Closing Costs With Heloc

Description

How to fill out South Carolina Closing Statement?

Legal oversight can be overwhelming, even for the most seasoned experts.

When you are seeking Closing Costs With Heloc and lack the time to spend searching for the right and current version, the procedures can be strenuous.

Access a comprehensive resource of articles, guides, and materials related to your situation and requirements.

Save time and effort searching for the documents you need, and employ US Legal Forms’ enhanced search and Review tool to locate Closing Costs With Heloc and obtain it.

Enjoy the US Legal Forms online library, backed by 25 years of experience and reliability. Enhance your everyday document management through a straightforward and user-friendly process starting now.

- If you have a subscription, Log In to your US Legal Forms account, find the form, and obtain it.

- Check your My documents tab to review the documents you have previously saved and manage your folders as desired.

- If this is your first time with US Legal Forms, create an account and gain unlimited access to all the platform's benefits.

- Here are the steps to follow after acquiring the form you require.

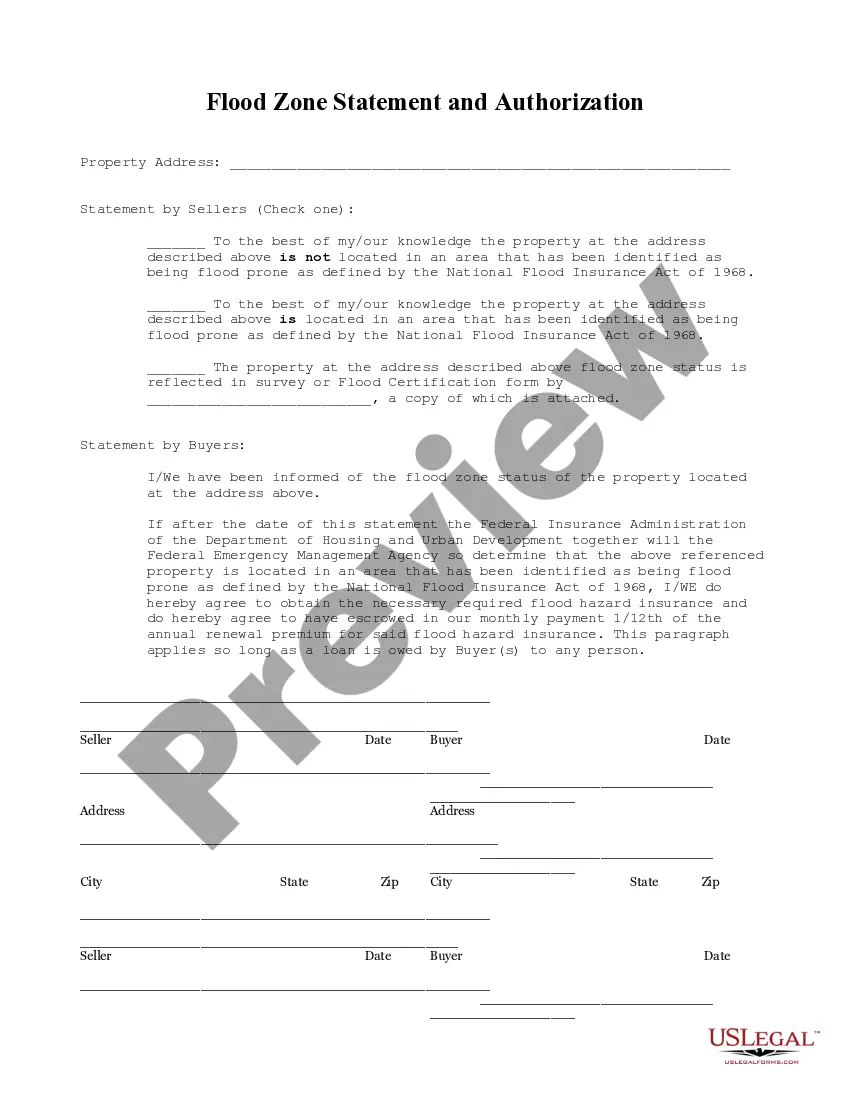

- Verify it is the correct form by previewing it and checking its details.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses every requirement you might have, from personal to corporate paperwork, all in one location.

- Utilize advanced tools to finalize and manage your Closing Costs With Heloc.

Form popularity

FAQ

Lenders can close out a HELOC at the end of the repayment term once the balance is paid in full. They can also close it out at the end of your term with a balance and create a new loan with the existing balance. You might request a close out under certain circumstances.

Yes. Lenders require an appraisal for home equity loans?no matter the type?to protect themselves from the risk of default. If a borrower can't make monthly payments over the long-term, the lender wants to know it can recoup the cost of the loan. An accurate appraisal protects borrowers too.

You don't necessarily have to wait to repay a HELOC before selling your home if you're confident your property will fetch a high enough sale price to satisfy that debt. Otherwise, you may want to wait until your home's value rises before selling it.

Some lenders will waive certain fees as part of a special offer. Other lenders will include the closing costs into the total balance of your loan, so you don't have to pay cash out of pocket.

How Do You Close a HELOC? After the underwriting process, the lender will reach out and invite you to schedule a closing date and time. The lender will then arrange a meeting between their representatives and the property owners for the selected time.