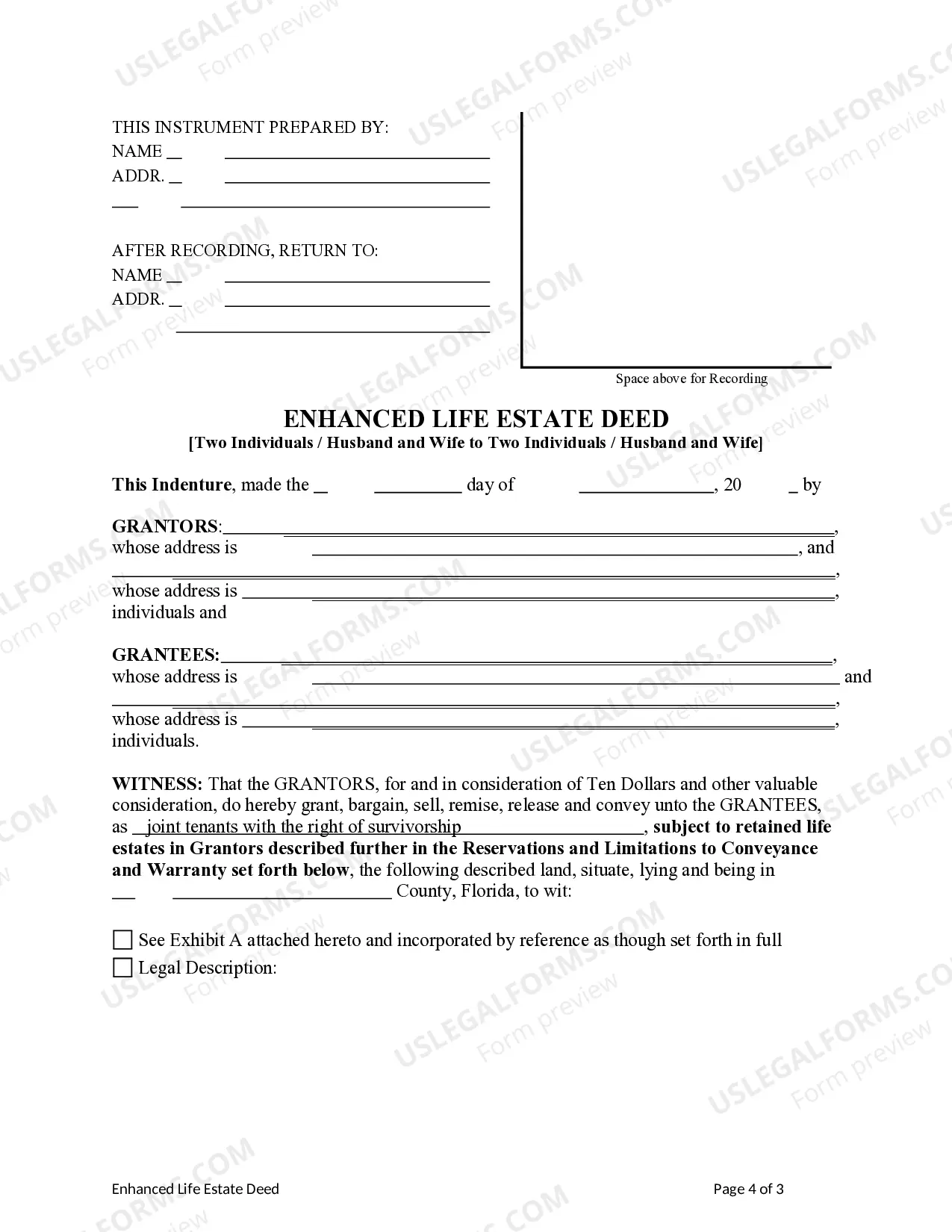

Estate Life

Description

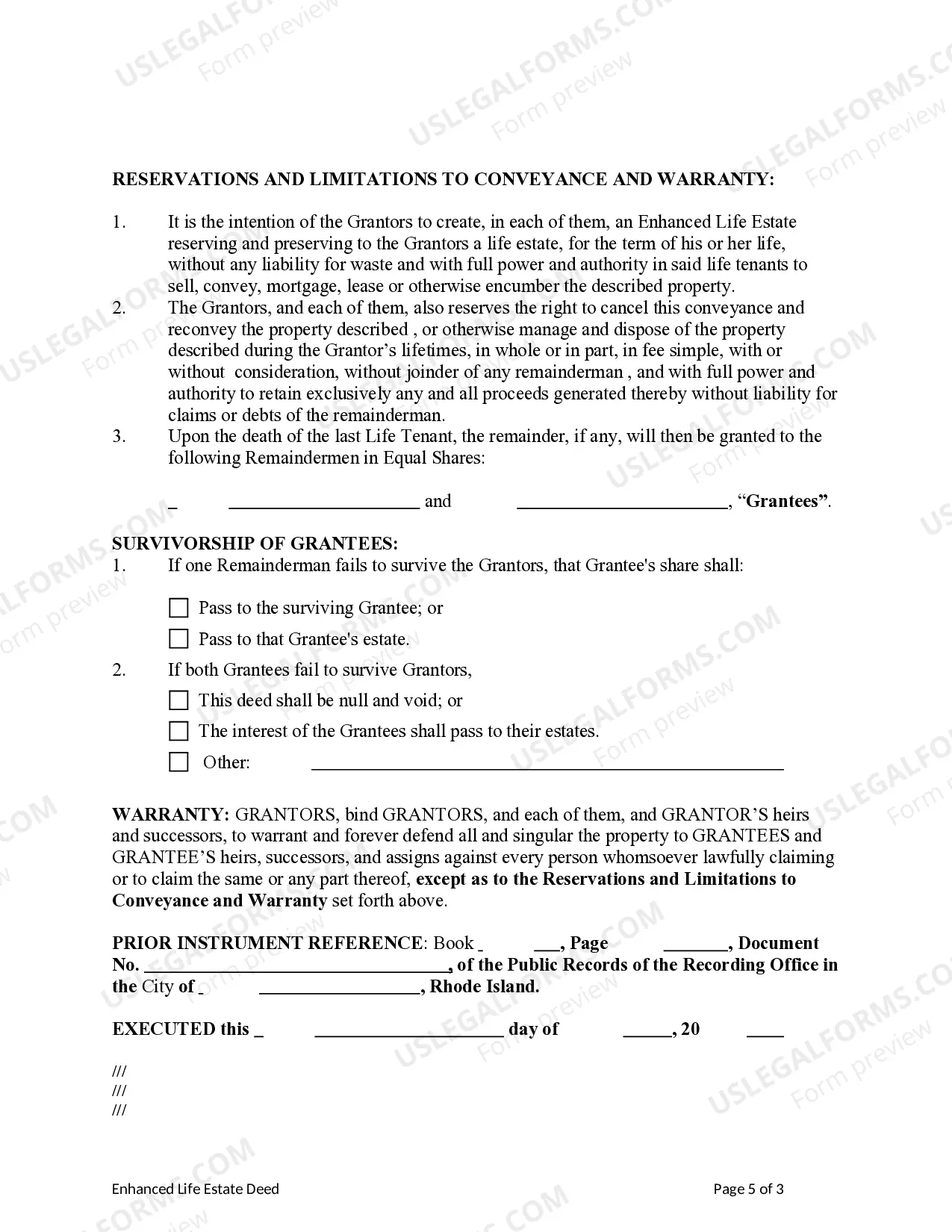

How to fill out Rhode Island Enhanced Life Estate Or Lady Bird Warranty Deed From Two Individuals, Or Husband And Wife, To Two Individuals, Or Husband And Wife.?

