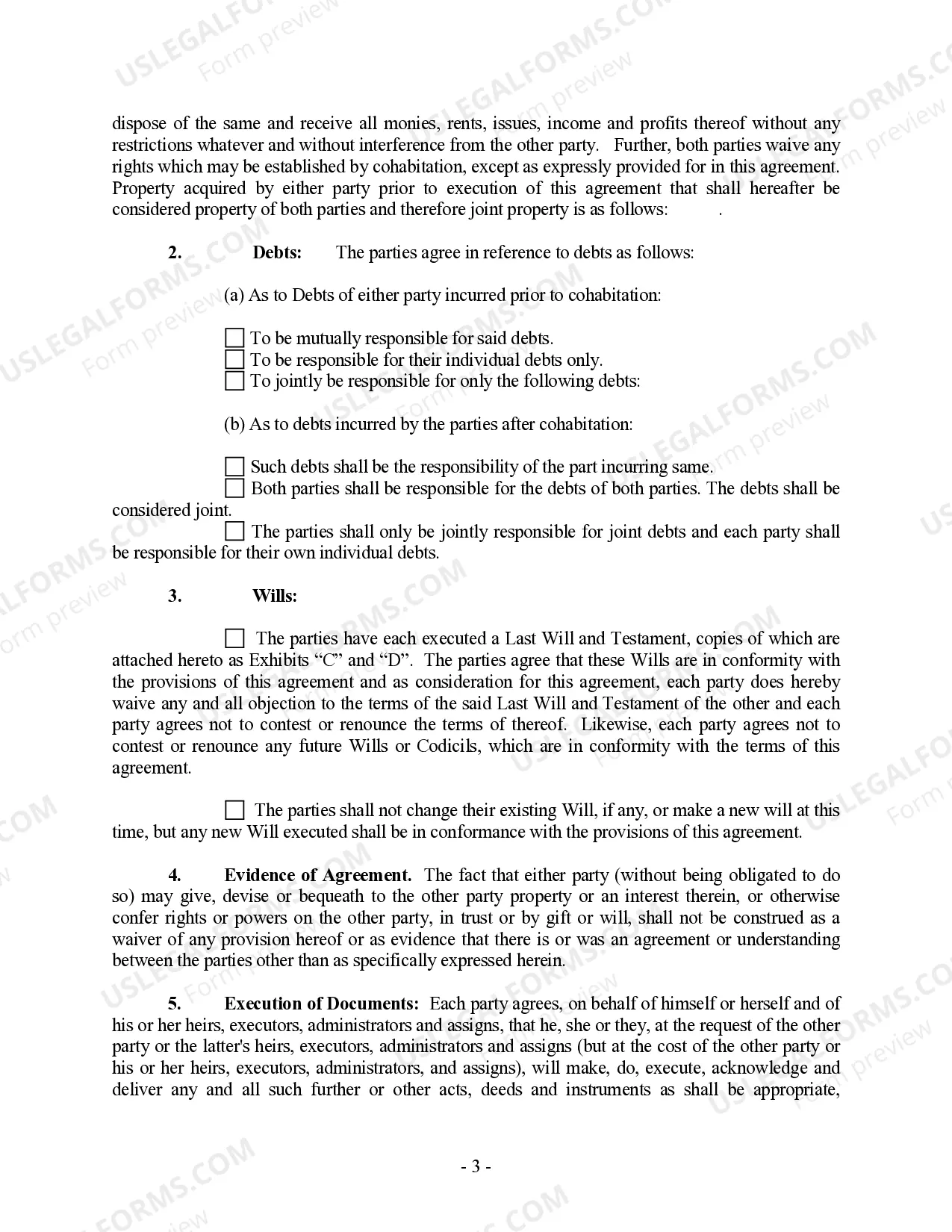

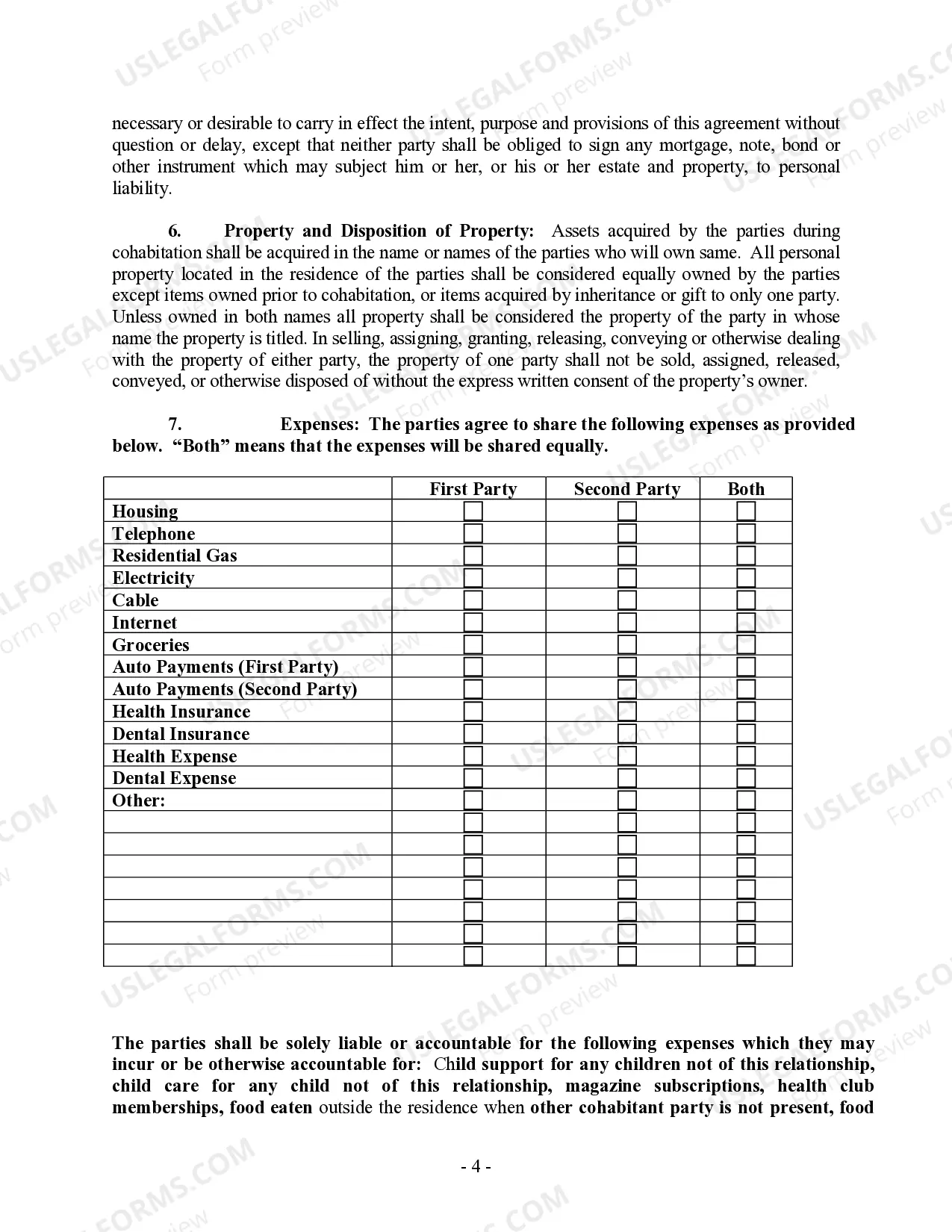

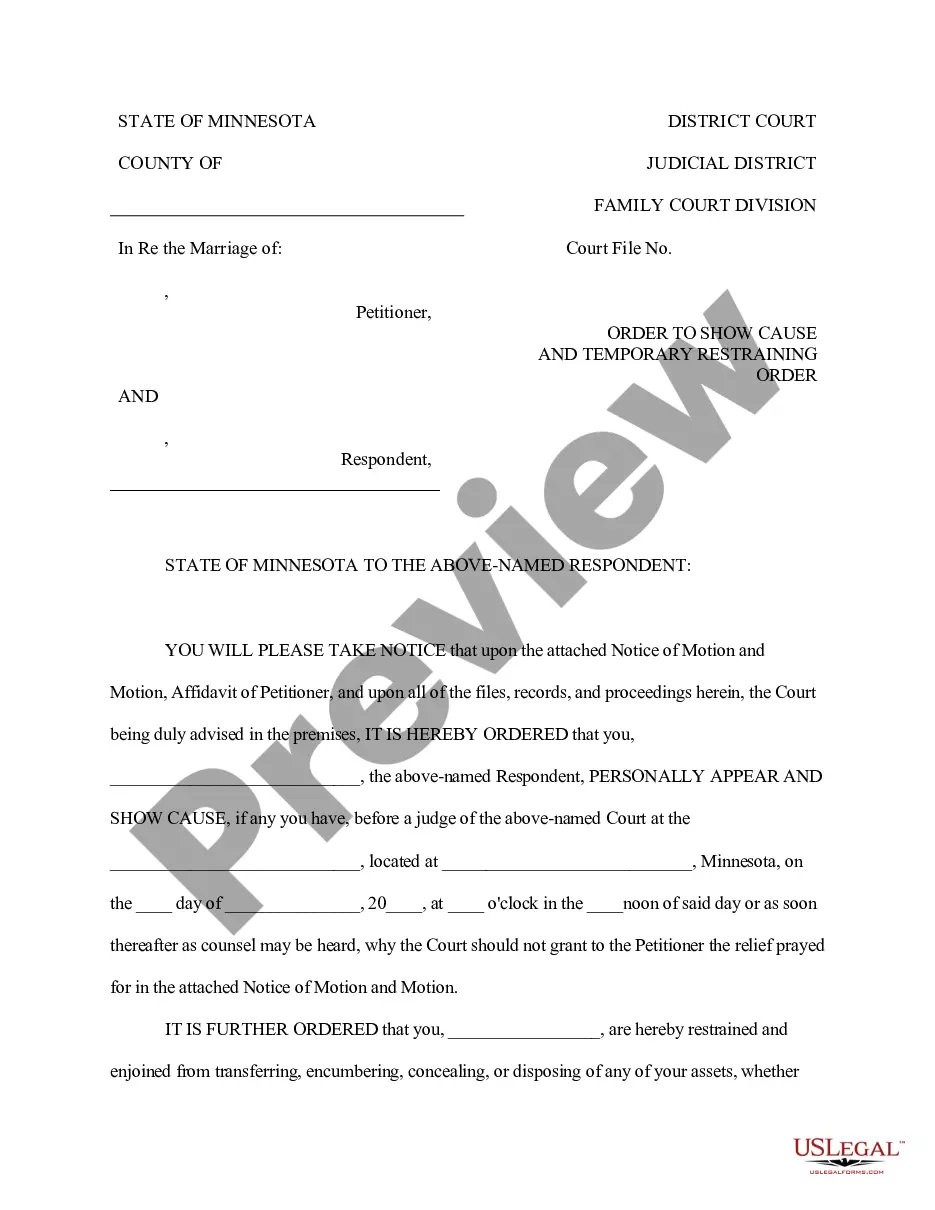

The Non-Marital Cohabitation Agreement helps clarify what is expected of each party. It contains provisions relating to expenses, assets and what happens if the parties discontinue the living arrangement, including ownership and division of property acquired during the course of the relationship.

South Carolina Cohabitation Withholding Registration Form

Description

How to fill out South Carolina Cohabitation Withholding Registration Form?

Properly prepared official documentation is one of the crucial assurances for preventing complications and legal disputes, but acquiring it without the assistance of an attorney may require some time.

Whether you need to swiftly locate a current South Carolina Cohabitation Withholding Registration Form or any other documentation for employment, family, or business purposes, US Legal Forms is always available to assist.

The procedure is even more straightforward for current users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the chosen file. Furthermore, you can retrieve the South Carolina Cohabitation Withholding Registration Form at any time, as all documents ever obtained on the platform can be found within the My documents section of your account. Save both time and money on creating formal documents. Experience US Legal Forms today!

- Verify that the form is appropriate for your situation and location by reviewing the description and sample.

- Search for another template (if necessary) using the Search bar at the top of the page.

- Press Buy Now after locating the suitable document.

- Select the pricing option, Log Into your account or create a new account.

- Choose your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Select either PDF or DOCX file format for your South Carolina Cohabitation Withholding Registration Form.

