South Carolina Legal Separation Forms Withholding

Description

How to fill out South Carolina Marital Domestic Separation And Property Settlement Agreement Adult Children?

Handling legal documentation and processes can be a lengthy addition to the day.

South Carolina Legal Separation Forms Withholding and similar forms typically necessitate you to search for them and understand how to fill them out accurately.

Therefore, whether you are managing financial, legal, or personal issues, having a thorough and useful online repository of forms readily available will benefit you greatly.

US Legal Forms is the premier online source of legal templates, providing over 85,000 state-specific forms along with various resources to help you complete your documents swiftly.

Is this your first time using US Legal Forms? Sign up and create a free account in just a few minutes and you will gain entry to the form library and South Carolina Legal Separation Forms Withholding.

- Explore the collection of pertinent documents available to you with a simple click.

- US Legal Forms offers state- and county-specific forms accessible at any time for immediate download.

- Safeguard your document management activities by utilizing a top-tier service that allows you to create any form in minutes without any extra or hidden fees.

- Just Log In to your account, locate South Carolina Legal Separation Forms Withholding, and download it instantly from the My documents section.

- You can also access previously downloaded forms.

Form popularity

FAQ

The withholding exemption for South Carolina allows taxpayers to claim certain allowances based on their personal and financial circumstances. You can claim exemptions for yourself, a spouse, or dependents. If you're in the process of a legal separation, knowing your withholding exemption can help you manage your taxes more effectively. Our platform provides South Carolina legal separation forms withholding to assist you with this process.

To fill out a W4 for the biggest refund, you may want to claim fewer allowances, such as 0. This will increase the amount of tax withheld from your paycheck, leading to a potential refund when you file your taxes. However, keep in mind that everyone's financial situation is different, so evaluating your needs is essential. For those dealing with South Carolina legal separation forms withholding, our tools can assist you in making informed decisions.

Filling out a withholding certificate requires you to provide your personal information, including your name, address, and Social Security number. You will also need to indicate your filing status and the number of allowances you are claiming. Ensure that you understand the implications of your choices, especially in relation to South Carolina legal separation forms withholding, to avoid tax complications.

On your W4 form, you should indicate 0 or 1 in the section that asks for your withholding allowances. Claiming 0 means more tax will be withheld from your paycheck, while claiming 1 will reduce the amount withheld. It's important to consider your financial situation when making this choice. For guidance on South Carolina legal separation forms withholding, check out uslegalforms.

To apply for a South Carolina withholding number, you need to complete the South Carolina Department of Revenue's Form SCDOR-1. This form can be submitted online or via mail. After processing your application, the department will issue a withholding number, which you will use for tax reporting. Utilizing South Carolina legal separation forms withholding can simplify this process.

Registering for a withholding account in South Carolina involves completing the registration form available on the South Carolina Department of Revenue's website. Ensure you provide accurate information regarding your business and payroll details. Once you submit the form, you will receive confirmation of your account registration. For assistance with South Carolina legal separation forms withholding and related processes, consider using US Legal Forms to access expert resources and templates.

To obtain a South Carolina withholding number, you must first complete the appropriate application form. You can easily find this form on the South Carolina Department of Revenue website. After filling out the form, submit it along with any required documentation to ensure you receive your withholding number promptly. Utilizing resources like US Legal Forms can simplify this process, providing you with the necessary forms and guidance.

