Pennsylvania Estate Document Format

Description

How to fill out Pennsylvania Residential Real Estate Sales Disclosure Statement?

Utilizing legal templates that comply with federal and state laws is crucial, and the internet provides numerous options to choose from.

However, why squander time searching for the suitable Pennsylvania Estate Document Format example online when the US Legal Forms digital library already offers such templates consolidated in one location.

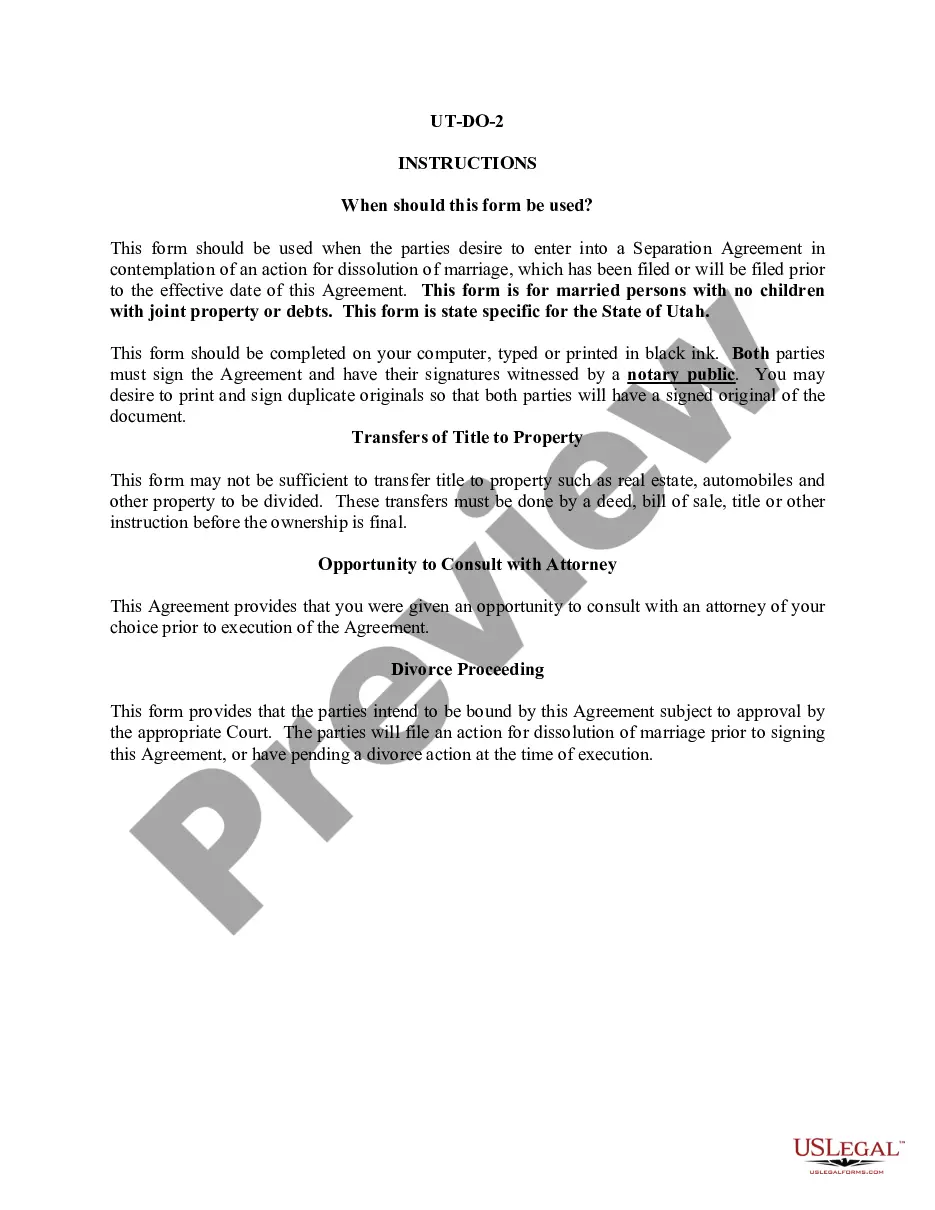

US Legal Forms is the largest online legal library boasting over 85,000 fillable templates created by lawyers for various business and personal situations.

Review the template using the Preview feature or through the text description to confirm it meets your requirements.

- They are easy to navigate with all documents organized by state and intended purpose.

- Our specialists keep abreast of legislative changes, ensuring you can always trust that your documents are current and compliant when obtaining a Pennsylvania Estate Document Format from our site.

- Acquiring a Pennsylvania Estate Document Format is straightforward and quick for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document template you require in the appropriate format.

- If you’re new to our platform, follow the instructions below.

Form popularity

FAQ

Under Pennsylvania law, executors have a duty to provide an accounting to beneficiaries. An accounting is a detailed report that outlines the assets, liabilities, income, and expenses associated with the estate, as well as the executor's actions in managing and distributing the estate.

If you are unable to receive a referral to a pro bono attorney to assist you in writing your will, you may be able to legally write one yourself. It is legal to handwrite a will in Pennsylvania. You should include two witness signatures in the written will, as well as your own signature and date.

The process of settling an estate involves naming a personal representative, collecting estate assets, filling appropriate forms with the Register of Wills, notifying heirs, providing a public notice, paying all debts and taxes, and distributing the remaining assets to heirs named in the will or under the laws of ...

The process of settling an estate involves naming a personal representative, collecting estate assets, filling appropriate forms with the Register of Wills, notifying heirs, providing a public notice, paying all debts and taxes, and distributing the remaining assets to heirs named in the will or under the laws of ...

No estate will have to pay estate tax from Pennsylvania. There is still a federal estate tax. The federal estate tax exemption is $12.06 million in 2022 and $12.92 million in 2023. This exemption is portable.