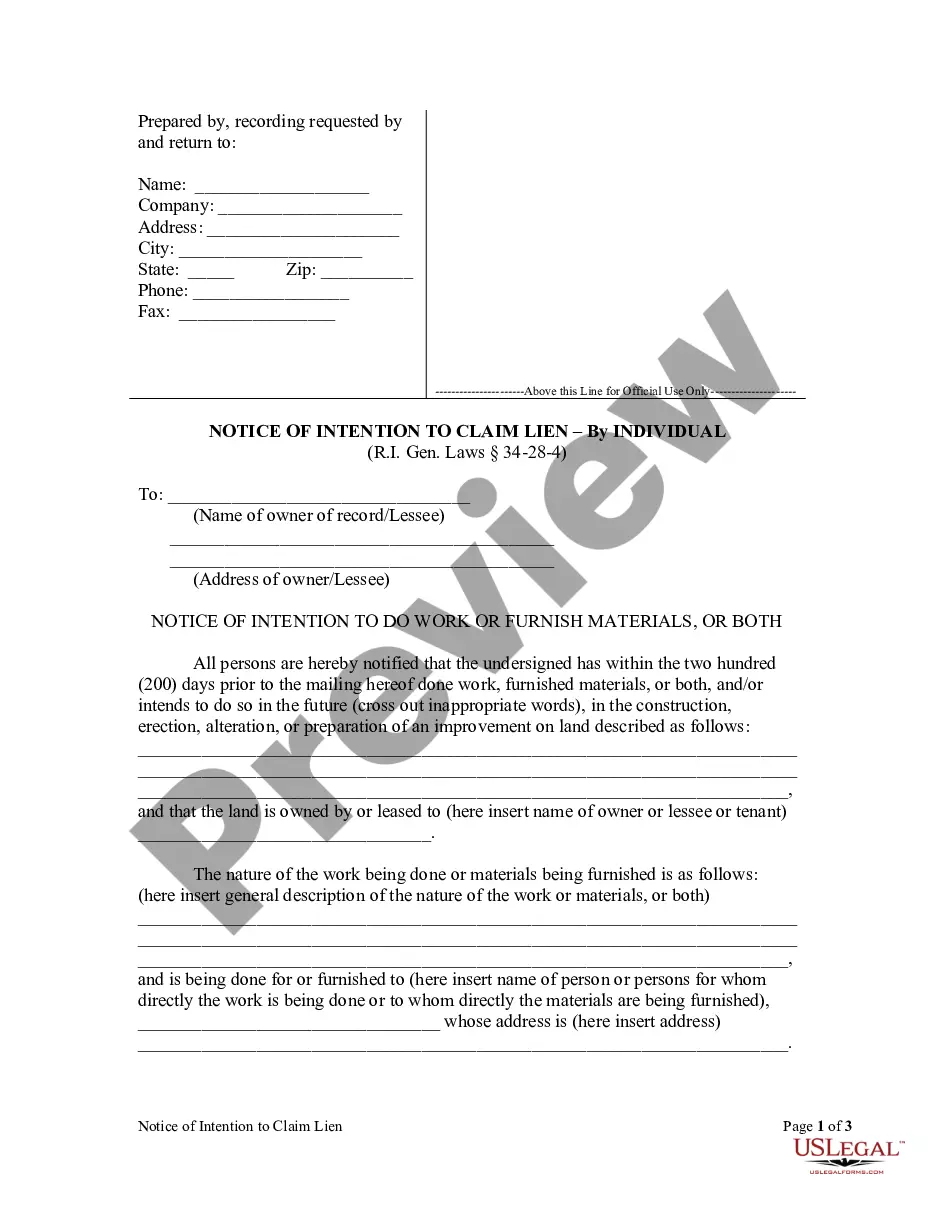

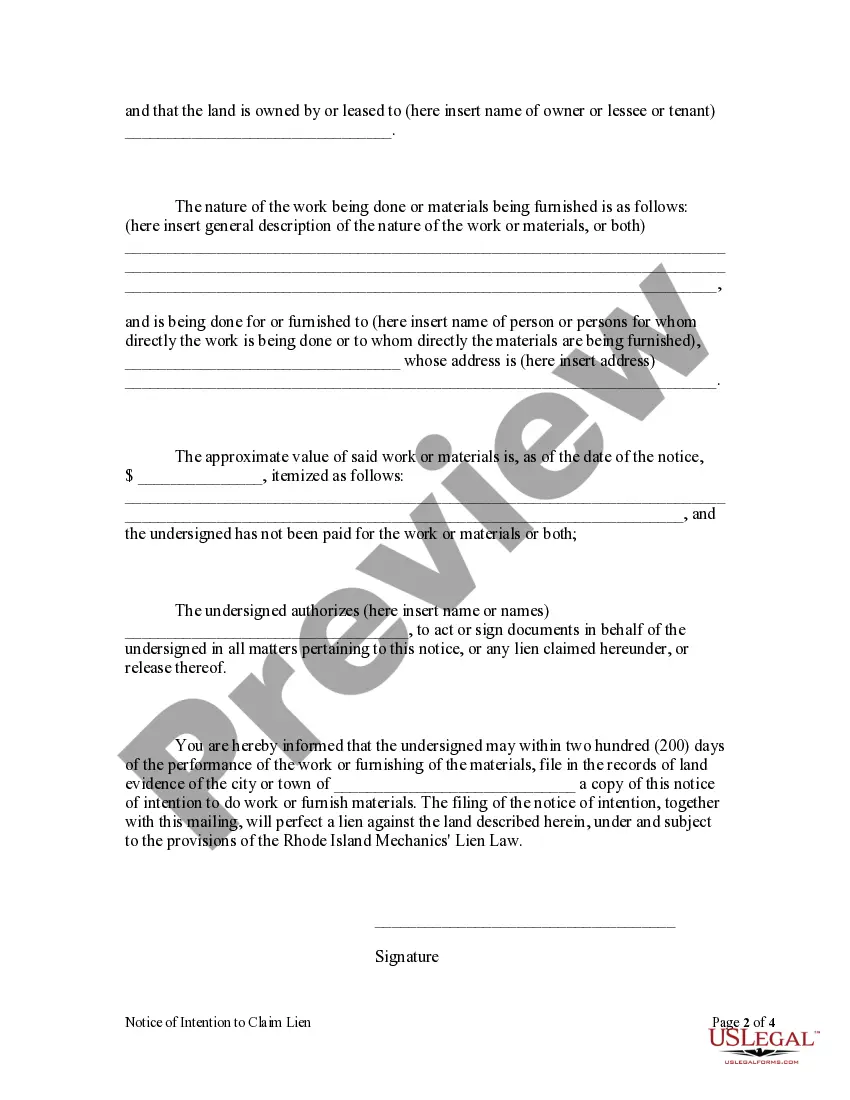

Any and all liens claimed or that could be claimed under Rhode Island law shall be void and wholly lost to any person unless the person shall, before or within one hundred and twenty (120) days after the doing of such work or the furnishing of such materials, mail by prepaid registered or certified mail, in either case return receipt requested, a notice of intention, hereinafter described, to do work or furnish material, or both, together with a statement that the person so mailing may within one hundred and twenty (120) days after the doing of the work or the furnishing of the materials, file a copy of such notice of intention in the records of land evidence in the city or town in which the land generally described in such notice of intention is located and a further statement that the mailing of the notice of intention and the filing of the copy will perfect a lien of the person so mailing against the land under and subject to the provisions of this chapter, to the owner of record of the land at the time of the mailing, or, in the case of a lien against the interest of any lessee or tenant, to the lessee or tenant, the mailing to be addressed to the last known residence or place of business of the owner or lessee or tenant, but if no residence or place of business is known or ascertainable by the person making the mailing by inquiry of the person with whom the person making the mailing is directly dealing or otherwise, then the mailing under this section shall be to the address of the land, and also shall before or within one hundred and twenty (120) days after the doing of the work or the furnishing of the materials file a copy of the notice of intention in the records of land evidence in the city or town in which the land generally described in the notice of lien is located.

