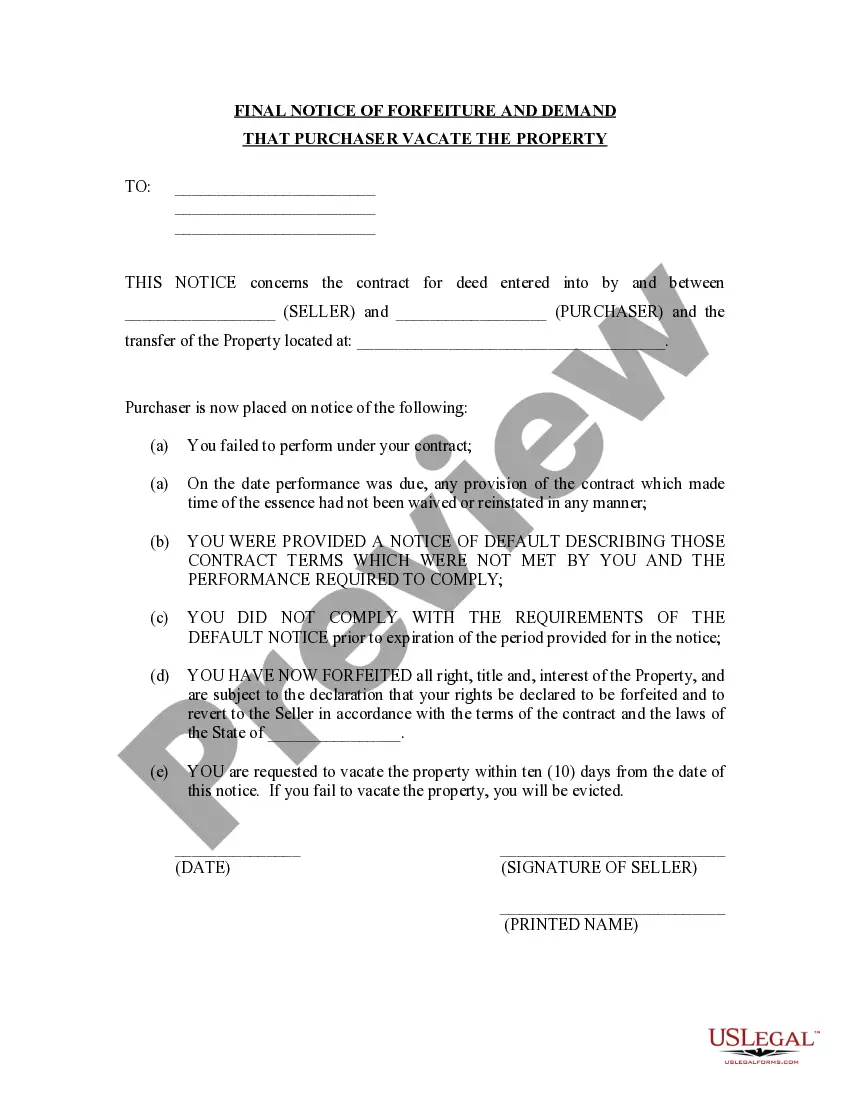

The Final Notice of Forfeiture and Demand Buyer Vacate Property form notifies the Purchaser, after all prior notices of breach have expired, that Seller has elected to cancel the contract for deed in accordance with its terms and all past payments made by Purchaser are now considered forfeited and any future occupancy of property will result in action by the court.

South Carolina Notice Withholding Registration Form

Description

How to fill out South Carolina Notice Withholding Registration Form?

How to discover professional legal documents that adhere to your state regulations and draft the South Carolina Notice Withholding Registration Form without consulting a lawyer.

Numerous online services offer templates to address various legal circumstances and requirements. However, it may require time to determine which of the accessible samples meet both your use case and legal standards.

US Legal Forms is a reliable platform that assists you in finding official documents created in accordance with the latest state law revisions and helps you save money on legal services.

