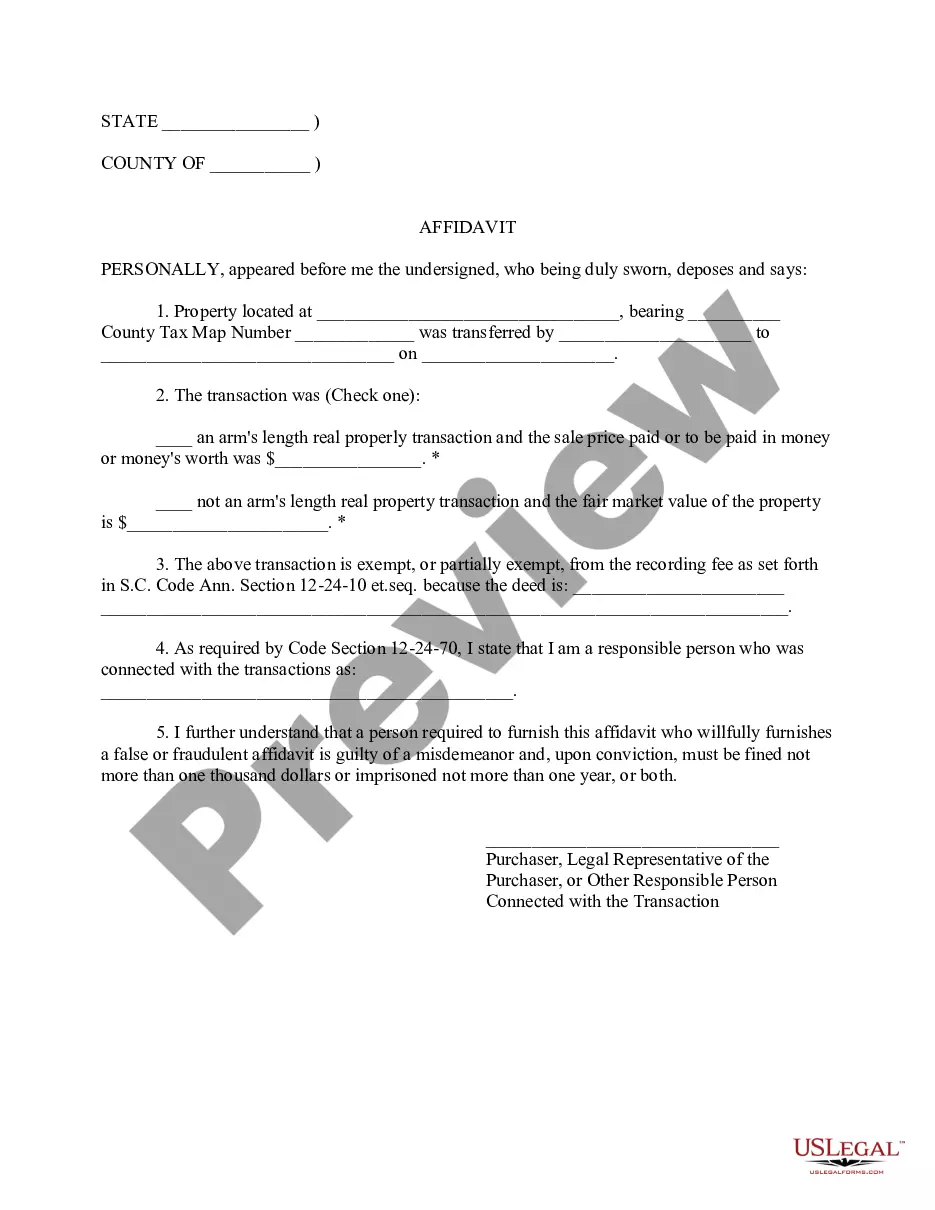

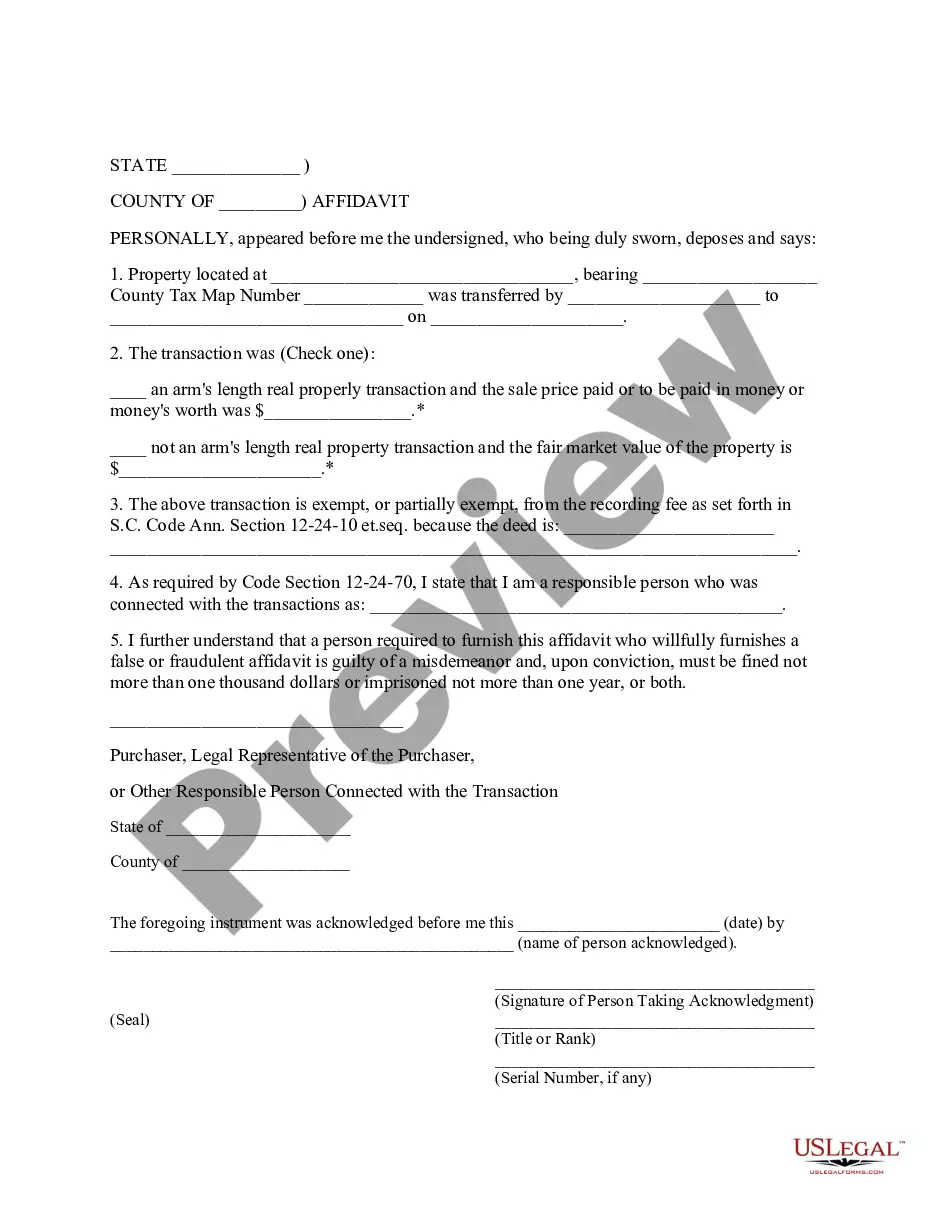

South Carolina Affidavit For Exempt Transfers

Description

How to fill out South Carolina Affidavit Of Property Value?

When you need to finalize South Carolina Affidavit For Exempt Transfers in accordance with your local state's laws and regulations, there can be numerous choices to select from.

There's no requirement to examine every document to ensure it fulfills all the legal prerequisites if you are a US Legal Forms subscriber.

It is a reliable source that can assist you in obtaining a reusable and current template on any topic.

Getting expertly crafted official documents becomes effortless with US Legal Forms. Additionally, Premium subscribers can also benefit from the powerful built-in tools for online PDF editing and signing. Experience it today!

- US Legal Forms is the most extensive online repository with a collection of over 85k ready-to-use documents for business and personal legal matters.

- All templates are verified to conform to each state's regulations.

- Consequently, when you download South Carolina Affidavit For Exempt Transfers from our site, you can be assured that you possess a valid and up-to-date document.

- Obtaining the required sample from our platform is exceptionally simple.

- If you already have an account, just Log In to the system, verify your subscription is active, and save the chosen file.

- Later, you can access the My documents section in your profile to retain access to the South Carolina Affidavit For Exempt Transfers at any time.

