Explain Quitclaim Deed

Description

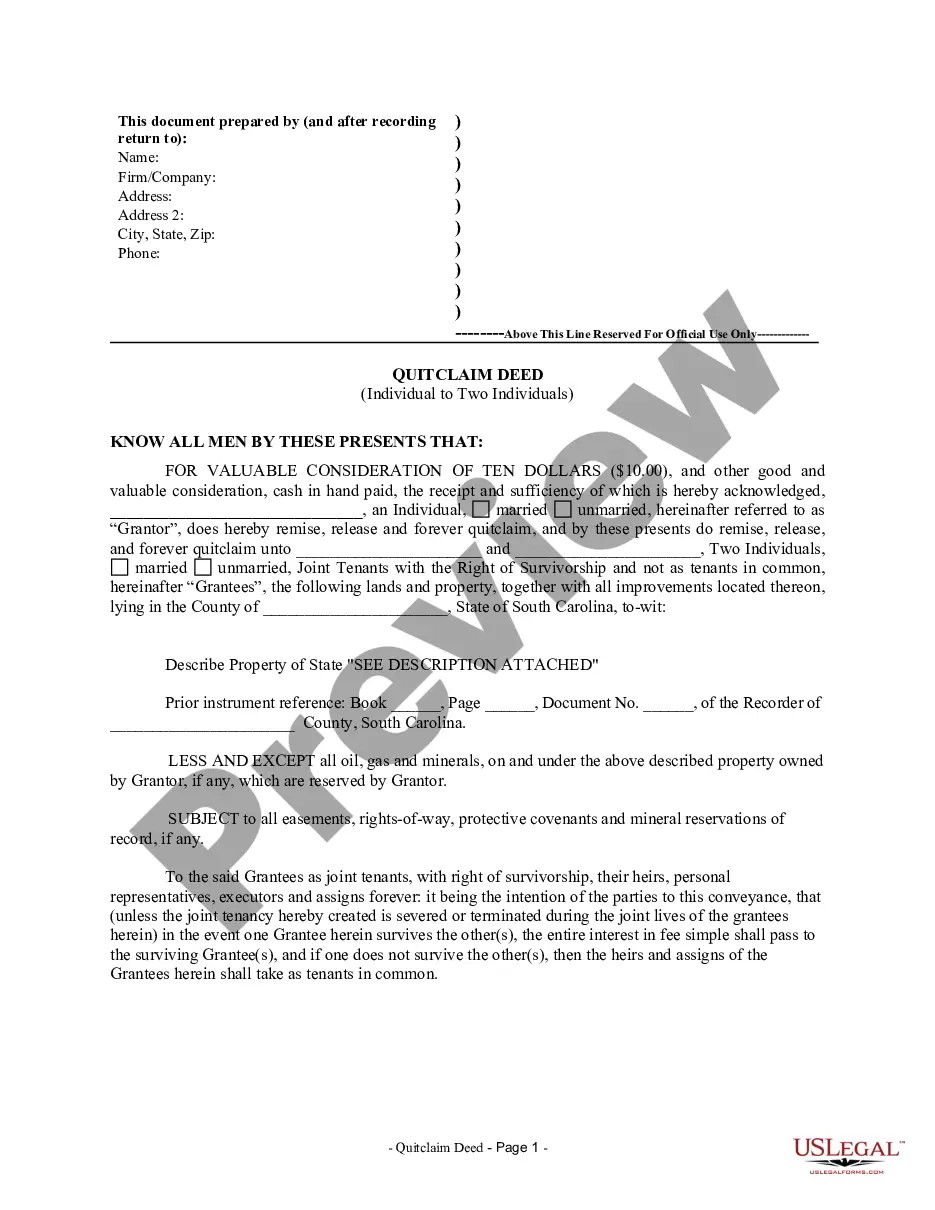

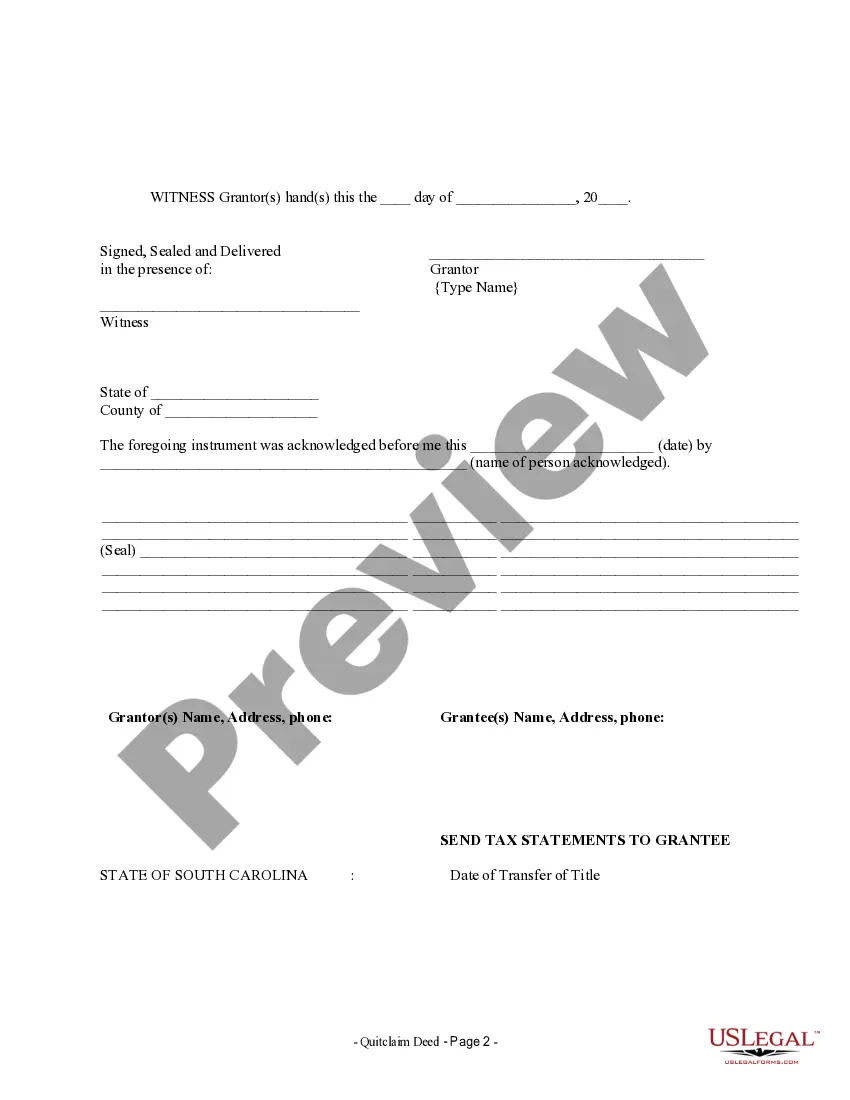

