Quitclaim Deed For Property

Description

How to fill out Pennsylvania Quitclaim Deed From Individual Grantor To Three Individual Grantees With Release Of Life Estate?

- Visit the US Legal Forms website.

- If you are a returning user, log in to your account and ensure your subscription is active before downloading the quitclaim deed template.

- If you are new, browse through the extensive online library of over 85,000 forms and find the quitclaim deed for property that fits your jurisdiction requirements.

- Preview the document to ensure it aligns with your needs. If it doesn't, use the Search tab to find a suitable template.

- Select and click the Buy Now button corresponding to your chosen plan to access the quitclaim deed.

- Complete your payment either via credit card or PayPal account for your subscription.

- Download the document to your device, ensuring it is stored securely for future use under My documents in your profile.

Following these steps will ensure you efficiently navigate the process of acquiring a quitclaim deed for property. US Legal Forms not only offers a robust collection of documents but also expert assistance to ensure your form is filled out correctly and legally binding.

Get started today and make property transfer hassle-free!

Form popularity

FAQ

A quitclaim deed in California can be prepared by anyone, but it's typically best to have it drafted by a professional. Attorneys or title companies provide reliable services and guarantee compliance with state laws. This approach not only saves you time but also minimizes the risk of errors. If you're unsure where to start, consider US Legal Forms as a resource for your deed preparation needs.

In California, a quitclaim deed for property can be prepared by various parties, including attorneys, title companies, or even individuals familiar with the process. While anyone can draft the deed, it’s advisable to seek professional help to ensure that all legal requirements are met. Using a qualified service, like US Legal Forms, can simplify the preparation process significantly.

Yes, title companies often prepare quitclaim deeds for property transactions. They facilitate the legal process and ensure that all necessary documents comply with local laws. Utilizing a title company can help streamline the deed preparation and filing, making it easier for you. Their expertise ensures that you avoid potential pitfalls in the process.

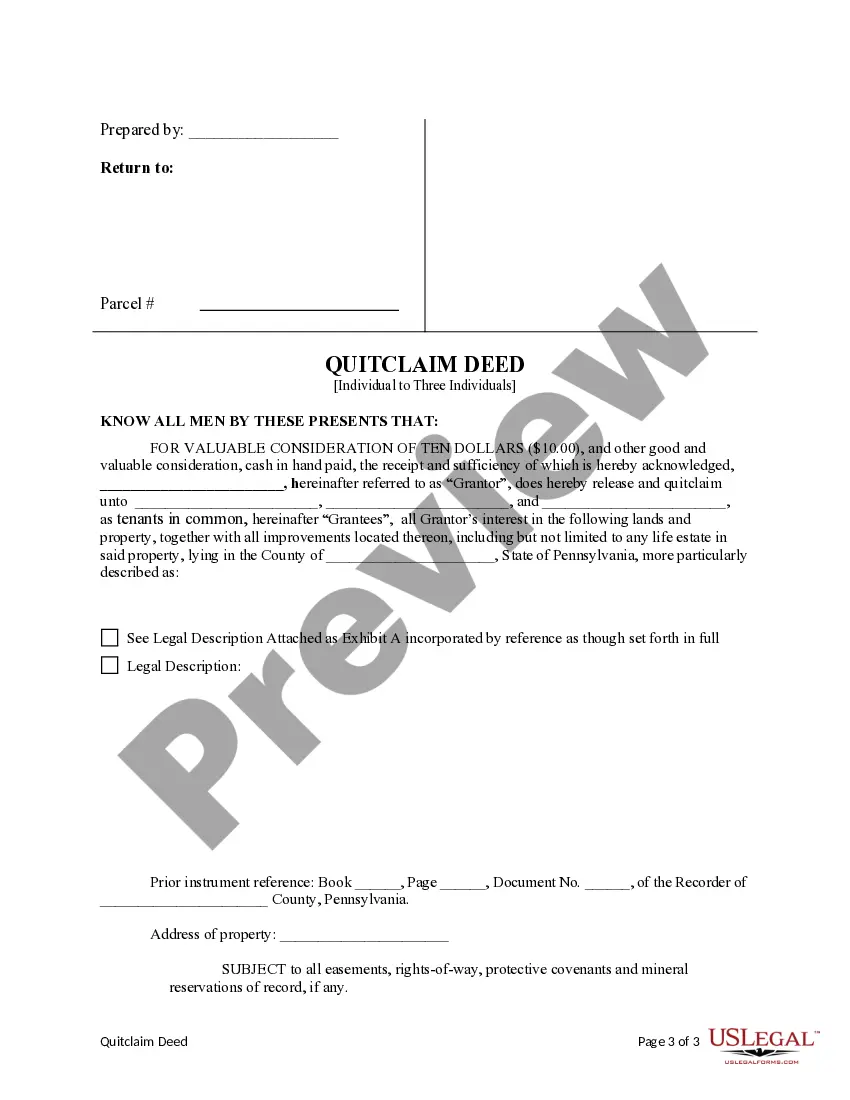

Filling out a quitclaim deed form involves several key steps. First, clearly identify the granter and grantee, as well as the property details. Use straightforward language to describe the transfer of interest and include any relevant legal descriptions. Resources like US Legal Forms can guide you through the process and provide templates that ensure accuracy and compliance with local laws.

