Limited Partnership Vs Llc

Description

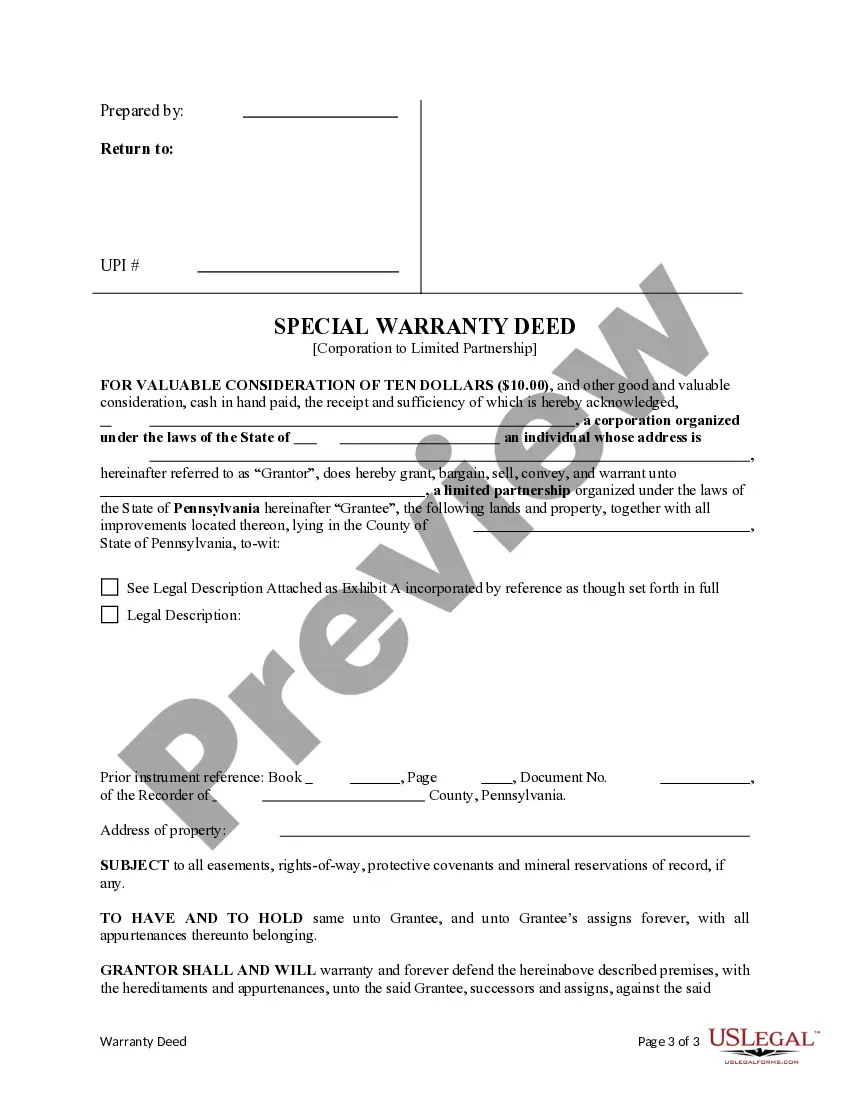

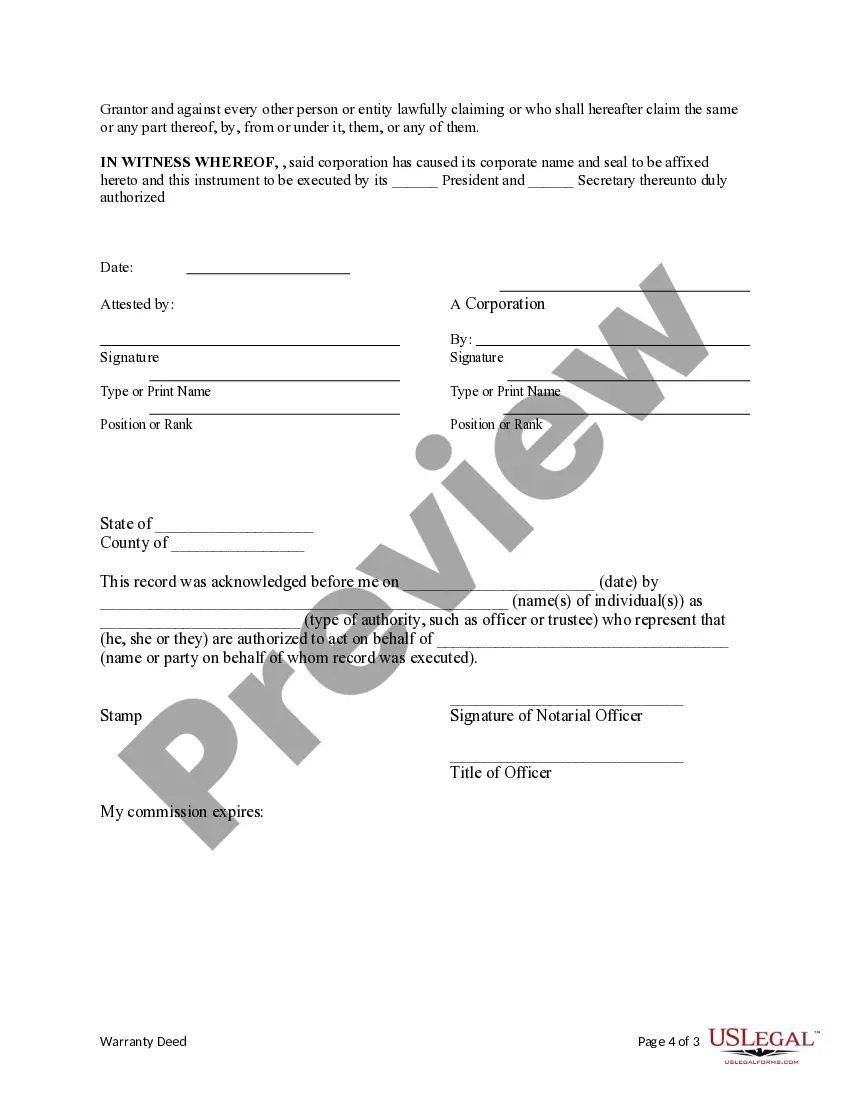

How to fill out Pennsylvania Special Warranty Deed From Corporation To Limited Partnership?

- If you have previously used US Legal Forms, log in and download your desired templates by selecting the Download button. Ensure your subscription is current; if not, renew it as per your payment plan.

- For first-time users, begin by reviewing the Preview mode and the form description. Confirm that you've selected the appropriate template that aligns with your needs and complies with local regulations.

- If you happen to find discrepancies, utilize the Search tab above to locate the correct form. Proceed with your selection if everything matches.

- To acquire your document, hit the Buy Now button and select your preferred subscription plan. Registration will be necessary to gain access to the extensive library.

- Complete your purchase by entering your credit card details or using your PayPal account for the subscription fee.

- Finally, download your form onto your device. You can access it anytime through the My Forms section in your profile.

US Legal Forms provides a robust collection of over 85,000 editable legal documents, ensuring users have more options than competitors at a similar cost.

TAKE THE NEXT STEP! Explore the benefits of using US Legal Forms today to create accurate and reliable legal documents for your business.

Form popularity

FAQ

To determine if your LLC is a single member or partnership, check the number of members listed in your formation documents. A single-member LLC has one owner, while a multi-member LLC qualifies as a partnership. Understanding this distinction is crucial for tax treatment and personal liability. For clarity, you may explore resources like US Legal Forms to guide you through the specifics.

Choosing between a limited partnership and an LLC depends on your business goals and needs. A limited partnership allows you to have both general and limited partners, while an LLC provides personal liability protection for all members. If your aim is to manage risk, an LLC might be a better fit. However, if you prefer flexibility in ownership and management, consider a limited partnership.

Partnerships have several disadvantages you should consider. First, partners share profit, meaning you receive less income compared to solo ownership. Second, personal liability can be significant, as partners are responsible for debts. Third, disagreements between partners can hinder progress. Additionally, partnerships lack continuity, as they may dissolve if a partner leaves. Evaluating these factors is essential when comparing limited partnership vs LLC.

