South Carolina Assignment Withholding

Description

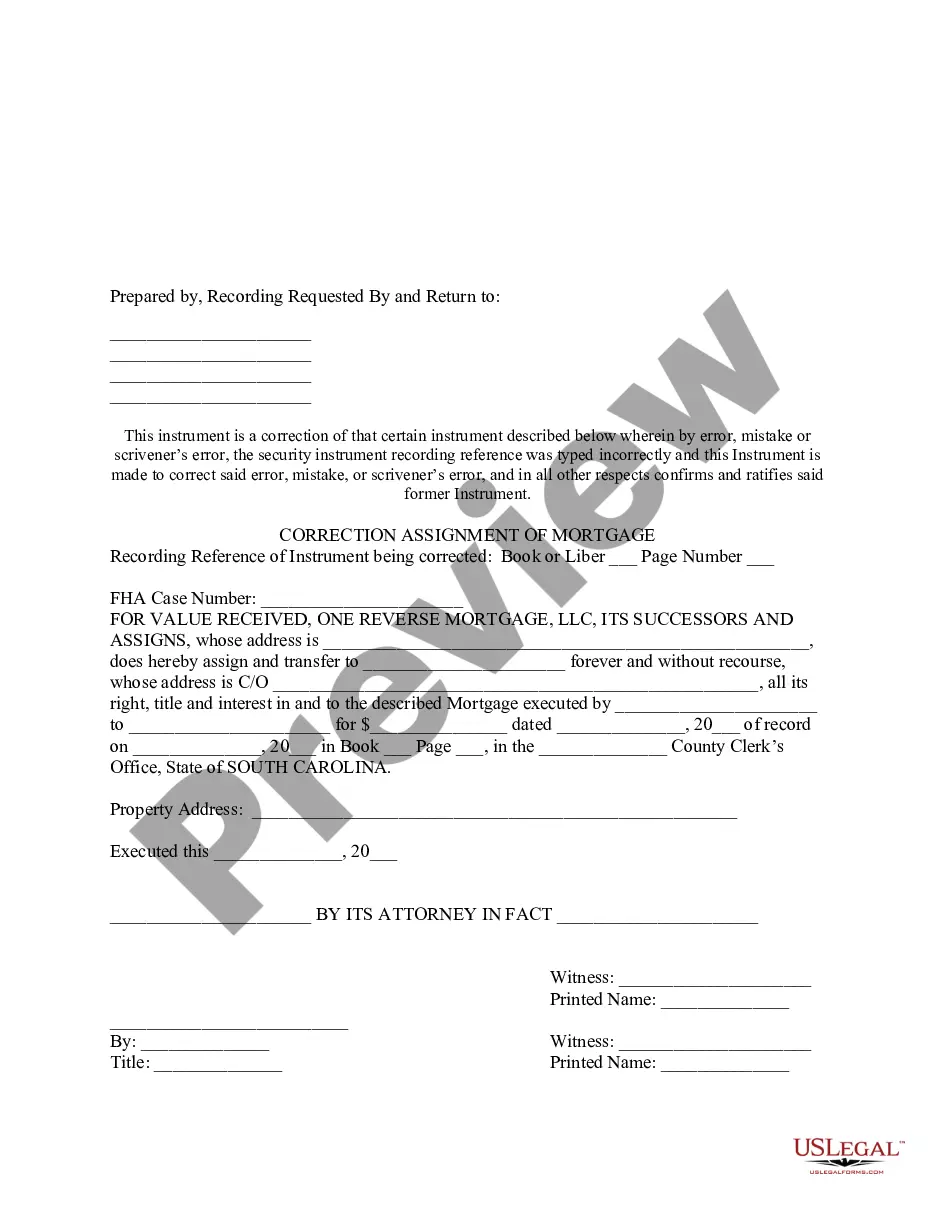

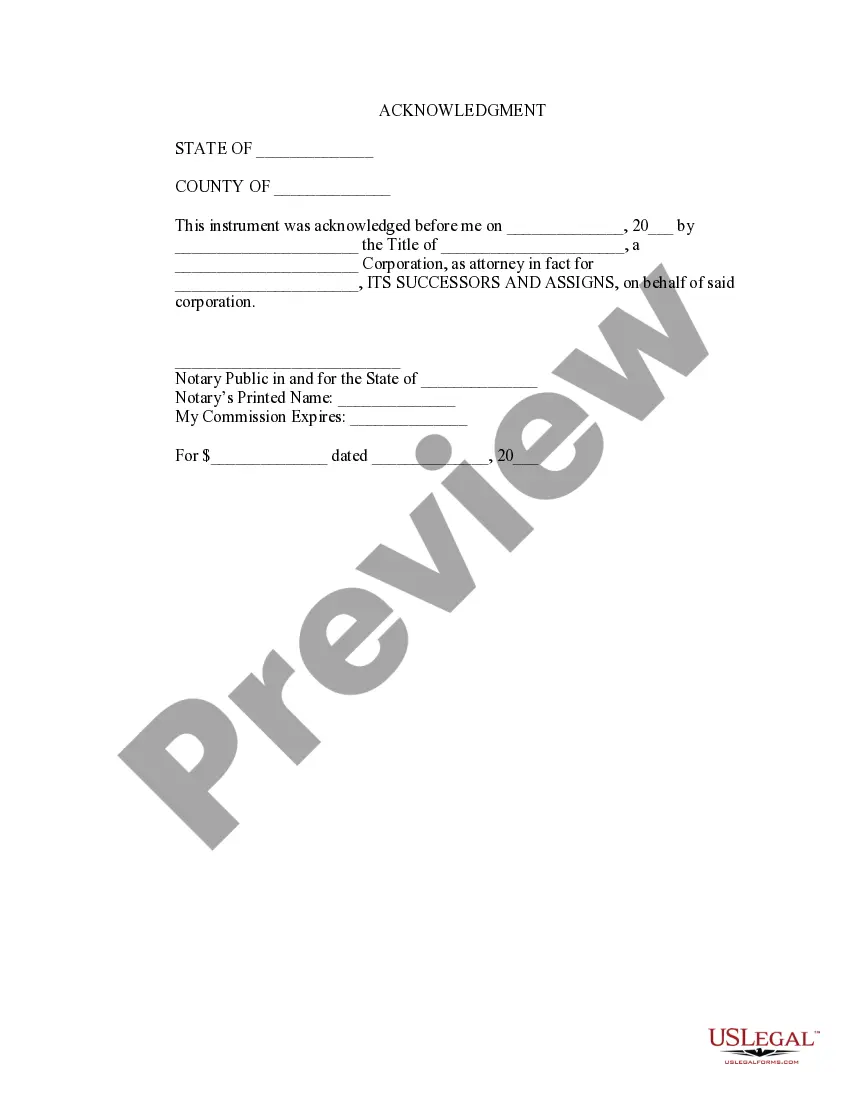

How to fill out South Carolina Correction Assignment Of Mortgage?

Properly prepared official documentation is one of the crucial assurances for preventing complications and legal disputes, but acquiring it without a lawyer's assistance may require time.

Whether you need to swiftly discover an up-to-date South Carolina Assignment Withholding or any other forms for work, family, or commercial events, US Legal Forms is consistently available to assist.

The procedure is even more straightforward for existing users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and click the Download button next to the selected document. Additionally, you can access the South Carolina Assignment Withholding at any time, as all documents ever obtained on the platform remain accessible within the My documents section of your profile. Save time and resources on preparing official documents. Explore US Legal Forms today!

- Ensure that the form is appropriate for your circumstances and locale by reviewing the description and preview.

- Search for another example (if needed) using the Search bar in the page header.

- Click Buy Now once you locate the suitable template.

- Select the pricing option, sign in to your account, or create a new one.

- Choose your preferred payment method to purchase the subscription plan (via a credit card or PayPal).

- Select PDF or DOCX file format for your South Carolina Assignment Withholding.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

When filling out your withholding allowances in South Carolina, it’s essential to assess your financial needs and family situation. Claiming more allowances will lower your withholding but may increase the risk of owing taxes later. Conversely, fewer allowances will result in more tax withheld from each paycheck. You can find valuable guidance from USLegalForms to choose the right number of allowances for your needs.

In South Carolina, the percentage of state tax withheld varies based on your overall income and filing status. As of now, rates range from 0% to 7%. It's important to refer to the state’s tax tables for the most accurate information regarding your specific situation. Resources like USLegalForms can help clarify these percentages and support your decisions.

The amount of state tax you should withhold in South Carolina varies by income level and number of allowances. Use the state's withholding tax tables to find the exact amount that aligns with your earnings. It's important to keep up-to-date with state tax laws, as these figures can change. USLegalForms provides helpful tools to determine the right withholding amount for your unique situation.

