Life Estate Deed Explained

Description

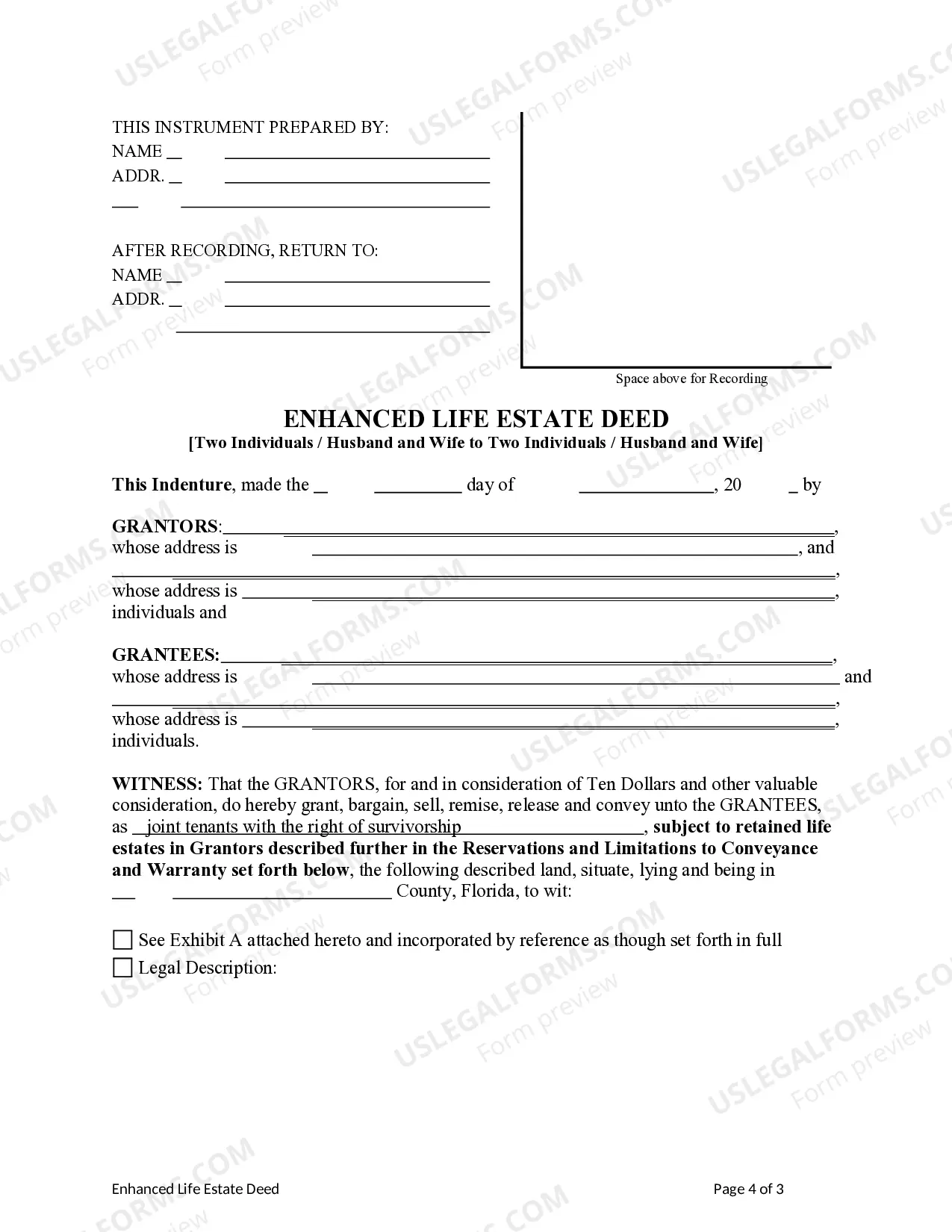

How to fill out Rhode Island Enhanced Life Estate Or Lady Bird Warranty Deed From Two Individuals, Or Husband And Wife, To Two Individuals, Or Husband And Wife.?

