Lien Release Form South Carolina Withholding

Description

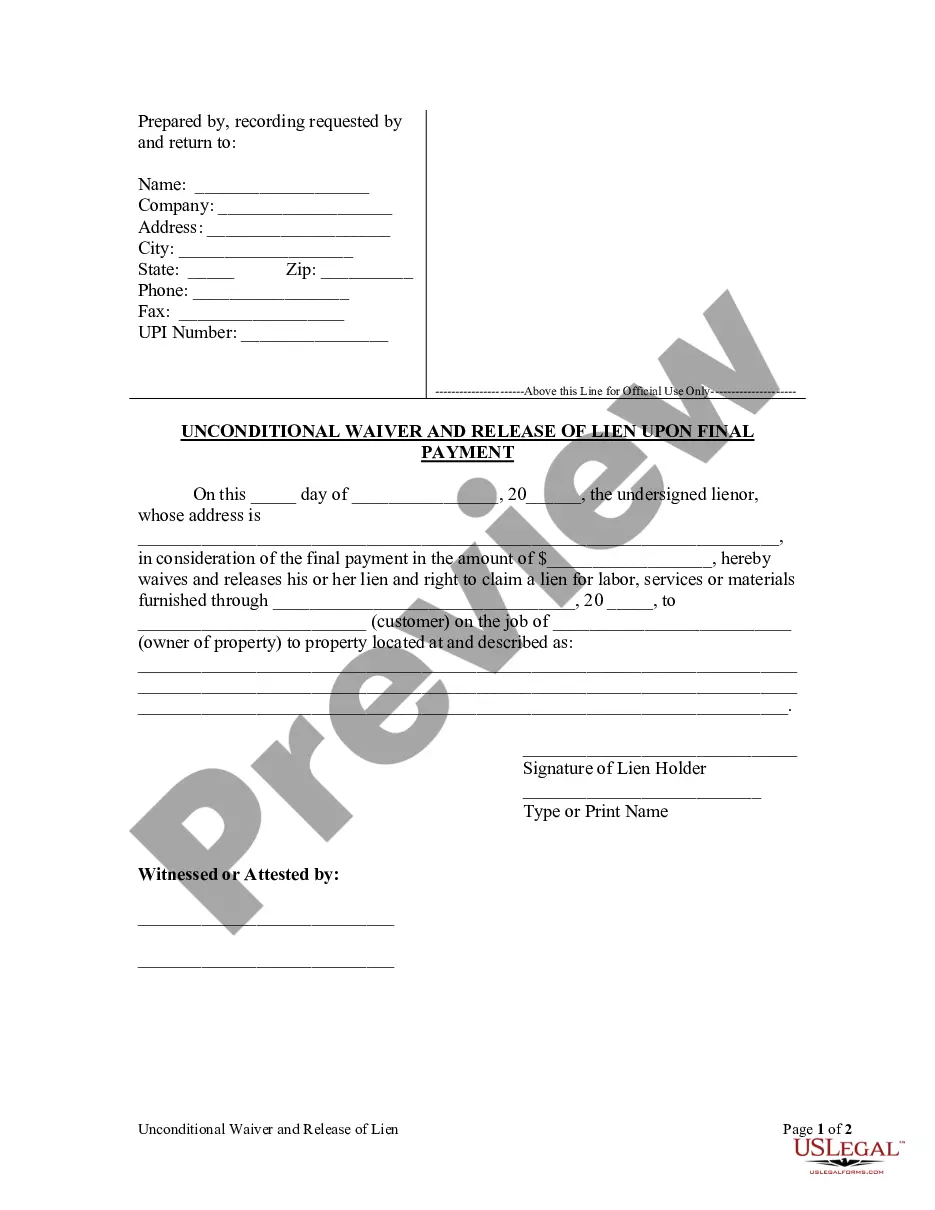

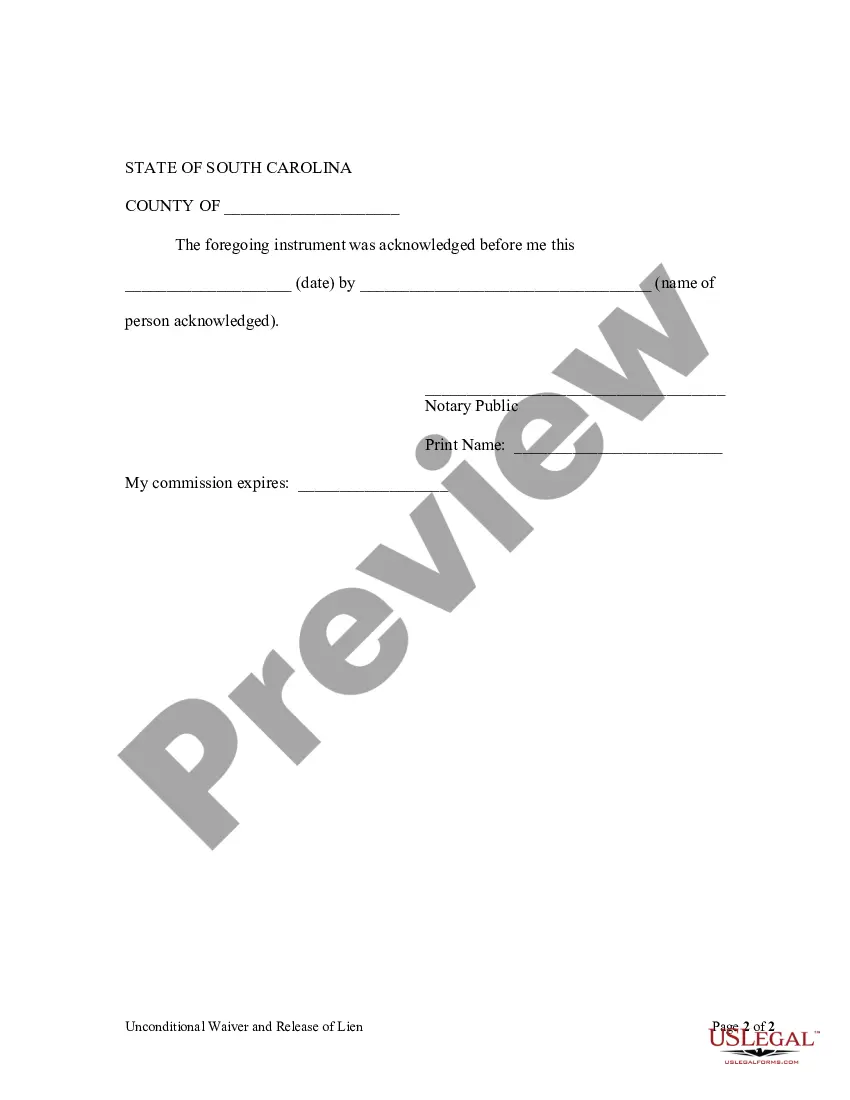

How to fill out South Carolina Unconditional Waiver And Release Of Claim Of Lien Upon Final Payment?

Whether for business purposes or for individual matters, everyone has to handle legal situations sooner or later in their life. Filling out legal paperwork demands careful attention, beginning from choosing the correct form template. For example, when you pick a wrong version of a Lien Release Form South Carolina Withholding, it will be rejected when you send it. It is therefore important to get a dependable source of legal papers like US Legal Forms.

If you need to obtain a Lien Release Form South Carolina Withholding template, stick to these simple steps:

- Get the sample you need by utilizing the search field or catalog navigation.

- Check out the form’s information to make sure it fits your situation, state, and region.

- Click on the form’s preview to examine it.

- If it is the incorrect form, go back to the search function to locate the Lien Release Form South Carolina Withholding sample you require.

- Download the file when it matches your requirements.

- If you have a US Legal Forms profile, click Log in to access previously saved documents in My Forms.

- In the event you don’t have an account yet, you can obtain the form by clicking Buy now.

- Pick the correct pricing option.

- Complete the profile registration form.

- Select your transaction method: use a bank card or PayPal account.

- Pick the document format you want and download the Lien Release Form South Carolina Withholding.