- Press Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

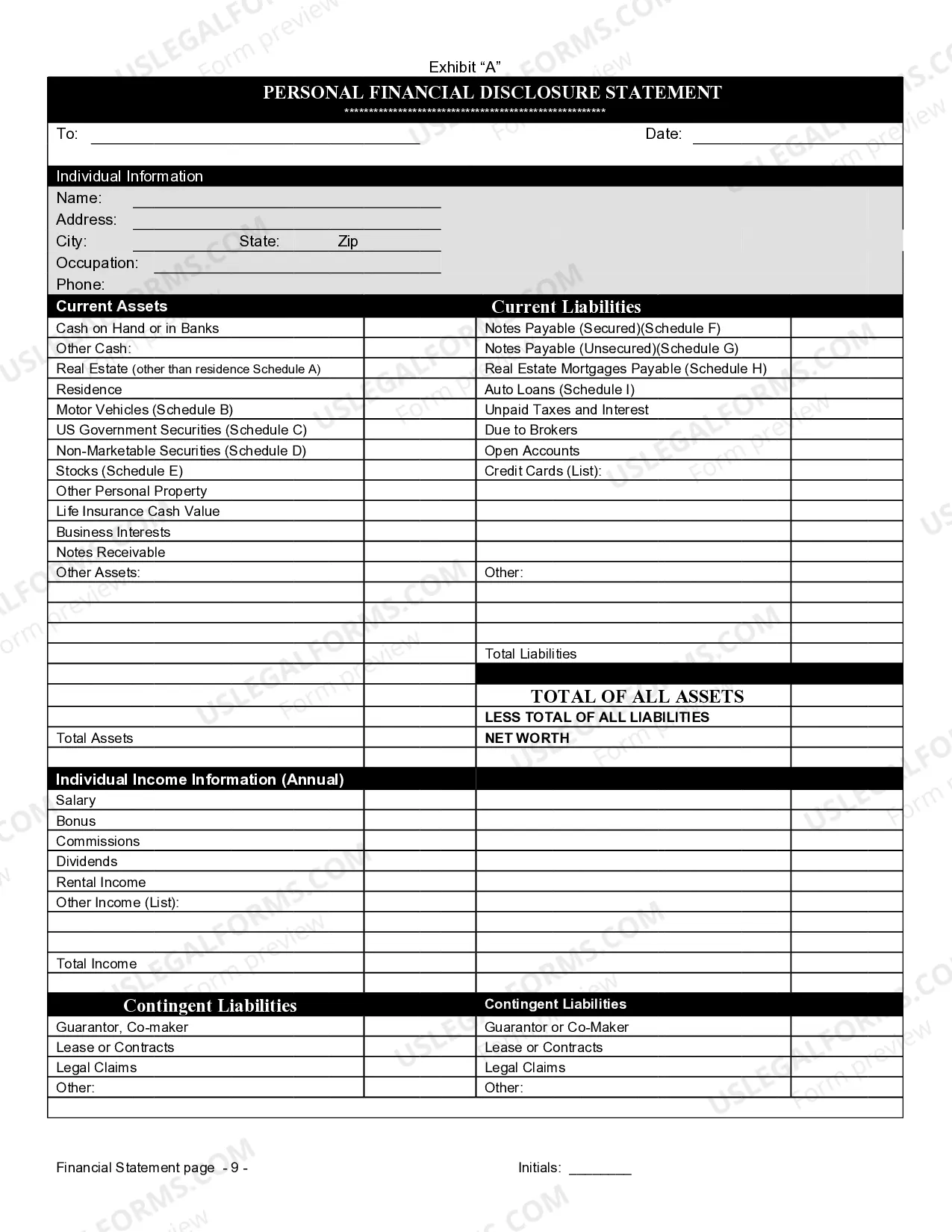

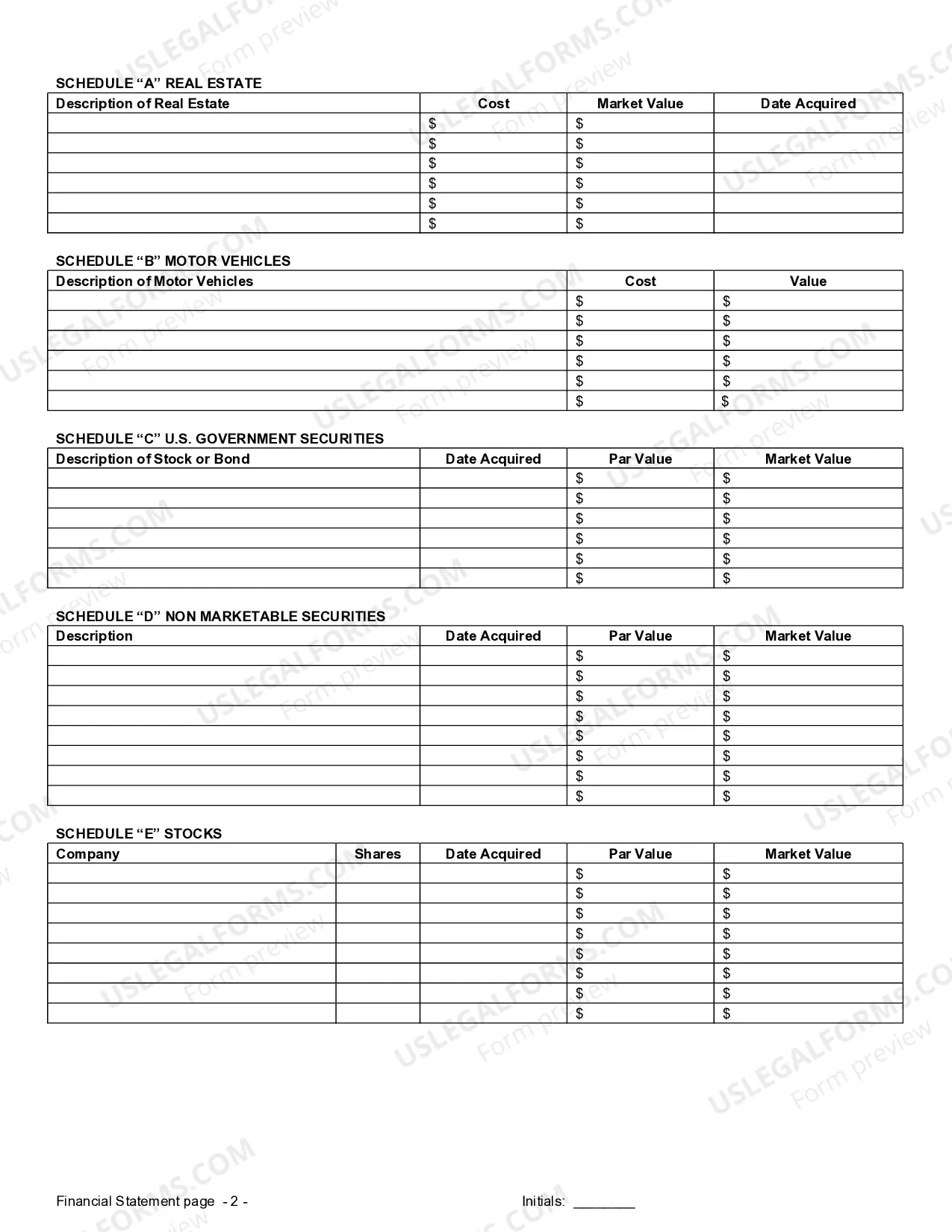

Filling out the SC W4 form is straightforward. Begin by providing your personal information, including your name, address, and Social Security number. Next, indicate your filing status and any allowances you plan to claim. Finally, if you are using the South Carolina cohabitation withholding registration form, make sure to follow the specific guidelines provided for cohabiting partners, as this can impact your withholdings and tax liabilities.

SC1040 is the individual income tax return form used in South Carolina for residents to report their income to the state. This form is essential for filing your taxes and determining any refunds or liabilities. You will reference your withholding from the South Carolina cohabitation withholding registration form while completing the SC1040. It ensures that you accurately reflect your withheld taxes throughout the year.

Registering for Withholding Tax in South Carolina involves filling out the South Carolina cohabitation withholding registration form. You can obtain this form on the South Carolina Department of Revenue website. Be sure to provide accurate information regarding your business or personal details to ensure smooth processing. After registration, you will receive instructions on how to remit the withheld taxes.

To set up withholding in South Carolina, you will need to complete the appropriate paperwork, including the South Carolina cohabitation withholding registration form. This form allows you to specify your withholding preferences based on your income and expected deductions. Once completed, submit it to your employer, who will then adjust their payroll systems accordingly. Remember, keeping your information up to date is crucial for accurate withholding.

