Pennsylvania Promissory Note With Chattel Mortgage

Description

How to fill out Pennsylvania Promissory Note In Connection With Sale Of Vehicle Or Automobile?

What is the most reliable service to obtain the Pennsylvania Promissory Note With Chattel Mortgage and other current versions of legal documents? US Legal Forms is the answer!

It boasts the most comprehensive collection of legal forms for any purpose. Each template is expertly prepared and verified for adherence to federal and local regulations. They are organized by area and state of application, making it easy to find the one you need.

US Legal Forms is a fantastic resource for anyone dealing with legal documentation. Premium members can benefit even more as they can fill in and sign previously saved documents electronically anytime using the built-in PDF editing tool. Give it a try now!

- Experienced users of the platform simply need to Log In to the system, verify their subscription status, and click the Download button beside the Pennsylvania Promissory Note With Chattel Mortgage to obtain it.

- Once downloaded, the template remains accessible for future use in the My documents section of your account.

- If you don’t yet have an account with our library, here are the steps you should follow to create one.

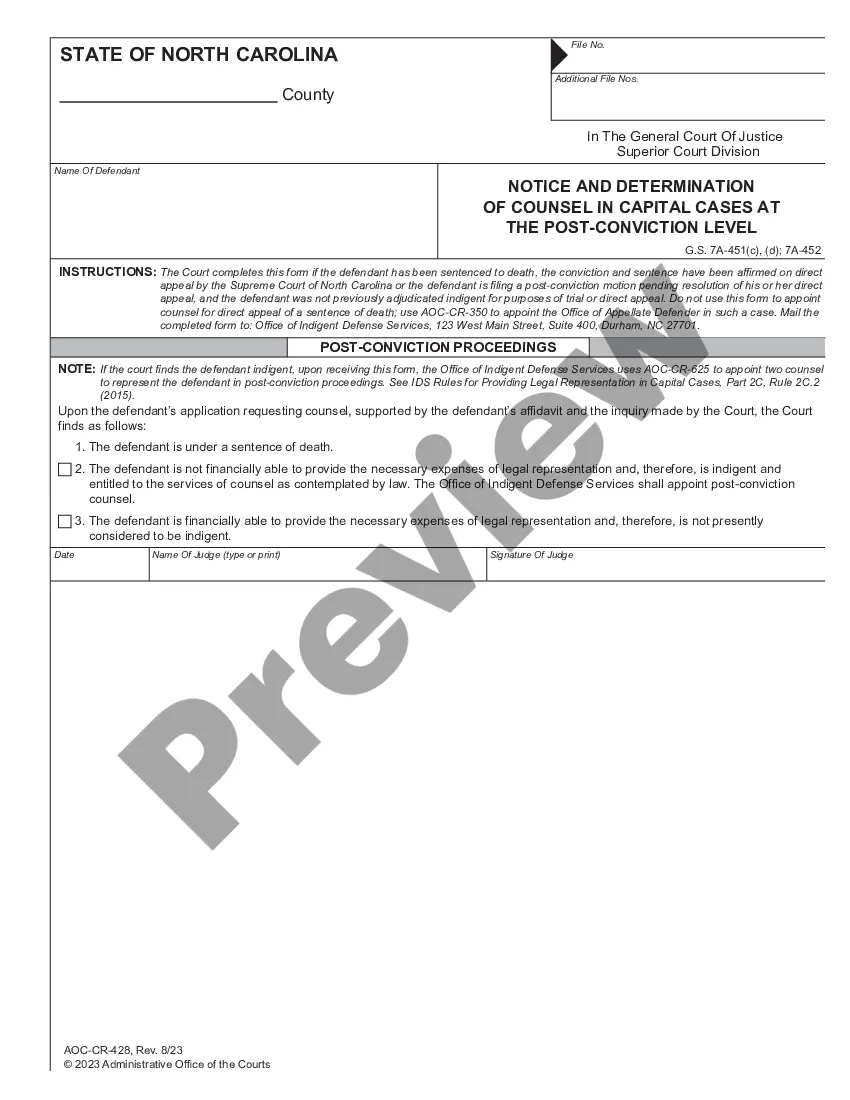