- Log in to your US Legal Forms account. If you haven't created one yet, register to gain access to the vast library.

- Browse or utilize the Preview mode to scrutinize available form descriptions. Confirm the selected form is appropriate for your estate matters.

- If you encounter any discrepancies, use the Search feature to locate another suitable template that meets your local jurisdiction's specifications.

- Purchase the selected form by clicking the Buy Now button. Choose a subscription plan that aligns with your needs.

- Complete your transaction securely using credit card details or PayPal. Ensure your subscription remains active for ongoing access.

- Download the finalized form directly to your device and save it for future reference via the My Forms section.

In conclusion, US Legal Forms simplifies the process of acquiring essential legal documents for estate life. With the guidance provided in these steps, you can efficiently manage your legal needs and ensure compliance with applicable laws.

Start your journey with US Legal Forms today and experience the advantage of having expert assistance available at your fingertips.

Form popularity

FAQ

When a property is labeled as a life estate, it signifies that a person has the right to live in or use the property for their lifetime. This means they can make decisions about the property but cannot sell or transfer ownership without the consent of the remainderman. Life estates play an important role in estate planning, helping individuals manage their estate life while also ensuring that their desired beneficiaries eventually receive the property. For assistance in creating a life estate, check out US Legal Forms for reliable resources.

In New York, a life estate allows someone to possess and use a property for the duration of their life. Upon the person's death, the property automatically passes to the designated remainderman without going through probate. This arrangement simplifies the transfer of property and can provide tax benefits, making it an appealing option for managing your estate life. For detailed guidance, consider using US Legal Forms to ensure a smooth process.

A life estate is a legal arrangement that grants an individual the right to use and benefit from a property during their lifetime. In contrast, a will is a document that outlines how a person's assets will be distributed after their death. With a life estate, ownership of the property transfers to another party upon the holder's death, whereas a will takes effect only when the person passes away. Understanding this distinction is vital when planning your estate life.

Typically, you should start the probate process within a few weeks to a few months after a person's death; this period may vary based on state laws. Timely initiation ensures that the estate can efficiently deal with debts and distribute assets according to the will or state law. Using the US Legal Forms resources can help you navigate this timeline effortlessly, making the process smoother and more focused on managing the estate life effectively.

Writing an estate plan involves several critical steps. Begin by identifying your assets and deciding how you want them distributed among your beneficiaries. Consider engaging tools and templates from the US Legal Forms platform, which can guide you through creating a comprehensive estate plan tailored to your wishes and needs regarding your estate life.

To prepare a final accounting for an estate, you should first gather all financial documents related to the estate, including bank statements, invoices, and tax returns. Next, create a detailed list of all assets and liabilities to provide a clear picture of the estate's value. Finally, use a reliable platform like US Legal Forms to access templates that simplify the process, ensuring compliance and accuracy in your final accounting.

To calculate a life estate, you will need to determine the life tenant's age and use a life estate calculator or mortality table. This method assigns a present value to the life interest based on life expectancy and various factors, helping you understand its worth. By utilizing platforms like USLegalForms, individuals can easily manage these calculations and create life estate documents seamlessly.

A life estate lasts for the duration of an individual's life, specifically the life tenant. Once that individual passes away, the right to use and occupy the property transfers to the remainderman. Therefore, the life estate's duration is directly tied to the life of the person designated in the agreement.

Yes, creditors can pursue a life estate, though the implications depend on jurisdiction. If the life tenant owes debts, creditors may impose claims against the property. However, since the property automatically transfers to the remainderman upon the life tenant's death, some challenges could hinder creditors' ability to recover their debts.

Individuals often want a life estate to retain living rights while transferring ownership of the property to another person at their death. This arrangement helps in bypassing probate, providing a streamlined transfer to heirs. Additionally, a life estate can offer tax benefits and serve as a tool for managing healthcare and financial decisions.