In South Carolina, the amount of state tax to withhold largely depends on your total income and the deductions you claim. Typically, employers need to follow the state’s withholding tables to calculate the right percentage. For precise calculations, consider using the South Carolina cohabitation withholding registration form as a guiding tool. It's essential to ensure that your withholding aligns with your tax obligations to avoid surprises during tax season.

The withholding rate for partnerships in South Carolina is currently set at a flat percentage of 7%. This rate applies to the share of income allocated to nonresident partners. To facilitate this process correctly, using the South Carolina cohabitation withholding registration form is advisable to ensure accurate withholding efforts based on the partnership's income.

Non-resident withholding in South Carolina refers to the requirement for partnerships to withhold a percentage of income allocated to nonresident partners. This ensures that state taxes are collected from those who earn income in South Carolina but reside elsewhere. Proper completion of the South Carolina cohabitation withholding registration form helps simplify this process for partnerships.

Filling out the SC W-4 form requires you to provide personal information such as your name, address, and Social Security number. You will also need to determine your filing status and any additional deductions or allowances you wish to claim. It's essential to understand how this form interacts with the South Carolina cohabitation withholding registration form to ensure accurate tax withholding.

Nonresident partners in South Carolina must have tax withheld on their share of the partnership income. The partnership must calculate the appropriate amount and remit it to the state. Completing the South Carolina cohabitation withholding registration form ensures that nonresident partners receive the correct withholding treatment.

Partnership withholding is primarily the responsibility of the partnership itself. Any partnership engaging in business in South Carolina must withhold tax on the share of income allocated to any nonresident partner. This often involves submitting the South Carolina cohabitation withholding registration form to correctly identify these partners and maintain compliance.