- After it is downloaded, you are able to complete the form by using editing applications or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you do not have to spend time searching for the appropriate sample across the internet. Take advantage of the library’s simple navigation to get the correct template for any occasion.

Form popularity

FAQ

Hear this out loud PauseSouth Carolina employers must submit and remit payroll taxes withheld from employee wages. The frequency of payments depends on the amount withheld. If the total withholding amount is less than $500 per quarter, payments are due quarterly by the last day of the month following the end of the quarter.

Hear this out loud PauseEmployee instructions Complete the SC W-4 so your employer can withhold the correct South Carolina Income Tax from your pay. If you have too much tax withheld, you will receive a refund when you file your tax return.

Hear this out loud PauseFile and pay online at MyDORWAY.dor.sc.gov. Do not mail when filing online. You must file a return even if no SC Income Tax has been withheld during the quarter. You must file a WH-1606 if the account was open for any portion of the calendar year.

You can close your account: at MyDORWAY.dor.sc.gov. Log in, select the More tab, then click Close a Tax Account to get started. by marking the Close Withholding Account box and including a close date on your WH-1605 or WH-1606 return You are required to file a return through the closing date.

Hear this out loud PauseYou can close your account: at MyDORWAY.dor.sc.gov. Log in, select the More tab, then click Close a Tax Account to get started. by marking the Close Withholding Account box and including a close date on your WH-1605 or WH-1606 return You are required to file a return through the closing date.