Limited Partnership Form Agreement With The Government

Description

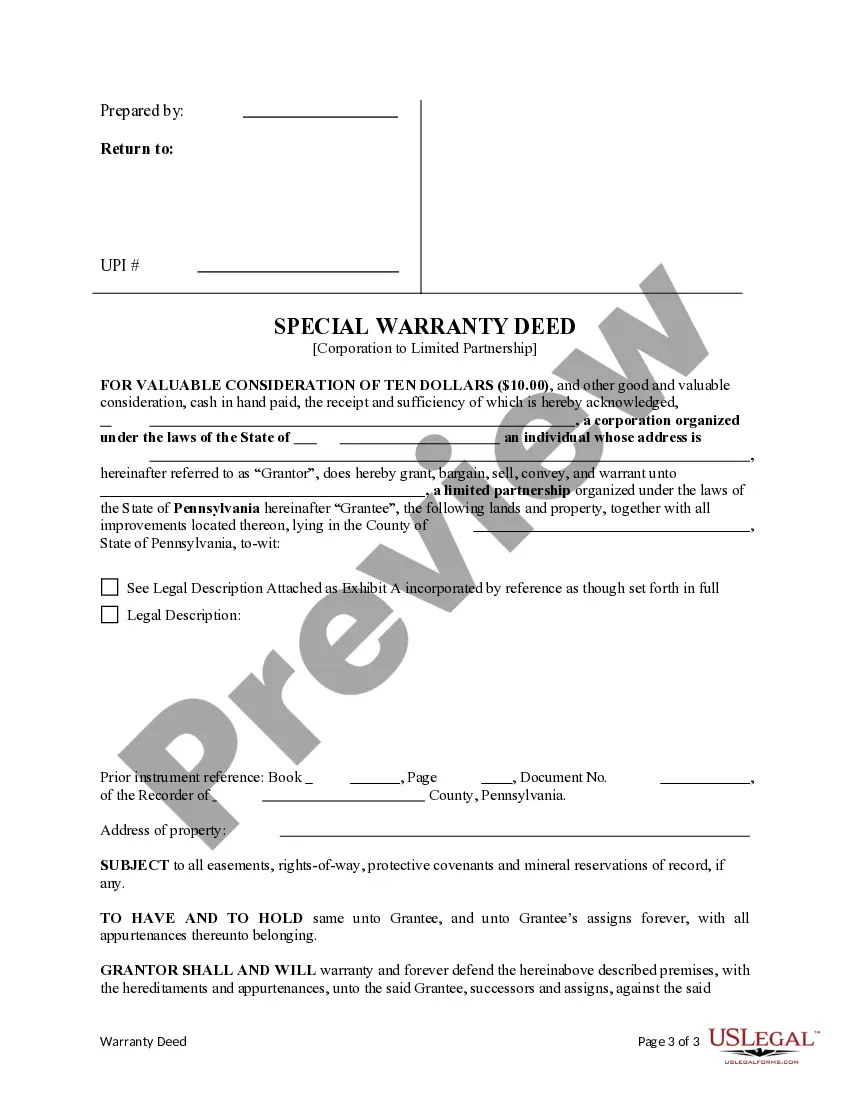

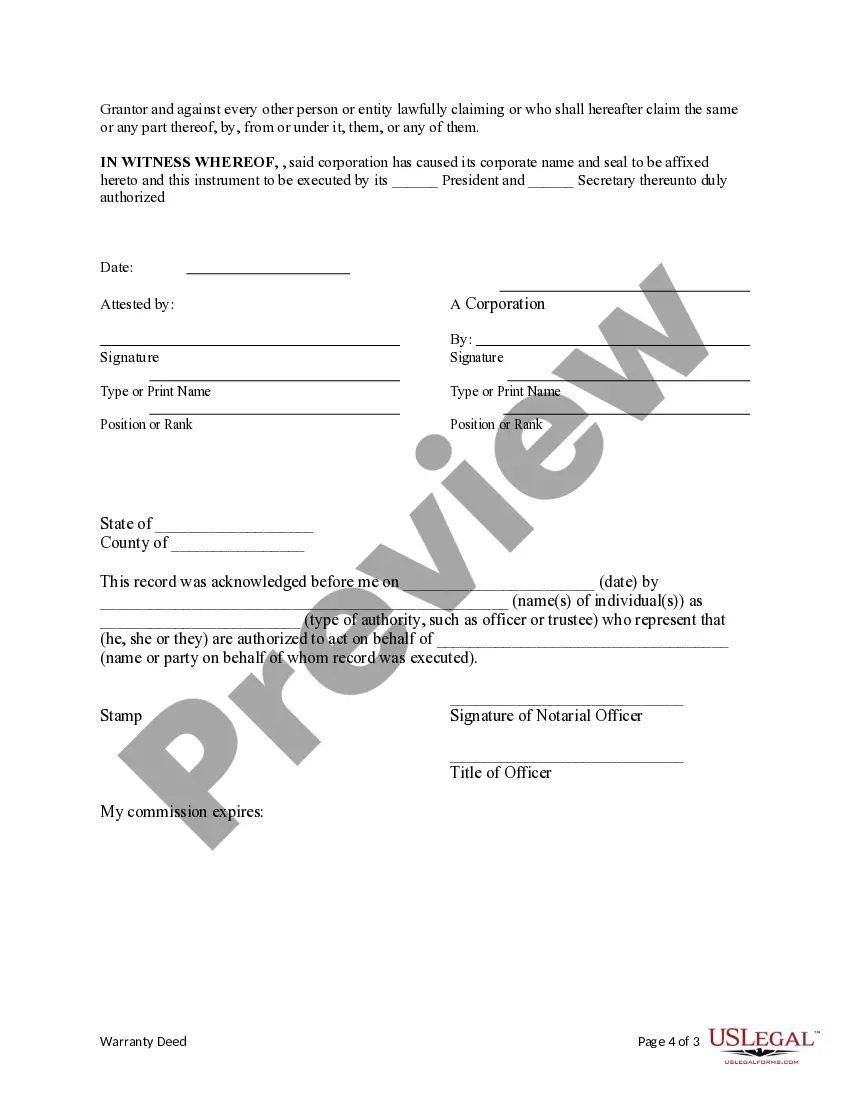

How to fill out Pennsylvania Special Warranty Deed From Corporation To Limited Partnership?

- If you are a returning user, log in to your account and access the document needed by clicking the Download button. Ensure your subscription is active, or renew it if necessary.

- If this is your first visit, start by checking the Preview mode and form description to confirm you have selected the appropriate agreement that meets your local jurisdiction.

- Should you need an alternative template, utilize the Search tab above to find the right form. If it meets your requirements, proceed to the next step.

- Purchase the document by clicking the Buy Now button and selecting your desired subscription plan. Creating an account is necessary to access the extensive library.

- Complete your payment using a credit card or your PayPal account to finalize the subscription.

- Download your form and save it to your device, allowing you to complete it and access it anytime via the My Forms section of your account.

US Legal Forms not only provides a robust collection of documentation but also offers access to over 85,000 fillable and editable legal forms. Users can rely on premium experts for assistance in ensuring that all documents are legally sound.

Take the first step towards making your business partnership official. Start your journey with US Legal Forms today!

Form popularity

FAQ

A limited partnership has its drawbacks, including the exposure of general partners to unlimited liability. This means if the business incurs debts or legal issues, general partners could lose personal assets. Additionally, limited partners have less control over management decisions, which can be a concern. Understanding these factors alongside a limited partnership form agreement with the government is crucial when forming your business strategy.

Using a limited partnership (LP) instead of an LLC can be advantageous if you seek to attract passive investors. In an LP, limited partners can invest without being involved in daily management, allowing them to take a more hands-off approach. This arrangement, coupled with a limited partnership form agreement with the government, can create a win-win situation for both the active and passive partners.

Yes, a limited company can have a partnership agreement, though this typically takes the form of a shareholders’ agreement. Such an agreement governs the relationships between shareholders and outlines how decisions are made. Having a limited partnership form agreement with the government provides a clear framework for operations and expectations.

