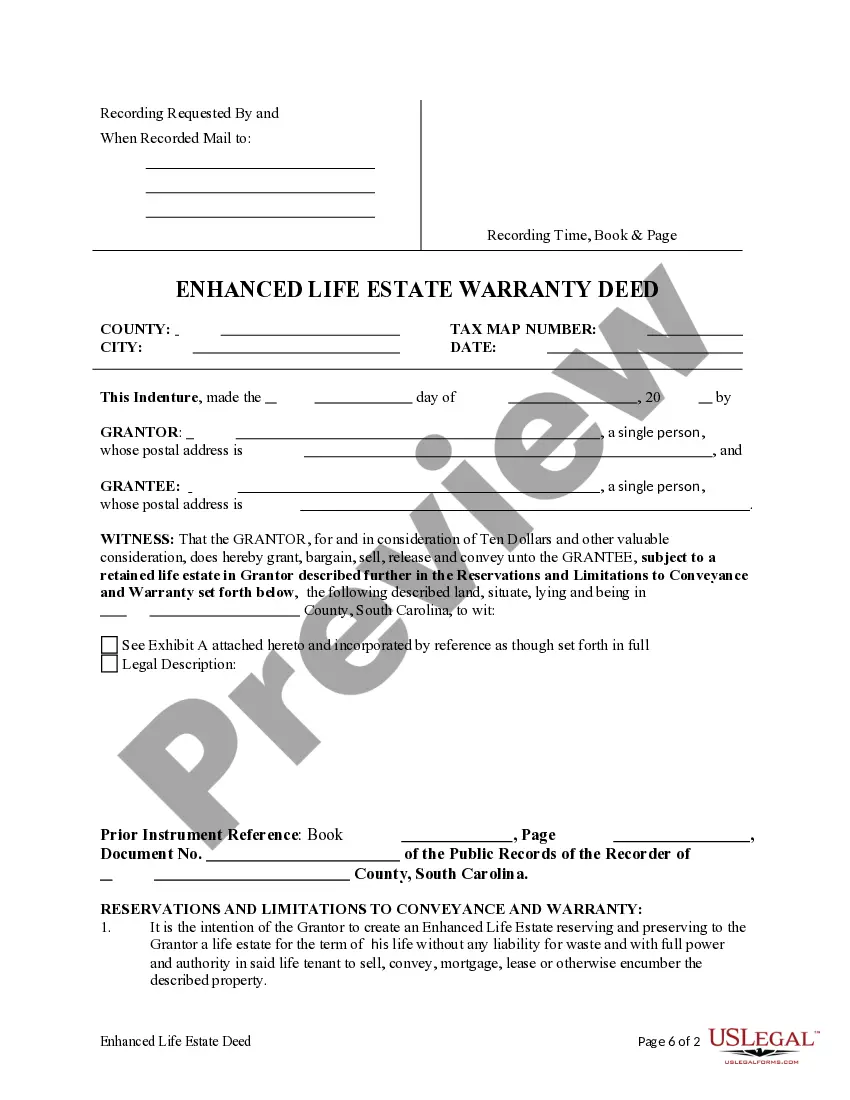

Purpose Of Lady Bird Deed

Description

How to fill out South Carolina Enhanced Life Estate Or Lady Bird Warranty Deed From Individual To Individual?

The Objective of the Lady Bird Deed displayed on this webpage is a versatile formal template created by experienced attorneys in accordance with federal and local laws.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal experts with more than 85,000 authenticated, state-specific documents for any professional and personal scenario. It’s the fastest, easiest, and most trustworthy method to acquire the forms you require, as the service ensures bank-level data protection and malware defense.

Select the format you want for your Purpose of Lady Bird Deed (PDF, Word, RTF) and download the document to your device.

- Search for the document you require and review it.

- Browse through the sample you found and preview it or read the form description to verify it meets your needs. If it doesn't, use the search feature to locate the correct one. Click Buy Now once you have found the template you need.

- Register and Log In.

- Choose the pricing option that works for you and create an account. Make a fast payment using PayPal or a credit card. If you already have an account, Log In and verify your subscription to move forward.

- Acquire the editable template.

