Quitclaim Deed For Trust

Description

How to fill out Pennsylvania Quitclaim Deed From Individual Grantor To Three Individual Grantees With Release Of Life Estate?

- Log in to your existing account on US Legal Forms to access your templates. Ensure your subscription is active; if it isn't, make sure to renew it based on your chosen plan.

- For first-time users, browse the platform to find the appropriate quitclaim deed for trust template. Preview the form and read the description carefully to verify its compatibility with your local laws.

- In case of discrepancies, utilize the Search function to locate any additional necessary templates. Confirm you have the right document before proceeding.

- To purchase the selected quitclaim deed, click the Buy Now button and select your preferred subscription plan. You will need to create an account for full access to the legal library.

- Complete your purchase by entering your payment information, using either a credit card or PayPal. Once done, you're ready for the final step.

- Download your quitclaim deed template directly to your device. You can later access it any time from the My Forms section in your profile.

By following these straightforward steps, you can ensure a seamless experience in obtaining a quitclaim deed for trust. US Legal Forms not only provides a robust collection of forms but also empowers users with expert assistance, making the process efficient and legally sound.

Ready to secure your property interests? Visit US Legal Forms today and get started!

Form popularity

FAQ

The strongest form of deed is a warranty deed, as it provides the greatest level of protection to the buyer. Unlike a quitclaim deed for trust, a warranty deed guarantees that the seller holds clear title to the property and has the right to transfer ownership. It also protects the buyer against any future claims on the property. For individuals seeking security in their property transactions, understanding the strength of different types of deeds is essential.

Yes, it is possible to prepare a quitclaim deed for trust on your own, but caution is advised. While many states offer templates for quitclaim deeds, the legal requirements can vary. If you choose to do this yourself, ensure that you follow your state's regulations precisely to avoid future complications. However, for peace of mind and accuracy, you might want to consider using a platform like US Legal Forms to guide you through the process.

Quitclaim deeds can be perceived as risky because they do not guarantee any rights or interests in the property. When dealing with a quitclaim deed for trust, it is essential to understand that this type of deed transfers ownership without any warranties. As a result, the grantor may still carry burdens or liens on the property, which can create issues for the recipient. Therefore, conducting thorough research before using a quitclaim deed is crucial.

While a quitclaim deed for trust provides a quick transfer of property, it lacks the assurances found in warranty deeds. This means that if the property has undisclosed claims or liens, you could face unexpected challenges later. Additionally, a quitclaim deed does not provide a buyer's recourse if the title is not clear. To navigate these complexities, consider utilizing resources from uslegalforms to ensure a smooth transfer process.

The main disadvantage of a quitclaim deed for trust is that it does not guarantee a clear title. If there are existing liens or debts associated with the property, the new owner may inherit those responsibilities. Additionally, it offers limited legal protection, as it does not disclose any potential issues that could arise after the transfer. Using uslegalforms can assist you in understanding any pitfalls before proceeding.

Individuals looking to transfer property swiftly and without significant legal hassle benefit the most from a quitclaim deed for trust. This includes parents wishing to place their home in a trust for their children or family members transferring assets among themselves. Since there are no guarantees regarding title issues, it’s essential to trust the grantor. In many cases, peace of mind comes from knowing the property is now under trust protection.

Choosing between a quitclaim deed and a trust depends on your goals. A quitclaim deed is a fast way to transfer property, while a trust provides comprehensive estate planning benefits, including avoiding probate. For long-term asset protection and control, a trust is often more favorable. However, utilizing a quitclaim deed for trust allows for a seamless transfer of property into the trust structure.

Deciding between gifting a house and putting it in a trust depends on your specific situation. Gifting a house may lead to tax implications, while placing it in a trust provides better asset protection and control over your property's future. Trusts can help maintain your wishes regarding property distribution after your death. Therefore, using a quitclaim deed for trust can be a prudent choice to balance generosity with security.

