Life Estate Deed Pennsylvania With Powers

Description

How to fill out Pennsylvania Quitclaim Deed From Individual Grantor To Three Individual Grantees With Release Of Life Estate?

You no longer have to invest time looking for legal documents to satisfy your local state obligations. US Legal Forms has compiled all of them in one location and streamlined their availability.

Our site features over 85,000 templates for any business and individual legal needs organized by state and area of application. All forms are properly drafted and verified for legitimacy, so you can be confident in obtaining a current Life Estate Deed Pennsylvania With Powers.

If you are familiar with our platform and already possess an account, you must ensure your subscription is active before accessing any templates. Log In to your account, select the document, and click Download. You can also revisit all downloaded forms at any time by opening the My documents tab in your profile.

You can print the form to complete it by hand or upload the sample if you prefer editing it online. Preparing official documents under federal and state law is quick and easy with our collection. Try US Legal Forms today to keep your paperwork organized!

- If you haven't worked with our platform before, the process will require a few additional steps to finish.

- Here’s how new users can find the Life Estate Deed Pennsylvania With Powers in our inventory.

- Carefully examine the page content to confirm it contains the sample you require.

- To assist you, use the form description and preview options if available.

- Utilize the Search field above to look for another sample if the previous one didn't suit your needs.

- Once you identify the correct template, click Buy Now next to the title.

- Select your preferred pricing plan and either create an account or Log In.

- Make the payment for your subscription using a credit card or through PayPal to continue.

- Choose the file format for your Life Estate Deed Pennsylvania With Powers and download it to your device.

Form popularity

FAQ

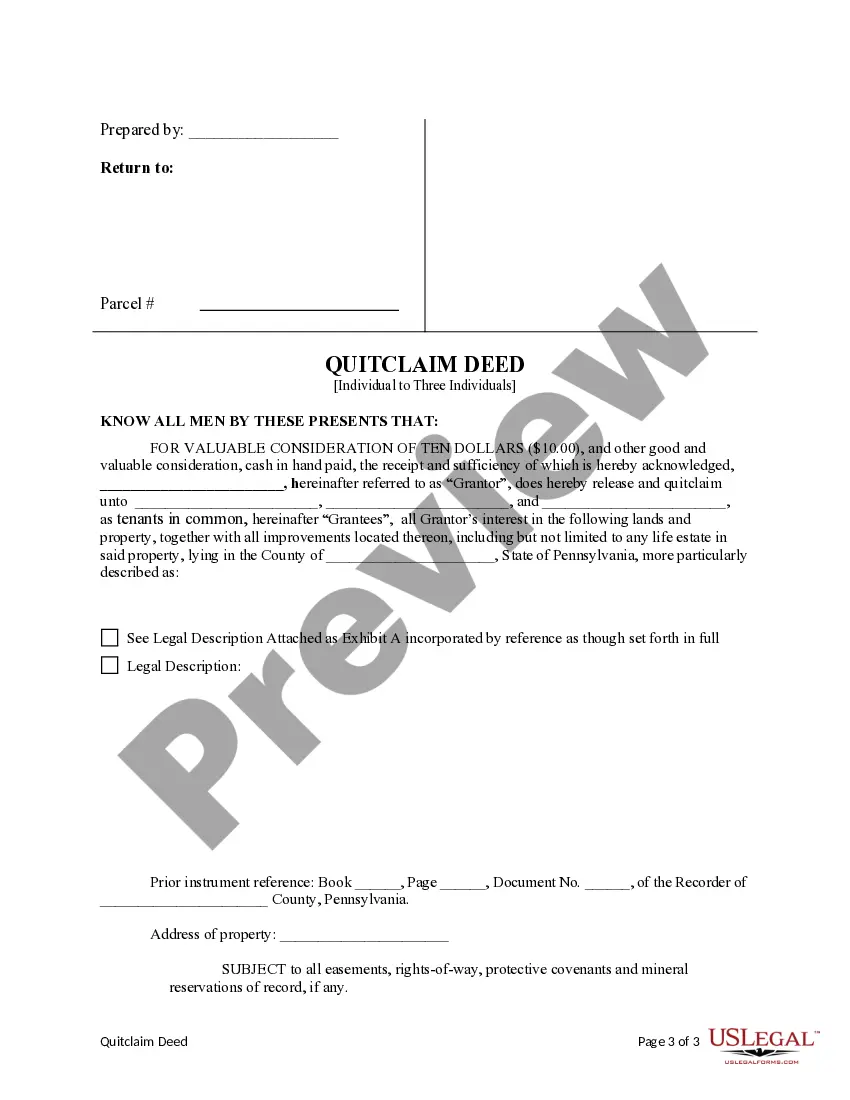

A life estate deed is a legal document that grants real estate ownership to two or more parties according to two types of interest. The life tenant acquires what is called a life estate, which generally means they can live on and make use of the property until the designated person's death.

