Pa Trust Filing Requirements

Description

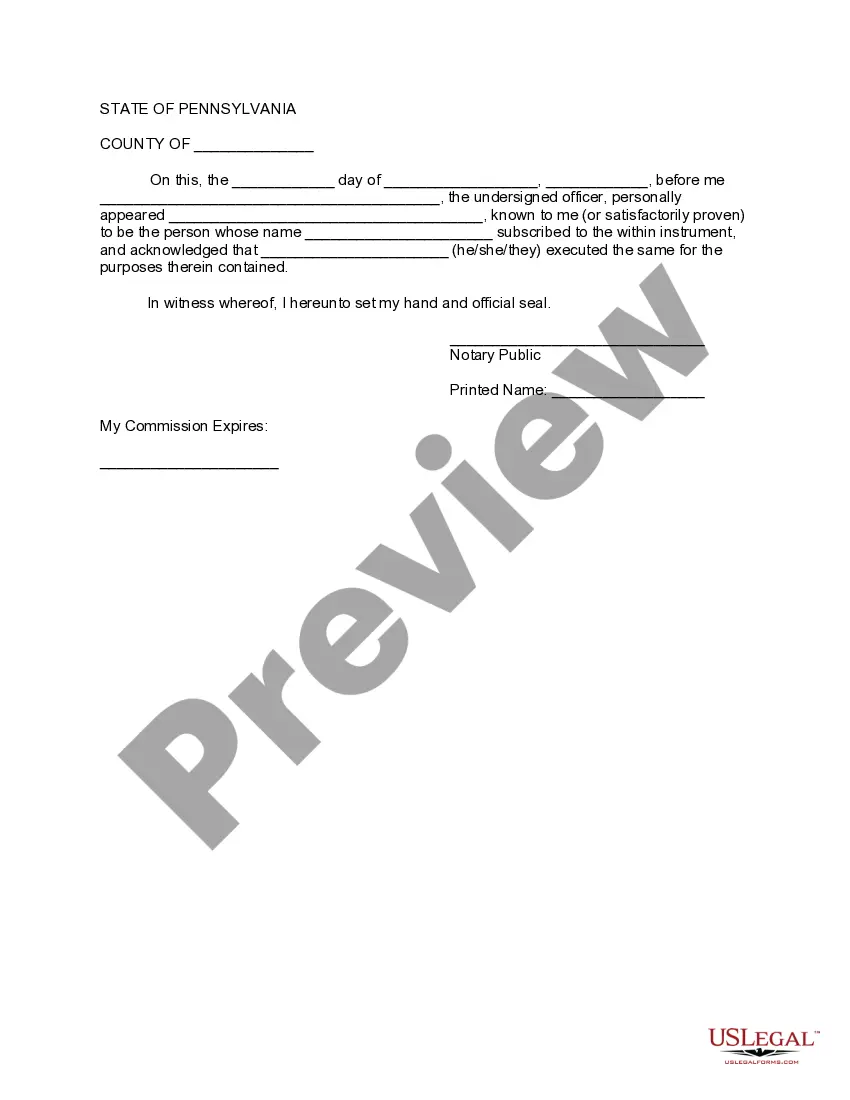

How to fill out Pennsylvania Amendment To Living Trust?

Creating legal documents from the beginning can frequently be somewhat daunting.

Certain situations may require extensive research and significant monetary investment.

If you’re looking for a more efficient and budget-friendly method for preparing Pa Trust Filing Requirements or other paperwork without navigating through complicated processes, US Legal Forms is readily available to assist you.

Our online archive of over 85,000 current legal forms encompasses nearly every facet of your financial, legal, and personal affairs. With just a few clicks, you can promptly access state- and county-compliant templates meticulously crafted for you by our legal professionals.

