Lease Specific Right With The Right

Description

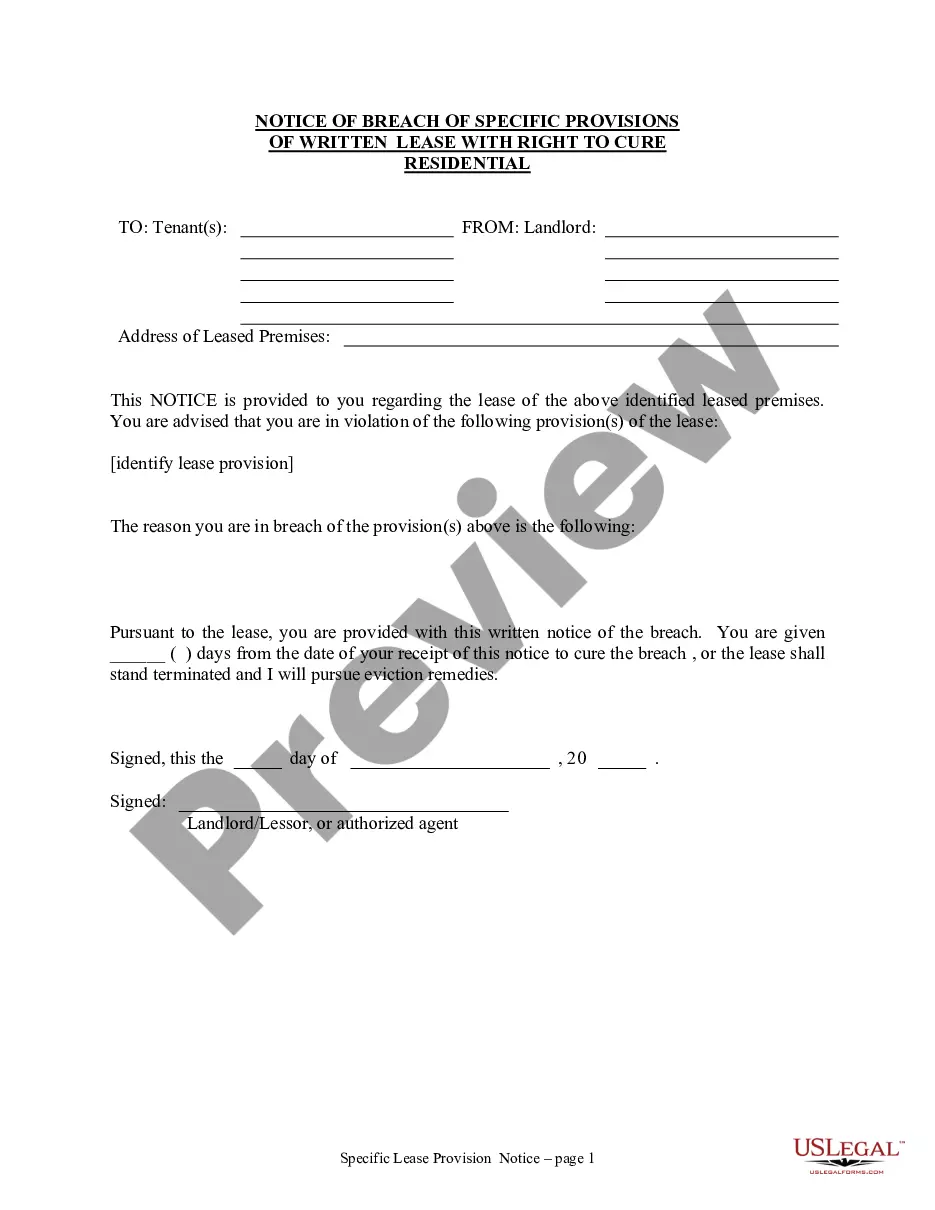

How to fill out South Carolina Notice Of Breach Of Written Lease For Violating Specific Provisions Of Lease With Right To Cure For Residential Property From Landlord To Tenant?

- If you're a returning user, log into your account and download the required form template directly to your device. Remember to check if your subscription is active; renew if necessary.