- If it's your first time using our library, please follow the instructions below.

- Browse through the suggested page and check it for alignment with your needs.

Form popularity

FAQ

Exempt Transfer means a Transfer of Units (a) with respect to any Member who is a natural person, to a member of such Member's immediate family, which shall include such Member's spouse, children or grandchildren, or a trust, corporation, partnership or limited liability company all of the beneficial interests of which

What is a Potentially Exempt Transfer? A Potentially Exempt Transfer (PET) enables an individual to make gifts of unlimited value which will become exempt from Inheritance Tax (IHT) if the individual survives for a period of seven years.

It is customary for the seller of the property to pay all real estate transfer taxes in South Carolina. The transfer taxes are usually due at the time of closing, alongside other fees such as appraisal fees or agent fees.

How to Transfer Real Estate in South CarolinaReview the property title to see who is officially listed on it.Sign the title over to the new owner in the place that is noted.Complete a general warranty deed to show the transfer of ownership from you to another.More items...

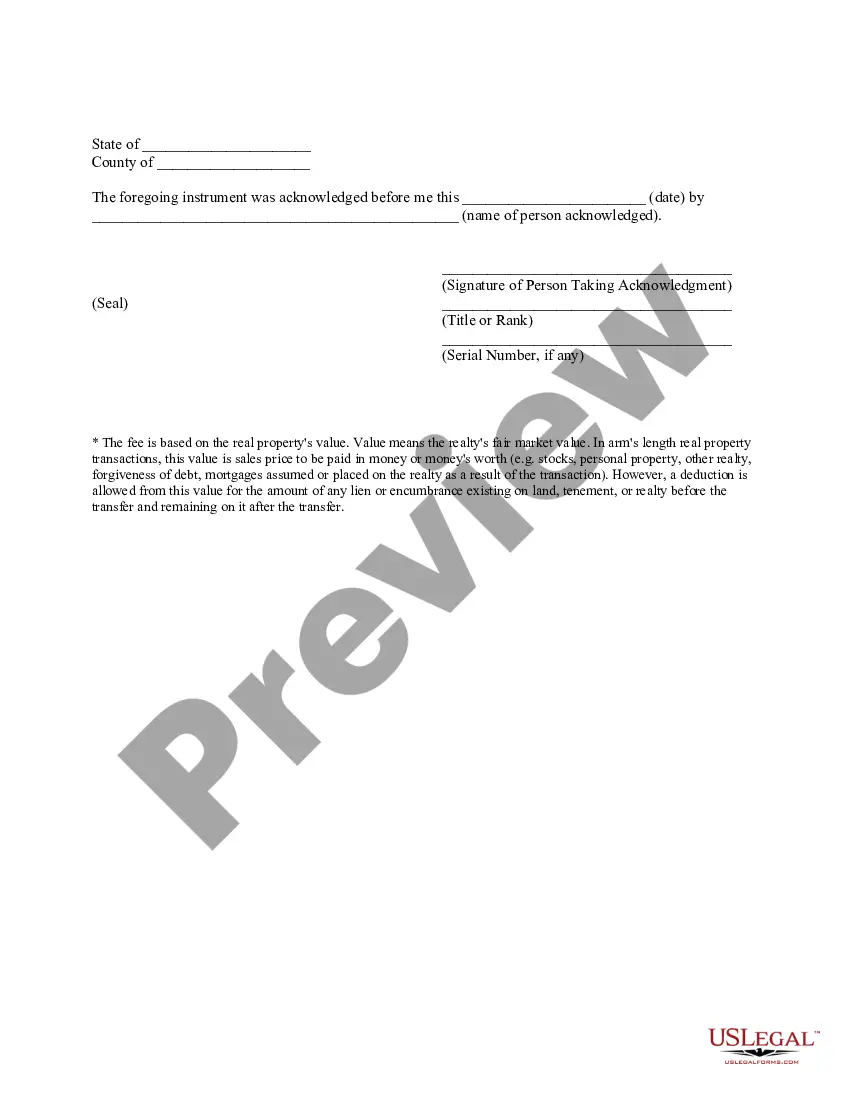

Easily calculate the South Carolina title insurance rates and South Carolina property transfer tax; customarily called documentary stamps, or revenue stamps. The recording fee is $1.85 for each five hundred dollars, or fractional part of five hundred dollars.