Form popularity

FAQ

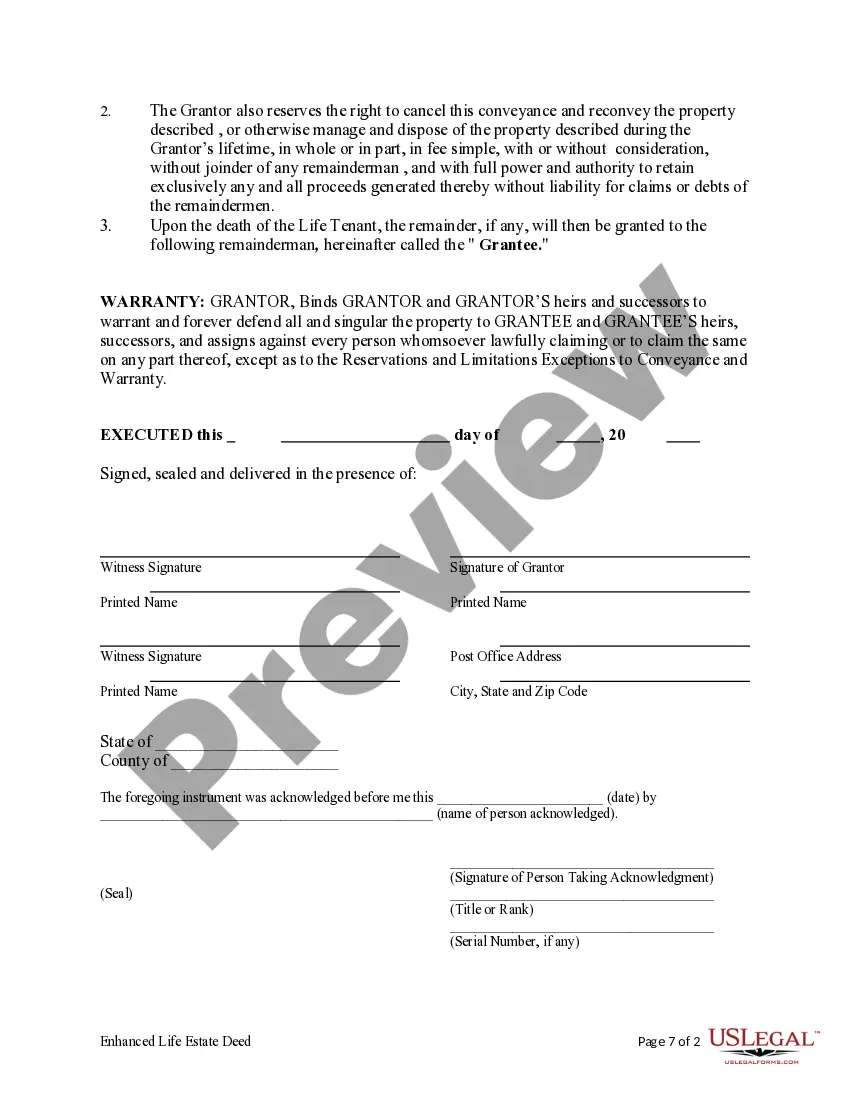

A lady bird deed can be a good idea for many individuals looking to simplify estate planning. The purpose of a lady bird deed is to allow the transfer of property while retaining control during your lifetime. However, it is essential to weigh these benefits against potential drawbacks. Consulting a legal professional or using resources from ulegalforms can help you make the best decision tailored to your situation.

While a lady bird deed has many benefits, it also has downsides. Its purpose can sometimes create complications if the grantor needs to sell the property before passing away. Additionally, if the grantor becomes incapacitated, the restrictions on selling or encumbering the property may create issues. Understanding these challenges can help you determine if it fits your estate planning needs.

