Closing Costs With Usda Loan

Description

How to fill out South Carolina Closing Statement?

Securing legal documents that adhere to federal and state regulations is crucial, and the web provides numerous selections to select from.

However, why squander time searching for the suitable Closing Costs With Usda Loan template online if the US Legal Forms digital repository has already compiled such documents in one location.

US Legal Forms is the largest virtual legal database with over 85,000 customizable forms created by attorneys for various business and personal situations. They are user-friendly with all paperwork categorized by state and intended use. Our experts stay abreast of legislative changes, so you can always ensure your documentation is current and compliant when obtaining a Closing Costs With Usda Loan from our platform.

Click Buy Now once you’ve located the correct document and select a subscription package. Create an account or sign in, and complete the payment using PayPal or a credit card. Choose the best format for your Closing Costs With Usda Loan and download it. All templates available through US Legal Forms are reusable. To re-download and fill out previously purchased documents, navigate to the My documents section in your account. Take advantage of the most comprehensive and user-friendly legal document service!

- Acquiring a Closing Costs With Usda Loan is quick and easy for both existing and new customers.

- If you already possess an account with a valid subscription, Log In and retrieve the document template you require in the appropriate format.

- If you are visiting our site for the first time, follow the instructions outlined below.

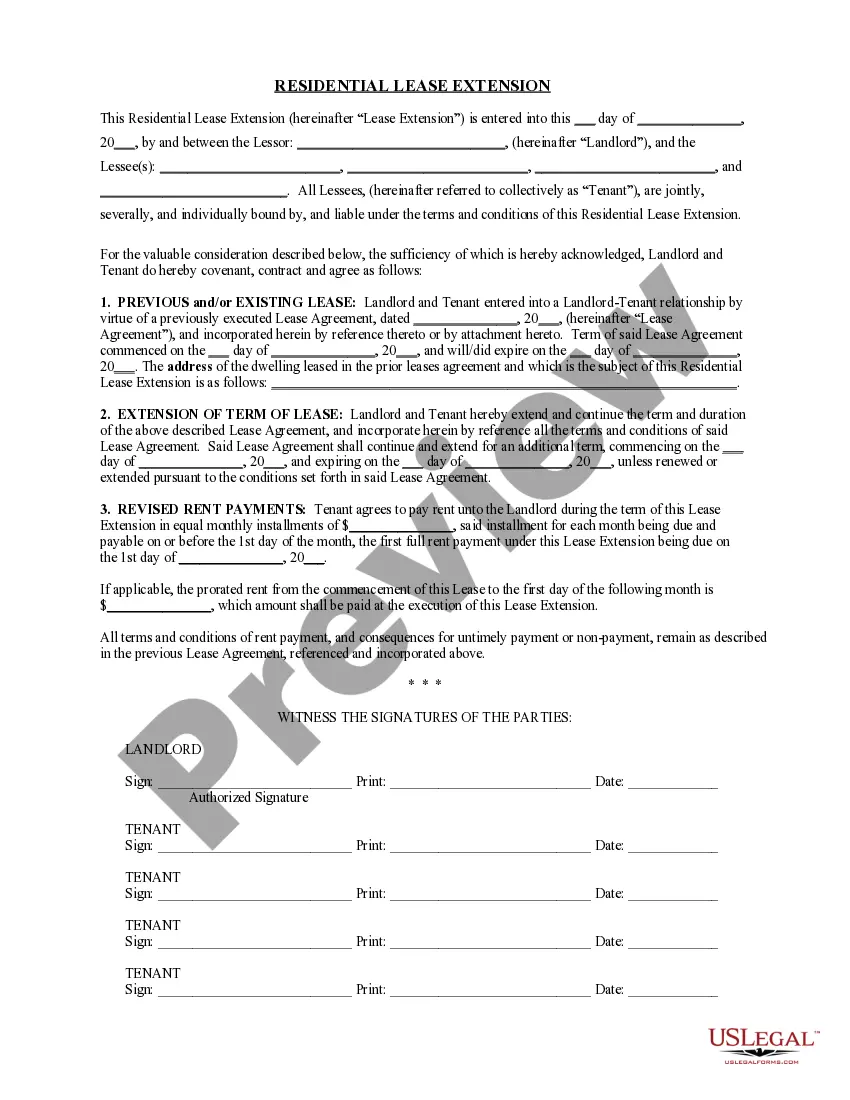

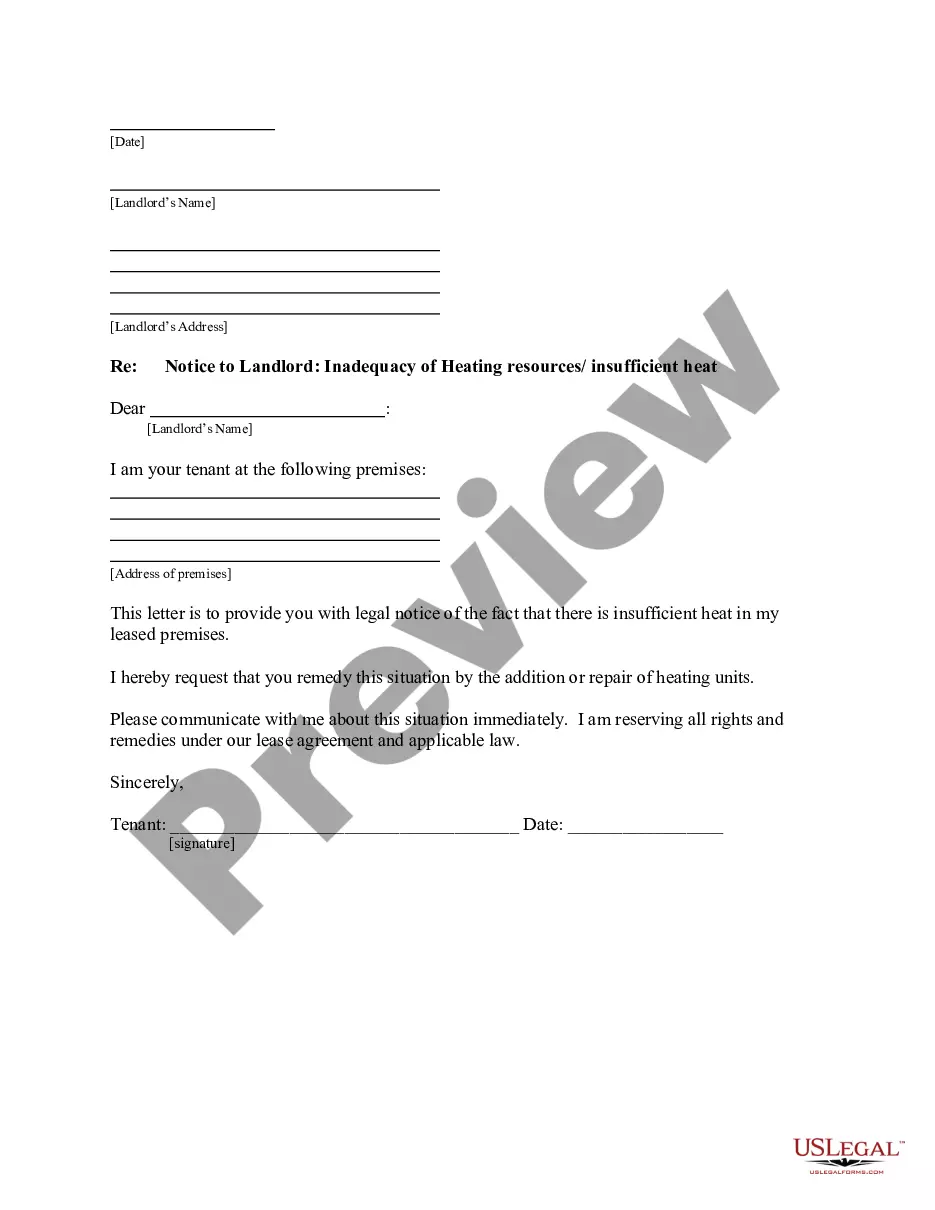

- Review the document using the Preview tool or through the text description to confirm it meets your requirements.

- Search for an alternative template using the search feature at the top of the page if necessary.

Form popularity

FAQ

Can closing costs be included in a mortgage? Yes, closing costs can be included in a mortgage loan. This is also known as ?rolling? closing costs into a loan. The downside of rolling closing costs into a loan is that you will be paying interest on the closing fees, so you'll pay more for your mortgage in the long run.

There is a single upfront fee based upon the sales price of the home at 1.00%. Say the home is listed at $150,000. That would mean the Guarantee Fee is $1,500. This fee is then rolled into the loan amount for a final loan amount of $151,500.

Closing costs, also known as settlement costs, are the fees you pay when obtaining your loan. Closing costs are typically about 3-5% of your loan amount and are usually paid at closing.

How to Assume a USDA Loan Step 1: Determine Eligibility. To assume a USDA loan, you must confirm that you meet eligibility requirements. ... Step 2: Find a Property. ... Step 3: Contact the Loan Servicer. ... Step 4: Gather Documentation. ... Step 5: Submit an Assumption Application. ... Step 6: Await Approval. ... Step 7: Complete Closing.

The USDA loan guarantee fee helps enable the USDA to make these mortgages available and essentially functions as mortgage insurance for a USDA loan. The upfront guarantee fee for 2023 is equal to 1% of the loan amount. The annual fee is equal to 0.35% of the loan amount.