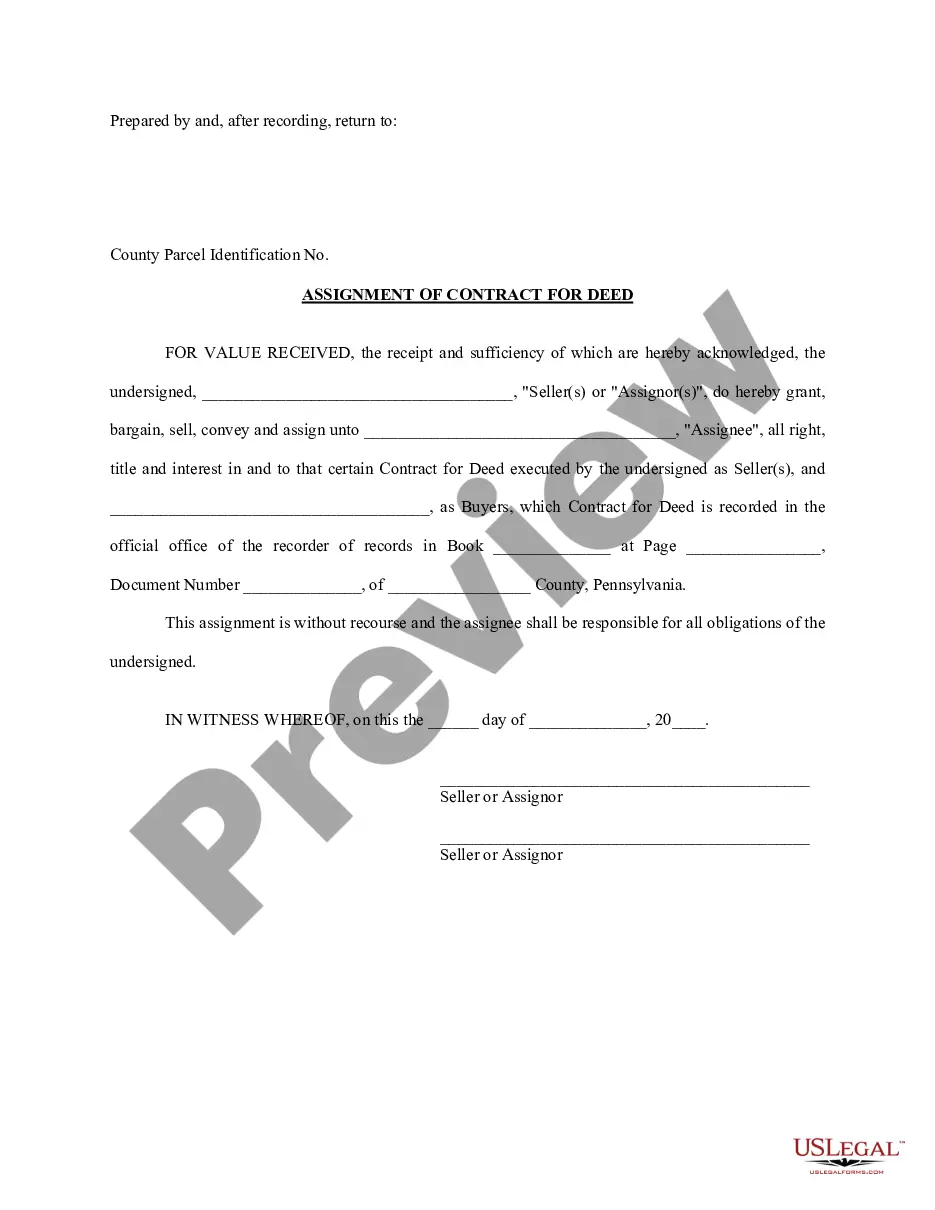

Assignment Of Contract Pennsylvania Withholding Tax

Description

How to fill out Pennsylvania Assignment Of Contract For Deed By Seller?

Which is the most reliable service to obtain the Assignment Of Contract Pennsylvania Withholding Tax and the latest editions of legal documents.

US Legal Forms provides the solution! It boasts the largest collection of legal forms for any purpose.

If you don't yet have an account, follow these steps to create one: Compliance check of the form. Review if the template meets your usage needs and complies with your local laws. Check the form description and utilize the Preview feature if it's available. Search for alternative documents. In case of discrepancies, use the search functionality at the top of the page to locate other templates. Click Buy Now to choose the suitable one. Create an account and subscribe. Select a pricing plan that fits, Log In or register for an account, and complete the payment for your subscription using PayPal or credit card. Download the document. Pick your desired format for the Assignment Of Contract Pennsylvania Withholding Tax (PDF or DOCX) and click Download to retrieve it. US Legal Forms is a fantastic resource for anyone dealing with legal documents. Premium users can benefit even more as they can complete and electronically sign previously saved documents anytime using the integrated PDF editing tool. Give it a try today!

- Each template is expertly drafted and verified for adherence to federal and state regulations.

- They are categorized by area and jurisdiction, making it easy to locate the document you require.

- Experienced users only need to Log In, ensure their subscription is active, and click the Download button next to the Assignment Of Contract Pennsylvania Withholding Tax to get it.

- Once downloaded, the document is accessible for later use in the My documents section of your account.

Form popularity

FAQ

PURPOSE OF FORM Complete Form REV-419 so that your employer can with- hold the correct Pennsylvania personal income tax from your pay. Complete a new Form REV-419 every year or when your personal or financial situation changes.

Any individual who is employed in a municipality/school district that levies a LST has to pay the tax. This tax is determined by where you work and not where you live. 3.

Pennsylvania law requires every employer located or transacting business in Pennsylvania to withhold Pennsylvania personal income tax from compensation of resident employees for services performed either within or outside Pennsylvania, and from compensation of nonresident employees for services performed within

Register for employer withholding tax online through the Online PA-100. Employers can file and pay employer withholding tax returns and submit W-2 information online using e-TIDES, by phone using TeleFile or through third-party software.

Self-employed taxpayers shall pay the tax to the municipality or the tax collector 30 days after the end of each calendar quarter. Limits. The total LST paid by any taxpayer in a calendar year remains limited to $52, regardless of the number of political subdivisions in which an individual works during the year.