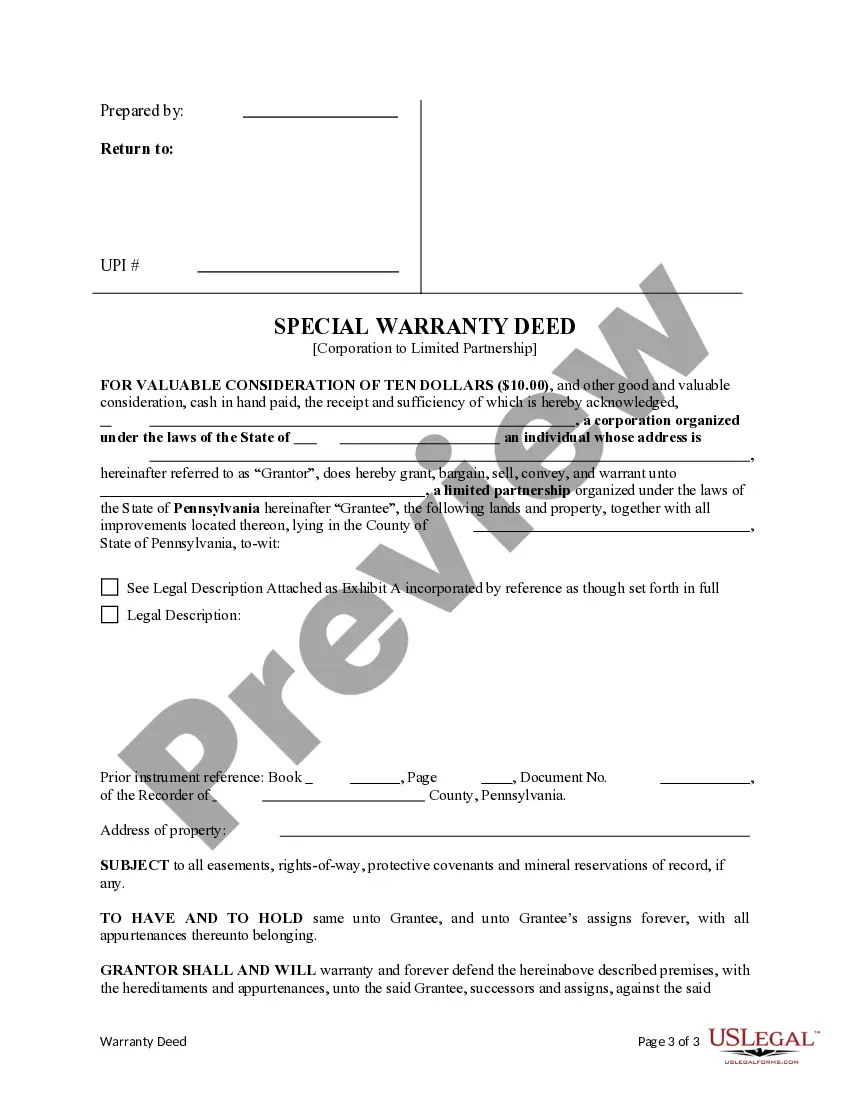

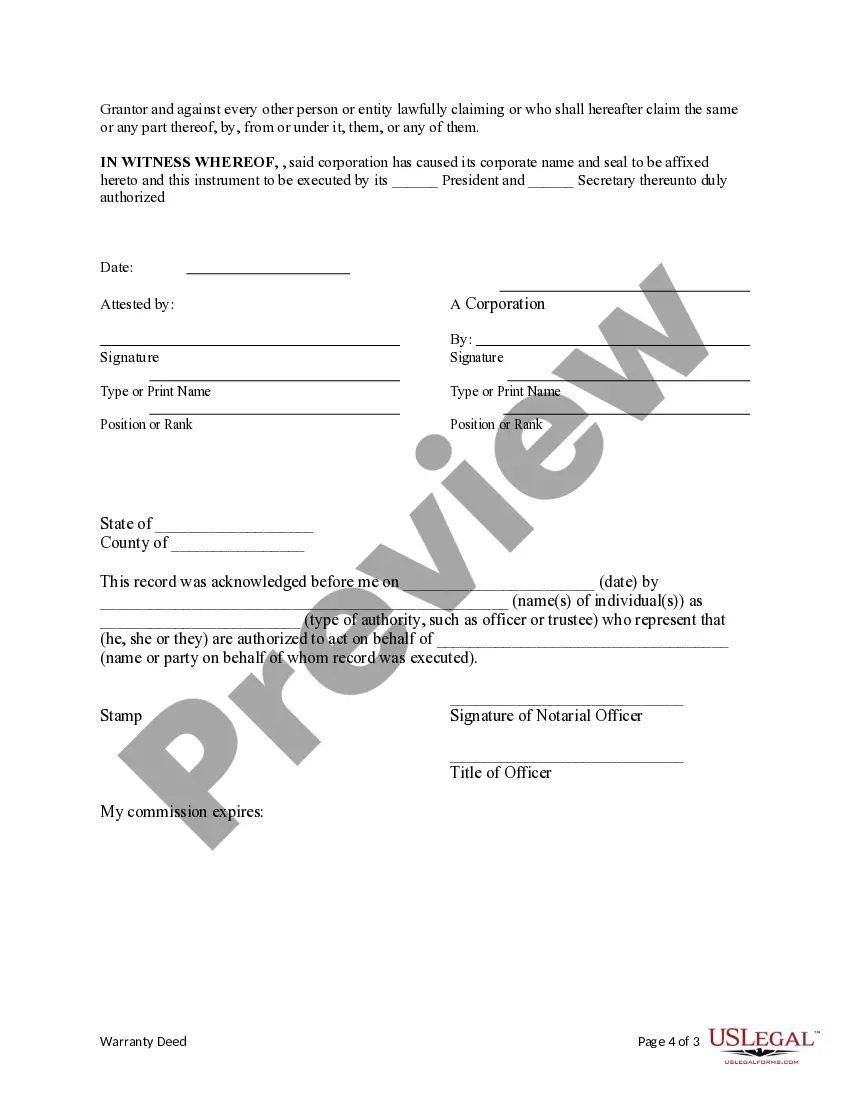

