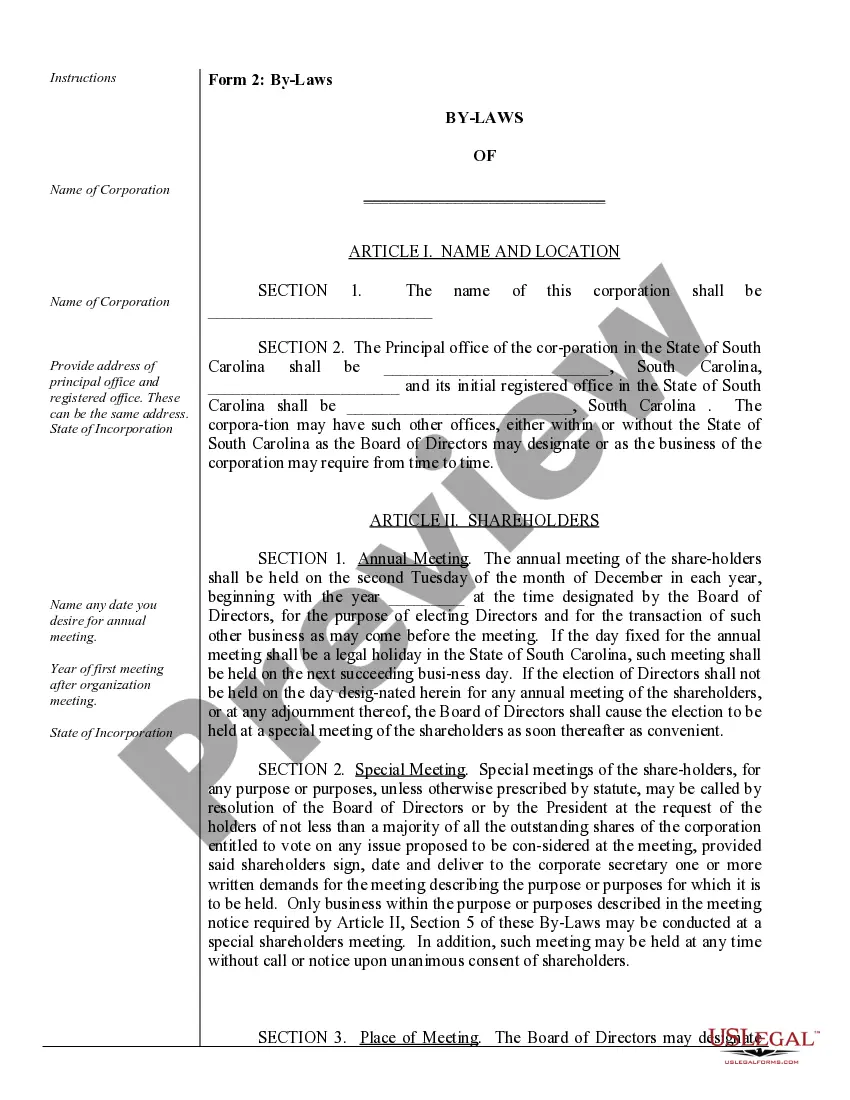

South Carolina Corporate Filing Requirements

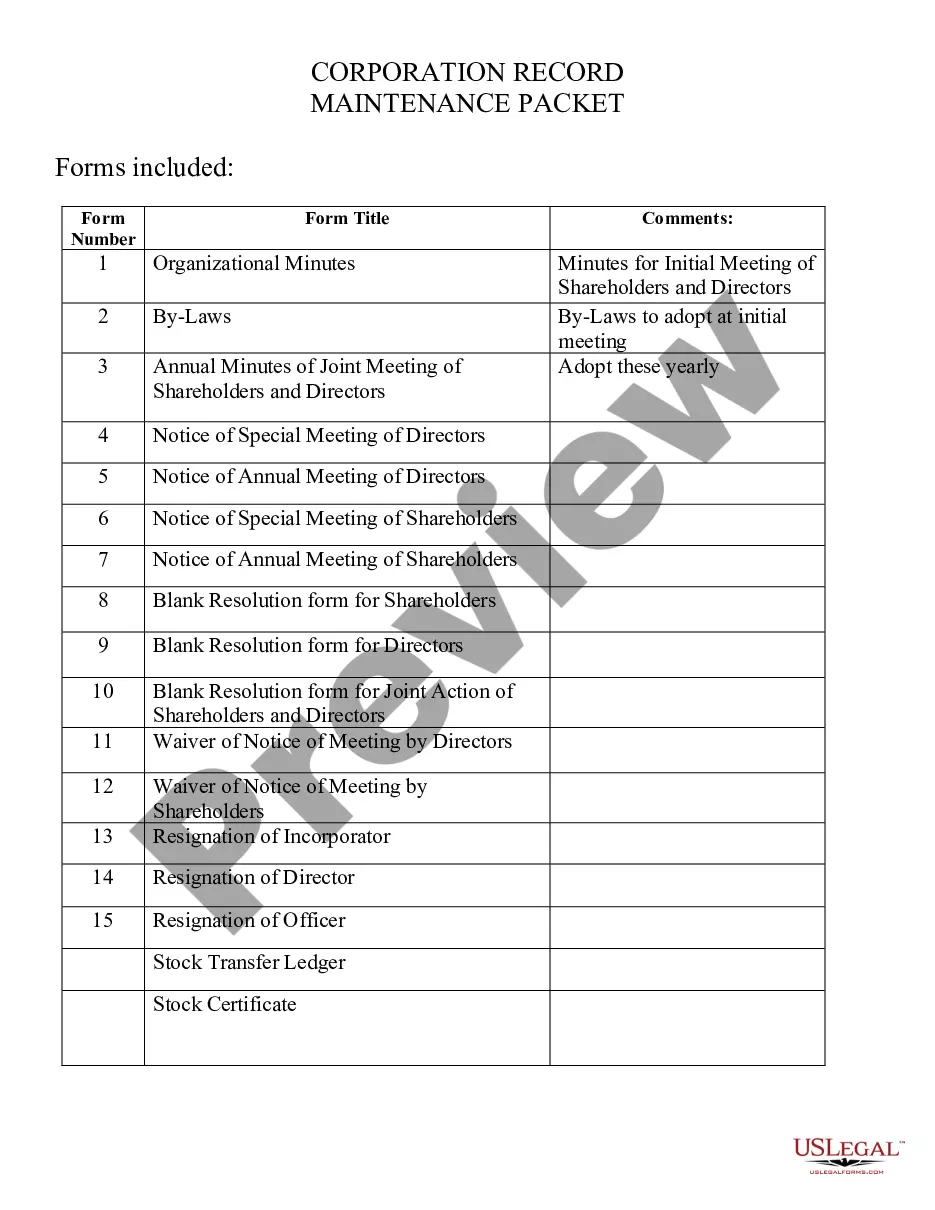

Description

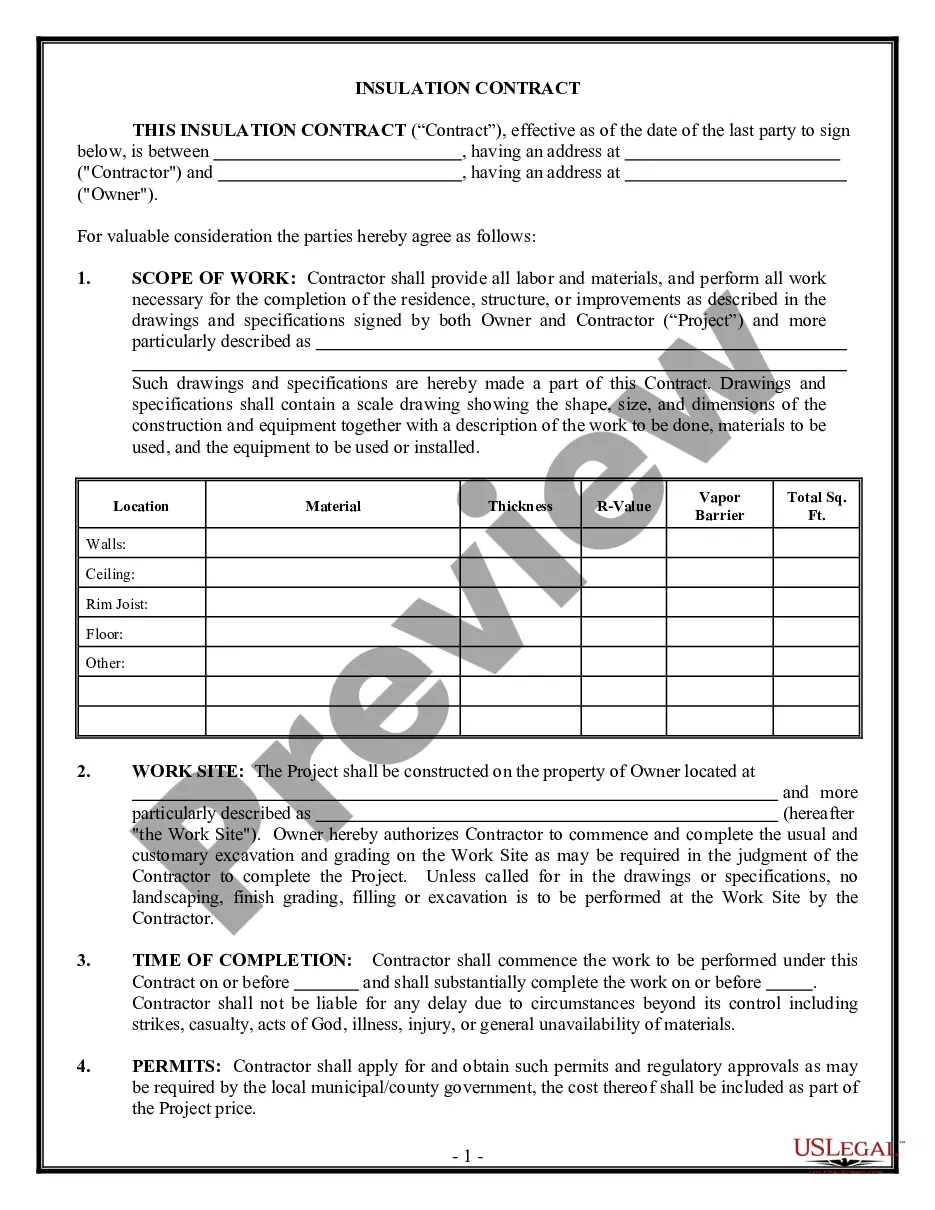

How to fill out South Carolina Corporate Records Maintenance Package For Existing Corporations?

The South Carolina Corporate Filing Requirements you see on this page is a reusable formal template drafted by professional lawyers in line with federal and local regulations. For more than 25 years, US Legal Forms has provided individuals, businesses, and attorneys with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the fastest, most straightforward and most reliable way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Obtaining this South Carolina Corporate Filing Requirements will take you just a few simple steps:

- Browse for the document you need and check it. Look through the sample you searched and preview it or check the form description to confirm it suits your needs. If it does not, use the search option to get the right one. Click Buy Now once you have located the template you need.

- Subscribe and log in. Select the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to continue.

- Acquire the fillable template. Pick the format you want for your South Carolina Corporate Filing Requirements (PDF, Word, RTF) and save the sample on your device.

- Complete and sign the paperwork. Print out the template to complete it by hand. Alternatively, use an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a eSignature.

- Download your paperwork again. Use the same document again whenever needed. Open the My Forms tab in your profile to redownload any previously downloaded forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