- For first-time users, initiate your journey by reviewing the form in Preview mode. Confirm that it suits your legal needs and complies with local jurisdiction requirements.

- If the form doesn’t meet your needs, utilize the Search tab to explore other templates. When you find the right fit, continue to the next step.

- Purchase the document by clicking the Buy Now button. Select your preferred subscription plan and create an account to gain access to the expansive library.

- Complete your transaction by entering your credit card details or using PayPal to finalize the subscription.

- Once your purchase is confirmed, download the form to your device for completion and access it anytime from the My Forms section of your profile.

US Legal Forms empowers users with a robust collection of over 85,000 fillable and editable legal forms, ensuring you find exactly what you need.

Don't let legal documents stress you out. Start your process today and experience the convenience of US Legal Forms!

Form popularity

FAQ

The 90% rule for leasing is a key indicator that defines when a lease qualifies as a finance lease. If the present value of the lease payments meets or exceeds 90% of the asset’s fair market value, the lease is categorized accordingly. This classification can affect how expenses and liabilities are recorded on financial statements. It's beneficial to understand the role of the lease-specific right with the right to navigate these financial parameters effectively.

Finding the right tenant involves several steps, including screening applicants thoroughly and understanding their needs. Evaluate prospective tenants based on their rental history, financial stability, and compatibility with your property. Utilize platforms like US Legal Forms, which offers resources and templates to help you create effective lease agreements. By leveraging your lease-specific right with the right processes in place, you can secure a tenant that aligns with your property goals.

Similar to the 90% rule in leasing, the 90% lease rule implies that qualifying leases must meet specific criteria related to payment valuation. When the total present value of payments is more than or matches 90% of the asset’s market value, it influences how the lease is treated financially. This rule helps organizations determine their obligations accurately and optimize resource management. You can apply the lease-specific right with the right in your evaluation process to ensure compliance.

The 90% rule in leasing denotes that if the present value of lease payments equals or exceeds 90% of the fair market value of the leased asset, the lease is classified as a finance lease. This classification affects how the lease is reported in financial statements. Properly identifying transactions that meet this rule can significantly impact a company's balance sheet and results. Adhering to the lease-specific right with the right ensures that businesses can make informed leasing decisions.

The new lease accounting rule, implemented under ASC 842, requires organizations to recognize lease assets and lease liabilities on their balance sheets. This change aims to provide greater transparency regarding financial obligations. It categorizes leases into two types: finance and operating leases, impacting how businesses report leasing arrangements. Understanding this rule is essential for companies to accurately represent their financial position while leveraging the lease-specific right with the right to their advantage.

Finance leases must meet certain criteria to qualify as such. These rules typically include that the lease must transfer ownership by the end of the term, the lease term must cover the majority of the asset's useful life, and the present value of lease payments must equal or exceed 90% of the fair market value. Additionally, the lease must specify that the asset is a specific right with the right capacity to fulfill all contractual obligations. Ensuring compliance with these rules is crucial for proper financial reporting.

To kick someone out who isn't on the lease, begin by having a direct conversation about the situation. You possess lease specific rights, which means you have authority over who resides in your home. If the person does not leave voluntarily, you may need to consult local eviction laws to follow the proper legal steps. For assistance with forms and processes, consider using US Legal Forms as a reliable resource.

Yes, you generally can ask someone to leave if there is no formal contract in place. Your lease specific rights will still apply in such cases, though it helps to communicate clearly and follow any local laws regarding notice periods. Additionally, documenting the request can protect you if disputes arise. If you need guidance, US Legal Forms can assist with proper procedures.

The right of use in a lease agreement refers to your authorized ability to occupy and utilize the property. It provides you with specific lease specific rights to enjoy the space without interference from the landlord. Understanding this right helps you know what you can and cannot do in your rental unit. If you need further clarification, US Legal Forms offers resources to help you grasp these rights clearly.

If someone lives with you who is not on the lease, this could violate the lease agreement. You should verify your lease specific rights regarding unauthorized occupants. Depending on your lease, you may have the right to ask them to leave. Always consult your landlord or seek legal advice to handle the situation appropriately.