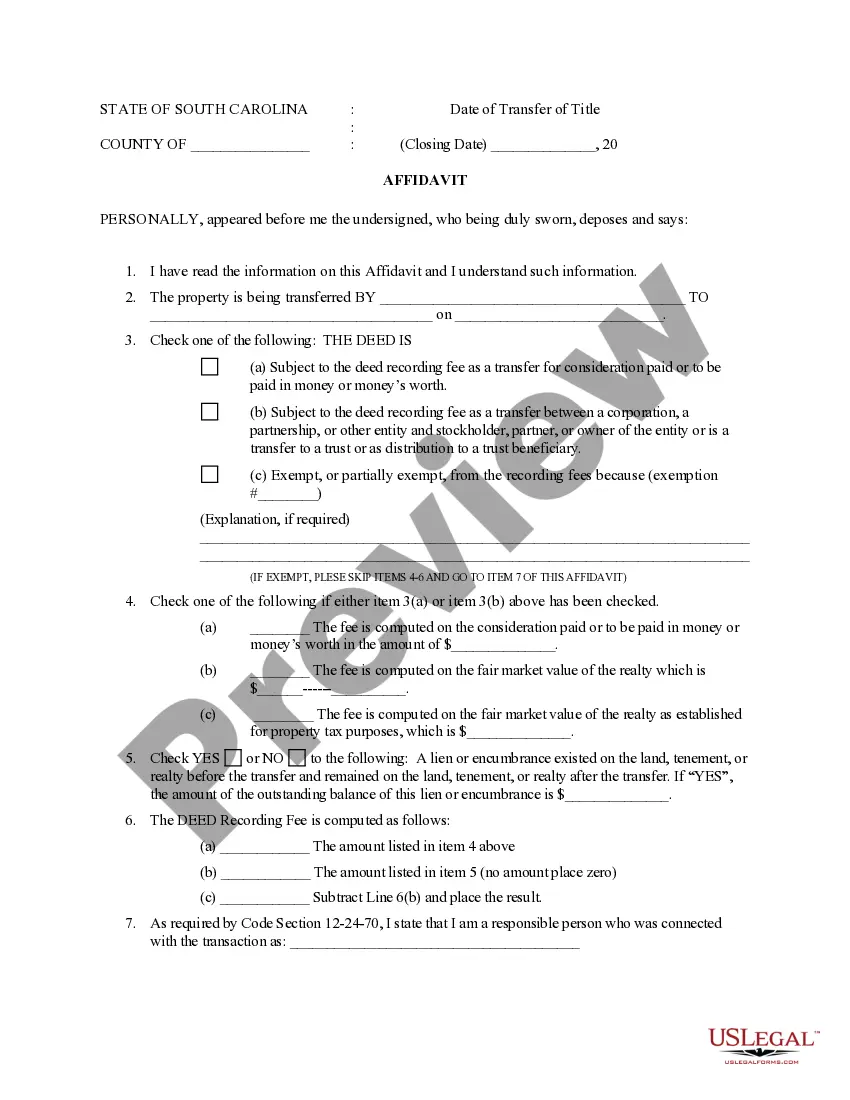

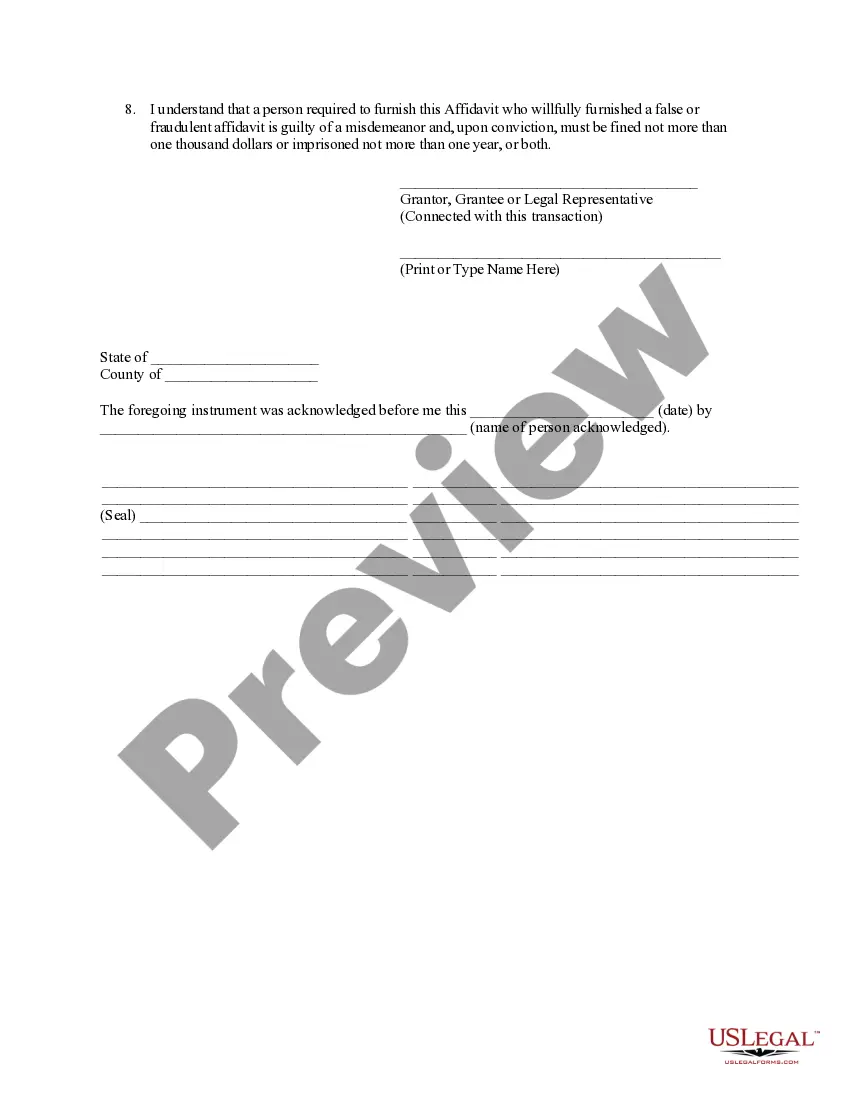

How to fill out South Carolina Quitclaim Deed From Individual To Two Individuals In Joint Tenancy?