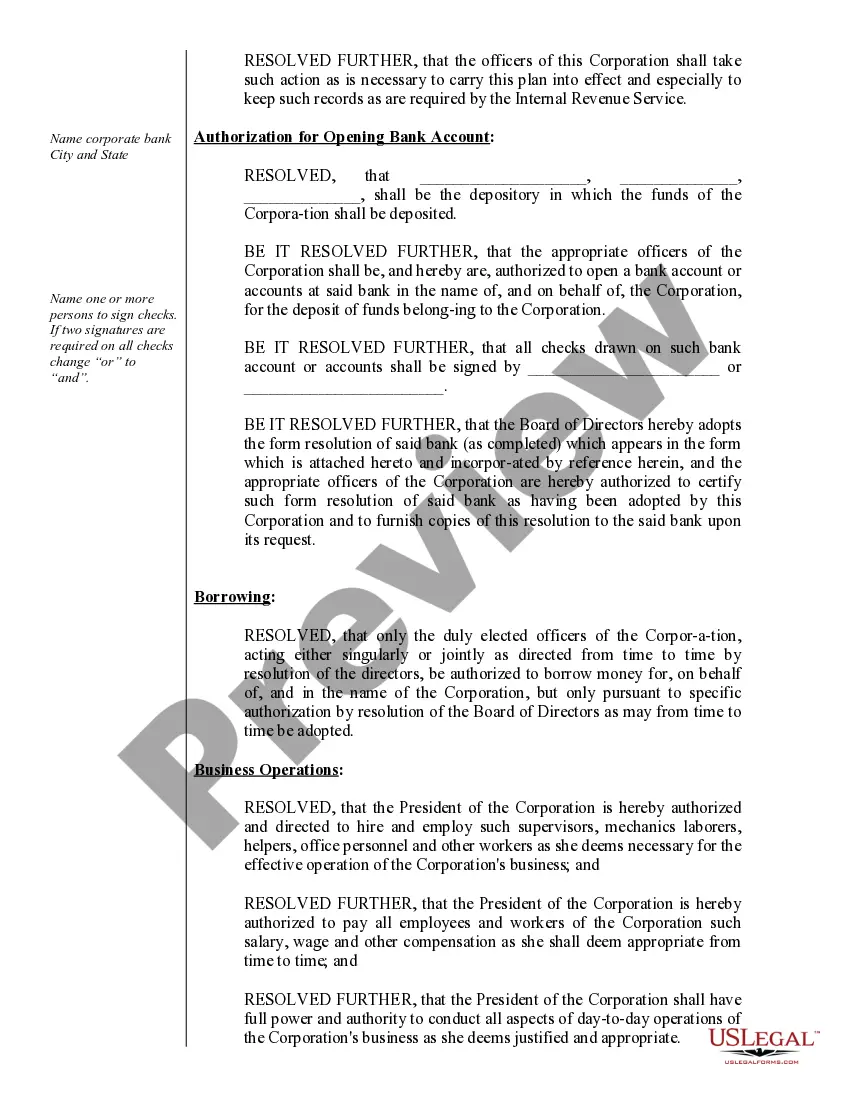

South Carolina Annual Report Information. Businesses and nonprofits are required to file annual reports to stay in good standing with the secretary of state. Annual reports are required in most states. Due dates and fees vary by state and type of entity.

If you are a nonresident or part-year resident, you are generally required to file a South Carolina return if you work in South Carolina or are receiving income from rental property, businesses, or other investments in South Carolina. Individual Income Tax returns are due April 15 of each year.

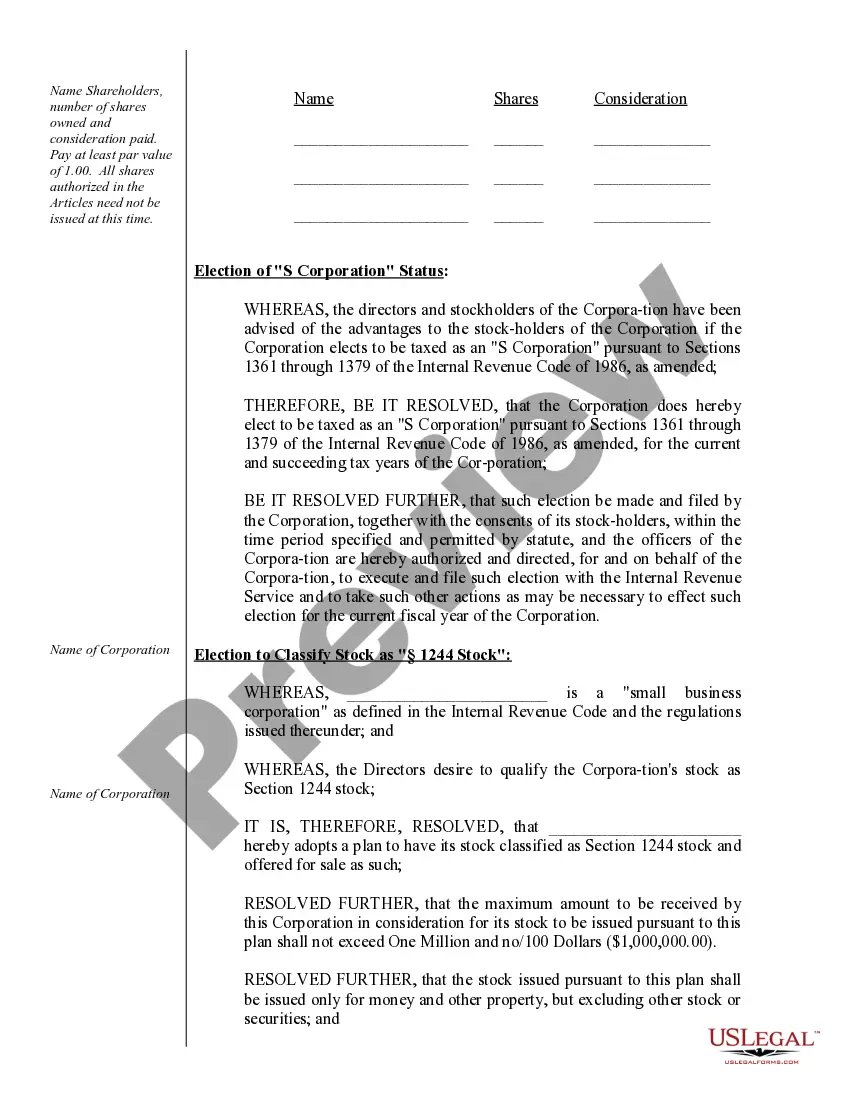

How to Form an S Corporation in South Carolina Step 1: Choose a name. ... Step 2: Appoint a registered agent. ... Step 3: Elect directors or managers. ... Step 4: File Articles of Incorporation/Organization with the South Carolina Secretary of State. ... Step 5: File Form 2553 to turn business into an S Corporation.

South Carolina does not require LLCs to file an annual report. Taxes. For complete details on state taxes for South Carolina LLCs, visit Business Owner's Toolkit or the State of South Carolina . Federal tax identification number (EIN).

The state of South Carolina requires all corporations to file a South Carolina Corporation Income Tax Return ? which includes an annual report. Most LLCs won't need to file a tax return ? unless they're taxed as a C or S corp.