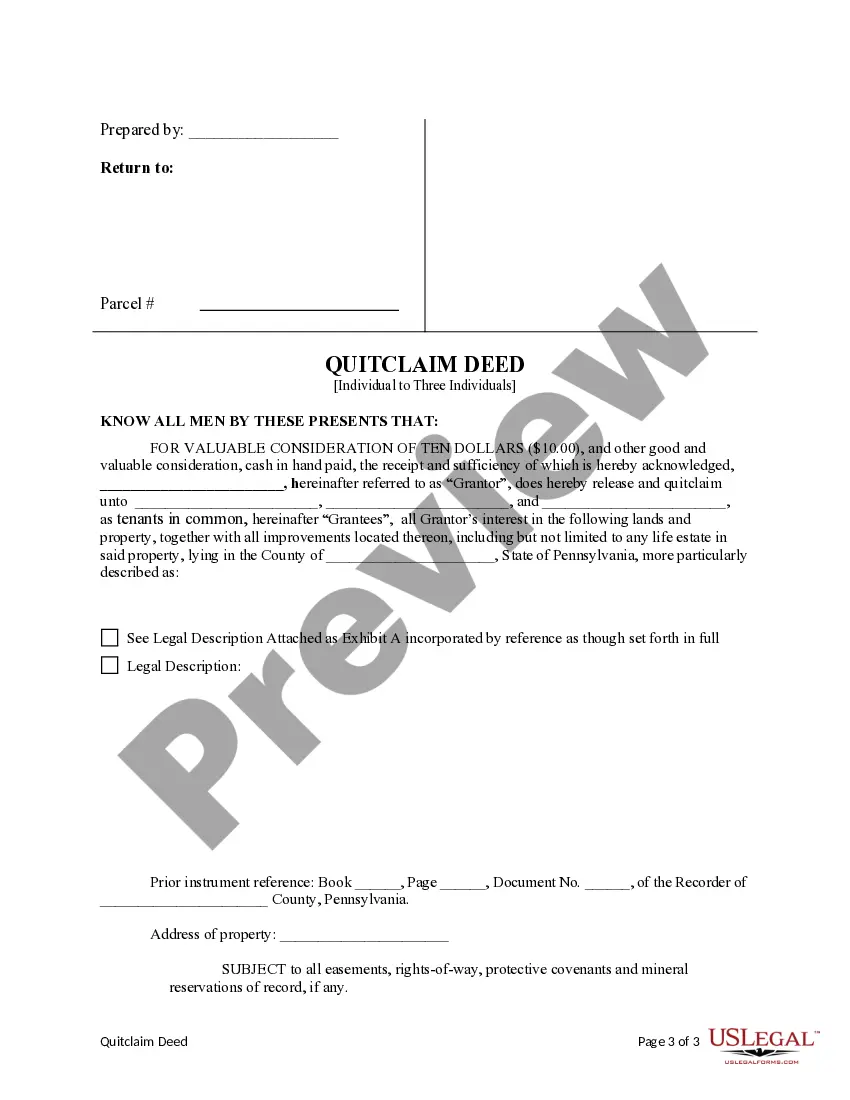

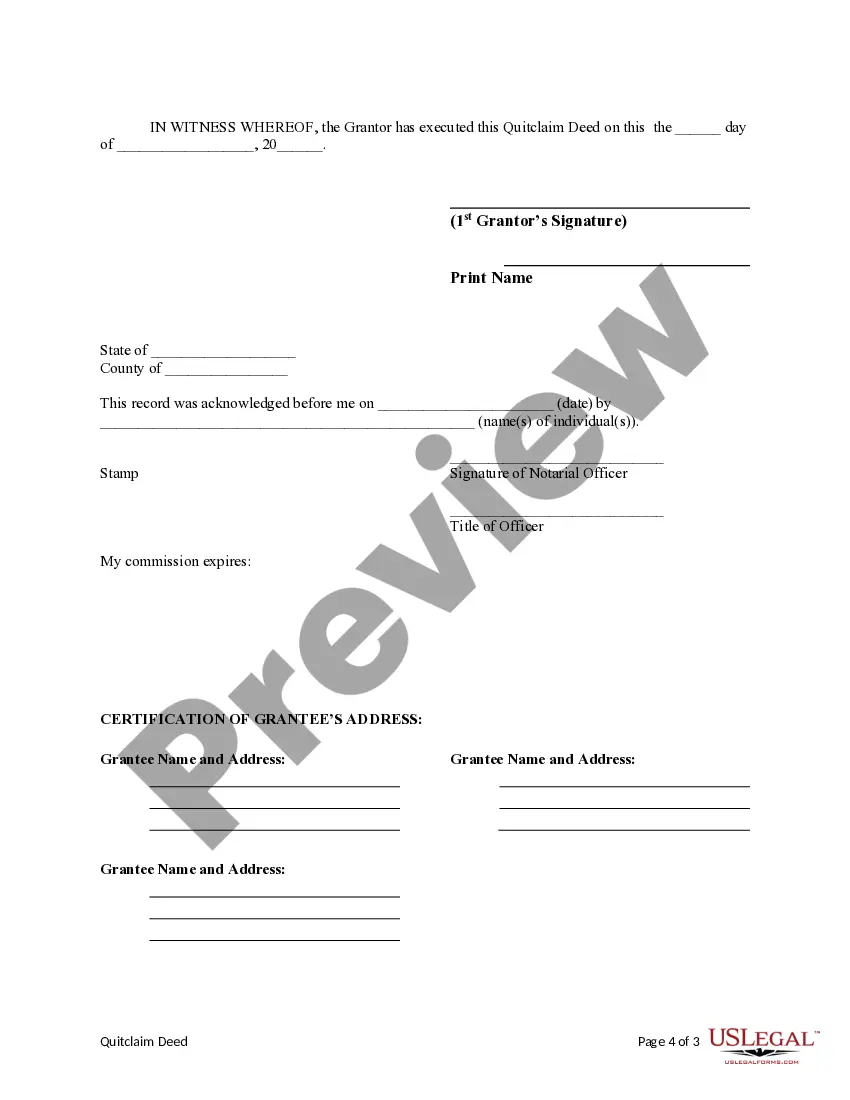

To quit claim a deed to a trust, you must first prepare the quitclaim deed form, detailing the property and the trust’s name. After completing the form, sign it before a notary to ensure its legality. Next, file the signed deed with the county recorder’s office to make the transfer official. This process secures your property within the trust, utilizing a quitclaim deed for trust effectively.

Properly filling out a quitclaim deed for trust requires accurate information. Ensure you include the full names of both the grantor and the grantee, the property description, and the date of the transfer. Additionally, make sure to have the document notarized to finalize the transfer. If you're uncertain, uslegalforms offers clear guidance and forms to support your needs.