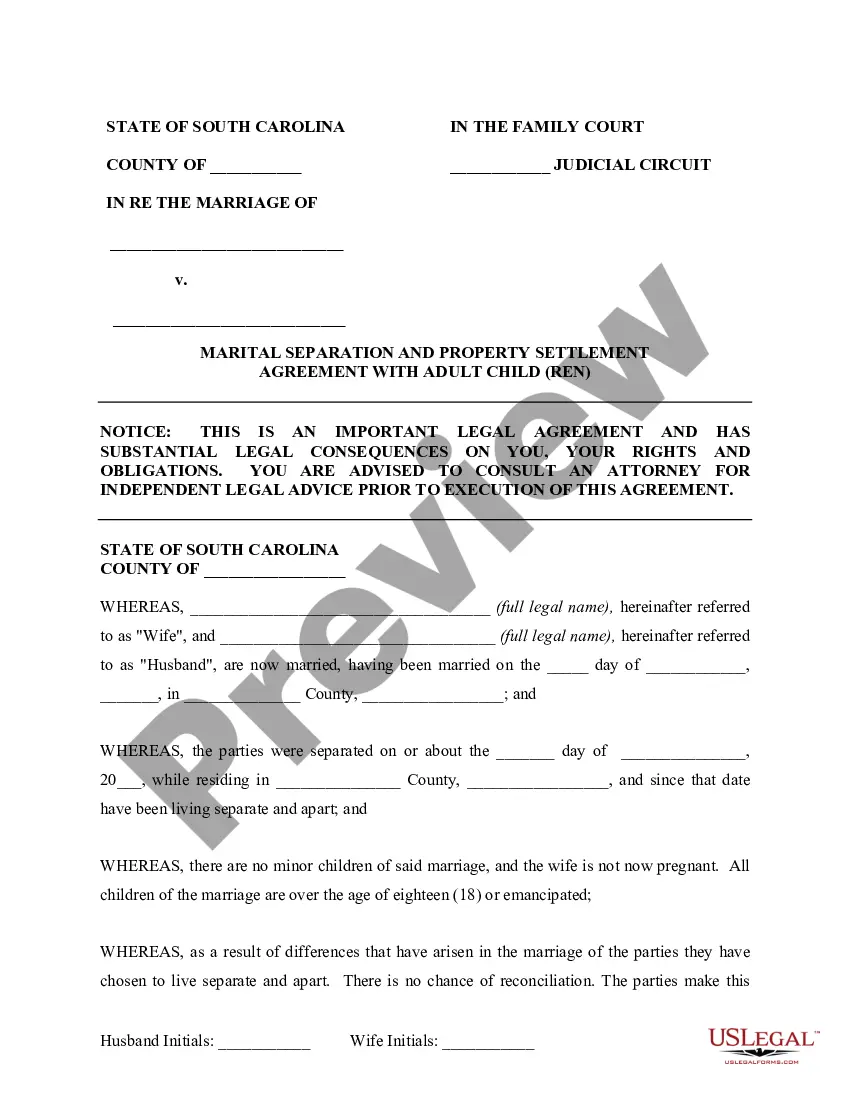

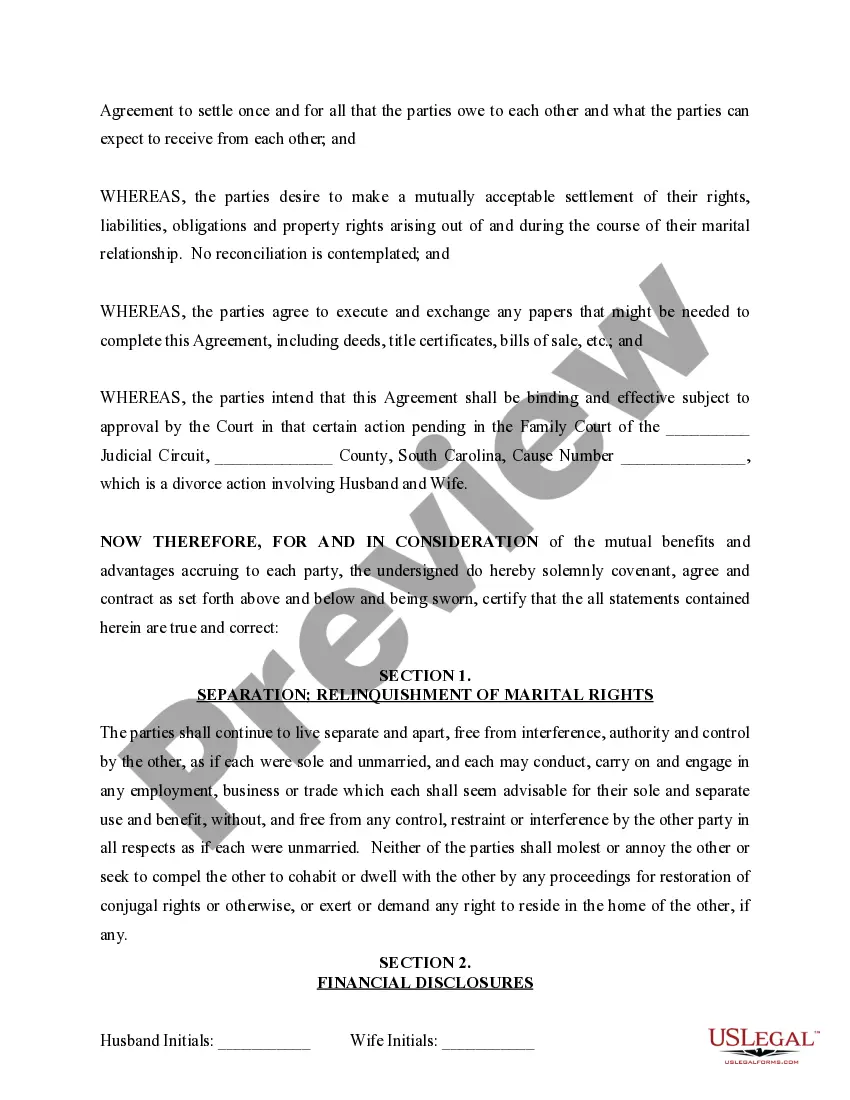

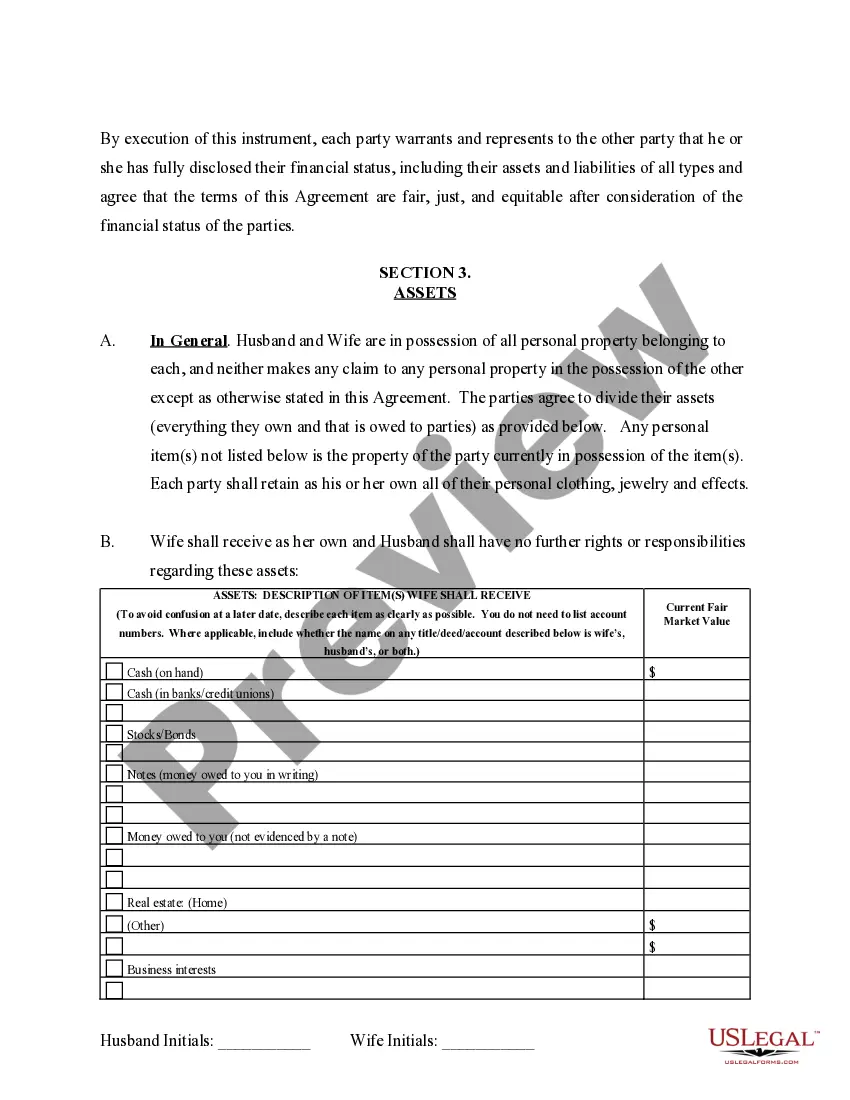

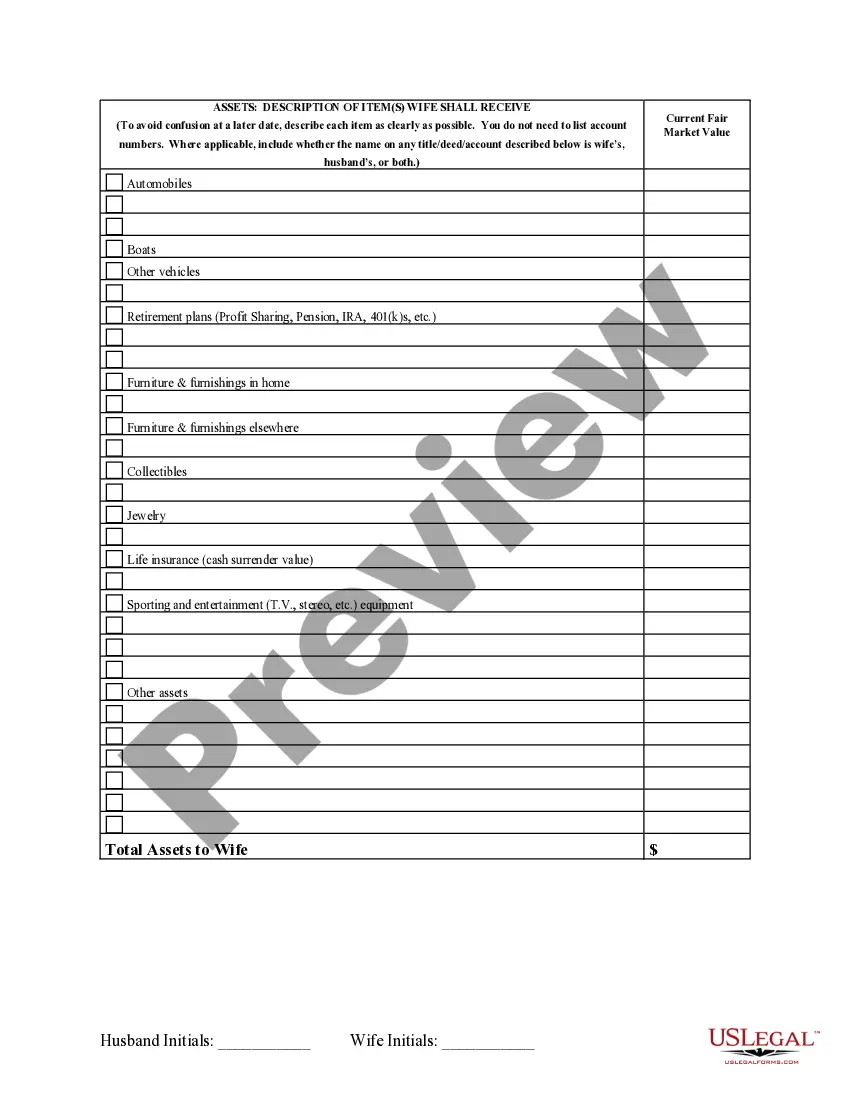

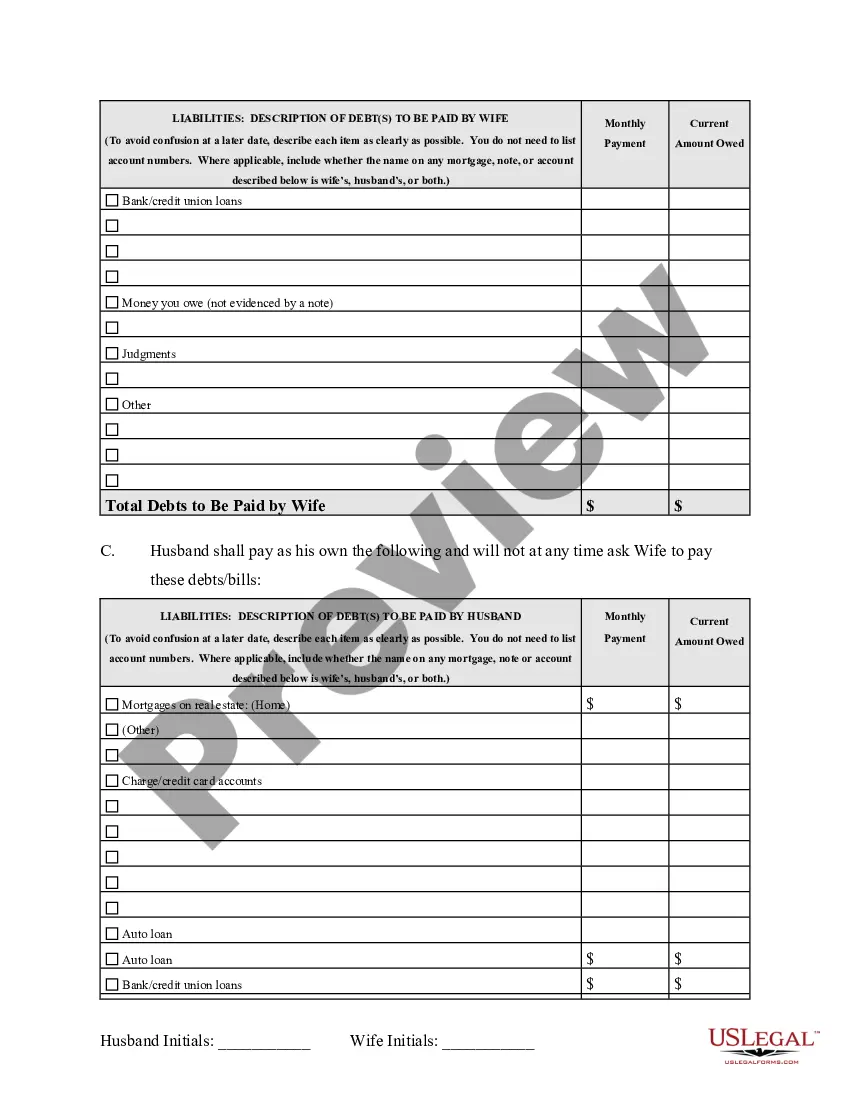

To get legally separated in South Carolina, you must first meet the state's residency requirements and grounds for separation. You will need to fill out the appropriate South Carolina legal separation forms withholding, which are available on platforms like US Legal Forms. Once completed, file the forms with your local family court and attend any required hearings. This process allows you to establish legal rights and responsibilities while living apart.

When you are legally separated, you can choose to file your taxes as married filing jointly or married filing separately. If you decide to file separately, you must indicate your separation status and ensure you have the correct South Carolina legal separation forms withholding. This choice can significantly impact your tax responsibilities, so consider consulting a tax professional for guidance based on your unique situation.

To file for legal separation in South Carolina, you need to complete the necessary legal separation forms. You can find these South Carolina legal separation forms withholding on platforms like US Legal Forms. After filling out the forms, you must file them with the family court in your county. Be sure to keep copies for your records and follow up with the court for any additional requirements.