Rhode Island Trust For Sale

Description

Form popularity

FAQ

The RI 1065 form is typically required for partnerships that generate income in Rhode Island. This includes businesses and entities that have multiple partners or members. If you are managing a Rhode Island trust for sale, it's essential to understand your filing requirements. Seeking assistance from professionals can ensure compliance and smooth operations.

Rhode Island inheritance laws dictate how assets are distributed if someone dies without a will. If there is a will, it outlines the distribution and is honored by the court. Utilizing a Rhode Island trust for sale can ensure your assets are managed according to your wishes, preventing complications and disputes. Understanding these laws can help you create a comprehensive estate plan.

Rhode Island allows individuals to inherit up to $1.53 million without incurring any inheritance tax. Anything above this threshold will be subject to taxation at varying rates based on the relationship to the deceased. By establishing a Rhode Island trust for sale, you may preserve more of your inheritance from taxes. Planning effectively can help maximize the benefits for your heirs.

In Rhode Island, the main inheritance tax form is the RI-706. This form allows you to report the estate values and calculate any taxes owed. Integrating a Rhode Island trust for sale into your estate plan can simplify the process and provide tax savings. Always ensure you consult with a tax advisor to understand your specific obligations.

The best state to open a trust can vary depending on several factors, including the type of trust and its intended purpose. While Rhode Island provides favorable laws for many types of trusts, including a Rhode island trust for sale, other states like Delaware and Nevada also offer strong benefits. Researching your options and consulting with a professional can lead you to make the most informed choice for your trust.

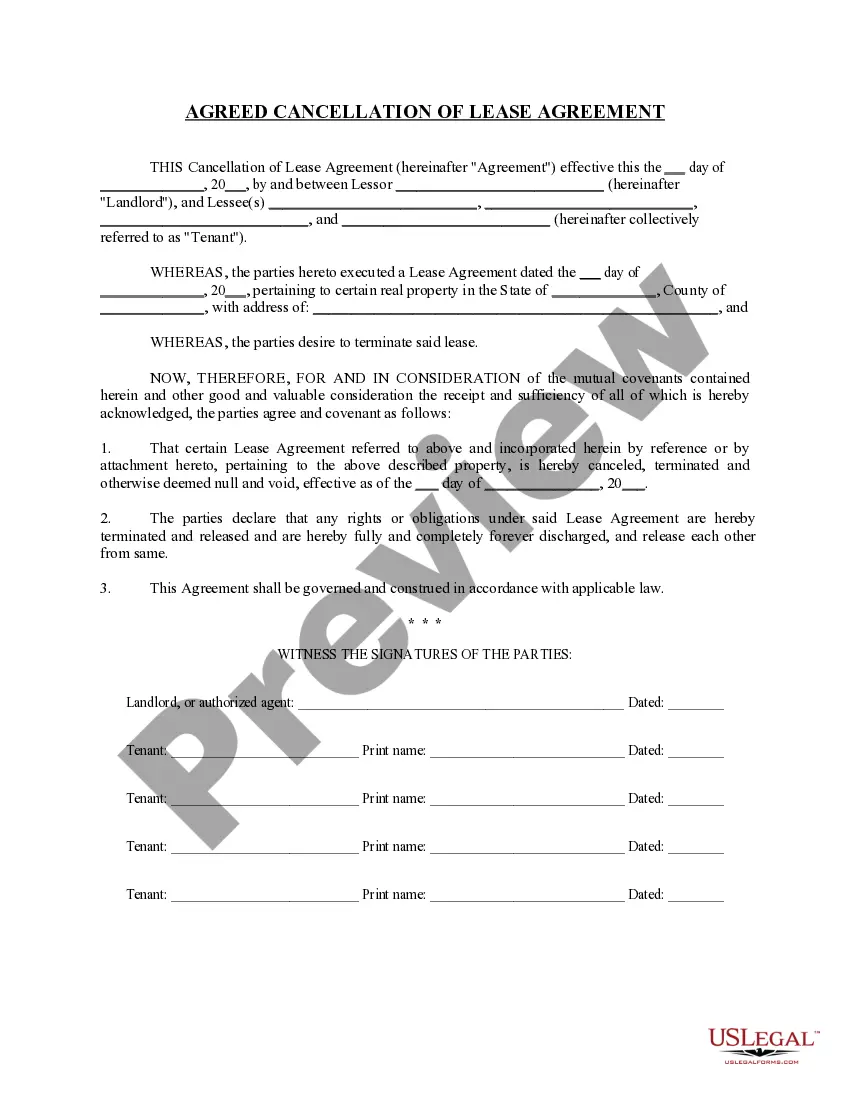

Setting up a Rhode island trust for sale involves several steps that include deciding on the type of trust you want, choosing a trustee, and drafting the trust document. You can start by outlining your goals for the trust and the assets you wish to include. Using services like USLegalForms can simplify this process, providing you with the necessary templates and guidance to create a trust that fits your needs.

The average amount in a trust varies widely depending on individual circumstances. Many trusts hold anywhere from a few thousand to several million dollars. In Rhode Island, a Rhode Island trust for sale can significantly vary in its assets. Understanding the value of common assets within a trust can provide insight into its purpose and potential.

Creating a trust in Rhode Island involves several key steps. Start by determining the type of trust that meets your needs, such as a revocable or irrevocable trust. Next, you will need to draft a trust agreement that outlines the terms. Consider using resources like US Legal Forms to navigate the legal requirements for establishing a Rhode Island trust for sale efficiently.

When considering the best states for land trusts, look at states that offer favorable laws and tax benefits. Rhode Island is an excellent option due to its growing interest in trust arrangements, especially with a Rhode Island trust for sale. Other states like Florida and California also provide beneficial legal frameworks. Choosing the right state can enhance your land ownership experience.

Filing income from a trust involves using the information from the Schedule K-1 provided by the trust. Start by including the reported income on your tax return, typically on Form 1040. This process helps the IRS keep track of your income and ensures your compliance with tax laws. Using a Rhode Island trust for sale can provide financial benefits, but accurate filing is essential to maintain those advantages.