Examine the document preview and descriptions to confirm that you have selected the correct form. Verify that the template you select adheres to the regulations and laws of your state and county. Choose the most suitable subscription plan to purchase the Pa Trust Filing Requirements. Download the document, then complete, sign, and print it out. US Legal Forms boasts an impeccable reputation and over 25 years of expertise. Join us today and simplify your document execution process!

- Utilize our platform whenever you need reliable and trustworthy services to swiftly find and retrieve the Pa Trust Filing Requirements.

- If you’re familiar with our site and have previously registered an account with us, simply Log In to your account, choose the template, and download it, or re-download it anytime afterward in the My documents section.

- Not registered yet? No worries. Setting it up takes minimal time and allows you to explore the library.

- But before you proceed with downloading Pa Trust Filing Requirements, consider these pointers.

Form popularity

FAQ

Filing a trust in Pennsylvania typically involves submitting the trust document to the appropriate local court or register of wills. You must ensure that the document meets all the PA trust filing requirements to be recognized legally. Additionally, you may need to file a tax return for the trust, depending on its income. For assistance with the filing process, consider using uslegalforms, which provides helpful tools and templates.

While it is not mandatory to hire a lawyer to set up a trust in Pennsylvania, it is highly recommended. A qualified attorney can provide valuable advice and ensure that the trust complies with PA trust filing requirements. This legal guidance can help prevent mistakes that may lead to issues in the future. If you're looking for assistance, uslegalforms offers resources and templates to help you navigate the process.

Filling out a trust involves detailing the trust's purpose, naming the trustee and beneficiaries, and specifying how the assets will be managed and distributed. You should clearly outline the terms of the trust to avoid confusion later on. Make sure you adhere to the PA trust filing requirements to ensure the trust is valid and enforceable. Utilizing tools from uslegalforms can make this process more straightforward and efficient.

To register a trust in Pennsylvania, you should first draft a trust agreement that outlines the terms and conditions of the trust. After creating the trust document, you may need to file it with the local register of wills or the court, depending on the type of trust. It is crucial to follow the PA trust filing requirements to ensure your trust is legally recognized. Platforms like uslegalforms can provide templates and helpful information for this process.

To file taxes for a trust, you must complete IRS Form 1041, which is the U.S. Income Tax Return for Estates and Trusts. This form requires you to report the income generated by the trust and any distributions made to beneficiaries. Additionally, you should familiarize yourself with the PA trust filing requirements, as Pennsylvania has its own specific regulations for trust taxation. Using resources like uslegalforms can help guide you through the filing process.

A trust must file taxes by the 15th day of the fourth month following the end of its tax year. For most trusts, this means filing by April 15 if the tax year aligns with the calendar year. Meeting PA trust filing requirements on time is crucial to avoid late fees and interest charges. To help you stay organized, US Legal Forms provides templates and resources for timely filing.

The filing requirements for a 1041 trust depend on the trust's income level and structure. Generally, if the trust has gross income of $600 or more, it must file Form 1041. Familiarizing yourself with PA trust filing requirements enables you to prepare the necessary documents accurately. US Legal Forms offers resources that guide you through these requirements efficiently.

Yes, it is mandatory to file an income tax return for a trust in certain situations. If the trust generates income, it must file Form 1041, regardless of whether the income is distributed to beneficiaries. Understanding the PA trust filing requirements helps ensure compliance and avoids potential penalties. Using platforms like US Legal Forms can simplify the process of filing and help you stay informed.

Yes, trusts are generally required to file tax returns if they have generated taxable income. This is a key aspect of understanding PA trust filing requirements. Even if a trust does not distribute income to beneficiaries, it must still report its earnings to the state. Utilizing the services of platforms like uslegalforms can simplify the process and ensure that your trust complies with all tax obligations.

To submit a trust tax return in Pennsylvania, you need to complete the PA 41 form accurately, detailing the trust's income and deductions. After filling out the form, you can file it electronically or mail it to the Pennsylvania Department of Revenue. Ensure that you include all required documentation to support the income reported. By following these steps, you will meet the PA trust filing requirements effectively.