Rhode Island Contractor Withholding Tax Registration

Description

How to fill out Rhode Island Renovation Contractor Package?

Legal papers management can be overpowering, even for the most skilled specialists. When you are interested in a Rhode Island Contractor Withholding Tax Registration and do not get the a chance to devote looking for the appropriate and up-to-date version, the operations can be stress filled. A robust online form catalogue might be a gamechanger for anyone who wants to take care of these situations successfully. US Legal Forms is a industry leader in online legal forms, with over 85,000 state-specific legal forms available to you whenever you want.

With US Legal Forms, it is possible to:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms covers any requirements you could have, from personal to enterprise papers, in one location.

- Utilize innovative tools to accomplish and control your Rhode Island Contractor Withholding Tax Registration

- Gain access to a resource base of articles, guides and handbooks and resources relevant to your situation and requirements

Help save time and effort looking for the papers you need, and utilize US Legal Forms’ advanced search and Review tool to find Rhode Island Contractor Withholding Tax Registration and get it. If you have a subscription, log in for your US Legal Forms account, search for the form, and get it. Take a look at My Forms tab to see the papers you previously saved and to control your folders as you can see fit.

If it is your first time with US Legal Forms, make a free account and obtain unrestricted usage of all benefits of the library. Here are the steps to consider after accessing the form you need:

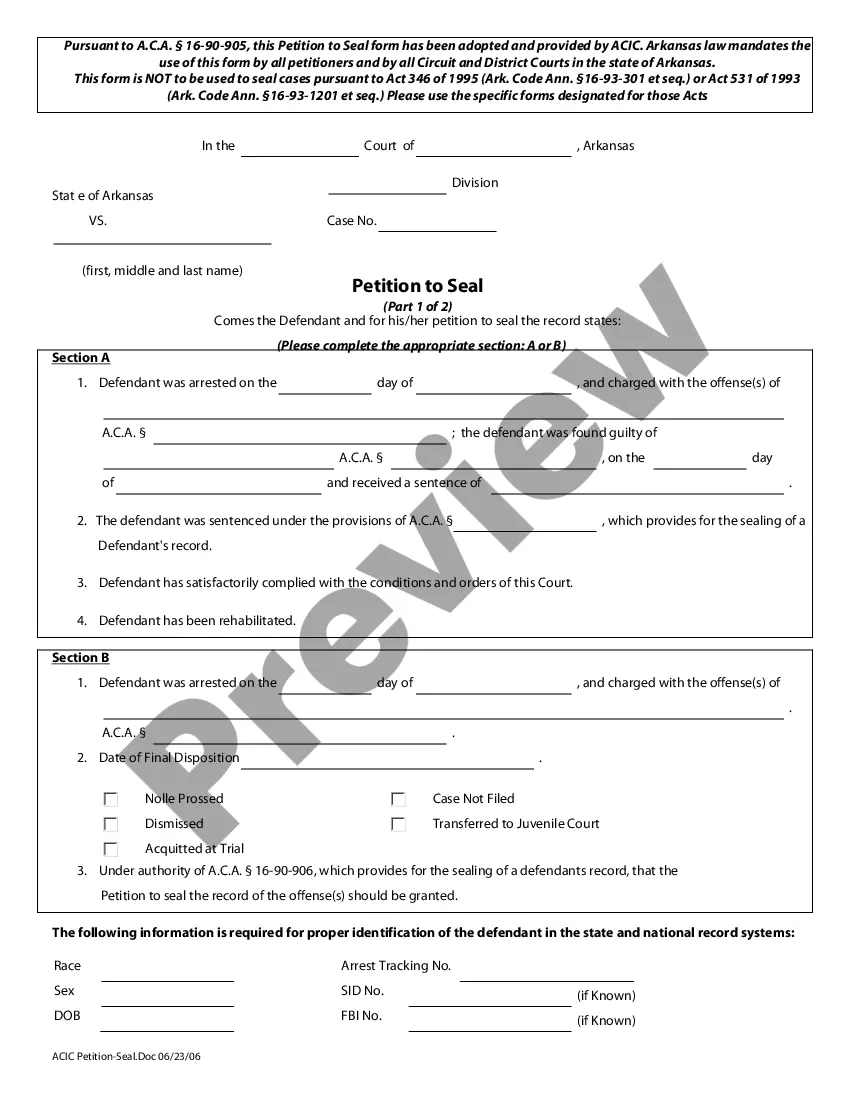

- Verify this is the correct form by previewing it and reading through its description.

- Be sure that the sample is accepted in your state or county.

- Choose Buy Now once you are all set.

- Choose a subscription plan.

- Pick the formatting you need, and Download, complete, eSign, print and send your document.

Take advantage of the US Legal Forms online catalogue, backed with 25 years of expertise and reliability. Transform your everyday document managing in a smooth and intuitive process today.

Form popularity

FAQ

Rhode Island Withholding Account Number If you are a new business, register online with the RI Department of Revenue. ... If you already have a Rhode Island Withholding Account Number, you can find it on previous correspondence from the RI Department of Revenue or by contacting the agency at 401-574-8829.

You must complete Form RI W-4 for your employer(s). Once you have completed Form RI W-4 for your employer, Form RI W-4 only needs to be completed if you are making changes to your withholding allowance or have a new employer.

Rhode Island has a graduated individual income tax, with rates ranging from 3.75 percent to 5.99 percent. Rhode Island also has a flat 7.00 percent corporate income tax rate. Rhode Island has a 7.00 percent state sales tax rate and does not levy local sales taxes.

The Rhode Island Form RIW-4, Employee's Withholding Allowance Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages.

Rhode Island ? like the federal government and many states ? has a pay-as-you-earn income tax system. Under that system, employers are required to withhold a portion of their employees' wages and to periodically turn over those withheld funds to the RI Division of Taxation.