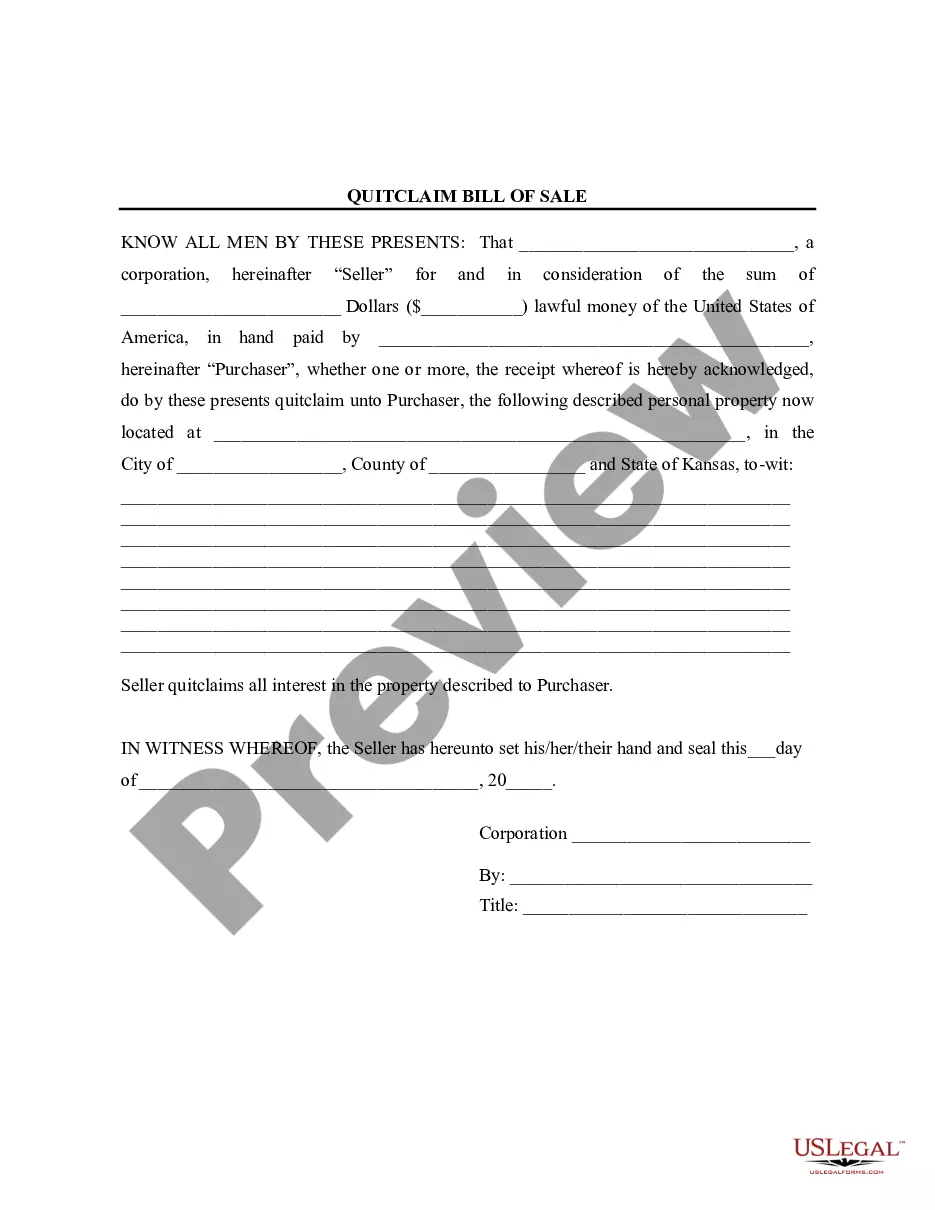

- Review form compliance. Before purchasing any template, ensure it aligns with your usage needs and your state or county regulations. Read the form description and use the Preview if provided.

Form popularity

FAQ

The bookkeeping behind the Chattel Mortgage purchase:Deposit Paid (Current Asset) no tax code.Motor Vehicles at Cost (Non-Current Asset) apply capital expense including GST tax code.Chattel Mortgage (Motor Vehicle) (Non-Current Liability) no tax code.Chattel Mortgage Interest Charges (Expense) no tax code.More items...?

Debit asset/car by the amount cost of the car. Credit cash by the amount of down payment and notes payable-car loan by the amount of any borrowed money for the car. If no money is borrowed, then credit cash for the entire cost of the car. In the example, debit asset/car by $20,000.

Chattel Mortgage DefinitionA chattel mortgage is a loan for a manufactured home or other movable piece of personal property, such as machinery or a vehicle. The movable property, called chattel, also acts as collateral for the loan.

There is no legal requirement for most promissory notes to be witnessed or notarized in Pennsylvania (promissory notes related to real estate may need to be notarized).

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.