Download the South Carolina Notice Withholding Registration Form using the appropriate button next to the file name. If you haven’t registered with US Legal Forms, follow the instructions below: Browse the webpage you have opened and verify if the form meets your requirements. To achieve this, use the form description and preview options if they exist. If needed, search for another template in the header specifying your state. Click the Buy Now button when you find the correct document. Select the most appropriate pricing plan, and then Log In or create an account. Choose the payment method (by credit card or PayPal). Select the file format for your South Carolina Notice Withholding Registration Form and click Download. The downloaded documents remain in your possession: you can always access them later in the My documents section of your profile. Subscribe to our platform and prepare legal documents independently like a seasoned legal professional!

- US Legal Forms is not a typical online repository.

- It comprises over 85,000 validated templates for a wide range of business and life situations.

- All documents are categorized by field and state to expedite your search process.

- Additionally, it incorporates robust solutions for PDF editing and eSignature.

- This empowers users with a Premium subscription to conveniently complete their paperwork online.

- Acquiring the necessary documents requires minimal effort and time.

- If you already possess an account, Log In and verify that your subscription is active.

Form popularity

FAQ

To fill out the South Carolina employee withholding allowance certificate, start by entering the employee's personal details, including their name and address. Next, indicate the total number of allowances they wish to claim based on their family status and other factors. Finally, ensure the employee signs and dates the certificate for authenticity. This completed form is essential for accurately filing your South Carolina notice withholding registration form.

On your employee's withholding allowance certificate, also known as the W-4 form, ensure that you accurately fill in the employee's personal information, including their name and Social Security number. Then, indicate the number of allowances they claim, which determines their tax withholding. This form must be completed correctly to ensure compliance and accuracy on the South Carolina notice withholding registration form.

The number of allowances you should claim in South Carolina depends on your individual circumstances. Typically, individuals claim one allowance for themselves, additional allowances for their spouse, and further allowances for each dependent. Assess your financial situation, and if uncertain, use tools like the IRS withholding calculator or consult professionals to make informed decisions regarding your South Carolina notice withholding registration form.

When determining withholding allowances for your South Carolina notice withholding registration form, consider factors such as your filing status and dependents. Each allowance you claim reduces the amount of income tax withheld from your paycheck. You can use the IRS withholding calculator or consult with a tax professional to find the right number for you, ensuring you meet your tax obligations effectively.

Filling out your South Carolina notice withholding registration form is straightforward. You need to provide your personal information, including your name, address, and Social Security number. Next, indicate the number of allowances you wish to claim. Ensure all information is accurate to prevent issues with your tax withholding.

Choosing the right tax withholding requires an understanding of your financial situation, including income and deductions. Generally, reviewing previous tax returns can help you estimate the appropriate withholding amount. The South Carolina notice withholding registration form includes a section for indicating your chosen withholding, and you can find helpful resources on the US Legal Forms platform to assist in making this critical decision.

Filling out a withholding form involves providing personal information, such as your name, address, and Social Security number, as well as details regarding your income. You will complete a South Carolina notice withholding registration form, which includes sections for exemptions, which can influence your tax outcome. Using the US Legal Forms platform can simplify this task, guiding you step-by-step through the completion of the form.

You can manage your withholding by filling out the appropriate form for the South Carolina notice withholding registration form. You typically need to understand your income and tax situation to determine the correct amount. US Legal Forms offers a streamlined experience, providing access to necessary forms while guiding you through the withholding process so you can complete it accurately.

To locate your South Carolina withholding number, you can visit the South Carolina Department of Revenue website. There, you can find resources to help you retrieve your number, often associated with your business registration details. Alternatively, if you're using the US Legal Forms platform, you can access forms and guides that clarify the process to ensure you have the correct information for your South Carolina notice withholding registration form.

Filling out the SC W4 form involves similar steps to the regular W4 form. You begin by providing your basic personal information, then indicate your filing status, and finally declare the number of allowances you wish to claim. Make sure to go through the form thoroughly before submitting it to your employer to prevent withholding issues.