- If you're already a member, log in to your account, ensuring your subscription is active. Then, find and download the required quitclaim deed template directly to your device.

- For new users, start by exploring the preview mode and reading the form description to identify a quitclaim deed that aligns with your local jurisdiction's requirements.

- If you need to adjust your selection, utilize the Search function to find the precise form. Once confirmed, proceed to the next step.

- Purchase the document by clicking on the Buy Now button. Select a subscription plan that suits your needs and set up your account for full access.

- Complete your purchase by inputting your payment details or using your PayPal account to finalize your subscription.

- Download your quitclaim deed template and save it on your device for completion. You can also access it anytime from the My Forms section of your profile.

Utilizing US Legal Forms accelerates your access to a robust collection of legal templates tailored to meet diverse needs. With over 85,000 editable forms and the option to receive expert assistance, ensuring legal compliance is effortless and reliable.

Embarking on legal documentation doesn’t have to be challenging. Start your journey with US Legal Forms today and experience how simple obtaining legal templates can be. Get started now!

Form popularity

FAQ

Several factors can render a quitclaim deed invalid. If it is not properly notarized or lacks the required signatures, it may not hold up in court. Additionally, if the property has liens or encumbrances that are not disclosed in the deed, this can create issues later on. To avoid complications, it’s best to have a clear understanding and explanation of a quitclaim deed before proceeding.

You can obtain a copy of your quitclaim deed by visiting the county recorder’s office where the property is located. Many jurisdictions also provide online access to property records, allowing you to retrieve the deed electronically. It is important to have the requisite information, such as the property's legal description and the original grantor's name, to facilitate the search. Keep in mind, a thorough explanation of a quitclaim deed can also guide you through this process.

Yes, a quitclaim deed can be voided under certain circumstances. If a fraud is committed during the transaction, or if the grantor lacked the capacity to sign the deed, it may be declared void. Furthermore, if the agreement was not executed according to state laws, the deed could be reversed. To navigate these complexities, it’s helpful to explain quitclaim deed within a legal framework.

Individuals who want to transfer property without the complexities of a title search often benefit the most from a quitclaim deed. This is especially useful in family situations, such as when conveying property to a spouse or family member. Buyers should be cautious, as a quitclaim deed does not guarantee a clear title. Knowing when to use this type of deed can help clarify property transfer, so explaining quitclaim deed is essential.

A quitclaim deed may become void if it was not properly executed or if it lacks the necessary legal formalities. For instance, if it is not signed by the grantor or fails to meet state requirements, a court may declare it invalid. Additionally, if the grantor did not have clear title to the property being transferred, the deed could be challenged. To fully understand these aspects, it is important to explain quitclaim deed in the context of your local laws.

Individuals often use a quitclaim deed to simplify the property transfer process in informal situations, like family transactions or changes in marital status. This type of deed is appealing due to its speed and lack of complexity. People may also prefer it when they trust the other party, knowing that no warranties are required. For more insights and detailed descriptions, check out our resources on USLegalForms to help explain quitclaim deed effectively.

One of the main disadvantages of a quitclaim deed is that it does not protect the new owner from any title issues that may arise. If there are liens or claims against the property, the new owner assumes those risks without recourse. Additionally, quitclaim deeds offer no warranties regarding the property's title, which can lead to unforeseen complications. For a more comprehensive overview, consider visiting USLegalForms to explain quitclaim deed nuances.

A quitclaim deed is most commonly used to transfer property ownership between parties without guaranteeing the title’s validity. It is often utilized in situations such as divorces or transferring property within a family. This method allows for a quick transfer of interest, making it ideal for straightforward cases. To fully understand this process, let us help you explain quitclaim deed further with resources available on USLegalForms.

To fill out a quitclaim deed form, start by identifying the property and the parties involved in the transaction. Clearly include the names of the grantor, who is transferring the property, and the grantee, who is receiving it. Be sure to describe the property accurately, including its location and legal description. You can find user-friendly templates and guidance on how to properly complete these forms on the US Legal Forms platform, which can effectively help you understand how to explain quitclaim deed processes.

Generally, quitclaim deeds are not reported to the IRS. However, if the transaction involves a sale or exchange for consideration, it may have tax implications that require reporting. Always consult with a tax professional to clarify your obligations. To learn more about your rights and responsibilities concerning quitclaim deeds, consider leveraging resources like USLegalForms to help explain a quitclaim deed comprehensively.