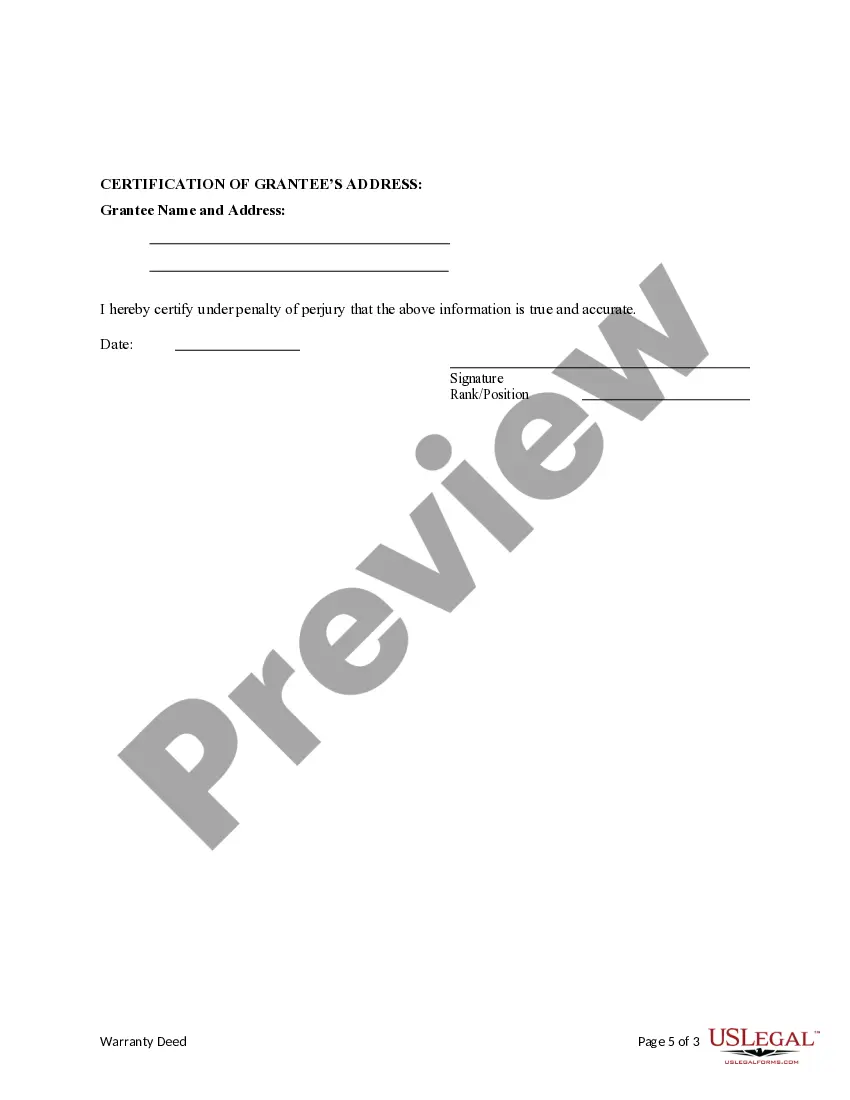

Special Warrant Deed

Description

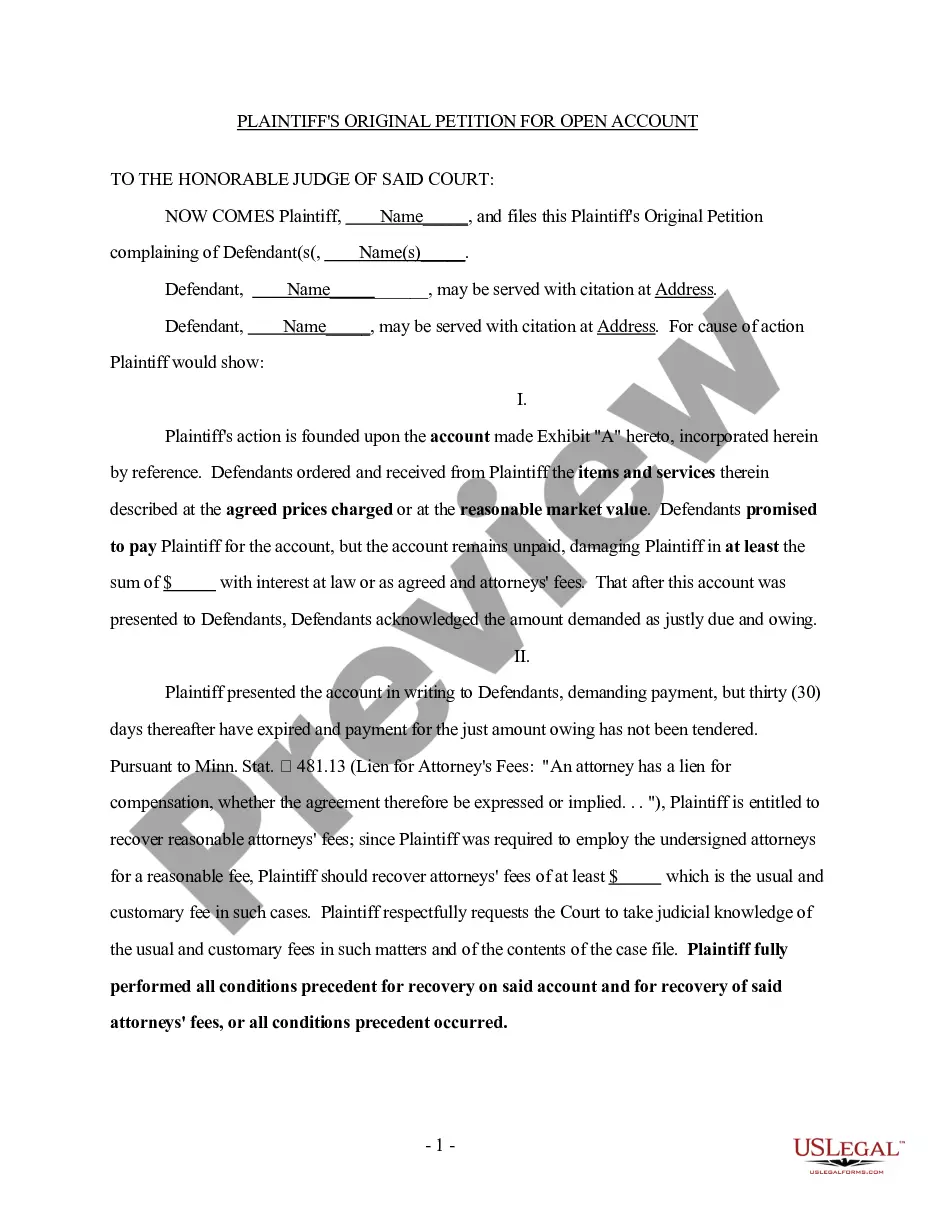

How to fill out Pennsylvania Special Warranty Deed From Corporation To Limited Partnership?