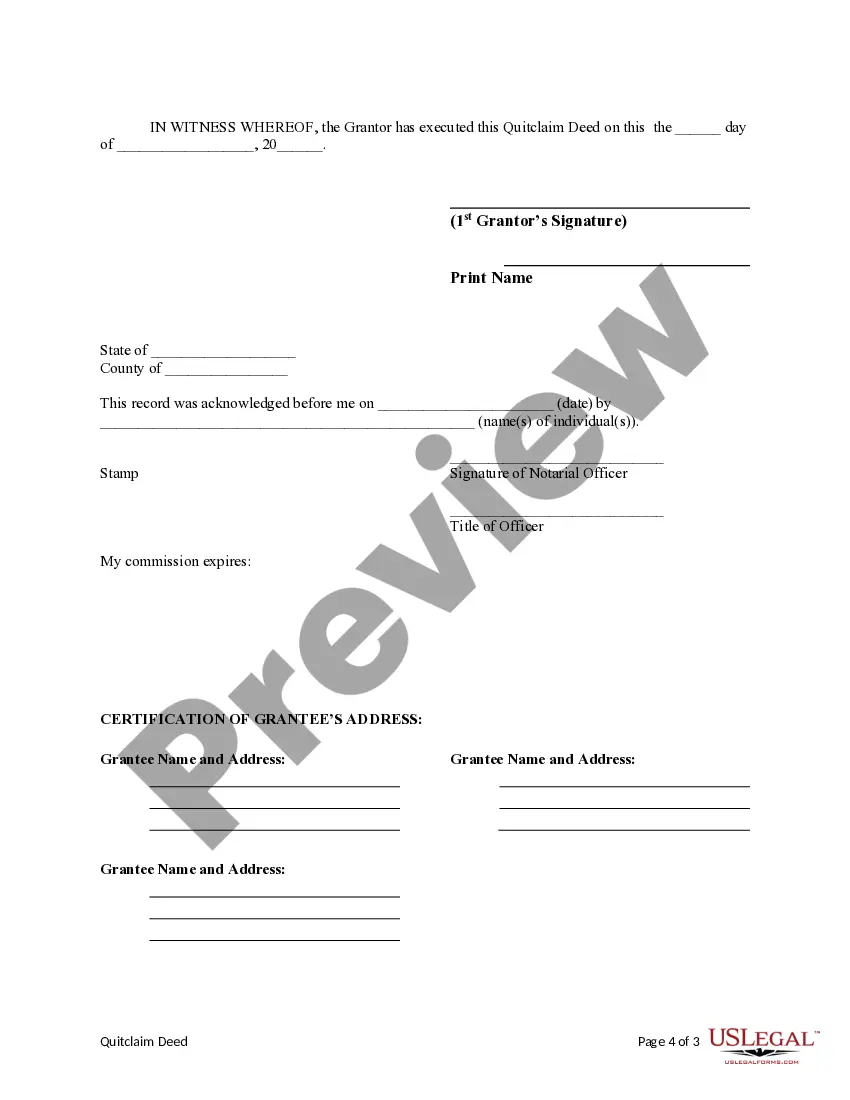

Although the property will not be included in the probate estate, the life estate property will usually be included in the taxable estate of the life tenant. This means that the Pennsylvania inheritance tax will apply.

Is life insurance subject to PA inheritance tax? No. Life insurance on the life of the decedent is not taxable in the estate of the decedent. In addition, the proceeds are not taxable according the state income tax law.

Generally, a life estate is a form of joint ownership that allows one person to live in a house until his or her death, at which time it passes by operation of law to the surviving owner. Life estates are used to help fulfill various planning goals.