Rhode Island Notice Withdrawal Of Foreign Corporation

Description

How to fill out Rhode Island Notice Withdrawal Of Foreign Corporation?

Maneuvering through the red tape of formal documents and templates can be challenging, particularly when one is not accustomed to it professionally.

Even locating the correct template for a Rhode Island Notice Withdrawal Of Foreign Corporation can be labor-intensive, as it needs to be accurate and precise down to the last digit.

Nonetheless, you will require significantly less time selecting a suitable template from a trusted source.

Acquiring the appropriate form involves a few simple steps: Enter the document's title in the search field, locate the relevant Rhode Island Notice Withdrawal Of Foreign Corporation among the results, review the sample description or preview it, and if the template suits your needs, click Buy Now. Then, select your subscription plan, register your account using your email and create a password, choose a payment method via credit card or PayPal, and save the template file to your device in your preferred format.

- US Legal Forms serves as a platform that streamlines the quest for the appropriate forms online.

- US Legal Forms constitutes a single place where you can discover the most recent document samples, understand their usage, and download them for completion.

- This is a collection boasting over 85,000 forms applicable in various fields.

- When searching for a Rhode Island Notice Withdrawal Of Foreign Corporation, you won't have to question its validity since all forms are verified.

- Generating an account at US Legal Forms ensures you have all the necessary samples within your reach.

- You can store them in your history or add them to the My documents repository.

- Access your saved forms from any device by clicking Log In on the library site.

- If you still lack an account, you can always search again for the needed template.

Form popularity

FAQ

To register a small business in Rhode Island, you must choose a business structure, like an LLC or corporation, and file the appropriate paperwork with the Secretary of State. Additionally, you'll need to obtain any necessary permits or licenses, which may include a Rhode Island notice withdrawal of foreign corporation if applicable. Consider using platforms like uslegalforms to simplify the paperwork process and ensure your business is compliant. This approach will help you establish a solid foundation for your new venture.

Yes, Rhode Island does require businesses to obtain a general business license to operate legally within the state. However, the specifics can vary based on your business type and location. You will need to check with your local municipality to determine the types of licenses required. Proper licensing, including the Rhode Island notice withdrawal of foreign corporation when relevant, helps ensure that your business follows all state regulations.

To close a business in Rhode Island, you need to file a Rhode Island notice withdrawal of foreign corporation if your business is registered as a foreign entity. This process involves settling all debts, notifying relevant authorities, and completing necessary paperwork. You may also consider consulting with a legal professional to ensure compliance with state laws and regulations. By following these steps, you can effectively close your business and minimize potential liabilities.

Yes, Rhode Island typically requires businesses to obtain a license, which varies based on the type of business activity. It's essential to check local regulations for specific requirements in your industry. If your foreign corporation is planning to dissolve, understanding the requirements surrounding the Rhode Island notice withdrawal of foreign corporation can help ensure a smoother process.

Rhode Island offers various programs and incentives to promote business growth, but opinions vary. While some entrepreneurs find support in certain sectors, others may face challenges due to regulations. If you're navigating the process of foreign corporation withdrawal, the Rhode Island notice withdrawal of foreign corporation can help streamline your transition and provide a clearer path.

In Rhode Island, LLCs are treated as pass-through entities, meaning profits are reported on the members’ personal tax returns. Consequently, income is taxed at individual rates, not at the corporate level. If you're a foreign corporation planning to withdraw, understanding the implications of the Rhode Island notice withdrawal of foreign corporation on your tax responsibilities can significantly help you.

To file your annual report online in Rhode Island, visit the Secretary of State's website where you can complete the process easily. Make sure all company details are accurate before submission, as inaccuracies can lead to complications. If you're managing a foreign corporation, knowing how to handle the Rhode Island notice withdrawal of foreign corporation is also essential for maintaining compliance.

Dissolving a business in Rhode Island involves filing a formal dissolution notice with the Secretary of State. You must ensure all debts and obligations are settled, and you may need to obtain a Rhode Island notice withdrawal of foreign corporation if you're a foreign entity. Seeking assistance from platforms like uslegalforms can guide you through the required paperwork and ensure compliance with state laws.