Pa Inheritance Tax In Trust For Accounts

Description

How to fill out Pennsylvania Amendment To Living Trust?

Legal document managing can be mind-boggling, even for the most experienced specialists. When you are interested in a Pa Inheritance Tax In Trust For Accounts and don’t have the a chance to devote in search of the correct and updated version, the procedures could be stressful. A robust web form library can be a gamechanger for anyone who wants to handle these situations successfully. US Legal Forms is a industry leader in web legal forms, with more than 85,000 state-specific legal forms available at any time.

With US Legal Forms, it is possible to:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms handles any requirements you may have, from personal to enterprise paperwork, all-in-one place.

- Make use of advanced tools to finish and manage your Pa Inheritance Tax In Trust For Accounts

- Gain access to a useful resource base of articles, guides and handbooks and materials relevant to your situation and requirements

Help save effort and time in search of the paperwork you need, and utilize US Legal Forms’ advanced search and Preview feature to get Pa Inheritance Tax In Trust For Accounts and acquire it. If you have a membership, log in for your US Legal Forms account, search for the form, and acquire it. Review your My Forms tab to see the paperwork you previously saved and also to manage your folders as you see fit.

Should it be your first time with US Legal Forms, make a free account and acquire limitless use of all advantages of the library. Here are the steps to consider after downloading the form you need:

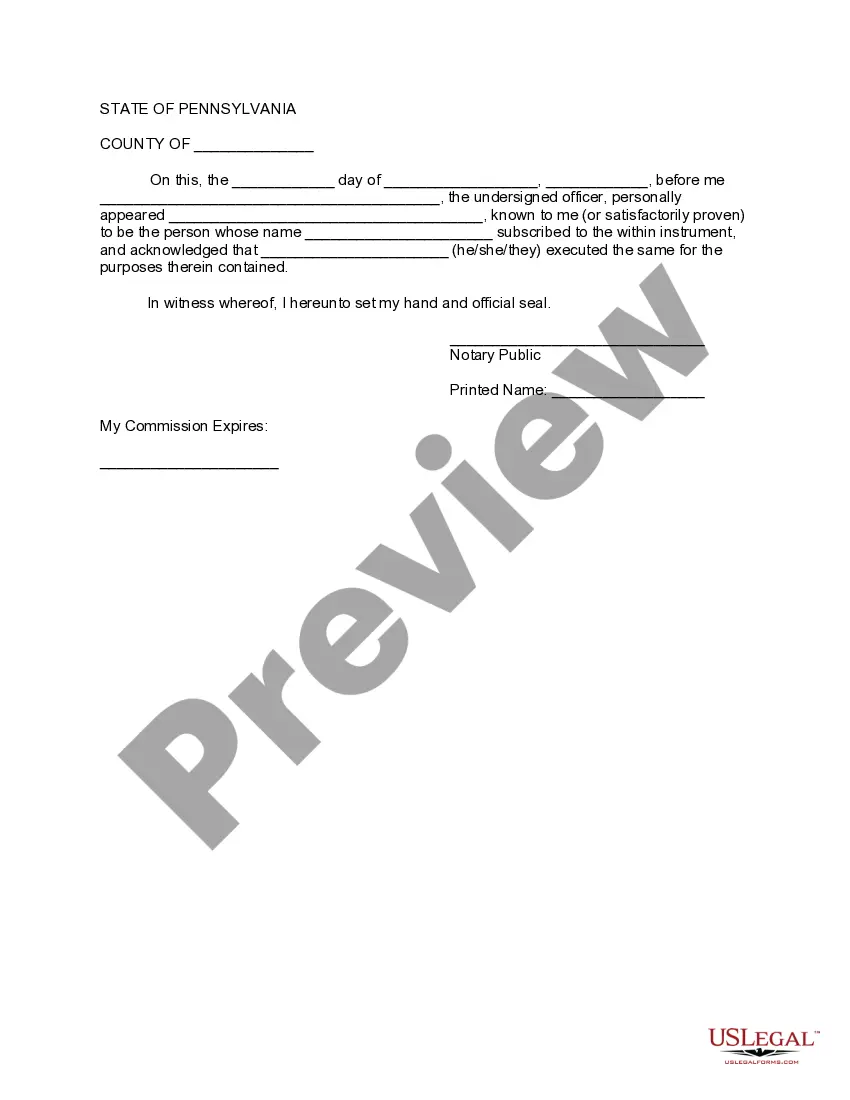

- Confirm it is the right form by previewing it and reading through its description.

- Ensure that the sample is recognized in your state or county.

- Choose Buy Now when you are all set.

- Choose a monthly subscription plan.

- Pick the formatting you need, and Download, complete, sign, print out and send out your document.

Enjoy the US Legal Forms web library, supported with 25 years of experience and stability. Transform your day-to-day document management into a smooth and user-friendly process right now.

Form popularity

FAQ

Hear this out loud PauseThe tax rate for Pennsylvania Inheritance Tax is 4.5% for transfers to direct descendants (lineal heirs), 12% for transfers to siblings, and 15% for transfers to other heirs (except charitable organizations, exempt institutions, and government entities that are exempt from tax).

There are practical ways to minimize or avoid PA inheritance tax without needing to move to a state without estate tax or inheritance tax. #1 - Gifting. Either to individuals, charities, or irrevocable trusts. #2 - Buying real property in a state without estate or inheritance tax.

Hear this out loud PauseIf you still wish to keep control of it through a single trustee, you may set up an irrevocable trust that will pass it tax-free. That type of trust should be distinguished from a revocable trust, which is still subject to inheritance tax.

Hear this out loud PauseAssets Owned In a Revocable Trust: Generally, if someone dies owning assets in a revocable trust over which he or she had access and control those assets, those assets will be 100% taxable for Pennsylvania inheritance tax purposes.

Hear this out loud PauseIn Pennsylvania, the entire value of a TOD account is subject to inheritance tax. WHO IS TO PAY THE DECEDENT'S FINAL BILLS? With TOD accounts, the liquid assets are distributed ?immediately? after death, before the payment of the decedent's final bills and inheritance tax.