Pa Corporation Pennsylvania Withholding Tax

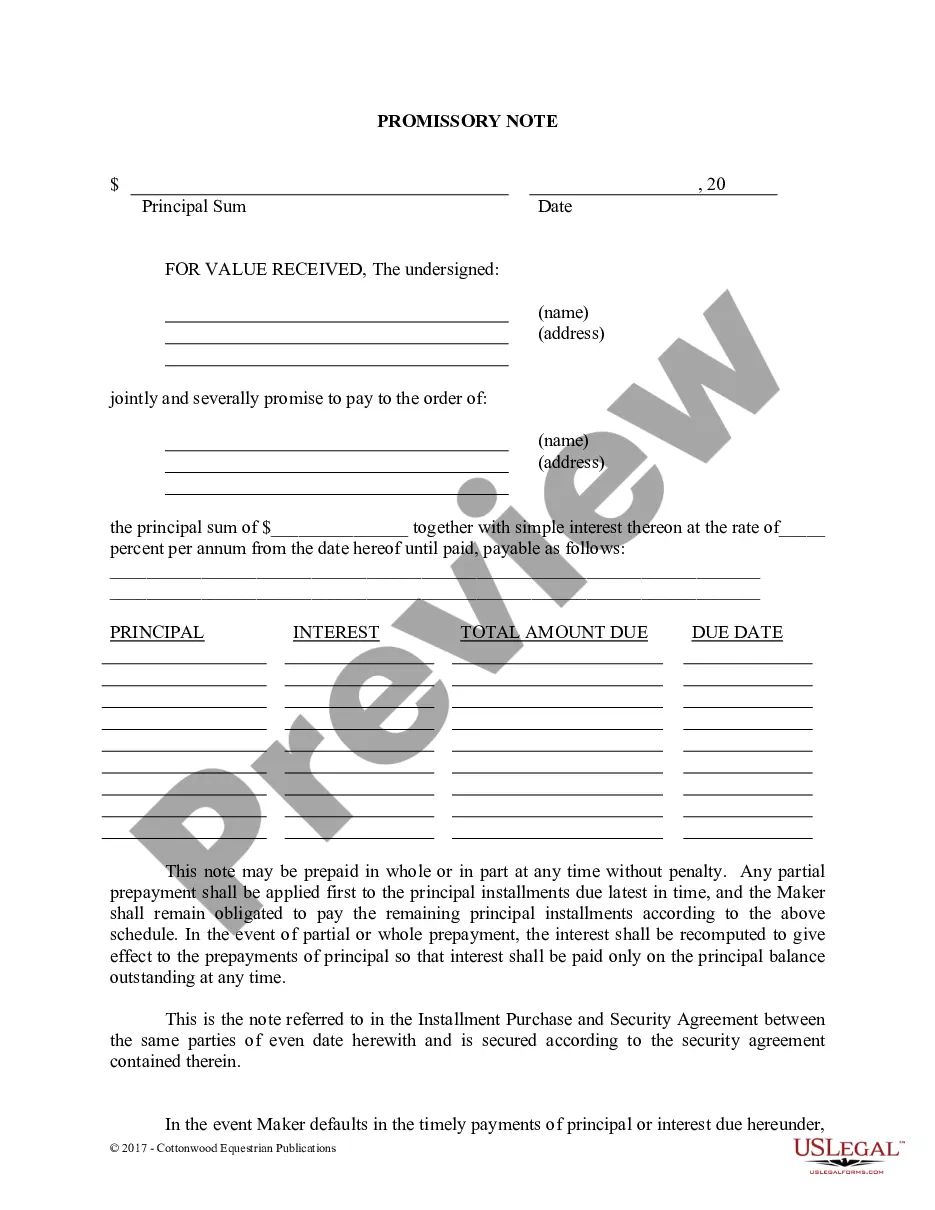

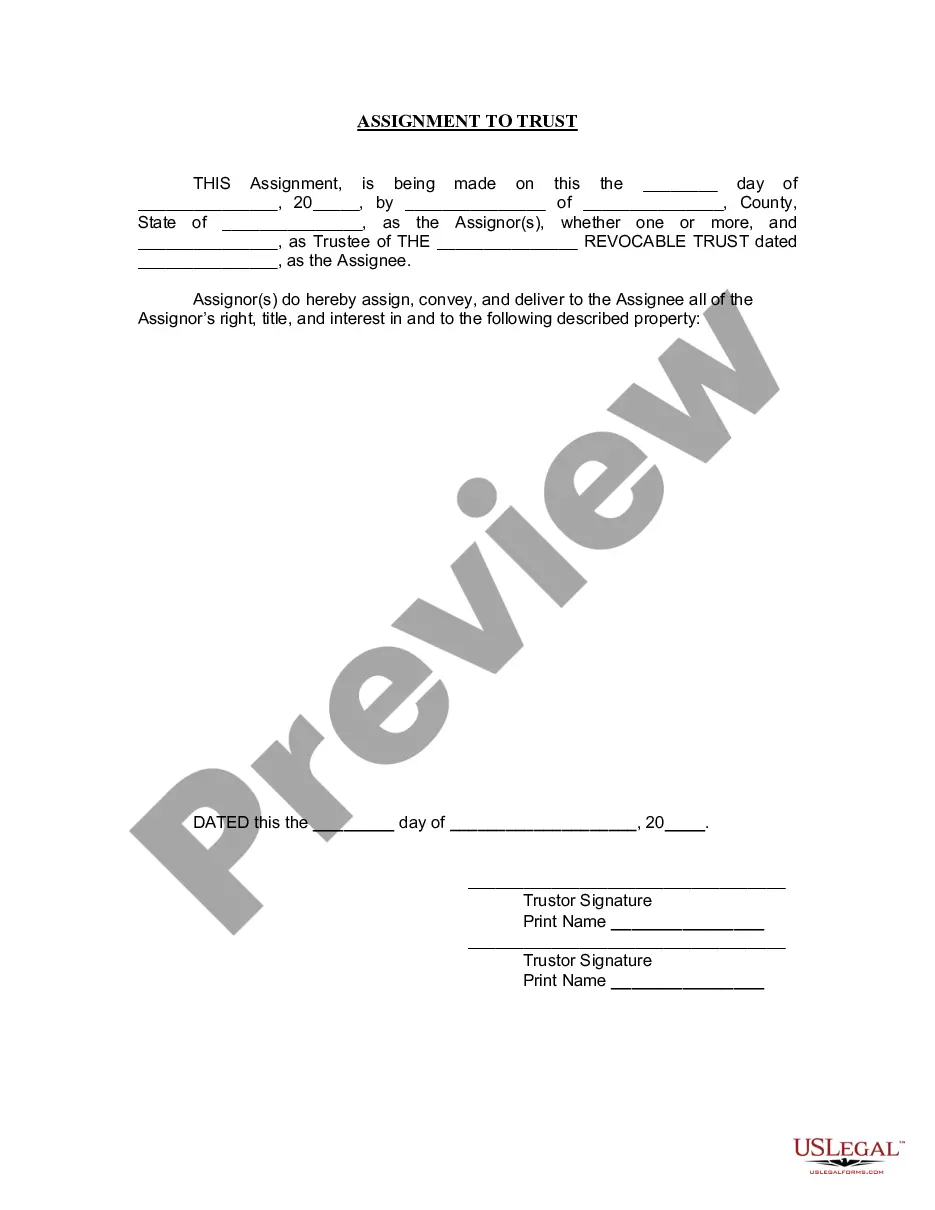

Description

How to fill out Pennsylvania Bylaws For Corporation?

Utilizing legal document examples that align with federal and local regulations is essential, and the internet provides a plethora of choices to choose from.

However, why waste time searching for the suitable Pa Corporation Pennsylvania Withholding Tax template online when the US Legal Forms digital library has these templates conveniently organized in one location.

US Legal Forms is the largest online legal repository with more than 85,000 fillable templates created by attorneys for various professional and personal situations.

Review the template using the Preview option or through the text description to confirm it fulfills your requirements.

- They are easy to navigate with all documents categorized by state and intended use.

- Our experts stay updated with legal amendments, ensuring your documents are current and compliant when requesting a Pa Corporation Pennsylvania Withholding Tax from our platform.

- Obtaining a Pa Corporation Pennsylvania Withholding Tax is straightforward and fast for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the needed document sample in your desired format.

- If you are unfamiliar with our website, please follow these steps.

Form popularity

FAQ

If you intend to make your payment by check, please make the check payable to the PA Department of Revenue. Note on the check your PA Employer Account Identification Number, your Federal Employer Identification Number or Revenue ID, and the tax period begin and end dates.

Register for Employer Withholding online by visiting mypath.pa.gov. Registering online allows business owners to withhold employer taxes with the Pennsylvania Department of Revenue and open Unemployment Compensation accounts administered by the Pennsylvania Department of Labor & Industry.

Register for Employer Withholding online by visiting mypath.pa.gov. Registering online allows business owners to withhold employer taxes with the Pennsylvania Department of Revenue and open Unemployment Compensation accounts administered by the Pennsylvania Department of Labor & Industry.

Pennsylvania Individual Tax The Pennsylvania individual income tax withholding rate remains at 3.07% for 2021.

Complete Form REV-419 so that your employer can withhold the correct Pennsylvania personal income tax from your pay. Complete a new Form REV-419 every year or when your personal or financial sit- uation changes.