Pennsylvania Bylaws With Secretary Of State

Description

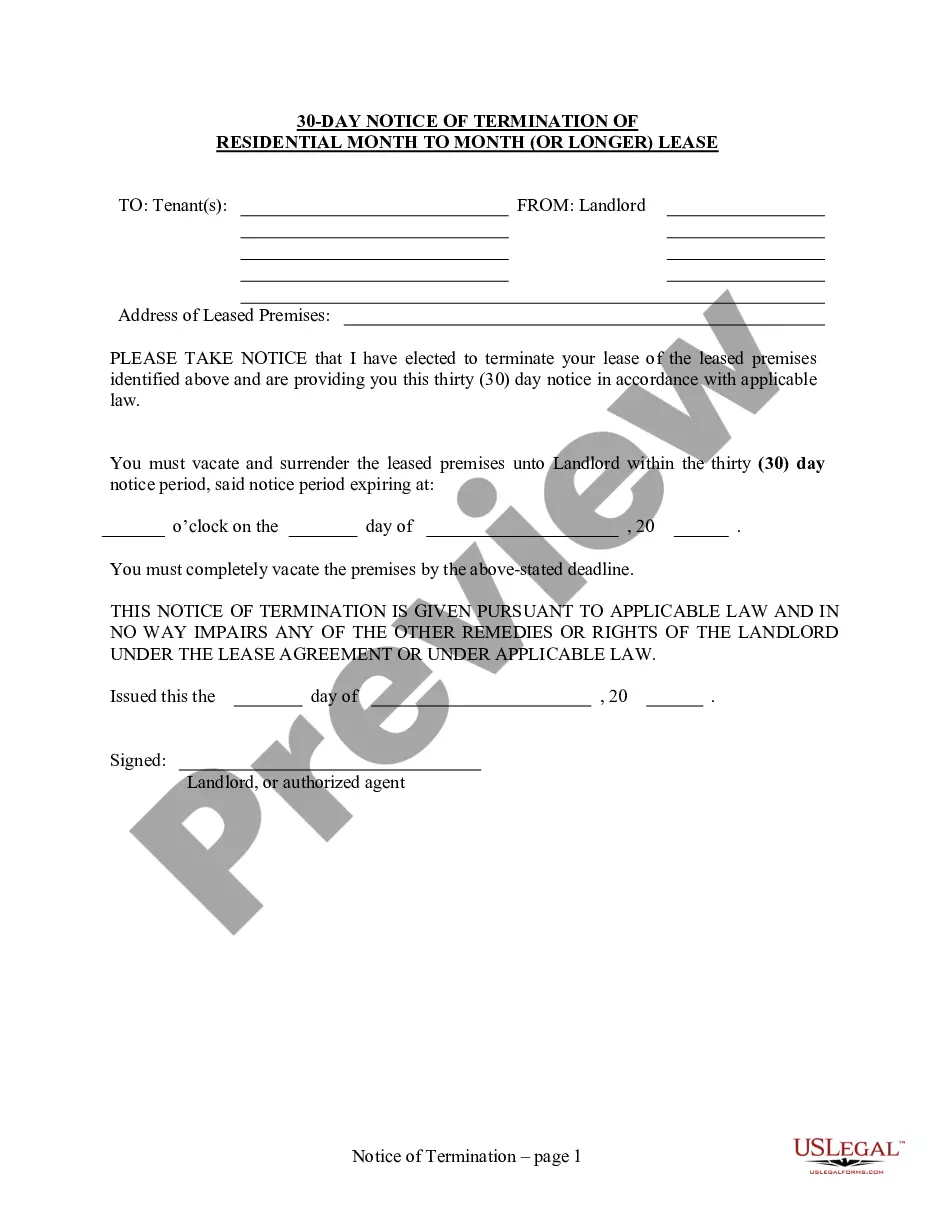

How to fill out Pennsylvania Bylaws For Corporation?

Finding a go-to place to take the most current and appropriate legal templates is half the struggle of working with bureaucracy. Discovering the right legal documents requirements accuracy and attention to detail, which is the reason it is crucial to take samples of Pennsylvania Bylaws With Secretary Of State only from reputable sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to be concerned about. You can access and view all the information about the document’s use and relevance for your circumstances and in your state or county.

Take the following steps to finish your Pennsylvania Bylaws With Secretary Of State:

- Use the library navigation or search field to find your sample.

- View the form’s description to check if it matches the requirements of your state and county.

- View the form preview, if there is one, to ensure the form is definitely the one you are interested in.

- Go back to the search and find the proper template if the Pennsylvania Bylaws With Secretary Of State does not suit your needs.

- When you are positive regarding the form’s relevance, download it.

- If you are an authorized user, click Log in to authenticate and access your picked forms in My Forms.

- If you do not have an account yet, click Buy now to get the form.

- Select the pricing plan that suits your needs.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by picking a transaction method (bank card or PayPal).

- Select the document format for downloading Pennsylvania Bylaws With Secretary Of State.

- Once you have the form on your device, you may alter it with the editor or print it and finish it manually.

Get rid of the inconvenience that comes with your legal documentation. Explore the comprehensive US Legal Forms collection where you can find legal templates, examine their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

Pennsylvania corporations have to file an Articles of Amendment ? Domestic Corporation form with the Corporation Bureau of the Department of State. You will also have to attach 2 copies of the completed Docketing Statement ? Changes. You can file by mail or in person. You also need to pay $70 for the filing.

Pennsylvania corporations have to file an Articles of Amendment ? Domestic Corporation form with the Corporation Bureau of the Department of State. You will also have to attach 2 copies of the completed Docketing Statement ? Changes. You can file by mail or in person. You also need to pay $70 for the filing.

A Pennsylvania registered agent is an individual or company that accepts service of process and other legal notifications on behalf of a Pennsylvania business. Both LLCs and corporations are legally required to have a registered agent.

Beginning in 2025, every Pennsylvania LLC will need to file an Annual Report each year to renew their LLC. Note: Pennsylvania used to require that LLCs file a report every 10 years (called a Decennial Report).

The document required to form an LLC in Pennsylvania is called the Articles of Organization.