To establish a limited partnership, you typically need to file a certificate of limited partnership with your state. This document should outline your business purpose, the roles of general and limited partners, and any other necessary information. Additionally, create an operating agreement to define partnership roles and responsibilities. Using platforms like USLegalForms can simplify the paperwork and ensure compliance with state laws.

A limited partnership may be beneficial if you seek to involve passive investors. In a limited partnership, general partners manage the business while limited partners enjoy liability protection without involvement in daily operations. This structure can attract investors seeking a stake in the company without taking on full responsibilities. Consider your investment strategy when comparing limited partnerships vs LLC.

Determining whether an LLC or partnership is better often depends on your specific situation. An LLC offers limited liability protection, which can protect your personal assets from business debts and liabilities. Alternatively, a partnership is easier to establish and involves fewer statutory requirements. Carefully weigh the benefits of limited liability versus operational simplicity to make the best choice.

Deciding between a partnership and an LLC can impact your business's future. An LLC generally provides enhanced liability protection, allowing owners to safeguard personal assets, while partnerships can be simpler to set up. However, if you value flexibility and a straightforward operational structure, a partnership might suit your needs better. Ultimately, your choice should align with your business goals and risk tolerance.

Choosing a Limited Liability Partnership (LLP) over a Limited Liability Company (LLC) often depends on ownership structure. An LLP allows partners to share management responsibilities while protecting personal assets from business liabilities. In contrast, an LLC offers flexibility in ownership but may require more formalities. If you're looking for a collaborative management approach, an LLP could be the way to go.

Choosing an LLP over an LLC can be beneficial for individuals in professional fields like law or accounting, where liability protection is essential. In the limited partnership vs LLC context, an LLP offers personal asset protection for all partners, unlike a limited partnership. This structure encourages collaboration while minimizing the risks associated with malpractice claims. For those seeking to protect their careers, considering an LLP might be the right move.

Limited partnerships typically benefit individuals seeking investment without wanting to manage the day-to-day operations. In the limited partnership vs LLC debate, this structure allows investors to contribute financially while limiting their personal liability. Such arrangements work especially well in industries like real estate and venture capital, where investors can enjoy passive income. However, understanding your role within the partnership is crucial for maximizing these benefits.