Pennsylvania Trust Code

Description

How to fill out Pennsylvania Amendment To Living Trust?

Drafting legal documents from scratch can often be intimidating. Certain scenarios might involve hours of research and hundreds of dollars spent. If you’re searching for a simpler and more affordable way of preparing Pennsylvania Trust Code or any other paperwork without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual catalog of more than 85,000 up-to-date legal documents covers almost every aspect of your financial, legal, and personal affairs. With just a few clicks, you can quickly get state- and county-compliant forms diligently put together for you by our legal professionals.

Use our platform whenever you need a trustworthy and reliable services through which you can quickly locate and download the Pennsylvania Trust Code. If you’re not new to our website and have previously created an account with us, simply log in to your account, locate the template and download it away or re-download it at any time in the My Forms tab.

Not registered yet? No problem. It takes minutes to set it up and explore the catalog. But before jumping directly to downloading Pennsylvania Trust Code, follow these recommendations:

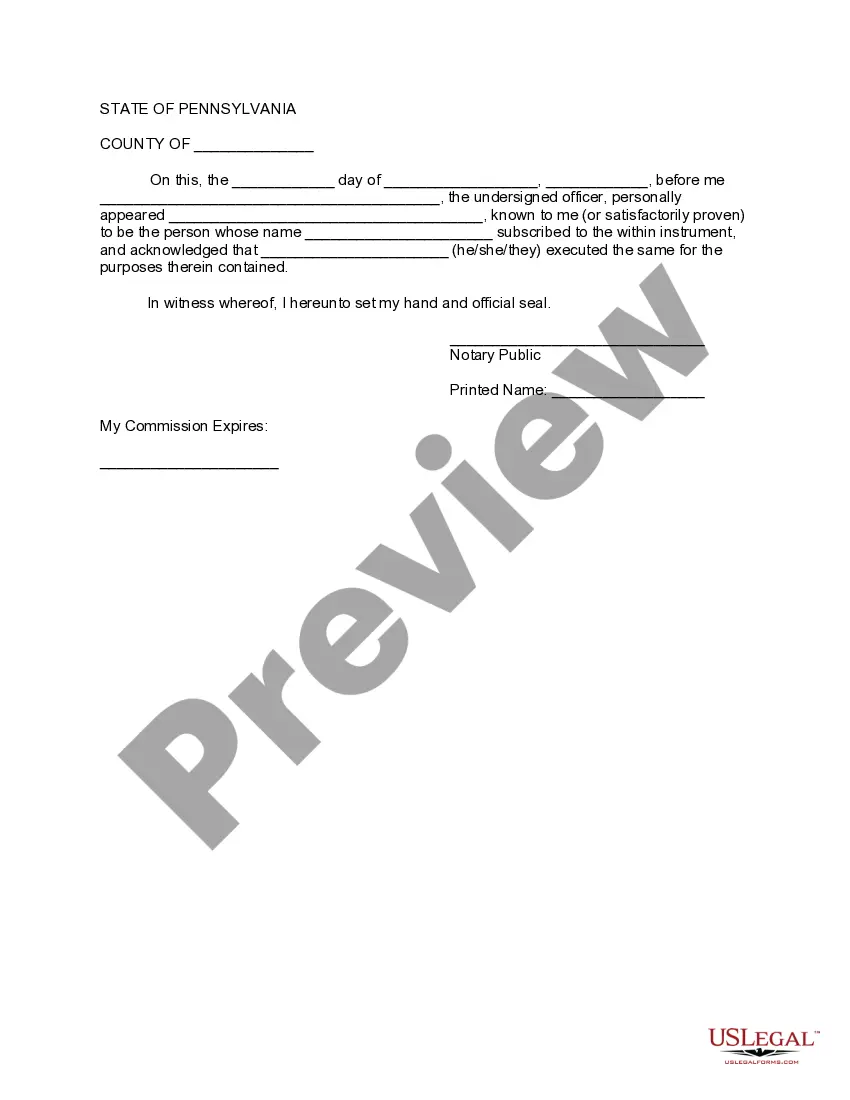

- Review the form preview and descriptions to ensure that you are on the the document you are searching for.

- Make sure the form you select complies with the requirements of your state and county.

- Choose the right subscription option to buy the Pennsylvania Trust Code.

- Download the file. Then fill out, sign, and print it out.

US Legal Forms has a good reputation and over 25 years of expertise. Join us now and turn document execution into something easy and streamlined!

Form popularity

FAQ

*Notice includes the following: (1) The fact of the trust's existence. (2) The identity of the settlor. (3) The trustee's name, address and telephone number. (4) The recipient's right to receive upon request a copy of the trust instrument.

To make a living trust in Pennsylvania, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

Some examples of mandatory rules created by the Pennsylvania's Uniform Trust Act include rules governing basic requirements for a trust creation, modification, and termination and when beneficiaries get notice of the trust.

The cost of setting up a trust in Pennsylvania varies depending on the complexity of the trust and the attorney's fees. A basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts can cost several thousand dollars more.

A trust is a separate taxpayer if, under the governing instrument and applicable State law, it is irrevocable. If a trust is revocable, the settlor is deemed the recipient of the income or gains of the trust, and must report such income on his or her individual tax return.