Pennsylvania Irrevocable Trust Form

Description

Form popularity

FAQ

Yes, you can write your own irrevocable trust, but it is essential to ensure that it complies with Pennsylvania laws. While drafting your own trust gives you control, you must include all necessary provisions to enforce the trust and protect your assets. Using a Pennsylvania irrevocable trust form can provide a solid structure and help avoid potential legal pitfalls. For ease, you could utilize uslegalforms for templates that meet state requirements.

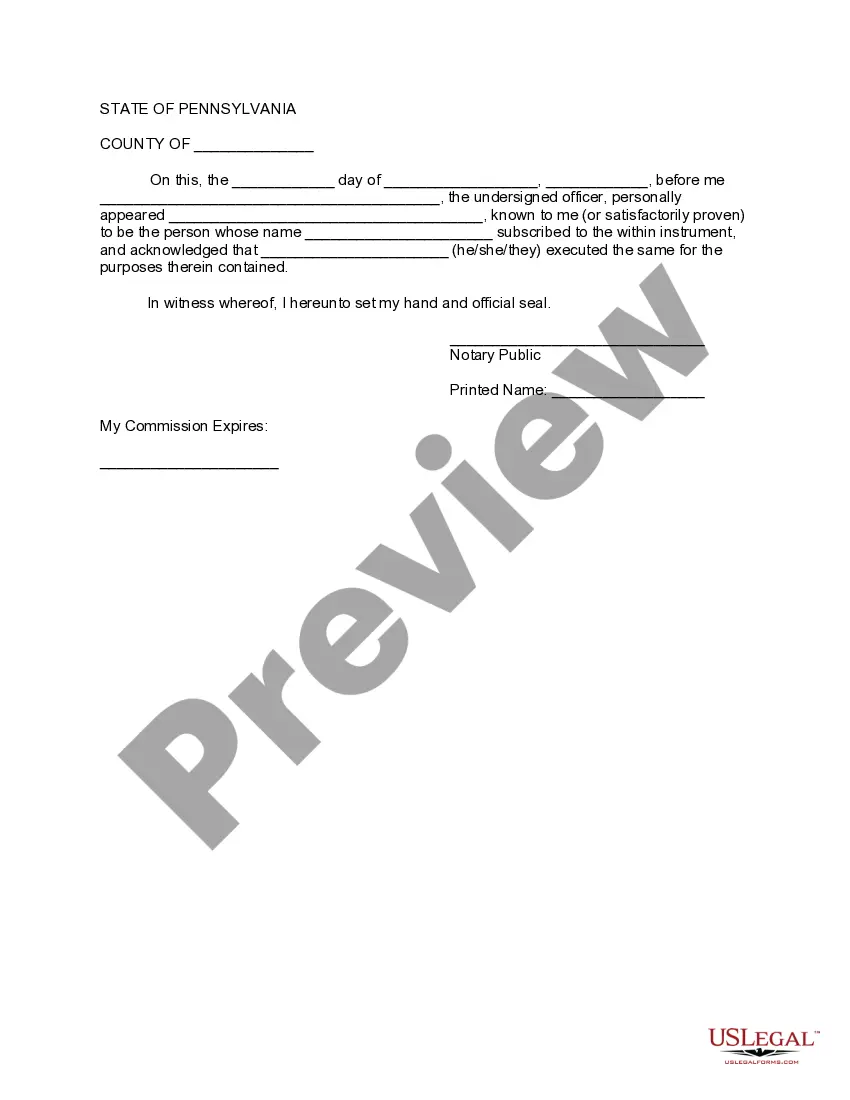

To fill out a Pennsylvania irrevocable trust form, start by gathering necessary information about the trust, its assets, and the beneficiaries. Clearly identify the trustee and the terms of the trust within the document. Follow the instructions provided with the form, ensuring you include all required signatures and notary public acknowledgments. If you want guidance through the process, consider using uslegalforms to simplify filling out the Pennsylvania irrevocable trust form.

Applying for an irrevocable trust involves several steps, starting with defining your objectives and determining which assets to include. You will then need to fill out a Pennsylvania irrevocable trust form, which typically requires legal assistance to ensure compliance with state laws. Using a service like US Legal Forms can simplify this process by providing the necessary templates and guidance. Finally, you will need to fund the trust and properly execute the documents to make it legally valid.

Yes, an irrevocable trust can potentially help in avoiding Pennsylvania inheritance tax. When assets are placed in a Pennsylvania irrevocable trust form, they are no longer considered part of the grantor's estate, which may reduce or eliminate inheritance tax liability upon death. However, it is crucial to follow Pennsylvania’s specific laws and regulations regarding trusts and taxes. Consulting with a tax advisor or an attorney can provide clarity on this important aspect.

In Pennsylvania, whether to choose a will or a trust depends on your goals and circumstances. A will can offer simplicity and is easier to create, while a Pennsylvania irrevocable trust form can provide benefits such as avoiding probate and protecting assets from creditors. For individuals with significant assets or those wishing to manage how their assets are distributed after death, a trust may be the more advantageous option. Ultimately, consult with a legal expert to find the best choice for your situation.

Yes, while irrevocable trusts can provide certain tax advantages, they may still be subject to Pennsylvania inheritance tax. The specific circumstances of the trust and its beneficiaries will ultimately dictate tax liability. A well-structured Pennsylvania irrevocable trust form can help you navigate these complexities. Consulting a legal expert will ensure you grasp all associated tax implications.

Generally, an irrevocable trust can reduce your inheritance tax burden because the assets are no longer part of your estate. However, some taxes may still apply, depending on various factors. Using the Pennsylvania irrevocable trust form can help you structure your estate in a beneficial way. Therefore, it's essential to understand the nuances of this strategy.

An irrevocable trust can help minimize inheritance tax in Pennsylvania by removing assets from your estate. However, it does not guarantee complete avoidance of tax. Utilizing a Pennsylvania irrevocable trust form appropriately can maximize tax benefits. Consulting with an expert can clarify how this tool impacts your unique situation.

Certain assets in Pennsylvania are exempt from inheritance tax, including property left to a surviving spouse, charitable organizations, and certain types of government bonds. It's important to familiarize yourself with the Pennsylvania irrevocable trust form, as it can aid in structuring your assets effectively. Understanding these exemptions can help you plan your estate to minimize tax liabilities. Always consult a professional for the latest regulations.

While you can create an irrevocable trust independently, it is wise to seek legal assistance for this process. The Pennsylvania irrevocable trust form has specific requirements that must be met. An attorney can help ensure that your trust is legally sound and aligns with your financial goals. Taking this step can prevent future complications.