- For returning users, log into your account and click the Download button to save the needed form template on your device, ensuring your subscription is active; if it’s expired, renew it as per your selected payment plan.

- If it's your first time, start by browsing the Preview mode and the form description to confirm you've selected the right life estate deed that aligns with your local jurisdiction's requirements.

- In case you need an alternative template, utilize the Search tab above to find the most suitable one; if it meets your criteria, proceed to the next step.

- Purchase the document by selecting the Buy Now button and choosing your preferred subscription plan; you'll need to create an account to gain access to the full library's features.

- Complete your transaction by entering your credit card or PayPal details for subscription payment.

- Finally, download your life estate deed and save it on your device; you can revisit it anytime in the My Forms section of your profile.

By using US Legal Forms, you gain access to an extensive library featuring over 85,000 customizable legal forms and packages, not to mention the option to consult with premium experts to ensure your documents are accurate and compliant.

In conclusion, processing a life estate deed through US Legal Forms streamlines the document preparation process, making it accessible and efficient. Don’t hesitate to start your journey with us today!

Form popularity

FAQ

Yes, you can sell a home that has a life estate deed, but the process may be more complex than a standard sale. The life tenant holds rights to live in and use the property until their death, while the remainderman receives full ownership after that time. This means that any sale will require coordination between both parties. To understand this better, it's helpful to refer to resources that explain life estate deeds in detail, such as those available on the US Legal platform.

While a life estate deed explained has benefits, it also presents some drawbacks. One key disadvantage is that the original owner cannot sell or mortgage the property without the consent of the remainder beneficiaries. Moreover, this arrangement may lead to complications if family dynamics change, especially in situations involving divorce or disagreements among heirs. As such, careful consideration is essential before proceeding with a life estate.

A life estate deed explained provides several advantages. First, it allows property owners to retain rights to their property during their lifetime while ensuring that the property passes to their chosen beneficiaries afterward. Additionally, it can help avoid probate, making the transfer process simpler and faster for your heirs. Consequently, it combines both control and flexibility in estate planning.

While life estates have their advantages, they come with certain drawbacks as well. One significant concern is the reduced control over the property once the deed is established, limiting your ability to sell or mortgage the asset. Moreover, depending on local laws, a life estate deed explained may have implications for taxes or debt liabilities. Understanding these potential negatives is crucial for making an informed decision.

People create life estates for various reasons, often focusing on estate planning. A life estate deed explained allows individuals to retain usage rights while ensuring property passes smoothly to heirs after their death. This arrangement can help avoid probate, save on potential tax burdens, and provide security for the life tenant. Ultimately, it serves as a proactive approach to managing one’s assets.

To navigate around a life estate, you can explore a few options. Firstly, discussing the situation with the life tenant might lead to a mutual agreement to transfer the interest. Additionally, utilizing a life estate deed explained to create a more beneficial property arrangement is essential. In some instances, you may need to consult a legal professional to explore your alternatives effectively.

A life estate deed explained simply means that one person, the life tenant, has the right to live in and use a property for their lifetime. Once the life tenant passes away, the property immediately transfers to the remaindermen, the individuals named in the deed. This arrangement can provide benefits like avoiding probate; however, it also involves specific rules and responsibilities. To fully grasp this concept, consider reviewing user-friendly resources or platforms like uslegalforms.

Yes, you can sell a house with a life estate deed, but there are important limitations to keep in mind. Since the life tenant holds only a partial interest in the property, any sale would require agreement from the remaindermen. This process can complicate transactions and potentially reduce the property's marketability. Therefore, you should consult with legal professionals and resources like uslegalforms for guidance.

When considering a life estate deed explained, it's essential to recognize some drawbacks. A primary disadvantage is the lack of flexibility, as the life tenant cannot easily sell or modify the property without consent from the remaindermen. Additionally, creditors of the life tenant may still have claims against the property, which could affect its value. Ultimately, understanding these disadvantages can help you make an informed decision.