- Visit the US Legal Forms website; if you're a returning user, log in to access your account.

- Check the Preview mode and description of the special warrant deed to verify it matches your local jurisdiction requirements.

- If necessary, use the Search tab to find an alternative template that meets your requirements accurately.

- Once you've found the appropriate form, click on the Buy Now button and select a suitable subscription plan to get access.

- Input your payment details, either via credit card or PayPal, to complete the purchase process.

- Download the completed template to your device and locate it in the My documents section for easy access in the future.

US Legal Forms empowers users by providing a robust collection of over 85,000 fillable and editable legal forms, ensuring that you have the resources needed for any document preparation.

Start your journey towards seamless legal documentation today by exploring US Legal Forms, ensuring your special warrant deed is handled with precision and ease.

Form popularity

FAQ

Purchasing land with a special warranty deed can be a sound investment, provided you understand the inherent risks. This type of deed may limit recourse for any issues that predate your ownership. Therefore, it is vital to research the land's history and condition. Using US Legal Forms can assist in obtaining all necessary documentation and help you feel secure in your real estate decisions.

Yes, you can sell a house with a special warranty deed, but it's important to communicate this clearly to potential buyers. This type of deed can be attractive to buyers who understand its limitations and are comfortable assuming risks related to prior ownership. However, sellers should prepare to provide detailed information about the property's history to build trust. Consider using platforms like US Legal Forms to navigate the selling process effectively.

The primary risk of a special warranty deed lies in its limited protections. This type of deed guarantees that the seller only warrants against issues that occurred while they owned the property. Potential problems that existed before that time are not covered, which means you could inherit unknown issues. It’s wise to perform thorough title searches to identify any concerns before proceeding with such a deed.

A disadvantage of a warranty deed is that it offers broad protection to the buyer, which can lead to personal liability for any issues that arise before the transfer. In contrast, a special warrant deed limits the seller's liability, addressing only claims during their ownership period. This means that with a warranty deed, you face more risk if previous issues surface. Understanding these distinctions can help you make informed decisions in property transactions.

Many people need a special warranty deed to protect themselves during a property transaction. This deed assures the buyer that the seller is responsible only for issues that arose during their ownership, limiting the buyer's risk. Furthermore, it can expedite the closing process as it streamlines title references. Utilizing a service like US Legal Forms simplifies the process of preparing a special warranty deed, ensuring that all necessary details are accurately included.

You can obtain a special warranty deed through various channels, including legal professionals or online platforms. Websites like US Legal Forms offer easy access to high-quality templates that you can customize to your needs. Additionally, local courthouses often provide standardized forms, but finding them online can save you time and ensure accuracy. By choosing reliable sources, you can ensure your document meets legal requirements.

A special warranty deed provides a limited guarantee about the property's title. Typically, a seller uses this type of deed to reassure the buyer that they have not experienced any issues with the title during their ownership. Unlike a general warranty deed, the seller’s liability only covers their period of ownership. This can be beneficial in real estate transactions, as it clarifies the seller's responsibility regarding title issues.

Sellers may choose a special warranty deed to limit their liability for defects or claims against the property. This type of deed reassures buyers that the seller is responsible only for issues occurring while they owned the property. Additionally, it can be appealing in situations where the seller wants to expedite the sale while still providing a level of reassurance to potential buyers.

While a special warranty deed offers some protection, its limited scope can be a disadvantage for buyers. It only covers issues that occurred during the seller's ownership, leaving you vulnerable to claims from prior owners. Therefore, if you're purchasing property with a special warranty deed, it's wise to conduct thorough research and consider title insurance to mitigate any risks.

A special warranty deed provides a limited guarantee, protecting the buyer against defects that arise only during the seller’s ownership. Unlike a regular deed, which offers a more comprehensive guarantee, a special warranty deed limits liability by addressing only issues created while the seller held the property. This distinction is important when considering the level of protection you desire in a real estate transaction.