Pennsylvania Residential Estate Without A Will

Description

How to fill out Pennsylvania Residential Real Estate Sales Disclosure Statement?

Whether for corporate reasons or personal matters, everyone must confront legal issues at some point in their lives.

Filling out legal documentation requires meticulous care, starting from selecting the appropriate form example.

With an extensive US Legal Forms collection available, you do not have to waste time searching for the correct template across the web. Utilize the library’s user-friendly navigation to find the right form for any situation.

- Locate the template you require using the search bar or browse through the catalog.

- Review the form’s details to ensure it aligns with your situation, state, and area.

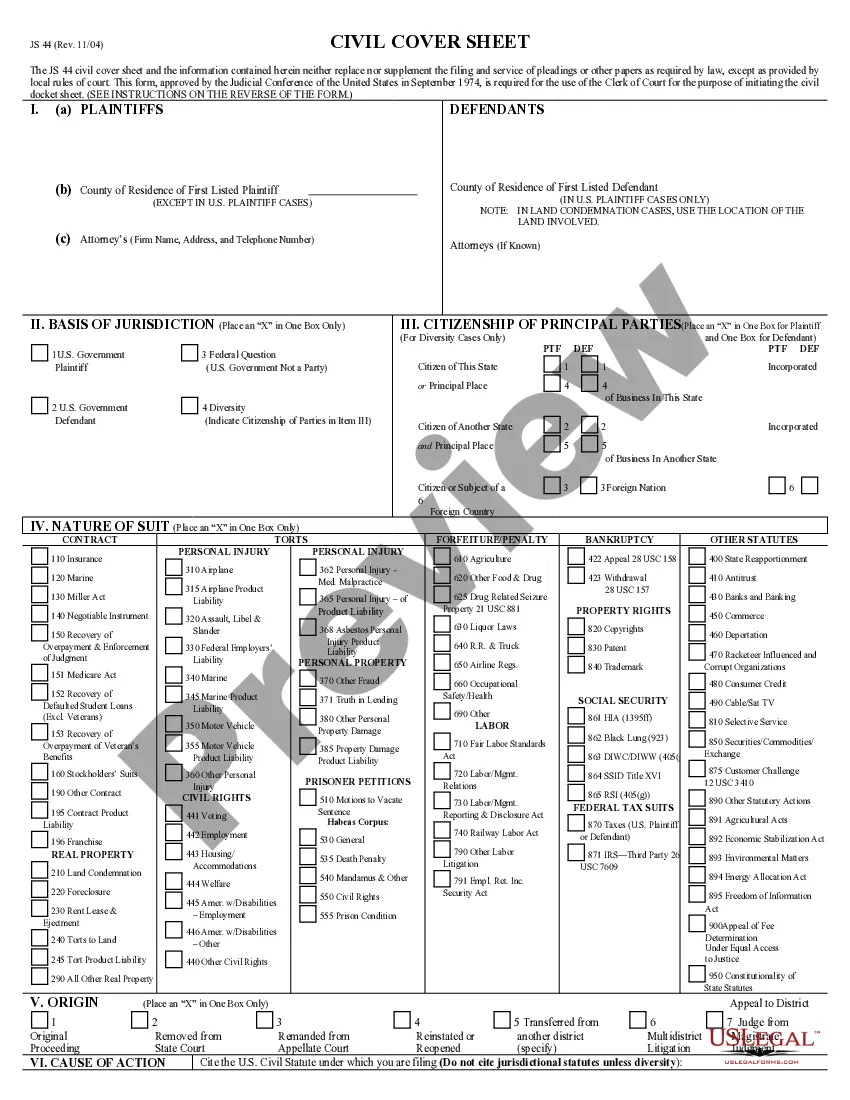

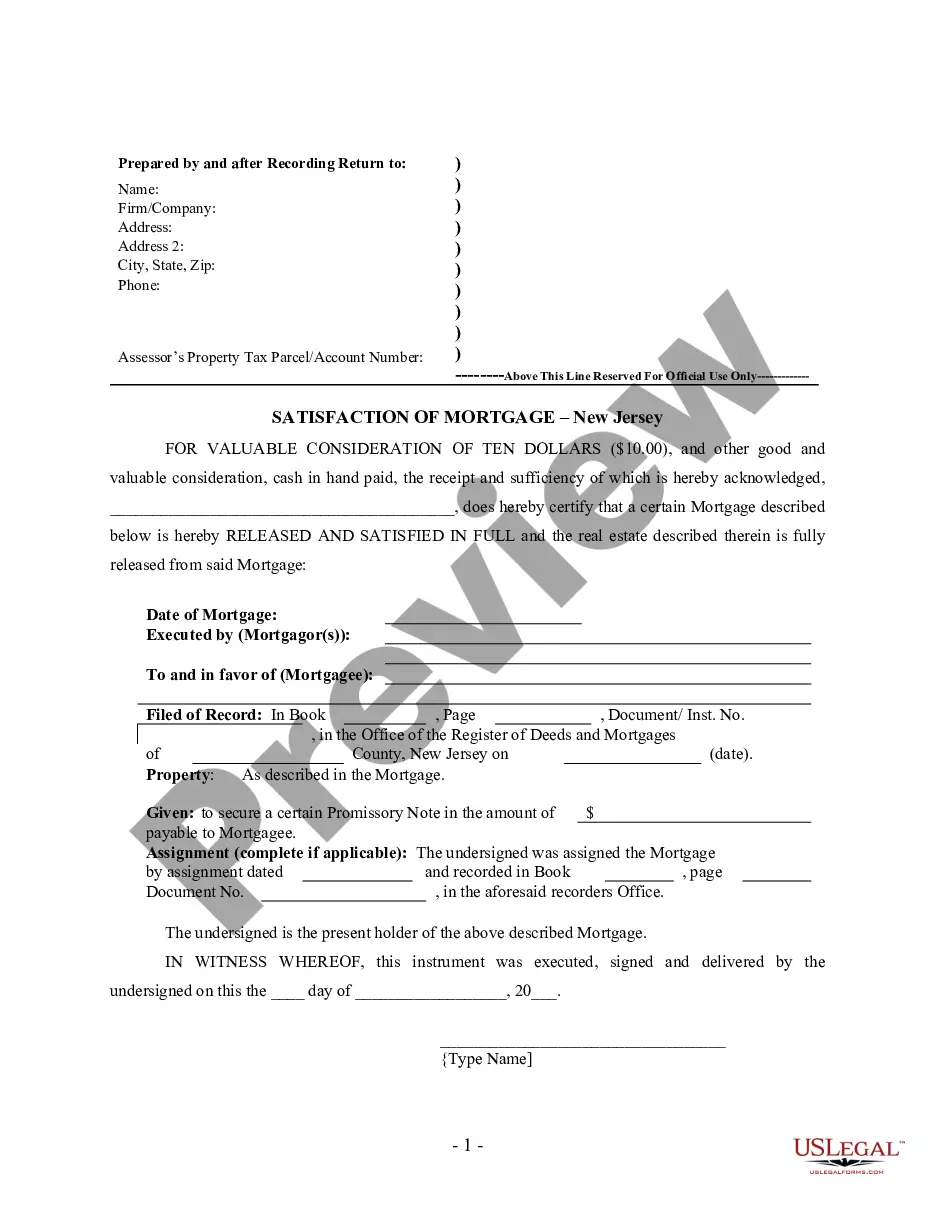

- Click on the form’s preview to examine it.

- If it is the incorrect form, return to the search feature to look for the Pennsylvania Residential Estate Without A Will template you seek.

- Download the document when it fulfills your needs.

- If you possess a US Legal Forms account, simply click Log in to retrieve previously stored templates in My documents.

- If you haven’t created an account yet, you can download the document by clicking Buy now.

- Choose the appropriate pricing option.

- Fill out the registration form for the account.

- Select your payment method: you can utilize a credit card or PayPal account.

- Choose the desired file format and download the Pennsylvania Residential Estate Without A Will.

- Once downloaded, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

Along with the petition for grant of letters, the petitioner must generally provide the following documents to open an estate in Pennsylvania: Original will or codicil. Death certificate. Estate information sheet. Bond. Renunciations. Witness affidavits.

The process of settling an estate involves naming a personal representative, collecting estate assets, filling appropriate forms with the Register of Wills, notifying heirs, providing a public notice, paying all debts and taxes, and distributing the remaining assets to heirs named in the will or under the laws of ...

Intestate succession without a will distributes the estate as follows: If the deceased has no children or spouse, their parents take the estate. If the deceased is married but has no children, their spouse takes the estate. If they have children but no living spouse, the children share the estate equally.

A living trust helps you avoid probate for practically every asset you own. Bank accounts, vehicles and real estate all apply. You would name someone to serve as a trustee after you pass away, known as a successor trustee, and then you would need to transfer ownership of the property into the trust.

The first heirs in line to receive property are the surviving spouse and the deceased's children. If the deceased did not leave a surviving spouse or children, then the property next passes to the parents, siblings, aunts, uncles, nieces and nephews.