401k Qualified Domestic Relations Order Withdrawal

Description

How to fill out Pennsylvania Motion To Reopen Case In Order To Include Qualified Domestic Relations Order In Final Decree Or Judgment?

Creating legal documents from the ground up can occasionally be intimidating.

Certain situations may require extensive research and significant financial investment.

If you’re seeking a more effortless and cost-effective method of preparing 401k Qualified Domestic Relations Order Withdrawal or any other forms without the hassle of navigating complicated processes, US Legal Forms is always accessible.

Our online collection of over 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal needs. With just a few clicks, you can swiftly obtain state- and county-specific forms meticulously crafted for you by our legal professionals.

US Legal Forms boasts an impeccable reputation and more than 25 years of expertise. Join us today and make document completion a straightforward and efficient process!

- Utilize our site whenever you require trusted and reliable services to effortlessly find and download the 401k Qualified Domestic Relations Order Withdrawal.

- If you’re a returning user and have already created an account with us, simply Log In, select the form, and download it, or re-download it anytime from the My documents section.

- Don’t have an account? No problem. Registering takes just a few minutes and allows you to browse the library.

- But before jumping straight into downloading the 401k Qualified Domestic Relations Order Withdrawal, consider these recommendations.

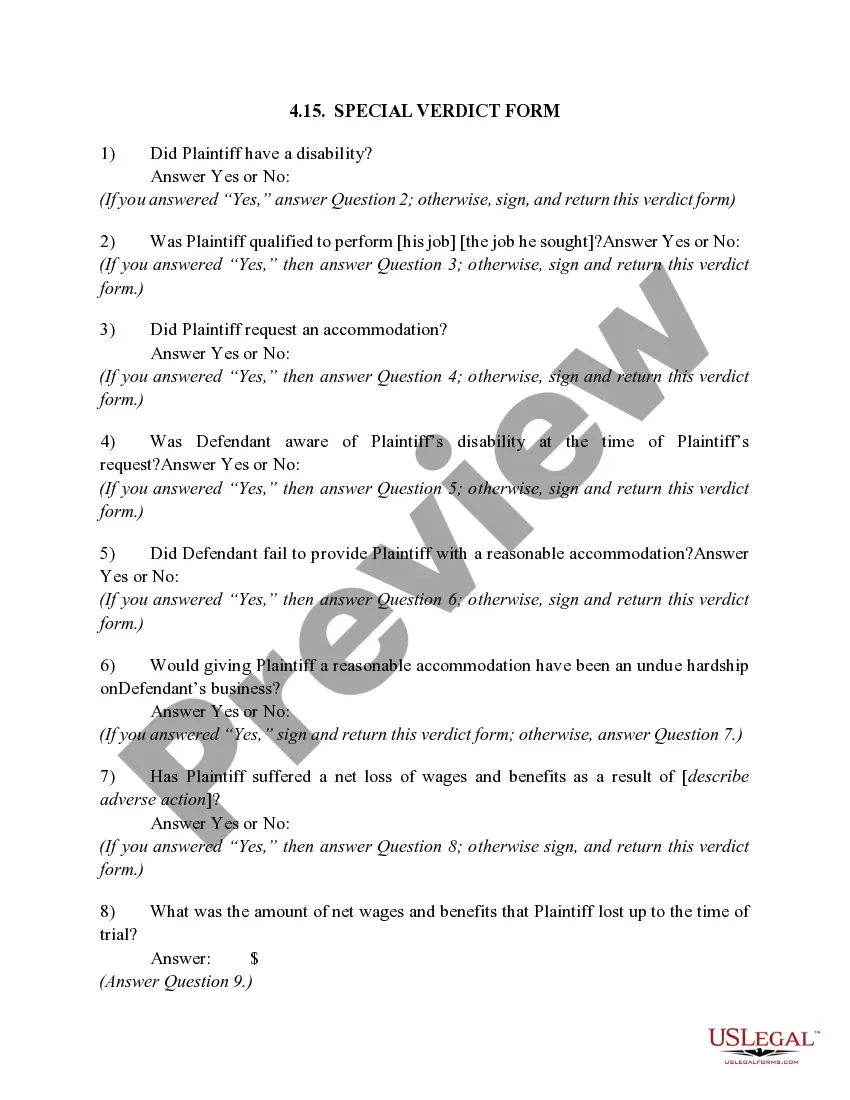

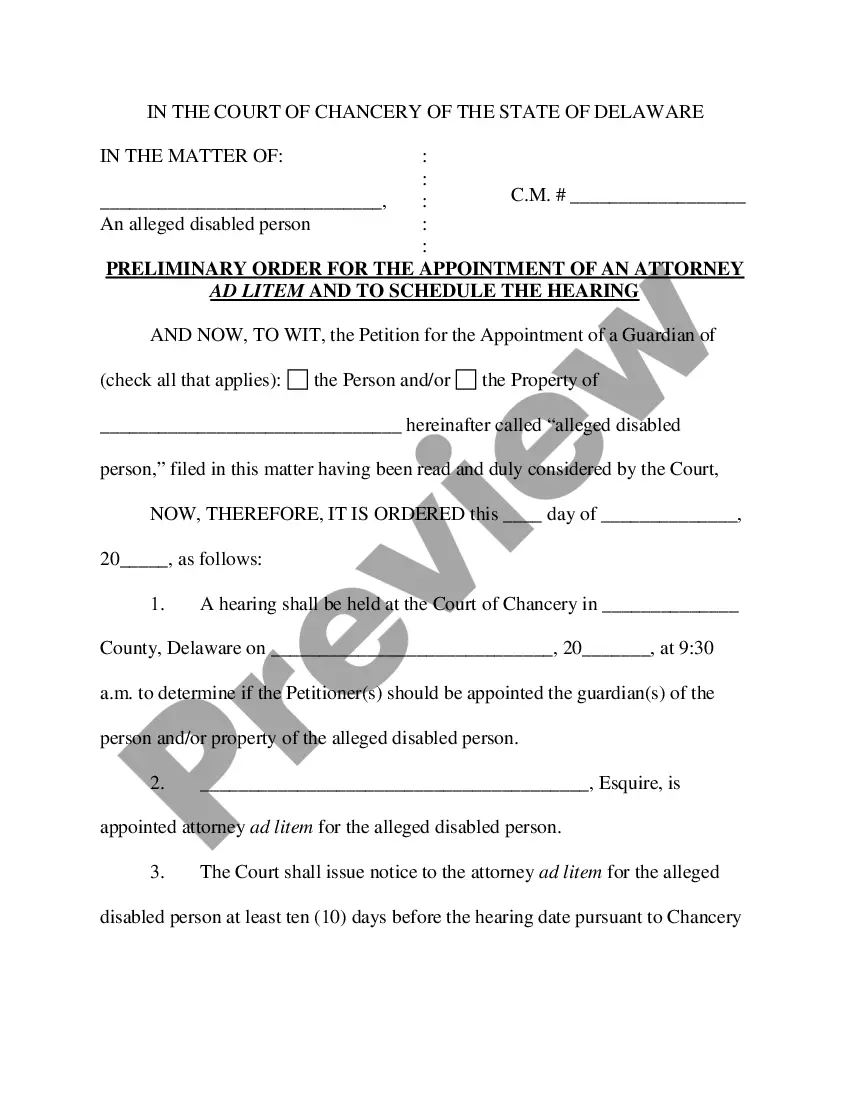

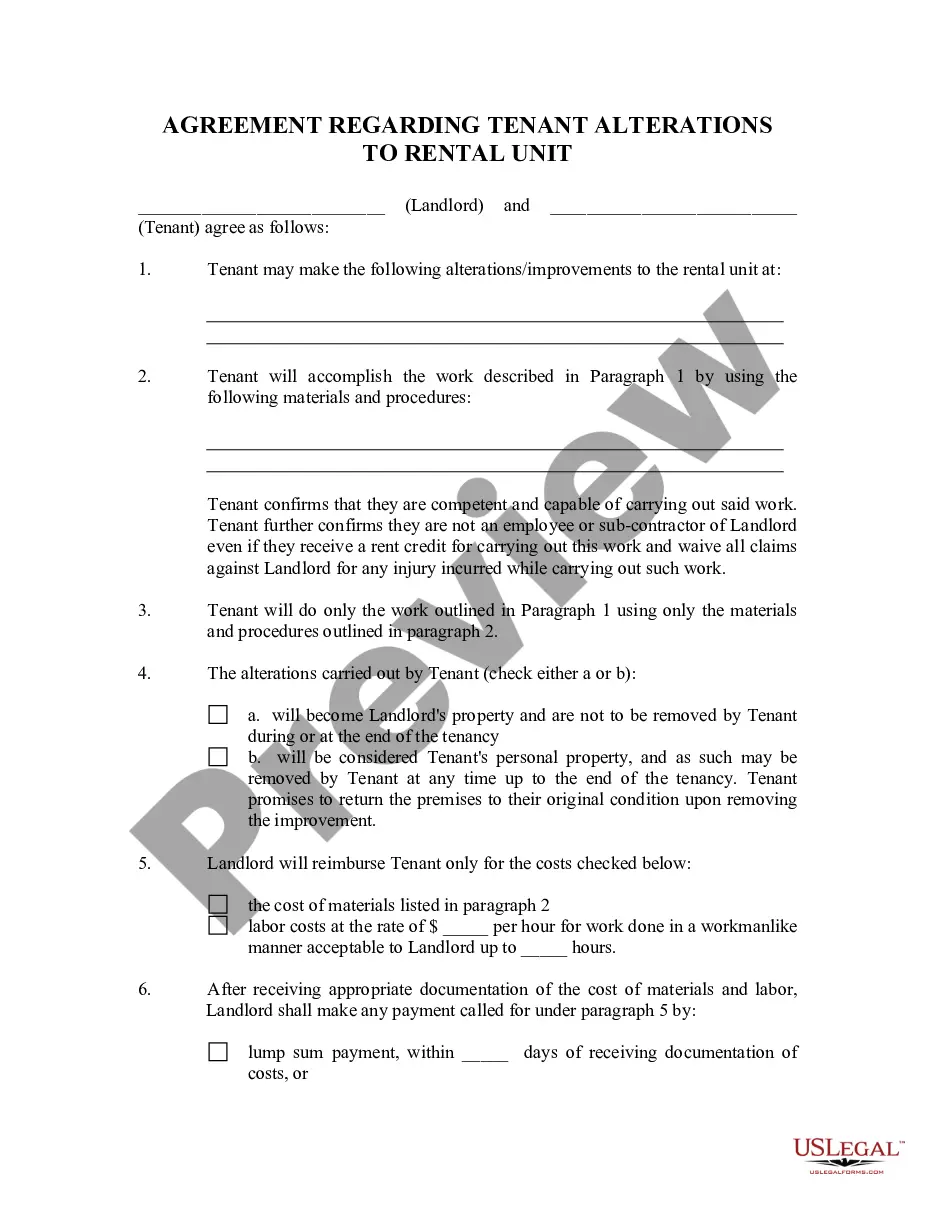

- Review the document preview and descriptions to confirm that you've located the document you need.

Form popularity

FAQ

In general, it takes 60 - 90 days after drafting the QDRO to complete the process when all goes smoothly. Once the QDRO is reviewed and then signed by each party, it is first sent to the court for entry into the case file.

The drafted QDRO is submitted to the retirement plan administrator, and once it's accepted and approved by the administrator, it's submitted to the court. Since divorces can be complex, particularly if a couple has many assets, a lawyer may be a good option to help ensure a smooth transfer of assets.

Can spouses combine retirement accounts? No, spouses cannot combine retirement accounts. However, a spouse can be named as a beneficiary of your account, which can be rolled into their own IRA in the event of your death.

Notification of determination Once you have made this decision, you must notify the participant and the alternate payee in writing. The letter should be sent to the addresses listed in the QDRO.

There are several steps to calculate a QDRO. Determine the present value of the participant's retirement benefit. Calculate the amount assigned to the alternate payee based on the QDRO's terms. Once the amount has been determined, convert the amount into an annuity to be paid to the alternate payee.