Rhode Island Business Application And Registration

Description

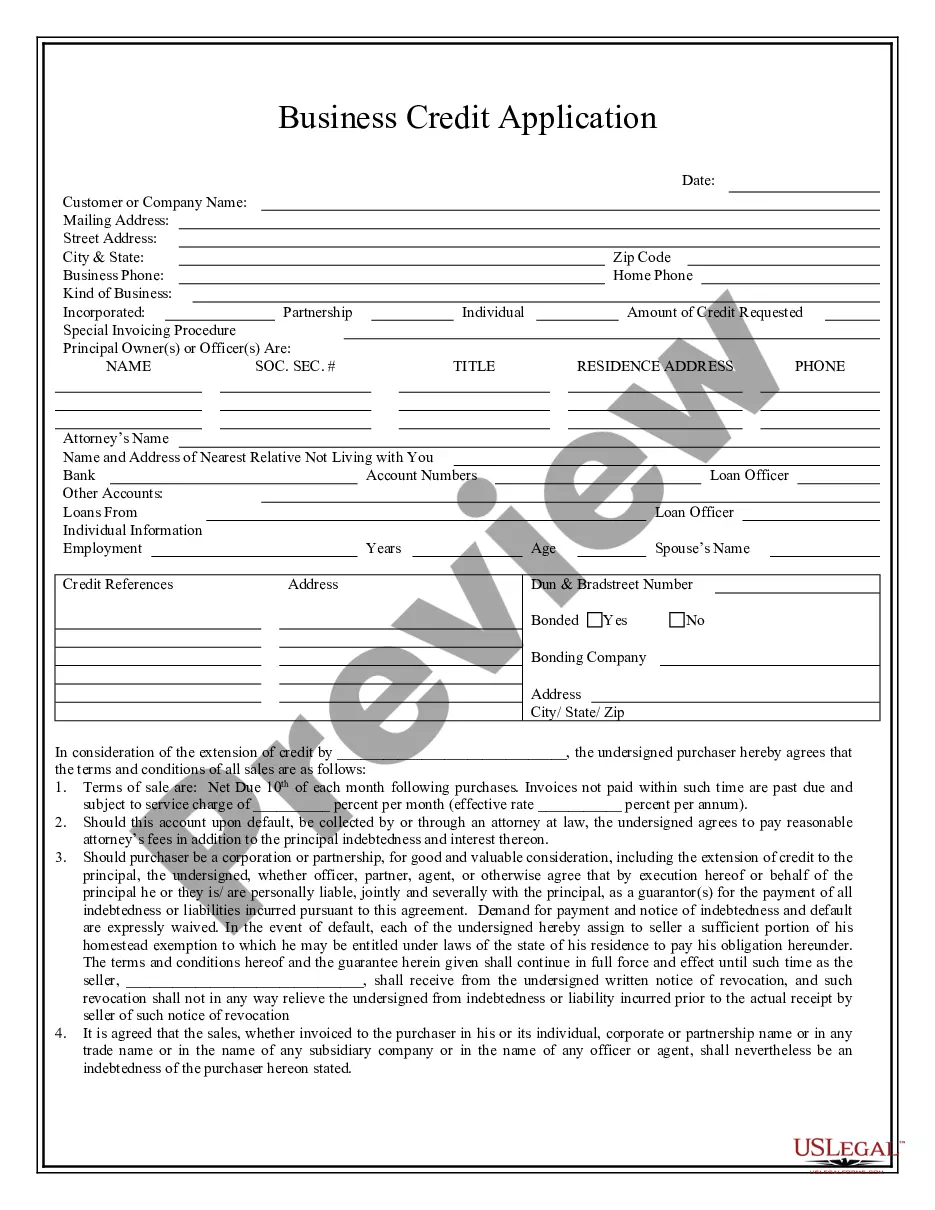

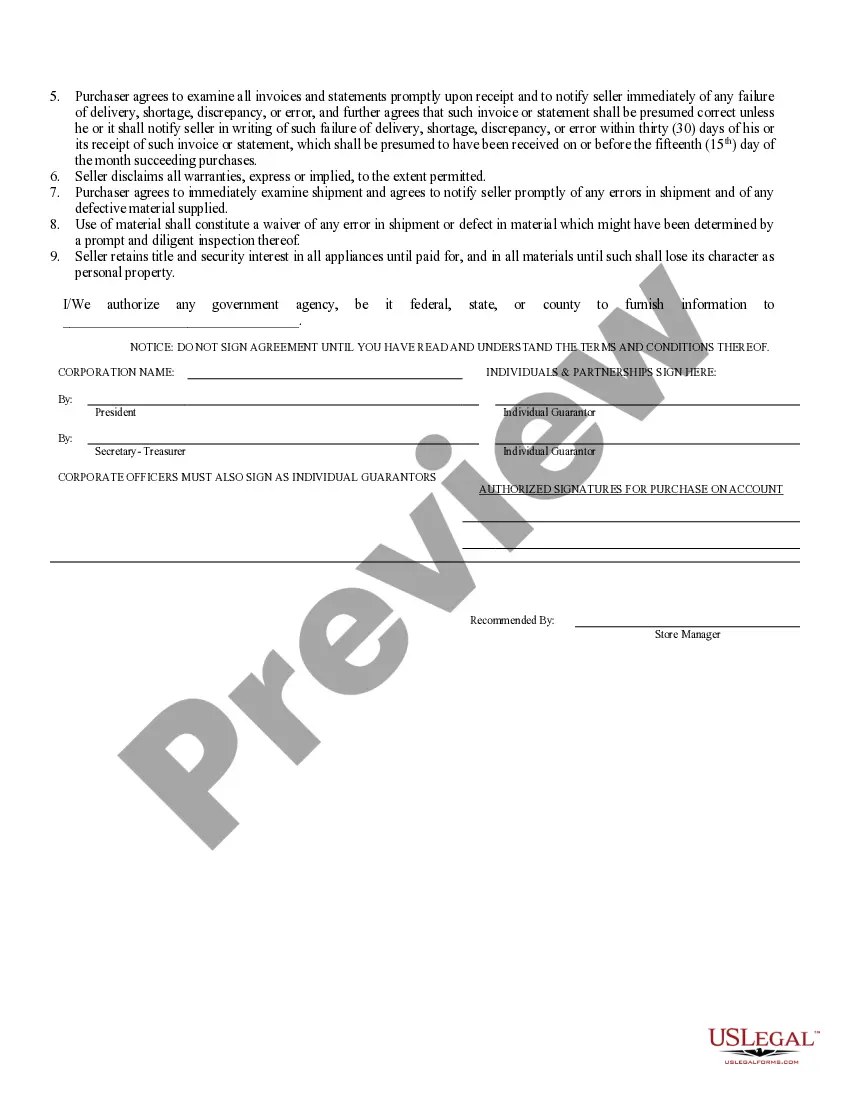

How to fill out Rhode Island Business Credit Application?

Drafting legal paperwork from scratch can often be a little overwhelming. Some cases might involve hours of research and hundreds of dollars invested. If you’re searching for an easier and more affordable way of creating Rhode Island Business Application And Registration or any other forms without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our online collection of over 85,000 up-to-date legal documents addresses virtually every aspect of your financial, legal, and personal matters. With just a few clicks, you can quickly get state- and county-specific templates carefully prepared for you by our legal professionals.

Use our platform whenever you need a trustworthy and reliable services through which you can easily locate and download the Rhode Island Business Application And Registration. If you’re not new to our services and have previously created an account with us, simply log in to your account, select the form and download it away or re-download it at any time in the My Forms tab.

Not registered yet? No problem. It takes minutes to set it up and navigate the library. But before jumping straight to downloading Rhode Island Business Application And Registration, follow these tips:

- Check the form preview and descriptions to make sure you have found the form you are looking for.

- Check if form you select conforms with the requirements of your state and county.