The amount you should deduct for state taxes in South Carolina depends on your income and the allowances you claimed. A common strategy is to refer to the withholding tax tables to find a specific figure that matches your income bracket. Appropriate deductions can help prevent owing taxes at year-end. Check out USLegalForms for guidance on determining the right deduction amount.

The percentage you should withhold for taxes in South Carolina generally depends on your income level and the allowances you claim. South Carolina's tax rates range, so you must consult the latest tax tables for an accurate percentage. Adjust it according to your financial situation or future tax obligations. Resources like USLegalForms can assist you in determining the right percentage.

Calculating your state tax withholding in South Carolina involves using your taxable income and the current withholding tax tables. You will generally need to consider the number of allowances you've claimed as well. These tables will provide you with insight into how much should be withheld from your paycheck. Utilizing resources from USLegalForms can simplify this process and help ensure accuracy.

Submitting tax withholding for South Carolina involves a few key steps. After calculating the amounts based on the SCW4 form, you can submit your payment electronically using the South Carolina Department of Revenue’s online portal. For paper submissions, you can send your payment along with the required forms via the mail. For clarity and ease, many find USLegalForms helpful in navigating these requirements effectively.

Filling out the SCW4 form is straightforward when you have the right guidance. Start by entering your business details, then move to employee information such as Social Security numbers and withholding amounts. Make sure to apply the South Carolina assignment withholding rates correctly. If you have any uncertainties, consider consulting USLegalForms for accurate templates and further assistance.

To apply for a South Carolina withholding number, visit the South Carolina Department of Revenue website. You can complete the application online or download the form to send via mail. This number is essential for businesses that need to manage state tax withholding for employees. Utilizing resources like USLegalForms can simplify the process and ensure you have all the necessary information.

The percentage you should withhold for state taxes in South Carolina generally varies based on your income brackets and any allowances you claim. South Carolina's tax structure is progressive, which means higher earners may face higher withholding percentages. Regularly reviewing your paycheck and adjusting your withholding according to the latest state rates is wise. This approach ensures that your South Carolina assignment withholding aligns with your financial expectations.