Selecting a limited liability partnership (LLP) instead of a limited liability company (LLC) can be beneficial for professionals who want to share profits and responsibilities without exposing themselves to personal liability. An LLP offers protection from debts and legal actions, ideal for partnerships infields like law or accounting. Obtaining a limited partnership form agreement with the government instills confidence in your partnership structure.

Choosing a limited partnership (LP) over a limited liability company (LLC) can provide unique advantages such as flexibility in management and possible tax benefits. In an LP, general partners manage the business, while limited partners offer capital without involvement in operations. This structure may suit those looking to invest while shielding their personal assets through a limited partnership form agreement with the government.

Yes, a limited partnership should have a partnership agreement. This agreement outlines the roles and responsibilities of each partner, ensuring clarity and preventing future disputes. By having a limited partnership form agreement with the government, you establish a formal structure that enhances your business's legitimacy.

The structure of a partnership agreement typically includes an introduction, definitions of key terms, and sections detailing each partner's roles and contributions. It should also outline profit-sharing arrangements and conflict resolution procedures. A well-structured limited partnership form agreement with the government can significantly enhance clarity and efficiency in your partnership.

To fill a partnership form, start by gathering relevant information about your partners and the business. Carefully enter details such as names, addresses, and business objectives. For a streamlined experience, consider using US Legal Forms; they offer an easy way to create a limited partnership form agreement with the government.

Yes, you can create your own partnership agreement, provided it covers all necessary elements. However, it's often beneficial to refer to templates or legal resources to ensure you're compliant with laws governing partnerships. Using a limited partnership form agreement with the government from a trusted source like US Legal Forms can also provide peace of mind.

Filling out a partnership form requires careful attention to detail. Begin by providing the names and addresses of all partners, followed by outlining the nature of the business. Utilizing platforms like US Legal Forms can simplify this task and ensure your limited partnership form agreement with the government meets all necessary requirements.