Pa Odometer Statement Withholding

Description

How to fill out Pennsylvania Bill Of Sale Of Automobile And Odometer Statement?

Creating legal documents from the ground up can frequently be intimidating. Certain instances may require extensive research and significant financial investment.

If you’re looking for a simpler and more budget-friendly method to generate Pa Odometer Statement Withholding or any other documents without unnecessary complications, US Legal Forms is consistently accessible to you.

Our online collection of over 85,000 current legal templates encompasses nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can swiftly obtain state- and county-compliant forms meticulously crafted by our legal professionals.

Utilize our platform whenever you require a dependable and trustworthy service through which you can easily locate and download the Pa Odometer Statement Withholding. If you’re familiar with our services and have registered before, simply Log In to your account, select the document, and download it or retrieve it again later in the My documents section.

Ensure the selected form aligns with the laws and regulations of your state and county. Choose the most appropriate subscription plan to acquire the Pa Odometer Statement Withholding. Download the form, then fill it out, sign it, and print it. US Legal Forms boasts an impeccable reputation and over 25 years of expertise. Join us today and make document preparation a straightforward and efficient process!

- Not registered yet? No problem.

- Setting up your account and browsing the catalog only takes a few minutes.

- Before you proceed to download the Pa Odometer Statement Withholding, adhere to these suggestions.

- Examine the form preview and descriptions to confirm that you have located the document you seek.

Form popularity

FAQ

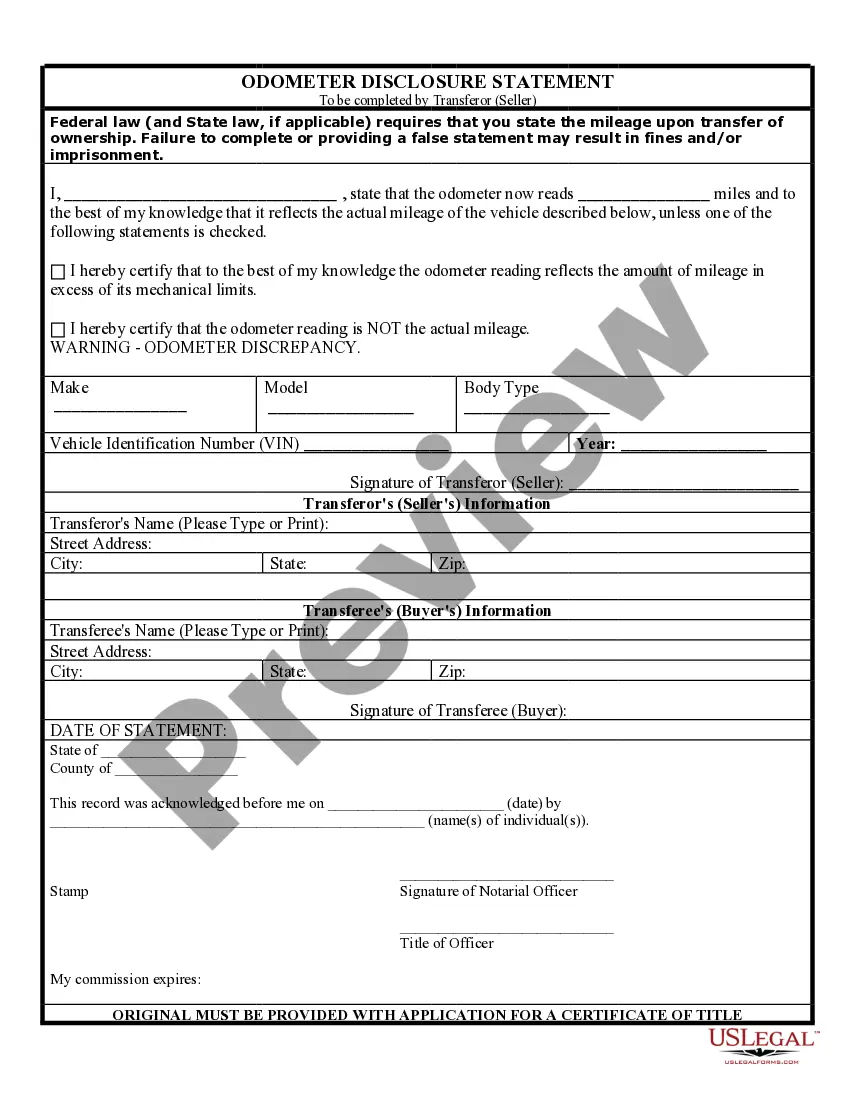

Reporting an odometer reading involves documenting the mileage of your vehicle at the time of sale or transfer. You can do this through an odometer disclosure statement, which should be filled out accurately and signed by both the seller and buyer. It's important to keep a copy of this document for your records and ensure compliance with PA odometer statement withholding requirements. For an easy and reliable way to create this document, visit uslegalforms, where you'll find customizable templates.

A notarized odometer statement is an odometer disclosure that has been signed in the presence of a notary public, adding an extra layer of authenticity. This document is often required in situations where legal proof of mileage is necessary, such as in certain vehicle sales or transfers. By having this statement notarized, you can help ensure compliance with PA odometer statement withholding laws. For your convenience, uslegalforms provides templates that can be easily notarized.

In Pennsylvania, certain vehicles may be exempt from odometer disclosure requirements. Typically, vehicles that are more than 10 years old or have a gross vehicle weight rating of more than 16,000 pounds fall under this exemption. Therefore, these vehicles do not require an odometer statement when transferred. However, for clarity and compliance with PA odometer statement withholding, it’s best to consult resources or experts if you are unsure about your vehicle's status.

An odometer disclosure statement is a legal document that records the mileage of a vehicle at the time of sale. For example, when selling a car, the seller must provide the odometer reading to the buyer, along with the date of the reading. This statement helps prevent fraud and ensures transparency in the transaction. If you need assistance with creating an odometer statement, uslegalforms offers templates that comply with PA odometer statement withholding regulations.

The exempt mileage title is used when the mileage displayed on a vehicle's odometer cannot be verified as accurate due to exceeding the odometer's mechanical limits or being tampered with. It is issued by the DMV to protect potential buyers from paying more for a vehicle than it is actually worth.

Understanding a Texas Odometer Disclosure statement is essential for any car buyer in the state of Texas. This statement contains important information about the mileage of a vehicle, which can help a buyer make an informed decision when purchasing a used car.

Understanding a Texas Odometer Disclosure statement is essential for any car buyer in the state of Texas. This statement contains important information about the mileage of a vehicle, which can help a buyer make an informed decision when purchasing a used car.

In order to have a correction made to the mileage on a vehicle record, you will need to provide the last two years of the vehicle's inspection records or VIN-specific vehicle repair bills, which indicate the mileage at the time of the inspection or repair.

Odometer Disclosure Statement. Information. Step 1 ? Vehicle Information. Step 2 ? Buyer Information. Step 3 ? Seller Information. Step 4 ? Odometer Information. ? WARNING ? ODOMETER DISCREPANCY ? I hereby certify that the odometer reading is NOT the. Step 5 ? Statement of Buyer.