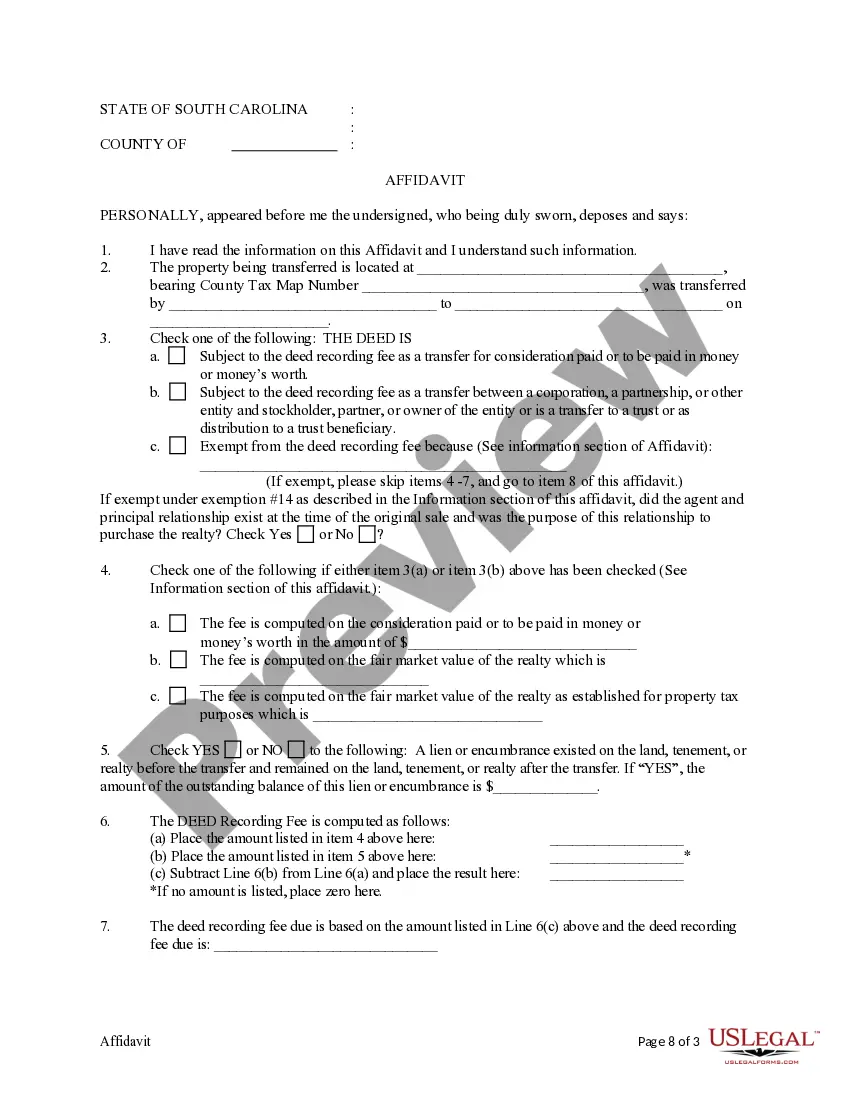

Yes, for a lady bird deed to take effect, you must record it with the county clerk in the jurisdiction where the property is located. This recording solidifies the purpose of the lady bird deed as legally binding, which is essential for ensuring the transfer of property is recognized. To make this process easier, you can utilize resources available on the ulegalforms platform.

A lady bird deed can help in avoiding probate but does not inherently avoid inheritance tax. The purpose of a lady bird deed mainly focuses on transferring property without the complexities of probate court. Therefore, it is crucial to consult a tax advisor or legal professional to understand how this deed impacts inheritance tax in your situation.

The purpose of a lady bird deed is recognized in several states across the U.S., including Florida, Texas, Michigan, and Virginia. It is essential to check your specific state's laws, as regulations may vary. Understanding these state-specific criteria can ensure effective estate planning. For further guidance, consider using the ulegalforms platform to help you navigate these legal intricacies.

The disadvantages of a lady bird deed can include complications in asset management and potential tax implications. While this type of deed allows you to retain control, you may encounter challenges if the designated beneficiary changes their mind or if you change your mind about them. Furthermore, this deed does not provide protection against state estate taxes, which could impact your heirs financially. Evaluating these factors with a legal expert, such as through UsLegalForms, can help guide your decision.

In most cases, the lady bird deed will take precedence over a will when it comes to the property covered by it. The primary purpose of lady bird deeds is to ensure a smooth transfer of property outside of probate, which means that the designated beneficiaries on the deed receive the property automatically. However, it's essential to understand that your overall estate plan needs to be cohesive to avoid conflicts. Consulting with an estate planning attorney can help clarify these aspects.

While the lady bird deed offers several benefits, there are some disadvantages to consider. One issue can arise if you need to sell or refinance the property, as this may involve additional legal steps. Additionally, the purpose of a lady bird deed does not protect the property from creditors or Medicaid claims, which could affect your estate's value. It's wise to weigh these factors against your estate planning goals.

Generally, a will cannot override a lady bird deed due to the purpose of lady bird deeds in estate planning. Once you execute a lady bird deed, the property automatically transfers to the designated beneficiary upon your death, bypassing the probate process governed by the will. However, if you later change your will or the lady bird deed, it may affect the overall distribution of your estate. Always consider reviewing your estate plans regularly to ensure everything aligns with your intentions.

The benefits of a ladybird deed include the ability to bypass probate and ease the estate settlement process for your loved ones. It allows property owners to retain full control of their assets while planning for future transfer. Furthermore, it can help reduce legal complications and retain property value. To navigate this process effectively, consider the templates and guidance available at uslegalforms.