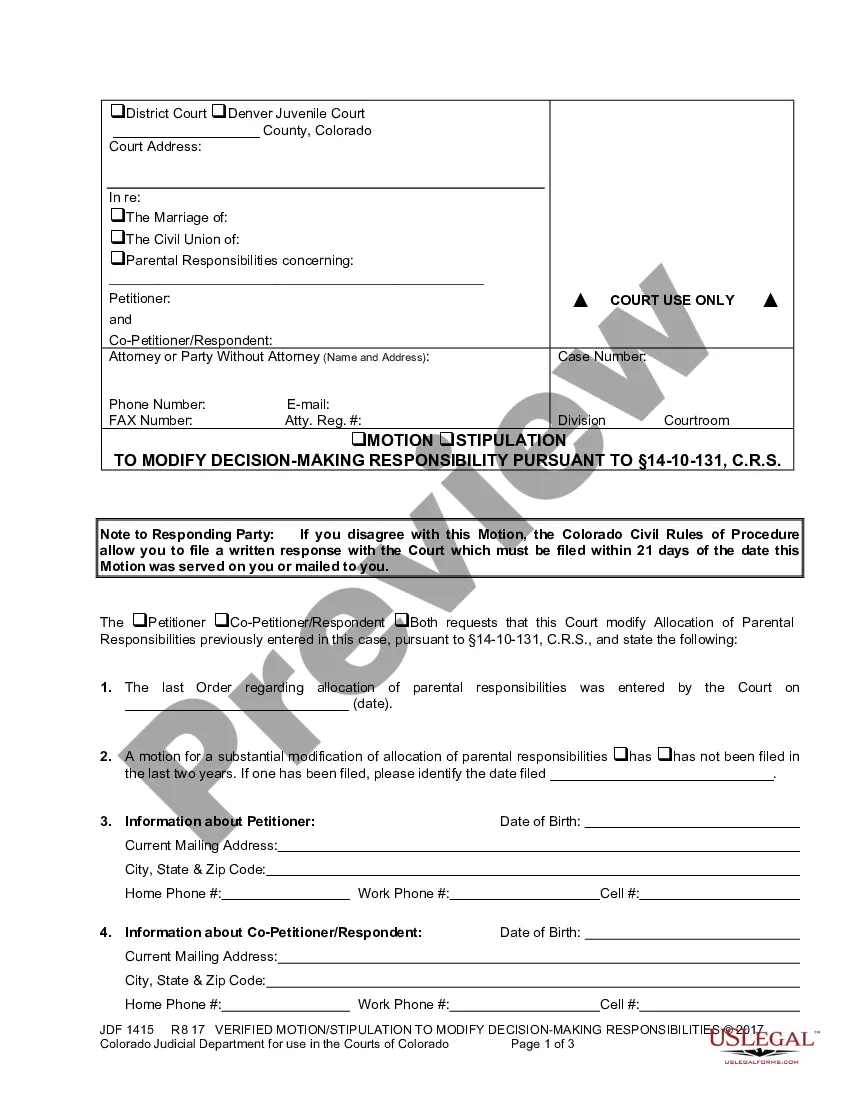

Closing Statement Same As Closing Disclosure

Description

How to fill out South Carolina Closing Statement?

Getting a go-to place to access the most current and relevant legal samples is half the struggle of handling bureaucracy. Choosing the right legal papers calls for precision and attention to detail, which is why it is vital to take samples of Closing Statement Same As Closing Disclosure only from reputable sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to be concerned about. You may access and see all the details regarding the document’s use and relevance for your situation and in your state or county.

Take the listed steps to finish your Closing Statement Same As Closing Disclosure:

- Utilize the catalog navigation or search field to locate your template.

- View the form’s description to see if it suits the requirements of your state and area.

- View the form preview, if available, to ensure the template is definitely the one you are interested in.

- Resume the search and find the appropriate document if the Closing Statement Same As Closing Disclosure does not match your needs.

- If you are positive about the form’s relevance, download it.

- When you are a registered user, click Log in to authenticate and access your selected forms in My Forms.

- If you do not have an account yet, click Buy now to obtain the form.

- Select the pricing plan that fits your preferences.

- Go on to the registration to finalize your purchase.

- Complete your purchase by selecting a transaction method (bank card or PayPal).

- Select the file format for downloading Closing Statement Same As Closing Disclosure.

- Once you have the form on your gadget, you can alter it using the editor or print it and complete it manually.

Remove the headache that comes with your legal paperwork. Discover the comprehensive US Legal Forms catalog to find legal samples, check their relevance to your situation, and download them immediately.

Form popularity

FAQ

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the ?closing disclosure.? Essentially, this is for buyers to review in advance before closing.

A closing statement or credit agreement is provided with any type of loan, often with the application itself. A seller's Closing Disclosure is prepared by a settlement agent and lists all commissions and costs in addition to the net total to be paid to the seller.

Lenders must provide borrowers with a closing disclosure (also called a CD) at least three business days before closing?that day when all the remaining paperwork is signed and you get the keys to your new home.

1 form is most commonly used for reverse mortgages and mortgage refinance transactions. Now, for most kinds of mortgage loans, borrowers receive a form called the Closing Disclosure instead of a HUD1 form.