Quitclaim deeds for property are often viewed with caution because they transfer ownership without any guarantees on the title. This means the grantee could inherit problems, such as existing liens or disputes over the property. Because of this lack of protection, many prefer traditional deeds that offer clearer assurances regarding ownership rights. Understanding these risks helps you make informed decisions.

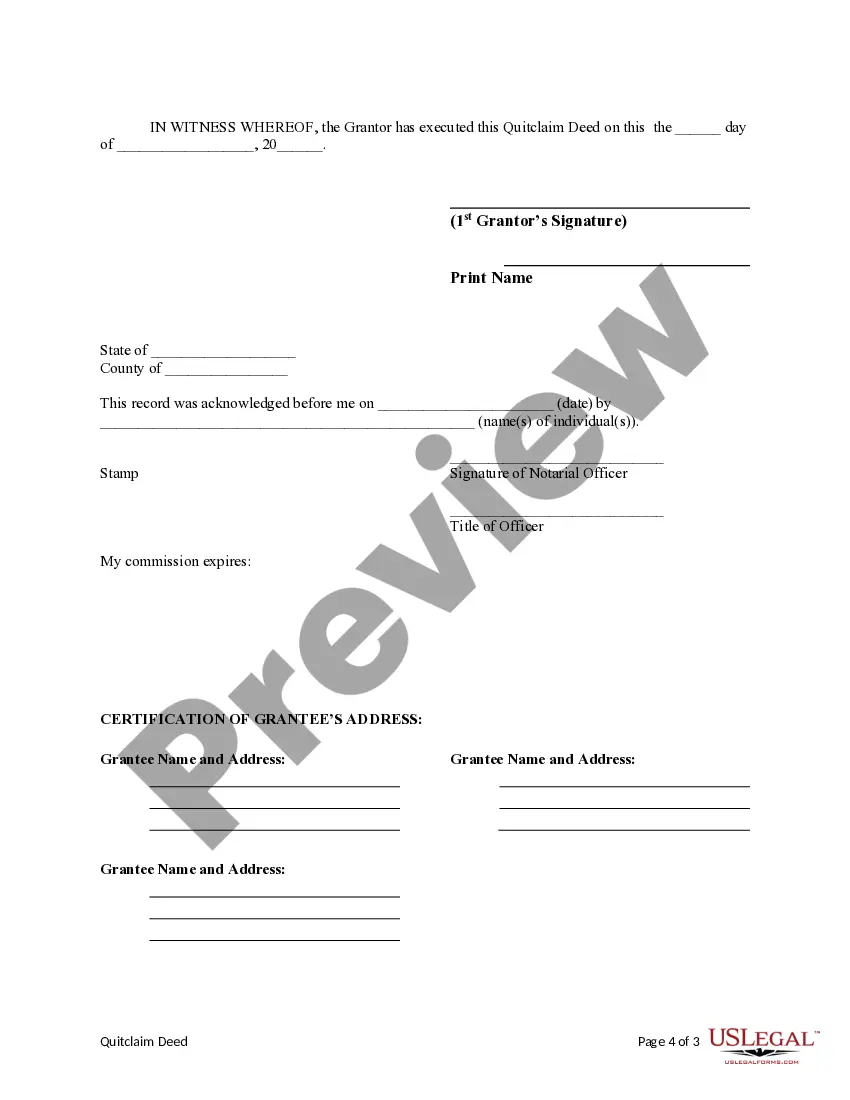

To properly fill out a quitclaim deed for property, start by including the names of the granter and grantee at the top of the document. Next, provide a clear description of the property, including its address and legal description. It's important to properly sign and date the document in front of a notary. After completing the form, file it with your local county office for the deed to be legally recognized.

Individuals often use a quitclaim deed for property to simplify the process of transferring ownership among family, friends, or in cases of divorce. It provides a straightforward way to finalize transactions without extensive paperwork, especially when the parties know each other well. Additionally, platforms like US Legal Forms offer reliable resources and templates that can aid users in creating a quitclaim deed tailored to their specific situations.

One major disadvantage of a quitclaim deed for property is that it does not offer any protection or warranty against defects in the title. If there are any existing liens or claims on the property, the new owner assumes those risks. Furthermore, it can create misunderstandings if both parties do not fully understand their rights and obligations, making it essential to consult legal advice before proceeding.

The primary purpose of a quitclaim deed for property is to transfer ownership rights from one party to another without any guarantee of clear title. This type of deed is often used in situations where ownership is not disputed, such as between family members or in divorce settlements. It allows the grantor to relinquish their claim to the property quickly and without the complexities of traditional real estate transactions.

A quitclaim deed for property is typically used to transfer ownership without guaranteeing the title. This makes it ideal for family transfers, divorces, or settling financial arrangements. It’s a quick way to handle property transfers while avoiding lengthy legal proceedings. If you need clarity and templates, consider using US Legal Forms for a smooth experience.