- Choose the right subscription option to get the Rhode Island Business Application And Registration.

- Download the file. Then complete, sign, and print it out.

US Legal Forms boasts a good reputation and over 25 years of expertise. Join us today and turn document completion into something simple and streamlined!

Form popularity

FAQ

Rhode Island LLC Processing Times Normal LLC processing time:Expedited LLC:Rhode Island LLC by mail:3-4 business days (plus mail time)Not availableRhode Island LLC online:3-4 business daysNot available

You can register for a Rhode Island seller's permit online through the Rhode Island Division of Taxation. To apply, you'll need to provide the Rhode Island Division of Taxation with certain information about your business, including but not limited to: Business name, address, and contact information.

We recommend applying for an EIN online if you have a SSN (Social Security Number) or ITIN (Individual Taxpayer Identification Number). This is the easiest filing method and it has the fastest approval time. Your EIN Number will be issued at the end of the online application, which takes about 15 minutes to complete.

Starting an LLC in Rhode Island will include the following steps: #1: Name Your LLC. #2: Choose a Registered Agent. #3: File Your Articles of Organization. #4: Create an Operating Agreement. #5: Register to Pay Taxes.

You can register online, or by mailing a ?Business Application and Registration Form? to Division of Taxation, One Capitol Hill, Providence, RI 02908 along with the $10 fee. You need this information to register for a sales tax permit in Rhode Island: Personal identification info (SSN, address, etc.)