Income And Expense Statement For Child Support

Description

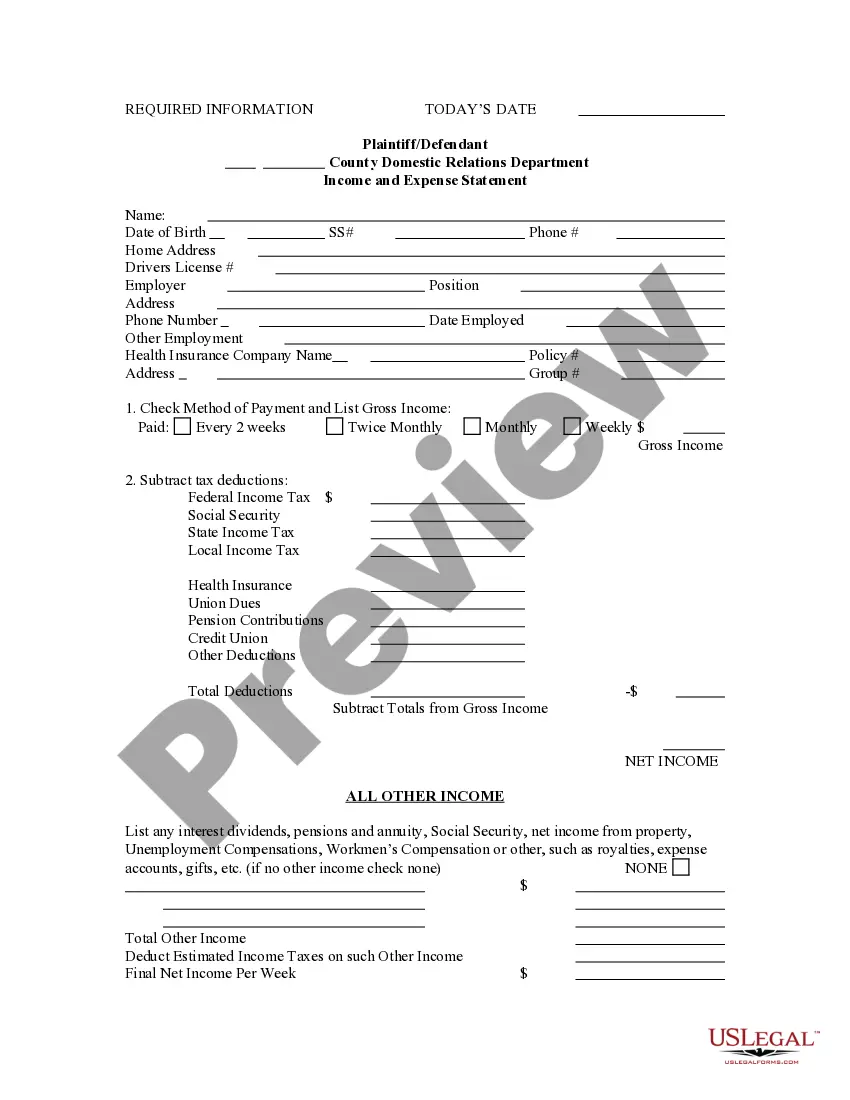

How to fill out Pennsylvania Income And Expense Statement?

Bureaucracy demands exactness and correctness.

Unless you deal with completing documents like the Income And Expense Statement For Child Support regularly, it may lead to some confusions.

Choosing the right template from the start will assure that your document submission will proceed smoothly and avert any troubles of resubmitting a document or repeating the same task entirely from the beginning.

In case you are not a registered user, locating the required template would demand a few additional steps: Find the template using the search bar. Ensure the Income And Expense Statement For Child Support you discovered is applicable for your state or area. Open the preview or examine the description containing the details on the usage of the template. If the outcome matches your inquiry, click the Buy Now button. Select the suitable option among the available subscription plans. Log In to your account or create a new one. Complete the transaction using a credit card or PayPal account. Access the form in the file format of your preference. Finding the correct and current templates for your documentation is a matter of minutes with an account at US Legal Forms. Eliminate the bureaucratic uncertainties and simplify your paperwork.

- Acquire the suitable template for your documentation in US Legal Forms.

- US Legal Forms is the largest online forms repository that houses over 85 thousand templates for various areas.

- You can secure the latest and most fitting edition of the Income And Expense Statement For Child Support simply by searching it on the site.

- Find, save, and download templates in your account or consult with the description to ensure you have the right one available.

- With an account at US Legal Forms, you can collect, store in one location, and browse the templates you save for easy access.

- When on the website, click the Log In button to Log In.

- Then, navigate to the My documents page, where your document history is retained.

Form popularity

FAQ

In California, the amount of child support for one child can vary based on several factors, including income, custody arrangements, and additional expenses. Typically, the income and expense statement for child support will help determine the exact amount. It’s wise to consult state guidelines or use a child support calculator for more accurate estimates. If you need assistance, consider utilizing a reliable service like US Legal Forms to streamline the process.

Extraordinary expenses for child support typically refer to costs beyond regular living expenses, such as medical care, education, or specialized services. These expenses should be documented on the income and expense statement for child support to ensure transparency. Parents may need to discuss these costs to reach an agreement. Using a structured platform like US Legal Forms can help you navigate these discussions effectively.

Yes, cell phone bills can be included in child support, as they often fall under the category of necessary expenses. When calculating support, the income and expense statement for child support may include these bills to reflect the child's needs. It's essential to document all relevant expenses accurately. This ensures that your child receives the necessary financial support.

Filling out child support paperwork begins with gathering necessary information, including your income and expenses. You'll need to complete an income and expense statement for child support, which outlines your financial situation. This forms a crucial basis for determining the appropriate amount of support. If you're unsure, using a platform like US Legal Forms can provide templates and guidance.

Parental support typically does not count as income for tax purposes or when analyzing your financial status. In your income and expense statement for child support, make sure to delineate between regular income and parental support. This helps maintain transparency in your reports to the court.

Child support payments are not regarded as income when it comes to taxes or income-based assessments. However, when you create your income and expense statement for child support, it is essential to understand how these payments influence your financial profile. Proper documentation ensures clarity in your obligations.

Child support is not classified as countable income for most financial assessments. When preparing your income and expense statement for child support, remember that support payments are intended to benefit the child directly, not to be reported as income. This distinction can be crucial in custody negotiations.

Yes, the income and expense declaration is typically required to be filed with the court in child support cases. This document provides vital information about your financial situation, including all sources of income and expenses. Ensure your income and expense statement for child support is thorough and accurate before submission.

Child support is generally not considered taxable income for the recipient. However, when you're setting up your income and expense statement for child support, it's important to distinguish between income and support to ensure all calculations are accurate. This affects the overall determination of support obligations.

You should report child support income on your tax return if required by local regulations. Include it in your income and expense statement for child support, ensuring you capture all relevant details accurately. This helps in providing a clear picture of your financial situation.